Tesla could “go bust” while its stock could fall to $14, Per Lekander, a hedge fund manager who has been shorting Elon Musk’s electric car maker since 2020, told CNBC on Wednesday.

His comments come after Tesla reported 386,810 vehicle deliveries in the first quarter of the year, significantly below even the lowest market estimates.

“This was really the beginning of the end of the Tesla bubble, which probably, arguably was the biggest stock market bubble in modern history,” Lekander, managing partner at investment management firm Clean Energy Transition, said on “Squawk Box Europe.”

“I actually think the company could go bust.”

Tesla was not immediately available for comment when contacted by CNBC.

Lekander was a former portfolio manager at investment firm Lansdowne Partners who successfully called a 2018 rally in carbon prices. Since 2020, Clean Energy Transition has been short Tesla’s stock, meaning Lekander’s firm will profit if the automaker’s shares fall.

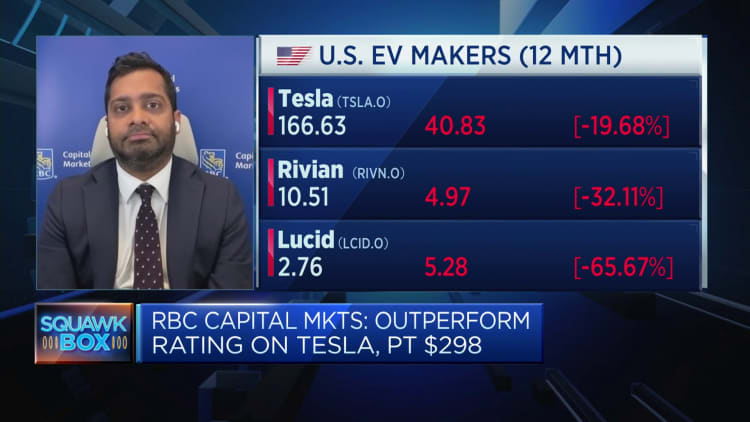

In a March 2021 interview with CNBC, Lekander called for Tesla’s stock to go down. At the time of the interview, Tesla’s shares closed at $233.94. On Tuesday, the stock closed at $166.63. But Lekander also called for a comeback of the traditional automakers, singling out Volkswagen. Shares of Volkswagen have fallen around 53% since that call, though they rallied at the start of this year.

Lekander has taken his bearish Tesla call further, suggesting the stock could fall to $14 per share. He said his call is based on an estimate that the company’s full-year earnings per share this year would be $1.40. Lekander contends that Tesla is a “no growth” stock and should be valued on 10 times forward earnings, versus around 58 times forward earnings currently. Forward earnings are an important metric used by traders to gauge the value of a stock.

If Tesla’s stock hit $14, that would represent around 91% downside from Tuesday’s close. Tesla’s shares have already fallen more than 30% this year.

“I think however Tesla cannot be at $14. If it falls under a certain level because of everything that’s been going on, it’s going to go bust.”

Lekander gave a number of reasons for his negative outlook. He said Tesla’s business model has been based on strong revenue growth, vertical integration and direct-to-consumer sales. Vertical integration broadly refers to when one company internally handles many parts of a process from the manufacturing of the car to the software. This model is “brilliant” when a company grows, but goes in “reverse” when sales fall, Lekander said.

The hedge fund boss said Tesla’s first-quarter problems were not to do with some of the reasons the company cited such as supply chain disruption. Instead, it is a “demand problem,” according to Lekander, who said two cars — the Model 3 and Model Y — make up the bulk of the U.S. automaker’s sales. And the company does not see another new vehicle being released until 2025.

“I don’t see any reason whatsoever to see any recovery over the next two years given that these models are stale and given the economy is not rocketing,” Lekander said.

Tesla said in its statement Tuesday it had faced numerous challenges during the quarter.

More CNBC reporting on Tesla

Negative Tesla voices growing

Lekander is among a chorus of negative voices on Tesla after disappointing delivery numbers.

“While the long-term proposition of electrical vehicles remains unchanged, the realities of delivering on that proposition are really starting to tell as Tesla (and the others) have run out of well-heeled consumers willing to pay big money to be beta testers,” Richard Windsor, founder of Radio Free Mobile, said in a research note Wednesday.

Windsor questioned Tesla’s roughly $500 billion valuation calling it “ludicrous” at a time when the company is facing rising competition.

“There is still plenty of downside in Tesla’s shares,” Windsor said.

Dan Ives, a noted Tesla bull at Wedbush Securities, who has a $300 price target on the electric vehicle maker, has become concerned.

“Let’s call this as it is: While we were anticipating a bad 1Q, this was an unmitigated disaster 1Q that is hard to explain away. We view this as a seminal moment in the Tesla story for Musk to either turn this around and reverse the black eye 1Q performance,” Ives said in a note Tuesday.

“Otherwise, some darker days could clearly be ahead that could disrupt the long-term Tesla narrative,” he added.

Analysts at HSBC and TD Cowen cut their price targets on Tesla’s stock on Wednesday.

Cathie Wood buys Tesla stock

Tesla is arguably one of the most divisive stocks on Wall Street and there are many that are still bullish on the company.

Cathie Wood’s Ark Invest bought Tesla stock for some of its funds this week ahead of the first-quarter delivery numbers in a sign of support.

Meanwhile, some analysts are talking up the longer-term potential of Tesla.

Tom Narayan, analyst at RBC Capital Markets, told CNBC’s “Squawk Box Asia” on Wednesday that most of the reasons behind the fall in first-quarter deliveries were “one-time in nature.”

But he said one near-term catalyst could be a recent directive from Tesla’s CEO to employees to install and show customers how to use the latest version of the company’s driver assist system, marketed as FSD or Full Self-Driving. Tesla also launched a free trial of the service for compatible cars which usually costs $199 per month.

“Maybe that gets people in the showrooms, maybe it gets people to subscribe to it, maybe it gets people to buy cars. So there is that near-term catalyst,” Narayan said.

The RBC analyst, who has an outperform rating on Tesla’s stock with a $298 price target, said his valuation is based on Tesla’s energy storage business, which is a “huge opportunity” for the company. And he added that “autonomy” is also a big part of his rating on Tesla.

“If FSD works, now it’s [Tesla] a software business with a software multiples,” Narayan said. Tesla’s FSD system does not make a car autonomous. It still requires a driver to take control of the car.

Don’t miss these stories from CNBC PRO:

Read the full article here