Coinbase has been granted a registration license in Canada, the company told CNBC, allowing it to make deeper inroads abroad as it faces a regulatory crackdown in its U.S. home market.

The firm said it has been registered in Ontario as a restricted dealer under the Canadian Securities Administrators (CSA), an umbrella organization of Canada’s provincial and territorial securities regulators.

The crypto exchange said that this authorization means the company now meets the Canadian regulators’ strict requirements for crypto assets dealings and can operate legally in the country.

Last year, Canada introduced new guidelines for crypto exchanges that limit how much certain investors can invest in crypto, as well as introduce mandatory registrations for crypto firms.

The policy changes led Binance, the world’s largest crypto exchange by trading volumes, to quit its activity in Canada, saying it was “no longer tenable” to operate there.

Rival crypto exchange Kraken said last year that it had filed a pre-registration undertaking (PRU) with the Ontario Securities Commission, effectively starting the process to become a registered dealer in Canada.

Coinbase filed its PRU in March 2023 and subsequently officially launched in the country in August that year. The company says it is the first international crypto exchange to receive restricted dealer registration in Canada.

“It’s something we’ve been working on for almost three years here in Canada, and more specifically with the Ontario Securities Commission over the last 12 months,” Lucas Matheson, Coinbase’s country director for Canada, told CNBC.

“We’ve been working diligently with our regulators over the past year on building a compliant platform in Canada to bring to Canadians.”

Matheson said that the regulatory environment in Canada has been more accommodating for crypto platforms, compared with the U.S.

Coinbase — and the broader crypto industry — has faced a significant backlash from the U.S. Securities and Exchange Commission in a major lawsuit over securities laws violations.

Matheson noted that Canada launched the first spot bitcoin exchange-traded fund globally long before the U.S. did — the Purpose Bitcoin ETF has now been trading for the last three years.

Sizable market opportunity

Matheson said the market opportunity in Canada is sizable.

“We have a population here that’s highly educated, that’s technology-savvy, that understands the digital economy,” Matheson told CNBC.

“Our registration in Canada makes us the first international and largest cryptocurrency exchange that’s registered in Canada. That positions us really well to help millions of Canadians access the digital economy.”

Canada is home to some notable tech companies, including e-commerce giant Shopify and artificial intelligence startup Cohere. Coinbase’s CEO Brian Armstrong visited the country in November 2023 to meet with the local team there and participate in a fireside chat with Shopify CEO Tobi Lutke.

Coinbase has a tech hub located in Canada with nearly 200 full-time local employees.

As the company looks to expand further globally, Matheson said he’s banking on the advantage of Coinbase’s status as an exchange that worked for regulator approvals before launching.

“We have a strong brand here in Canada as a publicly traded company, as a company who is committed to compliance, and registration more broadly in the world,” he said. “I think Coinbase has built a strong customer base of, of clients who who trust our platform, and, you know, the mission of Coinbase.

The license marks the latest win for Coinbase, which has been embarked on a global charm offensive to sway regulators and push its platform deeper overseas.

In 2022, Coinbase pulled the wraps off its so-called “Go Broad, Go Deep” strategy, which aimed to hire new leaders and fill for local licenses in various international markets.

Last year, Coinbase selected Ireland as its primary regulatory base in the European Union, seeking to take advantage of new crypto rules in the EU. The firm has also received individual approvals in France, Spain, Singapore, Italy, Ireland, and the Netherlands.

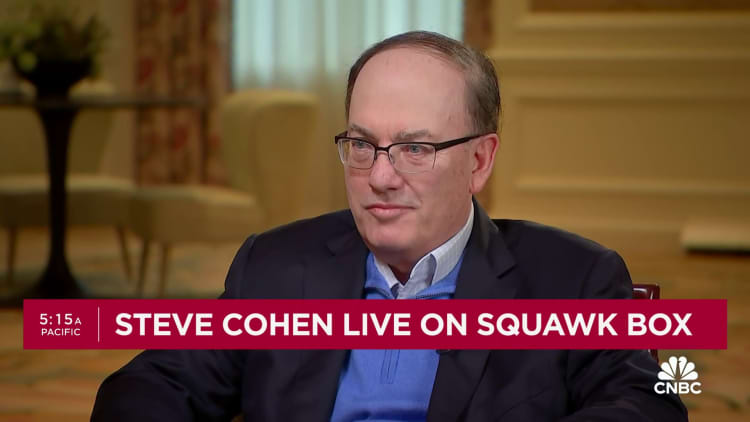

WATCH: CNBC’s full interview with Point72 chairman and CEO & New York Mets owner Steve Cohen

Read the full article here