Investment Overview

Ipsen S.A. (OTCPK:IPSEY, IPSEF) is a Paris, France-headquartered Pharmaceutical company focused on oncology, rare disease and neuroscience. The company’s business is built upon partnering with other biotech and pharma companies developing new drugs. According to Ipsen’s website:

Since 2020, Ipsen has brought in over 20-best- or first-in class programs across our pipeline at every stage of development and plans are in place to acquire more. We invest in opportunities in challenging disease areas to better address challenges faced by the community.

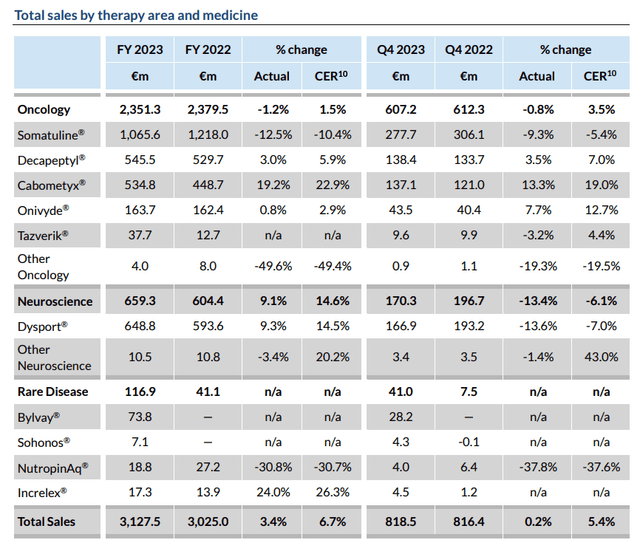

Ipsen sales by therapy (Ipsen)

As we can see above, the company has an established portfolio of commercial drug product assets and generated ~$3.4bn of revenues in 2023 – a 3.3% annual uplift. A core consolidated net profit of ~$830m was reported, versus $946m in the prior year.

Ipsen’s best-selling products are Somatuline (lanreotide), indicated for management of acromegaly and symptoms caused by neuroendocrine tumors, Dysport, an abobotulinumtoxinA injection indicated for Cervical Dystonia, Facial Wrinkles, Upper Limb Spasticity, and Lower Limb Spasticity, Cabometyx, a drug it licenses the rights to market and sell outside of the US, Canada, and Japan from Exelixis (EXEL), indicated for various solid tumor cancers, and Decapeptyl, indicated for prostate cancer patients.

In March 2023, Ipsen acquired Albireo, a “leading innovator in bile-acid modulators to treat pediatric and adult cholestatic liver diseases,” gaining access to Bylvay, indicated for pruritus and newly approved to treat Alagile Syndrome (“ALGS”), which analysts have forecast could achieve “blockbuster” (>$1bn per annum) sales, especially if a label expansion to treat biliary atresia can be secured.

The company says it “anticipates four commercial launches in 2024,” for Onivyde in the indication of pancreatic ductal adenocarcinoma (PDAC), elafibranor in second-line primary biliary cholangitis (“PBC”), Bylvay in ALGS, and Sohonos in fibrodysplasia ossificans progressiva (“FOP”), a rare musculoskeletal condition.

Onivyde was purchased from Merrimack Pharmaceuticals in 2017 in a deal worth $575m up front, plus $450m in potential milestones, while Ipsen secured the rights to develop and commercialize elafibranor from Genfit, in a deal worth ~$130m up-front, plus up to ~$390m in milestone payments. Sohonos was acquired via Ipsen’s $1bn acquisition of Clementia Pharmaceuticals in 2019.

For 2024, management has guided for a 6% annual revenue uplift, with core operating margin “around 30% of total sales, which includes additional R&D expenses from anticipated early and mid-stage external-innovation opportunities.” That is a little lower than in the past two years, but nevertheless, a strong margin overall.

Longer term, management hopes to drive “total-sales average growth of at least 7% per year for the period 2023-2027 at constant exchange rates” and a “core operating margin in 2027 of at least 32% of total sales.

Ipsen pays a small dividend which yields just over 1%, and is paid in dollars to holders of its ADR stock – the ADR ratio is 1:4 (ORD:ADR). The company reported a cash position of $560m as of the end of 2023, and net cash to debt of ~$70m.

In summary, Ipsen’s relatively unique approach – partnering with or acquiring biotech companies with promising, de-risked assets has been relatively successful to date, although with a current market cap of ~$9.7bn, shares are not especially cheap, and some investments have been better than others – for example, the Clementia acquisition has resulted in a single approval in a small indication, generating only $7m in revenues since its launch in August last year.

As such, and with somatuline’s patent protection having now expired, likely leading to long-term revenue erosion, Ipsen needs its pipeline to deliver some fresh opportunities – which is what makes its newly announced partnership with Sutro Biopharma an intriguing and potentially value accretive deal.

Ipsen Bolsters Pipeline Opportunities With Sutro BioPharma Deal For Antibody Drug Conjugates

Ipsen is currently guiding Tazverik – a drug candidate it acquired via its buyout of Epizyme in a deal worth ~$247m initially, with contingent value rights attached paying $0.3 per CVR “payable upon the first achievement of $250 million in aggregate net sales of Tazverik” – through a confirmatory study in second line follicular lymphoma treatment, with the drug having been awarded accelerated approval by the FDA in 2020.

A study failure could result in Tazverik being withdrawn from the market, while the drug has not been a commercial success, therefore this study does not add much value to Ipsen’s business.

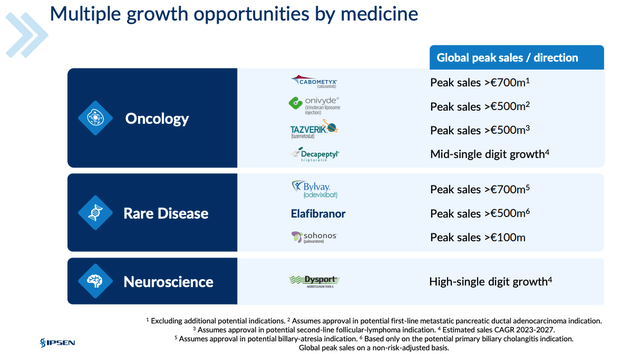

Ipsen is running Phase 2 studies of two longer-acting neurotoxin drug candidates, and of Fidrisertib, an ALK2 inhibitor licensed from Blueprint Medicines (BPMC), which is also indicated for FOP, as well as running a Phase 2 study of its candidate IPN60250 in Primary sclerosing cholangitis ((PSC)). As shown below, in a slide from a recent investor day presentation, management believes its portfolio is sufficient to drive ~$3bn per annum with no contribution from somatuline.

Ipsen earning potential from selected assets (Ipsen presentation)

Nevertheless, the pipeline could use one or two more assets of interest, and, as if acknowledging this, last week, Ipsen announced a deal with Sutro Biopharma (STRO), which includes:

an exclusive global licensing agreement for STRO-003. STRO-003, an antibody-drug conjugate (“ADC”) in the final stages of pre-clinical development, targets the ROR1 tumor antigen which is known to be overexpressed in many different cancer types including solid tumors and hematological malignancies.1 The agreement gives Ipsen exclusive worldwide rights to develop and commercialize STRO-003 and will be the first ADC candidate joining Ipsen’s expanding portfolio.

Antibody drug conjugates – which combine a monoclonal antibody with a cytotoxic payload connected via a chemical linker, combining the specificity of the antibody with the potency of the payload – are arguably the hottest property in the oncology treatment landscape at this time.

Last year, Pfizer (PFE) agreed to the ~$43bn takeover of Seagen, and its three approved ADCs, Adcetris, Padcev, and Tivdak. AbbVie (ABBV) spent ~$11bn acquiring Immunogen and its folate receptor-alpha-positive ADC Elahere, while Merck (MRK) invested $5.5bn to develop ADCs in partnership with Daiichi Sankyo.

In December last year, Bristol-Myers Squibb (BMY) purchased a Phase 2 stage ADC from China Pharma SystImmune, targeting EGFR and HER3. In January this year, Johnson & Johnson (JNJ) spent ~$2bn acquiring Ambrx, an ADC focused drug developer, and only a couple of days ago, the Danish biotech Genmab (GMAB) agreed to acquire Profound Bio in a $1.8bn deal, gaining access to:

three clinical and multiple preclinical programs including Rina-S, a potential best-in-class, clinical-stage, FRα-targeted, Topo1 ADC, currently in Phase 2 of a Phase 1/2 clinical trial, for the treatment of ovarian cancer and other FRα-expressing solid tumors.

Ipsen’s deal only gives it access to a single ADC asset – by the terms of the deal:

Sutro Biopharma is eligible to receive up to $900m in potential upfront, development, regulatory and commercial milestone payments including approximately $90m in near-term payments, including an equity investment, and tiered royalties on global sales, contingent upon successful development and commercialization.

Sutro & Ipsen’s Partnership Seems To Suit Both Parties

This feels like a deal that may suit both parties. Ipsen gains access to a promising, albeit early stage ADC, which Sutro says has “shown robust monotherapy efficacy and potential for a differentiated safety profile in preclinical development in solid tumors and hematological malignancies.”

Sutro, for its part, realizes a substantial cash windfall, with the potential for nearly $1bn more in potential payouts, and obtain a powerful Pharma partner which knows how to compete in commercial markets, should STRO-003 progress that far. At the same time, Sutro maintains full control of its lead asset, STRO-002, otherwise known as Luveltamab Tazevibulin, or Luvelta for short.

Sutro is currently enrolling Luvelta in a “registrational” (i.e., data collected from this study may be used to support and approval push, if positive) study in ovarian cancer. Luvelta targets receptor alpha (“FolRα”), similarly to AbbVie’s Elahere, which is also approved to treat advanced ovarian cancer patients, and expected to drive ~$500m revenues in 2024, and potentially, >$2bn in peak annual revenues.

Sutro believes Luvelta may have the edge over Elahere, because it addresses low and high medium expressing FolRα patients, while Elahere is limited to higher expressing FolRα patients only. According to a recent investor presentation, Sutro believes that while Luvelta could potentially serve a patient population of 80% of all of the ADC patient population, Elahere is restricted to 35%.

According to data shared with the American Society of Clinical Oncology, Luvelta achieved an objective response rate (“ORR”) of 43.8% in the higher dose cohort of a Phase 1 study in patients with a FolRα Tumor Proportion Score (“TPS”) of >25%, with a medium duration of response (“mDOR”) of 5.4m, and median Progression Free Survival (“PFS”) of 6.6m.

In its own pivotal study, Elahere was shown to reduce the risk of disease progression or death by 35% versus standard chemotherapy, meeting its primary endpoint, and also a secondary endpoint, showing a 42% ORR across 95 patients, and a 5% complete response rate (11 patients), with mDOR of 6.77m.

As such, the bar for approval seems quite high, however, Elahere’s pivotal SORAYA study was conducted in patients with FolRα TPS >75% (so far as I am aware) and therefore Luvelta may not be required to show superiority or even non-inferiority to Elahere in order to secure approval in a wider patient market. Besides ovarian, Luvelta has achieved an ORR of 29% in 17 patients with FolRα expressing endometrial cancer, and preclinical signs of efficacy in acute myeloid lymphoma (“AML”) and non small cell lung cancer (“NSCLC”).

It is tempting to wonder why Ipsen did not target luvelta as part of its deal for STRO-003 – perhaps Sutro management refused to hand over the rights, figuring it could go it alone – the company reports a current cash position of ~$375m, which it says extends it funding runway to 2H 2025, although a further $75m raise completed last week after the Ipsen deal was made public. Nevertheless, sharing some of the developmental costs for Luvelta might have appealed to Sutro management, although the company has multiple other Big Pharma partners with whom it is sharing its technology – according to its 2023 annual report / 10K submission these include:

an immunostimulatory antibody-drug conjugates collaboration with Astellas Pharma, a cytokine derivatives collaboration with Merck Sharp & Dohme Corp., a subsidiary of Merck & Co., Inc. ((MRK)); a B Cell Maturation Antigen, or BCMA, ADC collaboration with Bristol-Myers Squibb ((BMY)); a MUC1-EGFR ADC collaboration with Merck KGaA, Darmstadt Germany (operating in the United States and Canada under the name “EMD Serono”).

Vaxcyte is an additional partner, leveraging Sutro’s XpressCF® and XpressCF+® platforms, for the “discovery and development of vaccines for the treatment and prophylaxis of infectious disease.”

Concluding Thoughts – Ipsen / Sutro Deal May Deliver Long-Term Value For Both Companies – But Sutro Especially Is A Risky Investment

Ipsen seems to have made a smart move by making this deal with Sutro, giving itself access to the potentially very lucrative ADC market. The asset acquired is yet to begin in-human studies, so it seems as though Ipsen is prepared to spend years guiding this asset through the clinical trial process – historically, it has tended to bring in more de-risked assets at later stages of development.

Sutro, for its part, lands a $90m windfall, enabling it to complete its registrational study of Luvelta in ovarian cancer, and fund more studies as a combo therapy in ovarian (alongside chemotherapy), endometrial, NSCLC, and develop a preclinical tissue factor ADC directed against solid tumors.

Sutro’s platform and pipeline has been given additional validation by the number of partners it has attracted – Astellas also paid Sutro $90m upfront, and pledged up to $422.5, in development, regulatory and commercial milestones for each product candidate it develops, while Merck paid $60m upfront in 2018 and is developing a single candidate – MK-1484, a distinct cytokine derivative molecule for the treatment of cancer – with up to $500m milestones on the table.

Investing in either Ipsen or Sutro carries a level of risk, which is substantially higher in the case of Sutro, I would argue. Ipsen’s product portfolio looks capable of maintaining revenues >$3bn per annum for the foreseeable future, and the company and has been long term profitable and dividend paying. The drawback here is the patent expiry of its best-selling asset, and arguably, some slightly over-ambitious peak revenue targets for other portfolio drugs.

From Sutro’s perspective, the company appears to have a strong, late-stage candidate in the form of Luvelta, a decent amount of funding, and, if its technology is validated in the late-stage Luvelta study, for example, or a partner’s, the company may well become an attractive target for M&A, and its share price will likely soar.

There is a tangible risk that Luvelta does not meet the bar for approval in its registrational study, however, which would undermine its technology and eliminate any hope of commercial revenues in the short – to medium term. The ADC drug development market is becoming more crowded and it will be harder for every company to achieve best-in-class status in any indication.

The fact that Sutro’s market cap valuation is just $375m at the time of writing in my view serves as either a warning or an opportunity. Clearly, there is huge upside for shares to explore if Luvelta or one of its partnered drugs makes a clear case for approval – and blockbuster revenues – but partners can walk away from programs without coughing up any milestones, and if Luvelta fails, the company will be back at square one in many ways. Its safety and efficacy must be well-established in the new study, and come very close to matching Elahere, for the company to be certain of an approval shot.

As such, if you are an investor looking to gain some modest exposure to the ADC market, without jeopardizing your investment or risking an overnight >50% loss, then Ipsen S.A. is a company that should definitely be on your radar. If you are looking for a more speculative and potentially rewarding opportunity, Sutro Biopharma, Inc. could be a biotech stock to consider buying.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here