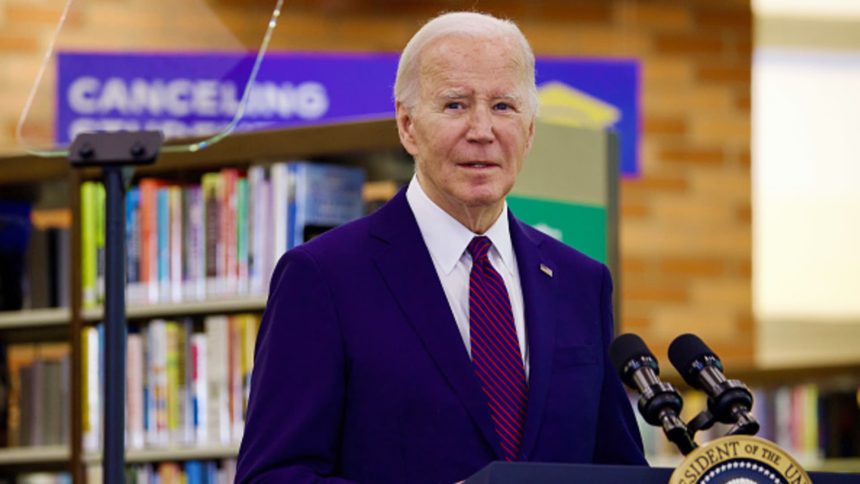

President Joe Biden will announce on Monday a new, sweeping student loan forgiveness plan, which could benefit tens of millions of Americans.

Biden will share the details of the aid package at an event in Madison, Wisconsin.

The news comes less than a year after the Supreme Court rejected his first attempt to cancel up to $20,000 in student debt per borrower. The conservative justices ruled that that effort was unconstitutional in June.

Although Biden’s Plan B for student loan forgiveness will be narrower than his initial effort, tens of millions of borrowers may still see their balances erased or lowered if the program survives legal challenges this time.

“These historic steps reflect President Biden’s determination that we cannot allow student debt to leave students worse off than before they went to college,” U.S. Undersecretary of Education James Kvaal said in a statement.

Kvaal added that Biden had directed the department “to complete these programs as quickly as possible, and we are going to do just that.”

Who may benefit from new forgiveness plan

Biden’s revised plan targets specific borrowers, including those who:

- Are already eligible for debt cancellation under an existing government program but haven’t applied

- Have been in repayment for 20 years or longer on their undergraduate loans, or over 25 years on their graduate loans

- Attended schools of questionable value

- Are experiencing financial hardship

It’s not entirely clear yet how financial hardship will be defined, but it could include those burdened by medical debt or high child care expenses, the Biden administration said.

The president is also expected to discuss a plan to “cancel runaway interest” for millions of borrowers.

Consumer advocates have long criticized the fact that interest rates on federal student loans may exceed 8%, which can make it tough for borrowers who fall behind or are on certain payment plans to reduce their balances. Some end up owing more than they originally borrowed, even after years of repayment.

The Biden administration estimates that, if its new plan is enacted as proposed, borrowers will get up to $20,000 of unpaid interest on their federal student debt forgiven, regardless of their income. Certain low- and middle-income borrowers could have the entire amount of interest that has accrued on their debt since they entered repayment canceled.

A narrower aid package Biden hopes will survive

The Biden administration believes its updated plan will survive legal challenges this time for several reasons.

In addition to the fact that this effort is a more targeted aid program, the Education Dept. is also using a different law — the Higher Education Act — as its legal justification. Biden’s initial forgiveness effort was based on the Heroes Act of 2003.

The HEA was signed into law by President Lyndon B. Johnson in 1965, and allows the education secretary some authority to waive or release borrowers’ education debt.

The Heroes Act was passed in the aftermath of the 9/11 terrorist attacks, and grants the president broad power to revise student loan programs during national emergencies. The Biden administration tried to use this law in its first forgiveness effort because at the time, the country was under a national emergency status from the Covid-19 pandemic.

More from Personal Finance:

Why gas is so expensive in California

Credit card users face ‘consequences’ from falling behind

After Biden praises progress on inflation, economists weigh in

However, the conservative justices didn’t buy that argument.

“‘Can the Secretary use his powers to abolish $430 billion in student loans, completely canceling loan balances for 20 million borrowers, as a pandemic winds down to its end?'” Chief Justice John Roberts wrote in the majority opinion for Biden v. Nebraska. “We can’t believe the answer would be yes.”

Lastly, the Biden administration has now turned to the rulemaking process to deliver its relief. The president previously attempted to cancel the debt through executive action.

Student debt cancellation an important issue for voters

Biden likely wants to start forgiving student debt before voters cast their ballots in November.

Almost half of voters in a recent survey, or 48%, say canceling student loan debt is an important issue to them in the 2024 presidential and congressional elections. SocialSphere, a research and consulting firm, polled 3,812 registered voters, including 2,601 Gen Z and millennial respondents, in mid-March.

Forgiving student debt could especially help Biden with young voters, a demographic he’s been struggling with. Around 70% of Gen Z respondents said student debt cancellation was important to them in the election, that same survey found. More than half (53%) of respondents in that generation said they or someone in their household has student debts.

Biden’s plan is estimated to reach more than 30 million borrowers, when combined with his other ongoing debt forgiveness efforts, his administration said.

Mainly by improving current loan relief programs, the Biden administration has now cleared the education debts of 4 million people, totaling $146 billion in aid.

This is breaking news. Please check back for updates.

Read the full article here