With Oil performing so strongly recently, it’s worth looking at some suitable options for getting access. And the catalyst is clear as to why. The major factor which, I think, is massively underappreciated is geopolitical risk. Should Iran escalate things with Israel, we could see a significant Oil spike and risk-off period. I think generally speaking, there is significant complacency on the equity side, and the oil side is clearly sensing something could be coming, in my view.

So how do you get access to the Oil move here? The ProShares K-1 Free Crude Oil Strategy ETF (BATS:OILK) is a good fund to consider. This exchange-traded fund, or ETF, offers investors a unique opportunity to gain exposure to oil futures without the complexities and tax implications of traditional oil futures trading. OILK aims to provide investors with exposure to West Texas Intermediate (WTI) crude oil futures (CL1:COM). What sets it apart from traditional oil futures trading is that it does not issue a K-1 tax form, simplifying tax reporting for investors.

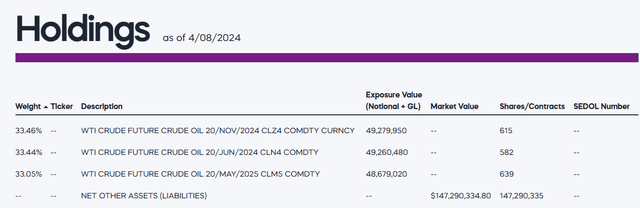

The fund’s benchmark is the Bloomberg Commodity Balanced WTI Crude Oil Index, which tracks the performance of a basket of three separate WTI Crude Oil futures contracts. It’s important to note that the fund does not intend to track the spot price of WTI crude oil but rather the performance of its futures contracts. This is the only real way to gain access that directionally tracks the spot. The ETF has an expense ratio of 0.73% and has total assets under management, or AUM, currently of $147 million.

Details on OILK’s Holdings

OILK’s portfolio consists of WTI Crude Futures contracts that are rolled over before their expiration dates. The fund currently holds three contracts: June 2024, November 2024, and May 2025, each occupying approximately a third of the fund’s portfolio. Because this fund is doing this automatically on a continuous basis, it removes the need and hassle to do it on your own.

proshares.com

Peer Comparison

OILK’s major differentiator is its unique tax structure. The United States Oil Fund, LP ETF (USO), for instance, is a more liquid ETF that also tracks oil futures. However, USO is structured differently, holding futures contracts of varying maturities, incurring costs from the roll effect. OILK, on the other hand, only holds three contracts with longer maturity dates, which may help explain its outperformance over USO in the long term.

It’s worth noting that oil may actually perform better than the S&P 500 (SP500). When we look at OILK relative to the SPDR® S&P 500 ETF Trust (SPY), it actually looks like oil wants to outperform stocks. Interesting development in my view. This, to me, suggests we could see demand actually going into commodities from equities should relative momentum persist.

StockCharts.com

Pros and Cons of Investing in OILK

The main advantage of investing in OILK is its simplified tax structure, offering investors exposure to oil futures without the need to deal with K-1 forms. Additionally, its strategy of investing in futures contracts of differing maturity dates has been shown to yield higher returns than similar ETFs.

On the downside, OILK’s returns may not closely track the spot price of crude oil due to its investment strategy. Furthermore, like all investments, OILK comes with risks, including the volatility of oil prices and the complexities of futures trading.

To me – this is a clean way to get access, and as good as it gets from a “convenience” perspective as a trading and investment vehicle.

Conclusion

Investing in ProShares K-1 Free Crude Oil Strategy ETF could be a good move for those seeking exposure to the oil market without dealing with the complexities and tax implications of direct futures trading. However, potential investors should be cognizant of the risks involved and consider their individual financial goals and risk tolerance before investing. OILK can be a useful hedge against uncertainties, especially in volatile market conditions. I certainly hope that Iran does not escalate things in the Middle East, but if war broadens out, Oil likely does become a beneficiary.

Read the full article here