The S&P 500 ETF (NYSEARCA:SPY) gapped up 1% at the open this morning, so below we wanted to provide a quick summary of how the ETF has typically traded on days when it gaps up 1%+.

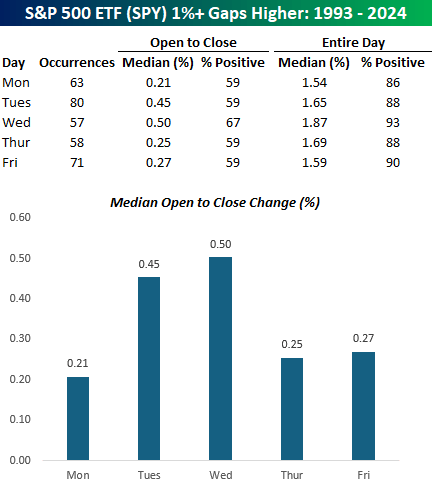

As shown in the table below, 1%+ gaps higher on a Friday have been the second most frequent of any weekday with 71, trailing only the 80 1%+ gaps higher on Tuesday.

On the 71 prior Fridays when SPY has gapped up at least 1%, its median change from the open to close was a further gain of 0.27% with positive returns 59% of the time.

SPY has had the best open-to-close performance (+0.50%) after gapping up 1%+ on Wednesdays and the highest consistency of gains (67%).

As for the entire trading day, 90% of the time when SPY gaps up 1%+, it finishes higher on the day. That may sound impressive, but the fact that there is a one in ten chance of the market giving up all of its opening rally means that gains are hardly guaranteed.

The worst day of the week in terms of holding 1%+ opening gains has been on Monday, as 14% of those days have erased the entire opening gap.

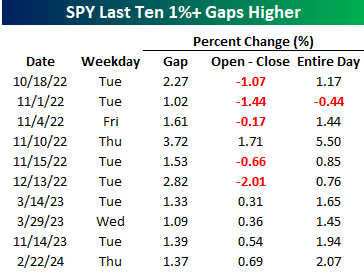

Looking at more recent 1%+ gaps higher, the table below lists the last ten 1%+ opening gaps higher in SPY. Six of the last ten opening gaps have occurred on Tuesdays, but overall, it has been a coin flip in terms of the market’s performance from the open to the close.

Of the five days where SPY did trade lower from the open to close, it only erased the entirety of its opening gap once (11/1/22).

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here