The subject of financial exploitation of elders in our country has been on law enforcement radar for decades. Significant public education programs on this topic by states, counties, and elder-focused organizations are ongoing, but are they doing any good?

There was an increase in financial elder exploitation by 14% over the last year, according to the annual FBI report. The data reveals the number of crime reports by persons over 60 in the U.S. Could that include your own aging parents or other loved ones?

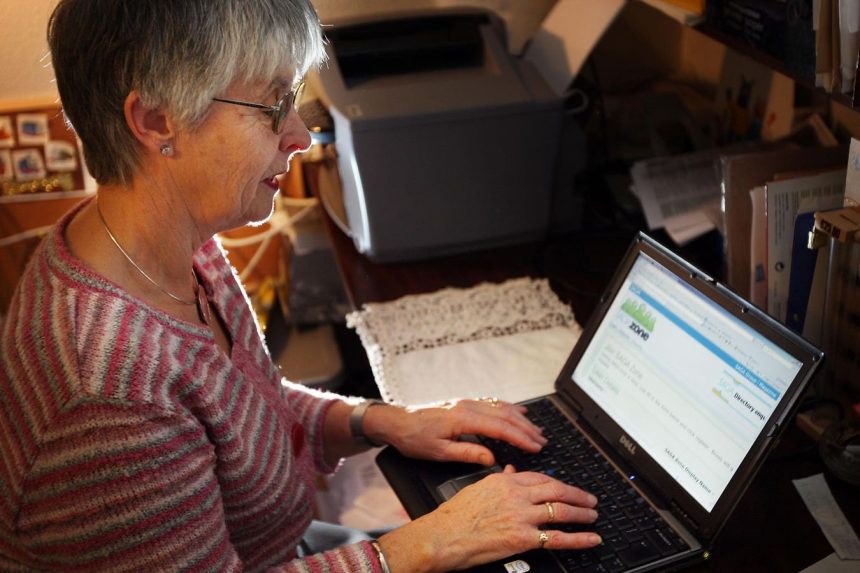

According to the report, “tech support scams were the most widely reported kind of elder fraud in 2023. Personal data breaches, confidence and romance scams, non-payment or non-delivery scams, and investment scams rounded out the top five most common types of elder fraud” that were reported to the FBI’s unit last year. Yet, every public education program warns elders about these very risks for those using the internet. According to Statista, 88% of people over age 65 are on the internet. Why aren’t these elders getting it? They are at ever increasing risk.

Possible Explanations

From our own observations at AgingParents.com, where we consult with families of elders or the elders themselves daily, we see that many people over age 65 are beginning to lose their financial judgment along with losing short-term memory. Both can be early warning signs of dementia. But at the early stages of these changes in the brain, no one seems worried. The older person can still function in daily life, do some usual chores and other basics, but they can’t keep track of money, bills and investments.

Family, even if duly appointed on legal documents like the financial Durable Power of Attorney, are reluctant to step in and take over money management. They don’t want to insult the aging parent. Or they are uncomfortable pointing out what they have just learned, perhaps that Mom forgot to pay her taxes as she always used to do on time. Or the family sees aging parents’ unopened bills or dunning notices of debts that are unpaid. Yet, they are squeamish with the topic and rarely step up at this stage and offer to take over bill payment or exercise financial authority over the aging loved one. That leaves the (apparently) “slightly impaired” aging parent at risk for the very fraud the FBI is telling us about and warning us about every year, including 2023. Solid expert research tells us that at the earliest stages of dementia, financial judgment is already significantly impaired.

What’s The Solution?

We believe that the problem of warning elders about financial abuse must include warning and educating their families, perhaps even more than focusing on only the aging persons themselves. Many people who know they are suffering with short term memory loss or forgetting to pay bills do not see it as anything to worry about. They make it acceptable to themselves by telling themselves that it’s normal with aging. But loss of financial judgment is NOT normal aging. Forgetting names and such may indeed be normal with aging. There must be a distinction between that kind of memory loss and the kind that leads a person to forget what their investments involve or lose the good sense that what looks like a scam is indeed a scam. Sometimes, the elder thinks they’re perfectly fine when everyone around them knows they’re not. That is the greatest risk—loss of financial judgment and the elder doesn’t realize it.

A Strategy

Anyone with aging parents or other vulnerable elders in their lives can certainly bring the data about elder financial exploitation and common scams targeting elders to their elders’ attention. That is not enough! Family members and loved ones need to step in and oversee spending, particularly when the older person spends a lot of time on the internet. Yes, that requires permission from your aging parent. Yes, it may be uncomfortable to bring it up and respectfully suggest that you help, and have access to view their accounts online. You can do this without having authority to stop a transaction, or with such authority. To obtain legal authority over any elder’s account online, you do need a Durable Power of Attorney signed and notarized by the aging person. While you’re at it, get your elder to sign the financial institution’s own internal POA too. They have a prejudice against “outside” POA forms sometimes. Legal power of attorney forms are available online and no lawyer is necessary to get the most basic form done. Even seeing what the elder is considering doing or has done with their funds can prompt more action by family to prevent fraud.

The Takeaways:

- Elder fraud, scams and exploitation are increasing steadily. Public education is not stopping it.

- Without a family member or other caring person to attend to the signs of an elder’s lost financial judgment, more scams targeting these impaired elders will continue to succeed.

- The best way to stop your aging parent from getting scammed is to have some conversations about the most common ones and to step in and watch what they are doing with their money.

- Educate yourself first, as family of an elder. Read the FBI report about elder-targeting exploitation tactics so you can pass on the information. Most importantly, have a plan in place to access your aging parent’s financial information so you can act when you get any whiff of suspicious activity or contacts they are receiving.

Read the full article here