Reckless government spending enabled by the Federal Reserve is hurting average Americans and endangering President Joe Biden’s chances at getting reelected, billionaire investor Stanley Druckenmiller said Tuesday.

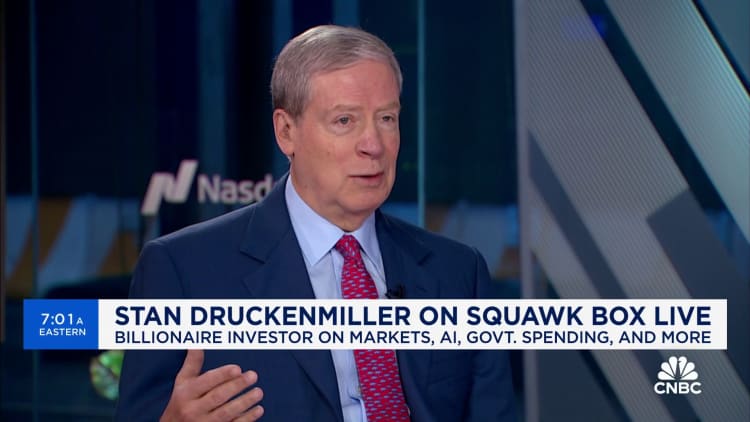

During an appearance on CNBC’s “Squawk Box,” the head of Duquesne Family Office who made his name betting against the British pound in the early 1990s blasted fiscal and monetary authorities, including Treasury Secretary Janet Yellen and Fed Chair Jerome Powell.

In addition, he called “Bidenomics” a failure and said consumers are paying the price in terms of higher inflation.

“There does seem to be a lot more recognition … of the fiscal situation facing us. Everybody seems to get it but Yellen, who just keeps spending and spending,” Druckenmiller said. “I think it’s dumb politically because it’s causing inflation and it doesn’t take a genius to figure out that the average American is getting hurt by the inflation.”

Druckenmiller’s comments come with the Fed still trying to bring inflation down, as policymakers have dashed investors’ hopes for aggressive interest rate cuts this year.

Getting markets enthused about rate reductions was a mistake because it set financial conditions “on fire,” he said.

“It seemed to me the Fed was in a perfect position. Inflation was coming down, financial conditions were tightening,” he said. “To some extent, I feel like they fumbled on the five-yard line.”

The Fed’s mistake

Though Druckenmiller said his firm was “a major beneficiary” of the jump in asset prices and easing conditions, he still thinks the Fed’s pivot in late 2023 to push harder on the idea that rate cuts were coming was a mistake. The Fed at that point only upped its unofficial forecast from two to three cuts. However, investors interpreted comments from Powell in December to mean that a substantial policy easing was ahead.

Elected officials generally welcome low interest rates. Druckenmiller said Powell didn’t do Biden any favors.

Biden is in a tight battle with former President Donald Trump heading into the November election.

“Bidenomics, If I was a professor, I’d give him an ‘F,'” Druckenmiller said. “Basically, they misdiagnosed Covid and thought [the economy] was going into a depression. The Fed did, too.”

“Treasury is still acting like we’re in a depression,” he added. “They’ve spent and spent and spent, and my new fear now is that spending and the resulting interest rates on the debt that’s been created are going to crowd out some of the innovation that otherwise would have taken place.”

The pandemic onset occurred under the Trump administration, which signed into law a $2.3 trillion coronavirus relief package in 2020. Biden then signed another nearly $2 trillion relief package in 2021.

Druckenmiller also didn’t have many good things to say about Trump, who he said was likely to see inflation under his presidency as well.

During his time in office, Trump was a fierce Fed critic and repeatedly hectored Powell and his colleagues to lower interest rates. In addition, Trump advocated heavy tariffs and has indicated he would do so again if he wins in November.

“With Biden, I’m more worried about stagflation, with all the government spending, with all the tricks that Yellen has been using to manipulate yield curve, with the way the Fed seems to have reignited financial conditions. I think the inflationary outcome could be there,” Druckenmiller said. “But I also fear regulation and everything else preventing productivity.”

“So, I’m basically a guy without a candidate,” he added. “I’m an old-style Reagan, free markets, pro-immigration and anti-tariff Republican.”

Don’t miss these exclusives from CNBC PRO

Read the full article here