Back in December of 2022, I wrote an article wherein I took a bullish stance on a company by the name of Hooker Furnishings (NASDAQ:HOFT). The company, for those not familiar, operates as a designer, marketer, and importer, of furniture and other similar goods. It produces some of its own furniture and it sells these products to retailers such as independent furniture stores, department stores, national chains, and more. At the time, I acknowledged that the company was facing some headwinds. However, I argued that the stock was attractively priced at that time. On top of this, the company had only a modicum of net debt.

Since then, things have not gone exactly as I would have hoped. Although shares are up 5.5% since the publication of that article, that is a far cry from the 31.4% increase seen by the S&P 500 over the same window of time. Fast word to today, and the picture is definitely interesting. Relative to similar firms, shares look perhaps only slightly undervalued. The company has gone from having net debt of $18.1 million on its books to having net cash of $20.3 million. That is certainly an improvement. However, revenue and cash flows both remain weak as difficult industry conditions push demand down. This has also caused a collapse of the company’s backlog.

Because of these problems, I am definitely not as optimistic as I was previously. While shares of the company are still very cheap, even after factoring in recent weaknesses, the change in industry conditions is problematic. Out of an abundance of caution, these problems have led me to become more cautious, ultimately leading to the downgrade that I’m instituting now from a soft ‘buy’ to a ‘hold’. Of course, this picture can always change based on new data that comes to light. And it just so happens that, before the market opens on June 6th, the management team at Hooker Furnishings is expected to announce financial results for the first quarter of the 2025 fiscal year. If analysts turn out to be correct, the end result will be additional pain on both the top and bottom lines. But if management can come out with a positive surprise, I could perhaps become slightly bullish again.

Tough times

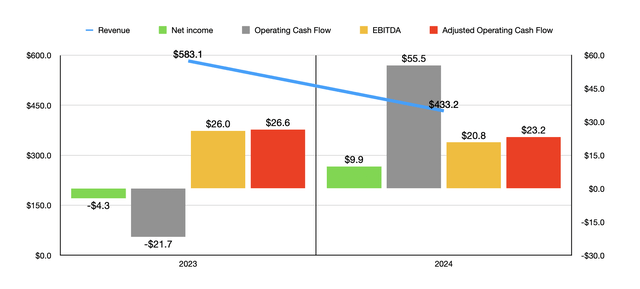

Fundamentally speaking, things have not been all that great for Hooker Furnishings. As an example, we need only look at financial results covering the 2024 fiscal year compared to what the company generated in 2023. Revenue for 2024 came in at $433.2 million. That’s a decline of 25.7% compared to the $583.1 million generated in 2023. Management attributed this to industry wide demand softening. However, not all of this was because of that. A $21 million reduction in revenue was actually attributable to the company’s decision to exit unprofitable product lines in the Home Meridian segment. If we adjust for this, revenue would have actually fallen by 22.9%.

Author – SEC EDGAR Data

When it comes to specific segments, there was pain across the board. The Home Meridian segment saw revenue drop by 33.7%. But this decline drops to 26.5% if we remove the aforementioned exits. The larger Hooker Branded segment reported a 24% drop, largely because of a 21.6% decline in unit volume. By comparison, average selling prices for that segment dropped by only 0.1%. The Home Meridian segment reported a 23% drop in volume and a 13.2% drop in average selling prices. And lastly, the Domestic Upholstery segment was hit to the tune of 24.2% from volume declines. This was offset marginally by a 7.7% improvement in pricing.

The bottom line for the company was a bit more complicated. While revenue took a hit, the firm went from generating a net loss of $4.3 million in 2023 to generating a profit of $9.9 million last year. But this was largely the result of the absence of a $24 million write down that the company experienced in 2023 associated with inventories in its Home Meridian segment. Most other profitability metrics worsened as well. It is true that operating cash flow went from negative $21.7 million to positive $55.5 million. But if we adjust for changes in working capital, we get a drop from $26 million to $23.2 million. Lastly, EBITDA for the company declined from $26 million to $20.8 million.

Author – SEC EDGAR Data

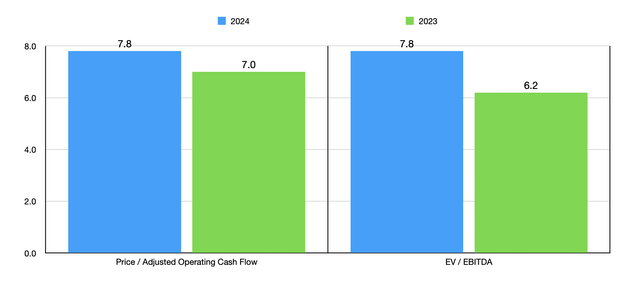

If we use the financial results generated in both 2023 and 2024, valuing the company becomes a cinch. In the chart above, you can see how shares are priced on both a price to adjusted operating cash flow basis and on an EV to EBITDA basis. I love seeing companies trade in the mid to high single digit range like this. But relative to similar firms, the stock looks only slightly cheap. As you can see in the table below, two of the five firms that I decided to compare Hooker Furnishings to are trading at multiples lower than what our candidate is.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Hooker Furnishings | 7.8 | 7.8 |

| Ethan Allen Interiors (ETD) | 9.3 | 5.4 |

| Tempur Sealy International (TPX) | 15.2 | 15.6 |

| The Lovesac Company (LOVE) | 6.0 | 8.2 |

| La-Z-Boy Incorporated (LZB) | 8.9 | 4.6 |

| Mohawk Industries (MHK) | 6.2 | 27.2 |

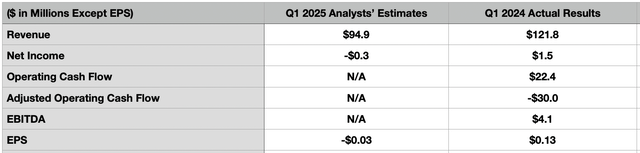

As I mentioned at the start of this article, management is expected to announce financial results for the first quarter of the 2025 fiscal year before the market opens on June 6th. The current expectation by analysts is that revenue will come in at about $94.9 million. That would represent a massive decline of 22.1% compared to the $121.8 million generated one year earlier. The winding down of certain products is very likely to be a big contributor to this decline. But overall weakness is probably also going to occur.

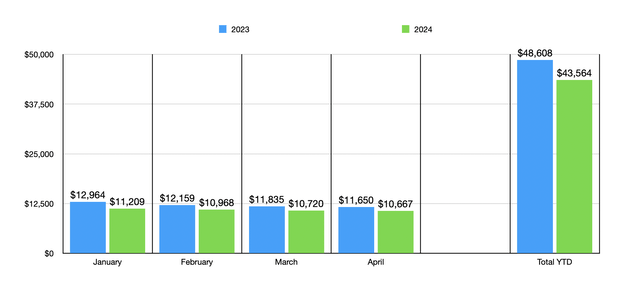

Author – Federal Reserve Data

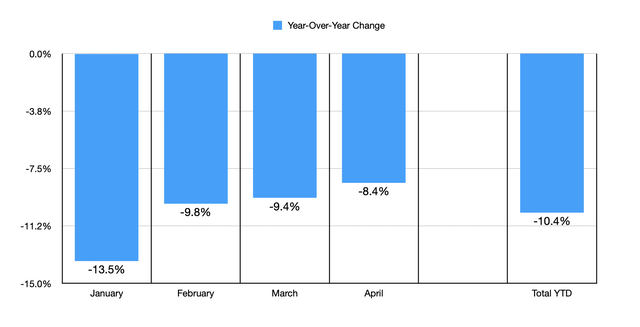

I say this because the most recent data provided by the Federal Reserve shows that furniture sales, at the retail level, are quite a bit lower this year than they were the year prior. For the first four months of the year, revenue totaled $43.56 billion. That’s down 10.4% compared to the $48.61 billion generated in the first four months of 2023. As the chart below illustrates, we are seeing the year over year declines get smaller each month. Back in January, the drop is 13.5%. By April, that had fallen to 8.4%. This does create some hope that recent pain will be very transitory.

Author – Federal Reserve Data

Regardless of what we ultimately see from a revenue perspective, it’s also likely that bottom line results will worsen. Analysts are expecting a loss of $0.03 per share. That compares to the $0.13 per share in profits generated in the first quarter of 2024. That would result in net income falling from $1.5 million to negative $0.3 million. In the table below, you can also see other financial results for the first quarter of 2024. In all likelihood, these will also worsen on a year over year basis.

Author – SEC EDGAR Data

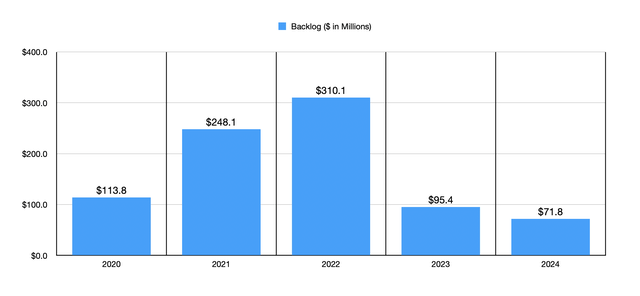

Eventually, I suspect that things will turn around for Hooker Furnishings. The company, with a net cash position of $20.3 million, certainly has time to wait. But the first leading indicator that we will likely see that the worst is over and that good times are on the horizon will be in the firm’s backlog. If we focus only on year end results, then backlog for Hooker Furnishings peaked at $310.1 million back in 2022. By the end of 2023, we had seen a decline to $95.4 million. And by the end of the 2024 fiscal year, that figure dropped further to $71.8 million. If or when we start to see an improvement on this front, especially if that is a significant improvement, then optimism will probably be warranted. But until then, we do look to be on a weakening trend.

Author – SEC EDGAR Data

Takeaway

As much as I like Hooker Furnishings, the picture for the company has gotten far worse than I anticipated. It’s only because of how cheap shares are that the stock didn’t decline since I last wrote about it. Had it been an expensive stock, I think quite a bit of downside could have been warranted. But instead, investors were graced with subpar returns. In the long run, I fully expect Hooker Furnishings to create significant value for its investors. But because of how things currently stand, even with earnings on the horizon, I think that a more cautious approach is warranted. That has led me to downgrade the stock from a soft ‘buy’ to a ‘hold’.

Read the full article here