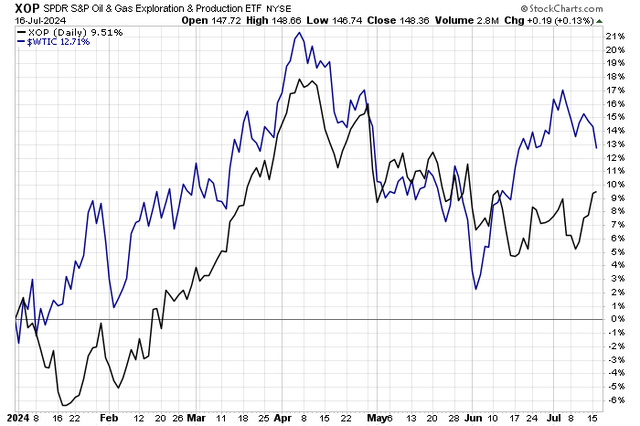

Chord Energy (NASDAQ:CHRD) is one of so many oil and gas exploration & production companies that have recently engaged in M&A to hopefully boost efficiencies, drilling, and ultimately profits. So far this year, though, WTI crude oil prices have outperformed Energy-sector equities for the most part.

Through July 16, domestic oil was up 13% in 2024 while the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) was up just 9.5%, about half the total return of the S&P 500. It remains to be seen if we will see higher valuation multiples for small- and mid-cap E&P names, but with low P/Es and high free cash flow, there are value considerations.

I reiterate a buy rating on CHRD. I see the stock’s low 8x earnings multiple as cheap, while its 11% free cash flow yield is likewise attractive. Following the merger with Enerplus, there are operational tailwinds ahead, in my view.

Oil & Gas Stocks Losing Ground to WTI Crude Oil YTD

StockCharts.com

According to Bank of America Global Research, CHRD is the largest oil and natural gas producer in Williston, formed from the merger of Oasis and Whiting Petroleum in 2022. Its management estimates that it has approximately 1,800 “core” locations.

Back in May, Chord reported a solid quarter. Q1 GAAP EPS of $4.65 was in line with the Wall Street consensus while its top line of $1.09 billion, up 22% from a year earlier, was an impressive $324 million beat. The $7.4 billion market cap firm produced oil volumes of 99 MBop/day, which was above the top-end of its guidance range. Along with the quarterly profit numbers being released, the management team declared a $1.25 dividend, bringing the yield to 3.8% on a trailing 12-month basis today.

The $11 billion cash and stock merger with Enerplus (ERF) is expected to boost scale in the key Bakken shale region, which likely results in better profit growth potential. But the onus is on Chord to execute. New capabilities via longer lateral drilling and wider spacing could lead to higher production volumes. Low financial leverage and calming rate markets should also help its cause. The company expects $200 million in synergies, largely due to improved efficiencies. I expect Chord to produce an FCF yield in the mid-teens over the coming quarters (annualized).

Looking ahead to the Q2 report, higher in-basin production and temporary refinery shutdowns could hurt EPS, but strong oil prices lately are an offsetting tailwind. Still, the natural gas liquids market has been soft over the recent months, while the firm’s capex has been steady. Key, however, will be that the quarter about to be reported is the first that reflects the deal with ERF, so the focus will be on the forward outlook.

Ahead of earnings on July 13, the options market has priced in a somewhat modest 4.0% earnings-related stock price swing when analyzing the at-the-money straddle expiring after the release. Shares have ranged just 1% to 5% in post-earnings reactions over the past few years. The expectation is for $5.51 in non-GAAP EPS, which would be a significant increase from $3.65 in the same quarter a year ago.

Key risks include weaker oil and gas prices if we see a slowdown in the macroeconomy, struggles with Chord integrating ERF, higher than expected capex costs, and a strong dollar which could pressure WTI and NGL prices.

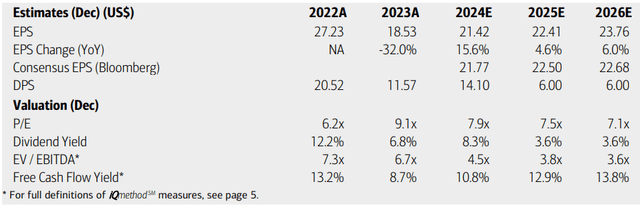

On the earnings outlook, analysts at BofA see operating EPS rising 16% this year, but then growth is seen slowing to a mid-single-digit range in the out year through 2026. The current Seeking Alpha consensus numbers are about in line with what BofA projects.

Dividends should normalize near $6 per share, making for a decent yield, while its P/E ratio remains compelling near 8 currently. What’s more, CHRD is just 2.9x on a forward EV/EBITDA basis – a massive difference to the cheap side compared to the S&P 500.

Chord: Earnings, Valuation, Dividend, Free Cash Flow Yield Forecasts

BofA Global Research

If we assume normalized non-GAAP EPS of $22 and apply a modest 9x multiple, which I assert is fair given Chord’s solid balance sheet, high free cash flow, and growing earnings, then shares should trade near $198. That is a slight increase from my previous valuation given realized profits and continued strong operating performance.

It’s possible that if EPS growth bumps up to the high single digits, then a low-teens P/E could be seen.

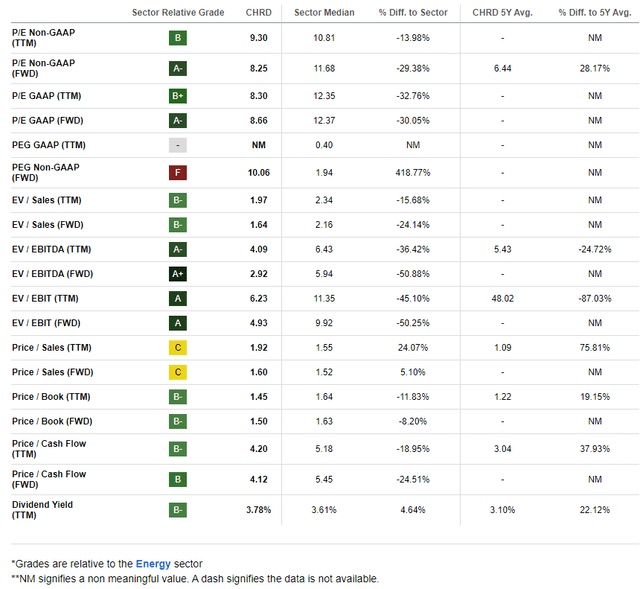

Chord: Compelling Valuation Metrics

Seeking Alpha

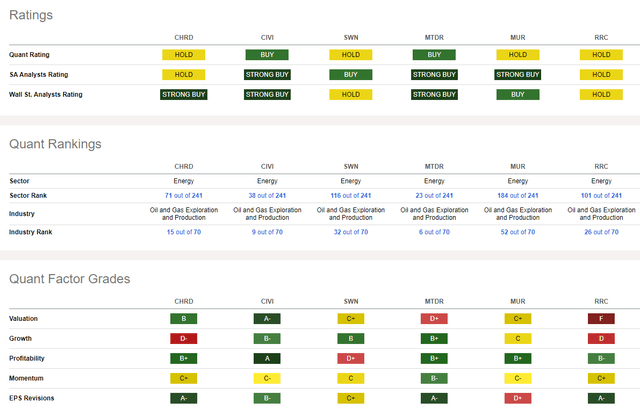

Compared to its peers, Chord features a relatively strong valuation grade while its growth history is weak. But I encourage investors to focus on where the company is today with its new assets and healthy operating metrics.

Indeed, profitability trends are sound and there has been a steady diet of sellside EPS upgrades in the past 90 days. But share-price momentum has been lacking, and I will note key price levels on the chart to monitor later in the article.

Competitor Analysis

Seeking Alpha

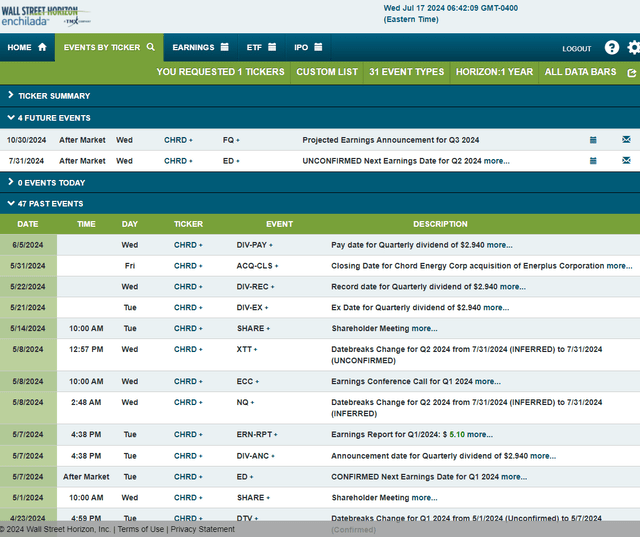

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q2 2024 earnings date of Wednesday, July 31 AMC. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

Wall Street Horizon

The Technical Take

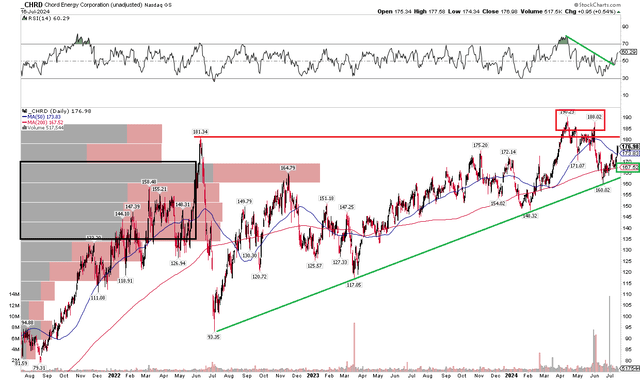

Last summer, I noted that the $165 mark was key for Chord. Notice in the chart below that shares rallied through that level of resistance, but gains have been limited since the upside move. Today, I am modestly concerned about the potential of a bearish false breakout above $185 that took place earlier this year. Still, there is a bullish uptrend support line that comes into play just shy of $170 while there has been a break of a downtrend in the RSI momentum gauge at the top of the chart.

Also, take a look at the volume by price indicator on the left side of the graph. There is a high amount of shares traded underneath the current stock price – that should offer a cushion if we see a protracted pullback. The rising long-term 200-day moving average suggests that the bulls control the primary trend, but the trend indicator line is flattening in its slope as a sign of weakening momentum.

Overall, the chart is mixed, with resistance above $185 while support is seen in the $160 to $165 zone.

CHRD: Bullish Uptrend, But False-Breakout Watch

StockCharts.com

The Bottom Line

I have a buy rating on Chord. The valuation remains solid, but not overly cheap. If EPS verifies strongly, then a higher P/E could warrant a higher intrinsic value estimate.

Read the full article here