Every weekday the CNBC Investing Club with Jim Cramer holds a “Morning Meeting” livestream at 10:20 a.m. ET. Here’s a recap of Wednesday’s key moments. 1. U.S. stocks advanced Wednesday after breaking the market’s three-day losing streak in the previous session. The S & P 500 climbed 1.5%, while the Dow Jones Industrial Average and Nasdaq Composite jumped 1% and 1.9%, respectively. “What we have here today is a good day,” Jim Cramer said. He pointed to Monday’s decline, when the Dow and S & P 500 posted their worst sessions since 2022, as “maybe a one-day glitch.” Remember, this sell-off was fueled by the unwinding of the “yen carry trade” and U.S. recession concerns following a disappointing jobs report last week. 2. Eli Lilly shares declined 1.7% Wednesday after peer Novo Nordisk posted disappointing earnings results before the bell. The company reported a weaker-than-expected net profit in the second quarter, and missed expectations for sales on its weight-loss drug Wegovy. Investors are weighing if the same fate is in store for Club holding Eli Lilly and its GLP-1 drugs Zepbound and Mounjaro. However, Novo Nordisk’s sales miss was the result of higher-than-expected concessions to U.S. pharmacy benefit managers — not by softening demand for its drugs. Still, Jim said Eli Lilly shares could fall further after the drugmaker releases its own quarterly results on Thursday. “That’s not the end of the world. If it really comes down hard, we will be tempted to buy some,” he added. “There’s a lot to like about Eli Lilly.” 3. Amazon received upbeat news regarding its e-commerce business after CVS Health’s quarterly earnings on Wednesday. Management said the company was on track to shutter 900 of its retail drug stores by year end, part of a restructuring that began in 2022. This eliminates competition for Amazon’s platform as consumers turn to it for shipping of everyday essential items. Shares of the portfolio name jumped nearly 3% on Wednesday. (Jim Cramer’s Charitable Trust is long LLY, AMZN. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

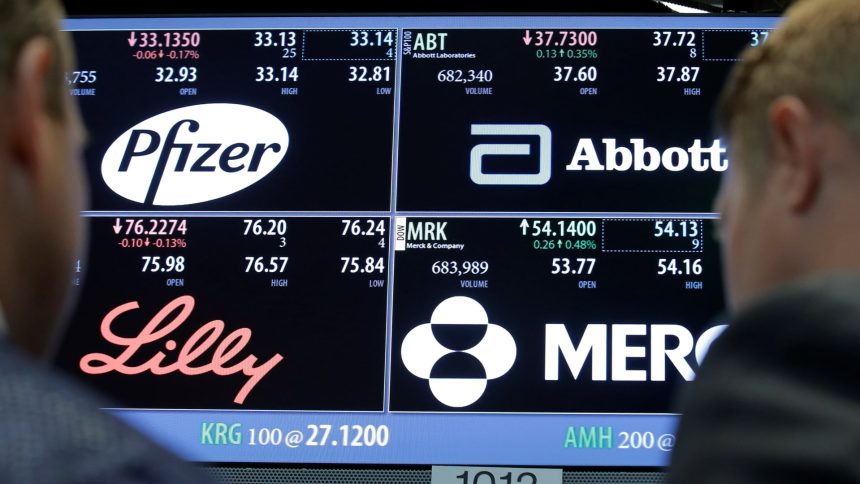

Read the full article here