Thesis

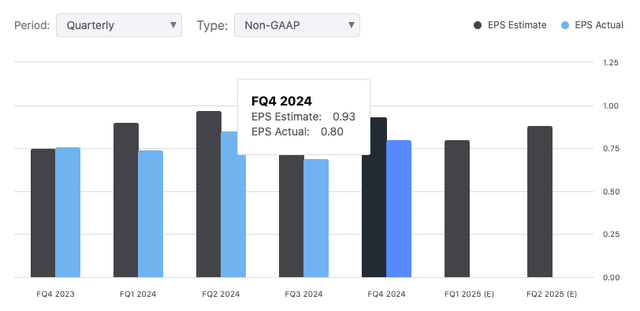

In my analysis, I’ll demonstrate that ScanSource, Inc. (NASDAQ:SCSC) has shown solid growth and made some smart moves with acquisitions; but, their current financials are a mixed bag. Recent Q4 2024 numbers hit the mark with a Non-GAAP EPS of $0.80, but revenue fell short by $87.19 million.

Seeking Alpha

And even though the stock’s been hot lately, I’m concerned about dropping sales, high costs, and a stock that might be overpriced.

About ScanSource

ScanSource, Inc., headquartered in Greenville, South Carolina, is a leading technology distributor. Since 1992, the company has focused on delivering tech products and solutions to their reseller partners. In the past few years, ScanSource has evolved from a traditional to a leading “hybrid” distributor — one that focuses on the connection of hardware to software and the cloud.

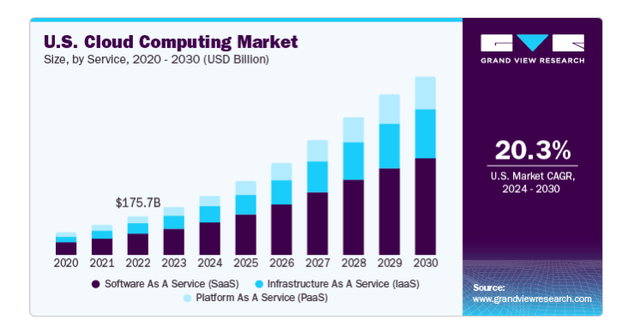

Grand View Research

For context, the global cloud computing market was valued at about $602.31 billion in 2023 and is expected to grow rapidly, with an average yearly growth rate of 21.2% from 2024 to 2030.

ScanSource runs its business in two main areas: Specialty Technology Solutions and Modern Communications & Cloud. These areas cover different industries like retail, healthcare, government, and education. The company is focusing more on offering extra services that add value, especially through its Intelisys division, which is a leading distributor of tech services.

Recently, ScanSource has been growing by buying other companies. In 2024, they bought two firms: Resourcive, which gives tech advice, and Advantix, which manages internet and network connections. These purchases are part of ScanSource’s plan to get better at offering all-in-one tech solutions, especially in areas like IT sourcing (finding and buying the right tech) and mobility solutions (tech that helps people work on the go).

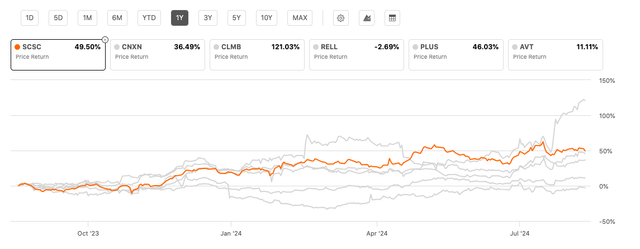

SCSC Performance

Seeking Alpha

In terms of peer performance, SCSC seems to be doing quite well (+50% 1Y) in a space dominated by other winners like CNXN (+37%) and, most notably, CLMB (+121%).

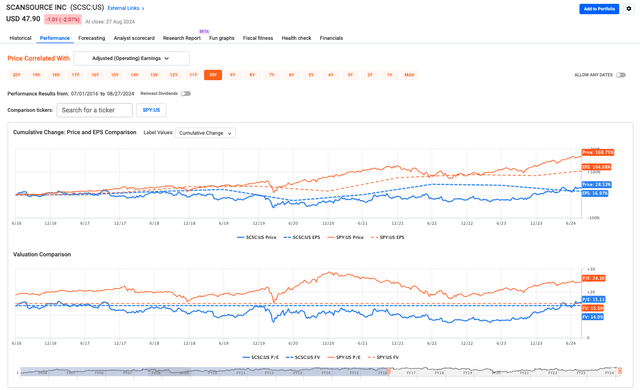

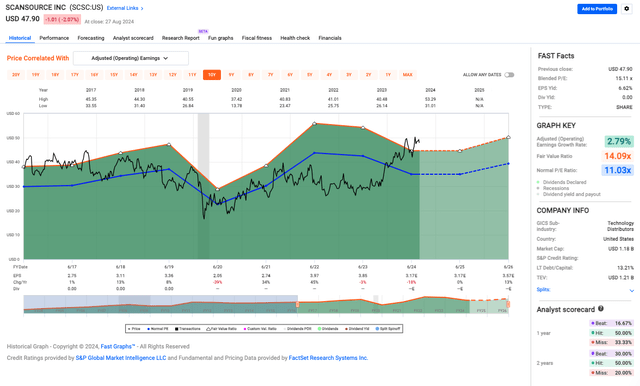

FAST Graphs

However, when we expand our optics over the longer term, comparing it to the broader market S&P 500, the numbers tell a weaker story: from July 2016 to August 2024, we only have an annual return of 3.12% compared to the S&P 500’s 12.82%.

FAST Graphs

Note that this gap gets even bigger when you factor in dividends, which SCSC does not pay. So, it seems, 2024 has been a breakout year (technically speaking, too) for the stock—something to strongly consider as we continue to examine the company.

SCSC Ratings

We haven’t had any meaningful coverage on the stock since late 2023. With that said, CW Capital’s ‘Buy’ call timed this recent technical outbreak spot on and nailed the full 50% if you were to follow that rating.

Seeking Alpha

Currently, Wall Street is a bit lukewarm on SCSC’s prospects, projecting only a 4.38% upside price target from here. Most recently, on August 15, 2024, Raymond James downgraded its recommendation on SCSC from “Outperform” to “Market Perform,” citing the stock’s rise this year. They added that the overall market conditions where the company operates are still weak and are particularly concerned about ScanSource’s plan to invest in “vertical integration,” which means they want to control more parts of their supply chain or production process, which could cost a lot of money, and Raymond James is unsure if this investment will pay off. Additionally, RJ pointed out that important financial indicators like how much cash the company is generating (something that I’ll cover as well) and its Return on Invested Capital (ROIC) are at high levels right now, something they think might be hard to maintain at these levels.

ScanSource Q4 2024 Earnings Highlights

According to management, ScanSource’s “hybrid distribution strategy,” a strategy that mixes traditional product distribution with newer digital services, has been getting a lot of interest from potential new clients, citing a successful reception at a recent Partner First conference. Also, the company just hired a new president, Ken Mills, for one of its divisions: Intelisys. Mills has a strong background working at big tech companies like Cisco and Dell, so this new blood and leadership could bring in fresh ideas and direction to the company, which could help Intelisys grow significantly – the company’s target is double digits.

Intelisys was bought by ScanSource back in 2016—a purchase that allowed ScanSource to get into the cloud and telecom markets. Intelisys goes back much further than that, founded in 1994 and based in Petaluma, California. Think of Intelisys as a middleman: they don’t create the services themselves but work with big companies that do, like telecom carriers and cloud providers. Intelisys then helps other businesses (resellers) sell these services to their customers. Size-wise, Intelisys works with over 130 different service providers and has a network of more than 2,400 resellers across the U.S.

Recall that I mentioned that ScanSource has been pursuing acquisitions – specifically taking aim at high-margin businesses that don’t require much working capital. This could increase EBITDA and bottom-line profits. And it’s no surprise that the recent buys of Resourcive and Advantix were high-margin, recurring revenue streams that seem to be ideally suited for ScanSource’s hybrid distribution model. That is, both deals are highly scalable, per management, and have the potential to extend beyond their current geographic focus for additional profits. Resourcive’s recurring revenue is particularly steady and predictable, bolstering ScanSource’s cash position.

Resourcive was picked as the first buy for SCSC in the advisory space for a reason. The focus was on two things: a solid leadership team and the right tech tool. The goal was to lock in a team that sticks around after the deal, not staff who’d just bounce after their company was acquired, which often happens and creates a talent drain problem for the acquiring company. So even though the Founder and CEO are out, the rest of the team, who’ve been there for about seven years, are staying, and management appears to be letting them do what they’ve been doing to lead the business forward.

Advantix, on the other hand, delivers 5G connectivity for mobility solutions – they help mobility VARs boost sales by mixing connectivity revenue with hardware devices (creating those hybrid solutions). The Advantix buy (btw, they’ve worked with this company before, so there’s already some history) seems like another smart move for the company and fits perfectly with their goal of snagging those recurring revenue businesses with better margins. Rolling Advantix into the new ISG group should ramp up hardware demand, especially in the mobility devices sector, as the market picks up which ultimately gives the company a leg up on the competition in the Barcode space.

Back to financials, ScanSource posted a $53 million free cash flow in Q4, with strong gross profit margins and decent adjusted EBITDA. As it stands, with $185 million in cash, they’re set to keep acquiring and buying back shares. Even with market challenges, Intelisys net sales grew 6% year-over-year. UCaaS and CCaaS also saw growth at 13% and 35%.

ScanSource ended Q4 with a net debt leverage ratio below zero. They improved working capital by cutting $245 million in inventory. This financial strength let them repurchase $22 million in shares during Q4 and $43 million over FY ’24. As I just mentioned, it looks like they’re ready to benefit from a market recovery, especially with their new ISG group driving hardware demand.

And finally, looking ahead to FY ’25, they expect $70 million in free cash flow and net sales between $3.1 billion and $3.5 billion, with adjusted EBITDA projected between $140 million and $160 million.

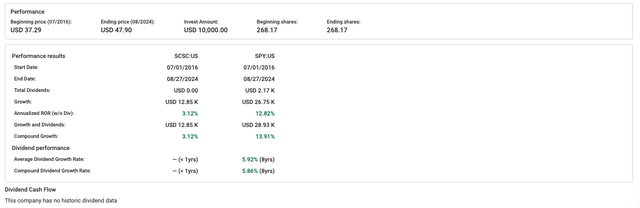

SCSC Valuation

Initially, ScanSource seems fairly priced with a Blended P/E ratio of 15.11x and an EPS yield of 6.62%, but when you stack those numbers against a 2.79% earnings growth rate, it raises questions about the company’s growth trajectory and value. With that said, the fair value ratio of 14.09x, compared to the normal P/E of 11.03x, suggests to me that the stock might be a bit overpriced and if growth keeps lagging, a price correction could be on the horizon.

FAST Graphs

In general, in the tech distribution game, tight margins and tough competition are the norms and that likely explains the slow growth. Overall, ScanSource has a conservative balance sheet with a 13.21% debt-to-capital ratio and this low debt shows caution, but based on the recent transactions, I don’t think that’s a strong hint that they’re not taking swings for growth – just smaller, more strategic swings.

The zero dividend will turn off income-focused investors, and with a $1.18 billion market cap, it’s a small-cap stock, usually means higher risk and more volatility.

Risks & Headwinds

Turning back to financials, ScanSource is hitting some rough patches that could impact its future and demand for its tech across both segments is weak, leading to falling sales. In the Specialty Technology Solutions segment, net sales dropped 14%, and gross profit fell 10%. The Modern Communication & Cloud segment got hit much harder, with a 32% drop in net sales. FY ’24 numbers reflect this decline, with net sales down 14%, gross profits down 11%, and GAAP net income down 12.5%. Non-GAAP net income took a 20.5% hit, and non-GAAP EPS fell from $3.85 last year to $3.08.

That cash flow I mentioned earlier? To put it into perspective, the free cash flow number for FY ’25 of $70 million is down significantly from $363 million in FY ’24 (hence, that recent Wall Street downgrade). This decrease comes after finishing most working capital reductions. The near-term outlook isn’t great either, with soft demand likely continuing, especially in the first half of FY ’25. According to management, market volatility and uncertainty make it hard for the company to predict growth, which could lead to missing targets, which is why Seeking Alpha’s given them a D+ factor grade in revisions, and the wide guidance range for FY ’25 shows this uncertainty, especially early on. The lack of backlog isn’t helping matters, making it tough to predict future sales – the company’s ongoing SG&A adjustments to match revenue expectations suggest cost pressures and operational challenges. Plus, hardware sales are still falling, posing a risk if the expected recovery doesn’t happen.

Moreover, the company relies heavily on Cisco in its Communications segment, and Cisco’s recent struggles could hit overall performance. Cisco’s financial problems include, but aren’t limited to a 6% drop in revenue, an 18% decrease in net income, and a 45% reduction in cash flow, compounded by the massive $28 billion cost of acquiring Splunk, which may not deliver expected returns (You can read up more about CSCO here).

And finally, high acquisition costs could also pressure returns if these new businesses don’t perform as expected. Though the acquisitions sound positive, their small scale (remember “small swings” not big ones) likely won’t significantly impact FY 2025 results, limiting their growth contribution.

SCSC Rating

I’m calling ScanSource a ‘Hold’ here. They’ve been growing fast and making smart buys, but these weak sales numbers, high costs, and a possibly overpriced stock make me cautious. New investors kicking the tires on this company need to remember that the stock’s had a great, breakout run this year, but with the future looking shaky, the momentum forward might be over-telegraphed, and in my opinion, it’s better to sit tight for now (current holders) or look elsewhere.

Read the full article here