ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) is profiting from a hell of a recovery in sea freight prices in 2024. The Haifa-based shipping company bumped up its EBIT outlook for the present financial year by a considerable amount and recorded much higher gross and net profits than in the last year.

In addition, the improved profit outlook drastically enhances ZIM Integrated Shipping’s appeal as a dividend stock: The shipping company pays a quarterly dividend based on profitability and its 2Q24 dividend quadrupled QoQ.

I would not be surprised to see ongoing profit tailwinds as freight prices climb higher and I think that the risk/reward relationship, particularly for passive income investors, is compelling.

My Rating History

In my last article entitled ZIM Integrated: Potential For Sustained Recovery, Maintain Buy, I pointed to the shipping company’s skyrocketing gross profits and net profits as trigger points that led me to modify my stock classification from ‘Buy’ to ‘Strong Buy’.

The ongoing recovery in sea fright rates provides additional support for my investment thesis and I anticipate a considerable dividend pay-out to passive income investors this year.

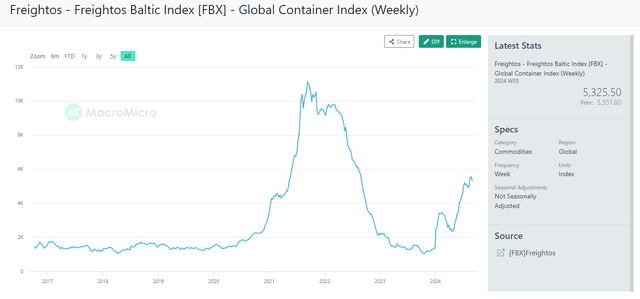

Freight Price Index Shows Major Recovery

Sea freight prices are surging, thanks to turmoil in the Middle East and ongoing attacks on vital sea arteries in the Red Sea.

The Freightos Baltic Index, which indicates how much the shipment of one 40’ container costs, reflects surging prices for sea freight in 2024.

Today, it costs $5,325 to ship a 40’ container and though rates are still way below pandemic peaks of more than $10K a 40’ container, sea freight prices are now substantially higher than last year which is also when ZIM Integrated Shipping stopped paying its well-sought after dividend.

Prices started to skyrocket in 2024 (and are still in an intact uptrend) as the security situation for container ships surrounding the Red Sea gradually deteriorated. Higher sea freight prices therefore primarily indicate the increased risk of shipping, but are nonetheless catalysts for higher average freight prices.

As a consequence, ZIM Integrated Shipping’s average freight rate surged to $1,674 ($/TEU) in 2Q24, up 40% QoQ.

Global Container Index (FBX Freightos)

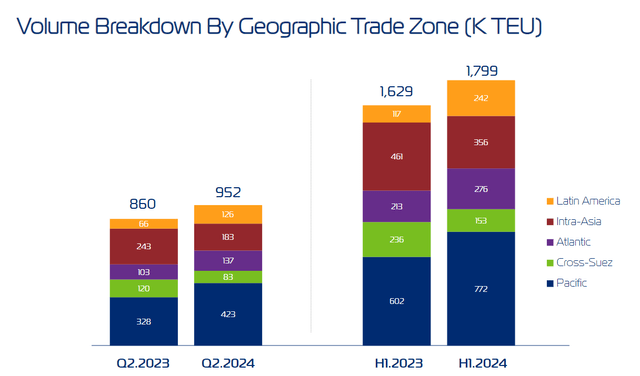

ZIM Integrated Shipping also profited from an increase in container traffic, meaning its shipped container volume increased in the second quarter. The company had a total shipment volume of 952 thousand TEUs in 2Q24, reflecting a YoY increase of 11%. Growth in carried container volume was driven primarily by a 29% YoY increase in Pacific-based shipping which contributed.

Volume Breakdown By Geographic Trade Zone (ZIM Integrated Shipping Services Ltd.)

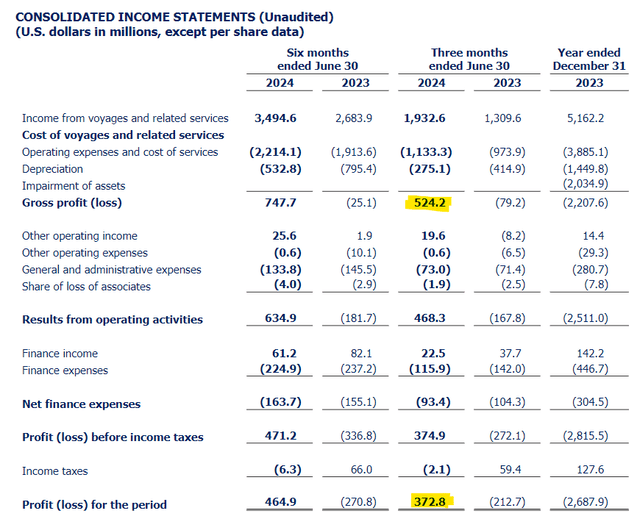

ZIM Integrated Shipping’s gross and net profits consequently skyrocket, leading to a very satisfying earnings call for the second quarter that also yielded, as I will discuss later, a substantial increase in the company’s EBIT forecast.

In 2Q24, ZIM Integrated Shipping took home $524.2 million in gross profits which is not bad at all considering that the pricing situation last year was so bad that the shipping company lost $79.2 million even before consideration of general and administrative expenses.

Its total net income rose to $372.8 million in 2Q24, compared to a loss of $212.7 million, telling us that the profit situation drastically turned around in the last year, but particularly in the last six months.

Gross Profit (ZIM Integrated Shipping Services Ltd.)

Improved Profit Outlook Yields Substantial Dividend Increase

ZIM Integrated Shipping’s pay-out policy calls for a return of 30% of quarterly net income to shareholders. In 2Q24, the company’s Board of Directors declared a cash dividend of $0.93 per share which is the equivalent of $112 million (30% of total 2Q24 net income of $372.8 million).

In the first quarter, ZIM Integrated Shipping paid a cash dividend of $28 million, or $0.23 per share, meaning the dividend quadrupled QoQ.

Based on annualized 1H24 dividends, passive income investors could be on track to receiving $2.32 per share in pay-outs this year, possibly more. This, at a present stock price of $18.27, implies a leading dividend yield of 13%.

Outlook For 2024

ZIM Integrated Shipping bumped up its forecast for 2024 EBIT in light of the improving pricing situation in the sea freight market: The shipping company now sees between $1.45 billion and $1.85 billion in adjusted EBIT this year, up from zero to $400 million which is a substantial improvement.

ZIM Integrated Shipping anticipates a recovery in its EBIT prospects to be driven primarily by higher sea freight prices, but does not expect a major change in volume on a full year basis.

Earnings Multiple

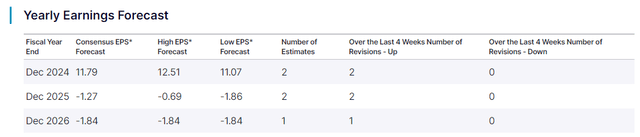

Due to the change in the direction of sea freight price trend in 2024, profit estimates for ZIM Integrated Shipping also have changed favorably. As a matter of fact, the market now models a positive full-year profit for the Haifa-based shipping company: The consensus profit forecast for 2024 is now anchored at $11.79, reflecting a profit multiple 1.6x. Based on 1H24 run-rate free cash flow, ZIM Integrated Shipping is selling for 1.1x free cash flow.

Yearly Earnings Forecast (Nasdaq)

These multiples, as low as they are, should be taken with a grain of salt, however, as ZIM Integrated Shipping’s profit potential is primarily driven by freight rates. A downturn in the sea freight market could drastically change the profit outlook and multiple in the next couple of months.

Why An Investment In ZIM Might Fail

ZIM Integrated Shipping’s prospects as an international shipping company are inextricably linked to sea freight prices. If case prices turn south, ZIM Integrated Shipping would be among the first companies to feel the pinch and immediately report lower gross and net profits.

Profit estimates also imply that the market anticipates negative profits next year, suggesting that present enthusiasm about the uptrend in shipping prices may not be sustainable.

My Conclusion

ZIM Integrated Shipping had a really solid 2Q24 that reflected substantial growth in gross and net profits. The improving profit and EBIT outlook are tied to the deteriorating security setup in the Middle East, which has caused a significant increase in sea freight prices that shipping companies can cash in on.

The improving net profit outlook particularly is promising because ZIM Integrated Shipping pays shareholders a percentage (30%) of its quarterly net income as a dividend.

As sea freight prices collapsed last year, the shipping company stopped paying a dividend. Now, dividends are roaring back and make ZIM Integrated Shipping compelling again for passive income investors.

Read the full article here