Last year was a breakout year for artificial intelligence, and no company benefited from the trend quite like chipmaker Nvidia.

Earnings released on Wednesday show Nvidia’s profits grew to nearly $12.3 billion in the three months ended January 28 — up from $1.4 billion in the year-ago quarter, a gain of 769% year-over-year and even stronger growth than Wall Street analysts had expected. That result helped bring the company’s full-year profits up more than 580% from the year earlier.

Nvidia also posted fourth quarter revenue gains of 265% year-over-year, also exceeding analyst projections, as the company continues to ride the wave of massive AI investment.

“Demand is surging worldwide across companies, industries and nations,” CEO Jensen Huang said in a statement Wednesday.

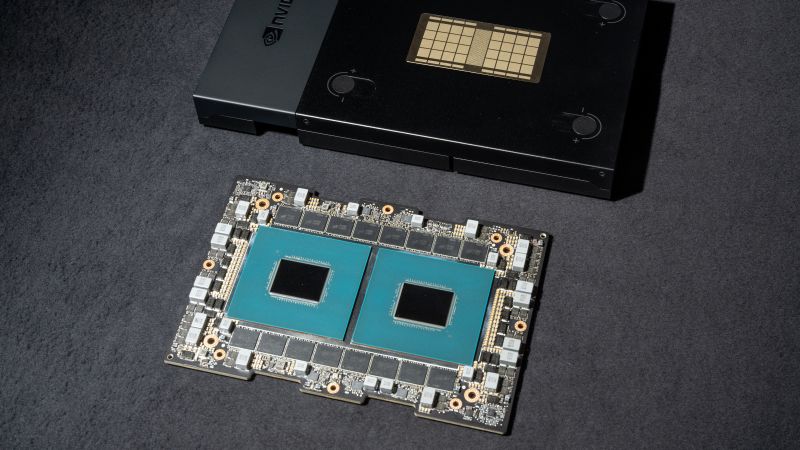

Nvidia is crucial to the burgeoning AI space. The American chipmaker is unmatched in producing processors that power artificial intelligence systems, including for generative AI, the buzzy new technology that can create text, images and other media.

Nvidia accounts for around 70% of AI semiconductor sales, even as Meta, Amazon, IBM and Microsoft have all begun producing some of their own chips, according to Dan Morgan, vice president at Synovus Trust Company.

Sales from the company’s core data center business grew 409% year-over-year to a record $18.4 billion in the fourth quarter, thanks to partnerships with infrastructure giants like Google, Amazon and Cisco.

But the company’s soaring stock price over the past year — shares grew around 230% in 2023 — means Nvidia is now deeply important to the broader market, too. In a note on Tuesday, Goldman Sachs analysts called Nvidia “the most important stock on planet earth.” Nvidia was the top performing S&P 500 stock in 2023.

Nvidia’s shares jumped nearly 7% in after-hours trading following Wednesday’s report.

But some shareholders worry that massive growth can’t last forever. And US restrictions introduced last year on exports of advanced AI chips to China, which affected products like Nvidia’s H800 and A800 chips, threaten to choke off access to a massive and fast-growing market.

The company acknowledged that data center sales to China “declined significantly” in the January quarter because of the restrictions, although other regions nonetheless contributed to strong growth in the unit.

“However, if Nvidia does not find a long-term workaround to the restrictions, it could start to trickle down into future growth,” Morgan said in emailed commentary ahead of Wednesday’s report.

Still, others on Wall Street believe the company still has plenty of room to run.

“The outlook for Nvidia is positive as AI chip competition from Intel, AMD, Meta and Microsoft could be months away while demand for Nvidia chips is only surging,” Insider Intelligence senior analyst Gadjo Sevilla said in a note earlier this week.

For now, the company says demand for its advanced AI chips continues to “exceed supply,” Nvidia CFO Colette Kress said on a call with analysts Wednesday following the report. “Building and deploying AI solutions has reached virtually every industry.”

The company said Wednesday that it projects revenue for the current quarter to come in around $24 billion, which would mark a 233% increase from the year-ago quarter and is ahead of what Wall Street had expected.

Read the full article here