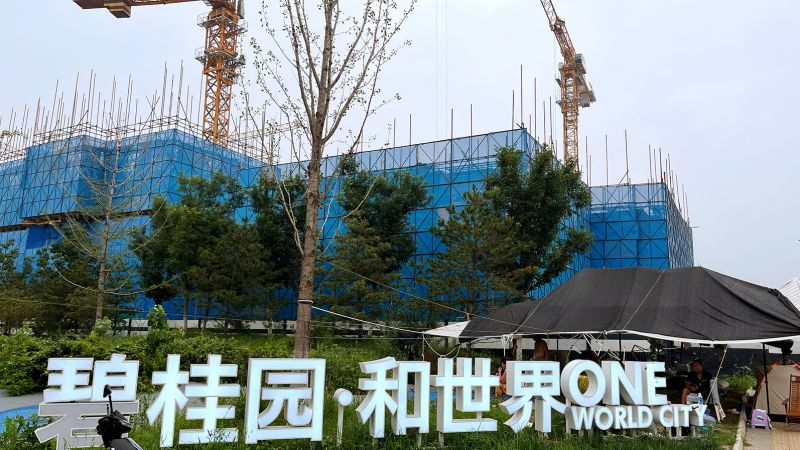

Country Garden, the embattled Chinese real estate firm, made late interest payments on two US dollar bonds shortly before the end of a 30-day grace period, avoiding an imminent debt default, according to multiple state media reports.

The China Securities Journal reported on Tuesday that the company had paid the overdue interest of $22.5 million on the bonds, citing people close to the company.

That means the property giant has been able to avoid defaulting on two of its dollar bonds this week, fueling optimism among some investors that the debt-laden company may be able to find enough cash to see it through the country’s real estate crisis.

Country Garden, which was China’s largest residential developer by sales last year, hasn’t responded to a CNN request for comment.

The two bonds, which were sold to overseas investors, matured on August 6 and the property giant had another 30 days to pay the coupons before it could be declared a defaulter.

Shares in Country Garden, which dropped as much as 5% on Tuesday, pared losses following the publication of the media reports. It last traded flat in Hong Kong. The stock has lost 62% this year.

Making the crucial payments doesn’t mean the company is out of the woods yet. It posted a loss of $7 billion in the first six months of the year and still faces a number of other debt deadlines.

The company has nearly $200 billion in total liabilities and faces mounting pressure to pay off those debts. It has about 31 billion yuan ($4.3 billion) in bonds set to mature through the end of 2024, according to Moody’s.

Country Garden is currently seeking approval from its creditors to delay payment on eight onshore bonds denominated in yuan, state-owned Yicai reported Tuesday, citing a document from the company.

The eight bonds have a total outstanding balance of 10.8 billion yuan ($1.5 billion) and are set to mature later this year, the report said.

Country Garden is expected to hold a meeting on Thursday with bondholders to vote on whether to delay payment on one of the eight bonds, the media outlet added.

The company made the proposal just days after after it secured creditors’ approval to delay payment on another maturing onshore bond.

Last week, the firm admitted it could default if financial conditions continue to deteriorate.

Read the full article here