Cheryl Magnusson and her husband wanted to borrow money for a home renovation project earlier this year. They didn’t expect an arduous process. She said they always easily landed loans, including a mortgage in 2009 in the wake of the US housing crisis.

At first, Magnusson, a teacher in Arizona who runs a consulting company with her husband, considered a home equity loan, sometimes called a second mortgage, because a borrower’s home secures the loan. But after multiple brokers told her they no longer offered that type of loan, she turned to USAA, a financial services company for military veterans and their families, for a personal loan of $75,000 instead. Magnusson said that while she used USAA for a personal loan in the past, this time, the process felt very different.

“They started asking for every document you could imagine,” she said. That included tax returns and other financial documents back to 2020, even though, according to Magnusson, she and her husband have enough income to pay off the loan in less than one year. Magnusson’s credit score is above 800, according to a screenshot she provided which was viewed by CNN.

Lately, it may take more than just a good credit score for many people to get approved for a loan. New research shows banks and other lenders have tightened their lending standards to an extraordinary degree in recent months. That means Americans not only have to search harder for a willing lender, they must also provide more documentation to get approved, making it more challenging to fund big-ticket purchases like cars, homes, and renovations.

According to the Federal Reserve Bank of New York’s June Survey of Consumer Expectations, the overall rejection rate for credit applicants increased to nearly 22%, the highest level since June 2018. Rejections jumped across the board, rising 14% for auto loans, 13% for mortgages, and nearly 31% for credit card limit increases. Deutsche Bank recently told investors that bank lending conditions look “consistent with recession levels,” even though the US is not currently in a recession.

While Magnusson and her husband ultimately secured the loan from USAA with an interest rate of 10% to renovate their kitchen in July, USAA required the couple to provide more than 20 financial documents to gain approval, she said.

Magnusson said she was “in tears” after spending hours on the phone with USAA to secure the loan over multiple days. “I was just dumbfounded,” she said.

In a statement to CNN, a spokesperson for USAA said it has streamlined its consumer loan process and 85% of decisions on unsecured loan applications in 2023 were made immediately.

“On select occasions, including some instances with large dollar requests, additional income verification may be required. Nearly half of the 15% of applications requiring manual support were processed the same day they were received,” the spokesperson said.

Greg McBride, Bankrate’s Chief Financial Analyst said that the Federal Reserve’s rate hiking campaign — the fastest in 40 years — is the primary reason banks and other lenders have gotten so strict about loans. As the Fed hikes its Federal Funds Rate, the rate that banks charge one another to borrow and lend their excess reserves, “money costs more,” McBride said.

McBride also said that while lending standards have been tightening for more than a year, the recent failures of regional banks, like Silicon Valley Bank and Signature Bank, may have pushed standards to become even more strict.

“That has led to the prospect of increased capital requirements for a larger swath of banks, not just the big banks,” he said. “That has accelerated the tightening of lending standards.”

Earlier this year, US bank regulators proposed a new rule that would increase the level of capital that banks with at least $100 billion in assets would be required to hold. According to McBride, those proposed rules have made some lenders more cautious about lending out money.

But it’s more than just the big banks that are tightening lending standards: some smaller lenders may be less likely to offer a loan than they would have in recent years, as well.

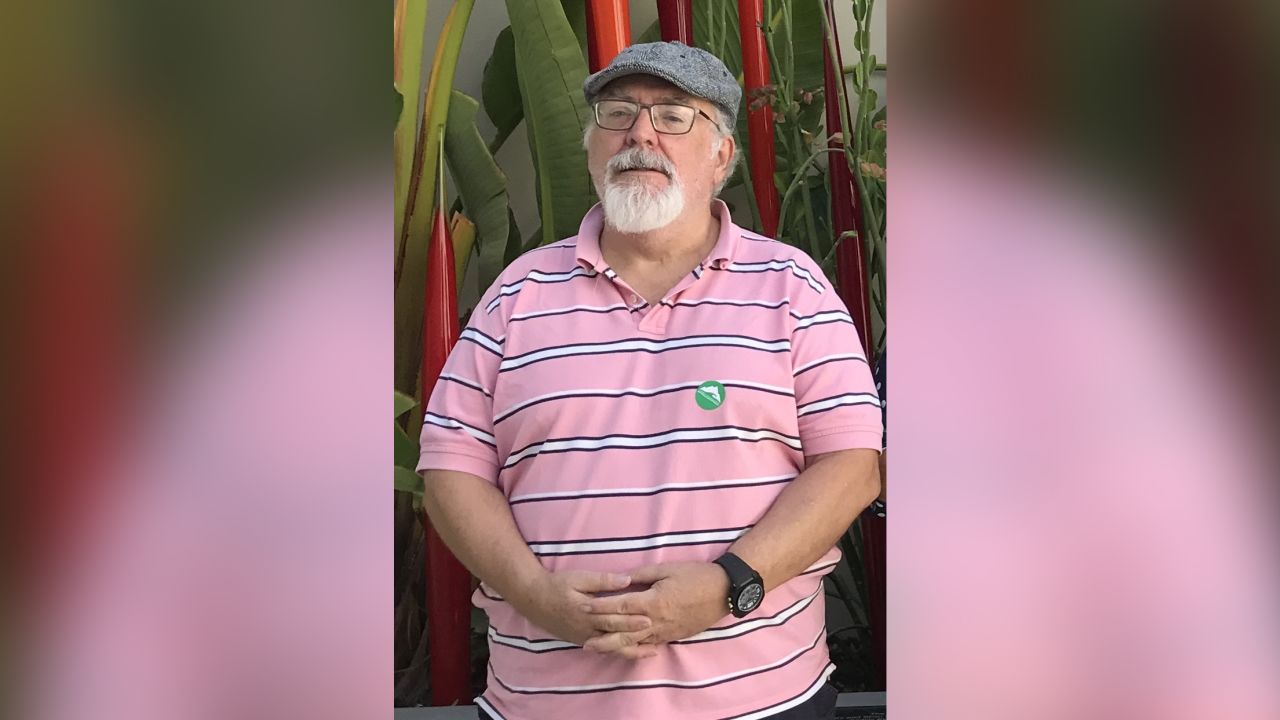

William Brown, who is retired from the Navy, said he recently faced difficulty securing a $7,000 increase on his credit card limit through his local, Florida-based credit union, Suncoast Credit Union. Brown has a credit score over 700, according to a screenshot he provided which was viewed by CNN.

Like Magnusson’s experience, Suncoast asked Brown to provide more documents than he anticipated to gain approval, and the process took weeks, he said.

“My wife and I have never been declined anything we’ve applied for ever,” Brown said. Suncoast asked for multiple forms of proof of his Navy pension and two years of tax returns, he said.

“I’ve never experienced this. For buying a house, yes, but I’ve never needed that much income proof for a car loan or anything like that,” he said.

In a statement to CNN, Suncoast executive vice president Darlene Johnson said that Suncoast’s underwriting positions have not changed because of interest rate increases but rising rates do impact payment calculations.

“That means that elevated payments will increase a member’s debt to income ratio which can potentially affect their ability to repay a loan and this is something all financial organizations consider when making underwriting decisions,” Johnson said.

Not only are application rejections up, but demand for loans has also dropped to “close to a historic low,” according to an August analysis by Evercore.

Data shows that fewer people are applying for mortgages, which is the largest debt most people undertake, for example.

According to the Mortgage Bankers Association, mortgage applications are 26% lower this week than they were the same week last year. The decline in applications comes as mortgage rates remain above 7%.

Loans are a “much costlier proposition” today, McBride said. “Do you want to pay more for something than you would have paid two years ago?”

While Magnusson and Brown were both ultimately approved for their loans, their interest rate payments are likely significantly higher than they likely would have been a few years ago when the Federal Reserve kept interest rates near historic lows.

McBride said that although loan application rejections are up and standards are tougher, getting a loan is still possible for those with good credit.

“Where it’s most difficult are riskier borrowers,” he said. “There’s less credit available, and what’s available costs considerably more.”

McBride suggested now is a good time for potential borrowers to do a “gut-check” and decide whether borrowing money will “solve your problem, make your problem worse, or just kick the can down the road.”

Read the full article here