United Auto Workers President Shawn Fain said Friday that Ford, General Motors and Stellantis will all avert an expansion of the UAW’s work stoppages at this time, suggesting the unprecedented strikes against all three could be nearing an end.

Fain said the union made that decision after a major breakthrough in talks with GM on a key bargaining goal concerning the future of auto jobs, as the automakers shift from traditional gas-powered cars to a lineup of EVs.

GM agreed to have the workers at its future EV battery plants be covered by the national labor agreement governing other UAW members at GM, Fain said, after the UAW threated an expansion of the strike to a GM plant in Arlington, Texas, that assembles the company’s full-sized SUVs.

The agreement is a major breakthrough on the union’s key demand that there be a “just transition” from gasoline powered cars to EVs, which are seen as a threat to union jobs.

“We have had a breakthrough that not only dramatically changed negotiations, it is going to change the future of our union and future of our industry,” said Fain.

GM said in a statement Friday said negotiations are continuing with the UAW.

“Our goal remains to reach an agreement that rewards our employees and allows GM to be successful into the future,” the company said.

GM has in the past insisted that workers in battery facilities are not GM employees, because the plants are run by joint ventures it has with Asian battery companies. Workers at the single GM EV battery plant that is open are represented by the UAW,but they are not part of the national labor agreement and are paid about one third less than members are currently paid, even after the union won wage increases there earlier this summer.

The company has said it does not oppose all the battery plants being union represented, but the company would need to be cost competitive with workers at other nonunion battery plants that have opened or are planned to open. Those plants generally pay about half of the current UAW pay scale.

Where things stand

The new written offer from General Motors to include electric battery production in the new contract came just 30 minutes before Shawn Fain was set to announce an expanded strike, according to a source familiar with the movements.

General Motors was falling behind Ford and Stellantis in negotiations, the source added.

Stellantis avoided a strike expansion this week because they made progress on cost-of-living adjustments, job security, and skilled trades labor.

Ford leads the way with the highest wage increase offer on the table at 23% over four years, which this source notes is more than twice their initial offer of 9%.

Retirement benefits remain a core issue at all three automakers, this source said.

About 20% of UAW members are transmission or engine workers, as the union is faced with what would happen to those members jobs in an EV transition. The new offer today from General Motors helps shore up that concern as any new battery workers at GM will now be UAW workers, the source said.

Although the union is not expanding the strike as it has on the last two Fridays, it remains on strike at five assembly plants spread between the three companies, as well as a network of parts distribution centers.

“We are making significant progress. In just three weeks we are moving these companies further than anyone thought was possible,” Fain said. “Our strike is working. But we’re not there yet.”

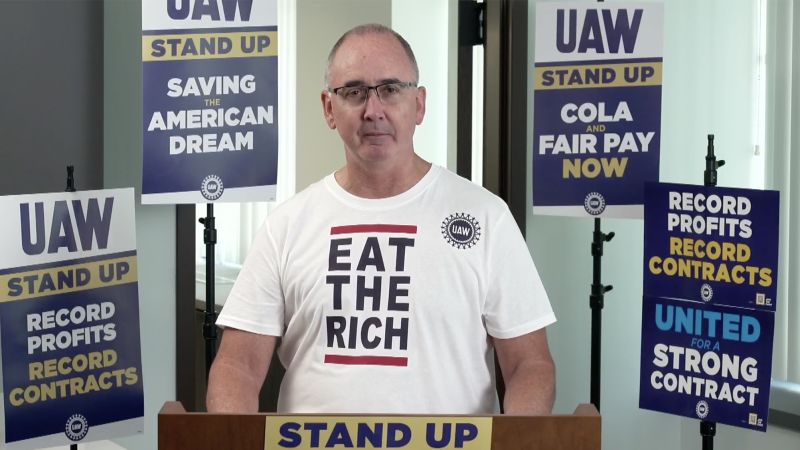

Fain has taken a hard line in both his rhetoric and his ambitious bargaining demands. He made his remarks Friday wearing at T-shirt emblazoned with the words “Eat the Rich.” He said his comments and demands have been dismissed as “theatrics,” but they are working.

“It’s not about theatrics, it’s about power, the power we have as working class people,” he said. “We’ve shown the Big Three we’re not afraid to use it. Strikes, and the threat of strikes, by a unified membership, is what delivers.”

GM earlier this week it admitted to losing $200 million in the first two weeks of the strike.

On Friday, Ford said it would lay off 495 employees at its Cleveland Engine Plant, Lima Engine Plant and its Sterling Axle Plant. The layoffs come despite Ford being spared in expanded strikes that day.

“While we are doing what we can to avoid layoffs, we have no choice but to reduce production of parts that would be destined for a plant that is on strike,” Bryce Currie, vice president, Americas Manufacturing and Labor Affairs for Ford Blue, said in a statement. “Strike-related layoffs are an unfortunate result of the UAW’s strategy.”

Ford said that brings its total strike-related layoffs to 1,800 workers.

In addition to the agreement with GM on battery plant workers, Fain said that the companies are now offering raise increases totaling between 20% at GM and Stellantis and 23% at Ford, through the life of the contract that ends in early 2028.

“It’s not where we need to be, but it’s a hell of a lot further along,” he said. And he added that Ford and Stellantis have also agreed to restoring cost-of-living adjustments to protect workers from rising prices, and that GM “isn’t far behind.”

While the union has been on strike against all three unionized automakers for the first time in its history, the UAW started the strike on September 15 with a targeted work stoppage by 12,700 members at one assembly plant for each company. A week later it added a series of 38 parts and distribution centers operated in 20 states by GM and Stellantis, but did not expand the strike at Ford, saying that automaker had made significant progress in negotiations.

Then on September 29 the UAW declined to expand the strike against Stellantis, once again citing progress in talks, but added a strike against one assembly plant each at GM and Ford. So the decision not to expand the strike at any of the companies on Friday is a break from past practice, and a hopeful sign of progress.

The union has said all along it stood ready to expand the strike to increase pressure on the companies. And Fain said that GM knew it’s next strike target at GM was the Arlington, Texas assembly line that makes the Chevrolet Tahoe and Suburban, the GMC Yukon and Cadillac Escalade. Fain described the Arlington plant “GM’s biggest money maker.”

“It was that threat that brought GM to the table,” he said.

Read the full article here