Following on the heels of a softer jobs report, the friendly consumer inflation (CPI) readings last week boosted asset prices. Falling yields and growing expectations of a possible economic soft landing fueled the rally. The 2-year U.S. Treasury yield fell from 5.06% to 4.89%, while the 10-year declined from 4.65% to 4.44%.

While the year-over-year CPI came in below expectations at 3.2%, that level is likely overstated due to the government’s measure of rent lagging the real world. While the shelter component of CPI rose at 6.7% year-over-year, Zillow reports that rents grew at a much lower 3.2% in October. This shelter component has over a one-third weight in the CPI calculation so it would be a meaningful difference.

Rather than assuming the correct rent level, removing shelter from the services inflation reading provides a helpful measure called the Supercore CPI. The Supercore improved to 3.8% in October, which is crucial because services are the primary driver of the still-elevated headline CPI reading. Recall that services inflation is inexorably linked with wage growth, which is why the monthly jobs report is watched so closely for its impact on inflation and future Federal Reserve monetary policy.

Adding to the positive market sentiment is a softening of economic activity to sustainable levels. After the too-hot GDP growth of 4.9% in the third quarter, the Atlanta Fed’s estimate of fourth quarter GDP is currently at 2%. Many economists expected a sharper slowdown in the quarter. Still, activity is well above contractionary levels but not too high to force further short-term interest rate hikes from the Federal Reserve.

This string of inflation-friendly data has caused markets to price in that the Fed’s victory in the inflation battle is inevitable. The Fed Funds futures market has removed any chance of additional rate hikes and placed not insignificant odds of a rate cut as early as March 2024, though the consensus would still be short-term interest rate cuts beginning in mid-2024.

The removal of fear of additional rate hikes from the Fed has raised hopes that an economic recession can be avoided. This improved sentiment is reflected in the supercharged recent performance of the more economically sensitive cyclical stocks relative to the consumer staples.

As noted last week, stock performance was narrow the previous week, with yields weighing on almost everything except the Magnificent 7. Recall the Magnificent 7 consists of Microsoft

MSFT

FB

AAPL

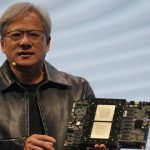

NVDA

DIA

TSLA

The supportive CPI reading last week boosted both stocks and bonds. Falling yields and growing expectations of a possible economic soft landing fueled the rally. It is a distinct positive that the market has broadened, but the risk is now that any possibility of further Fed rate hikes has been removed from markets. Given the Thanksgiving shortened week, crucial data reports are sparser, and earnings season continues to wind down with only eleven S&P 500 companies reporting earnings.

Read the full article here