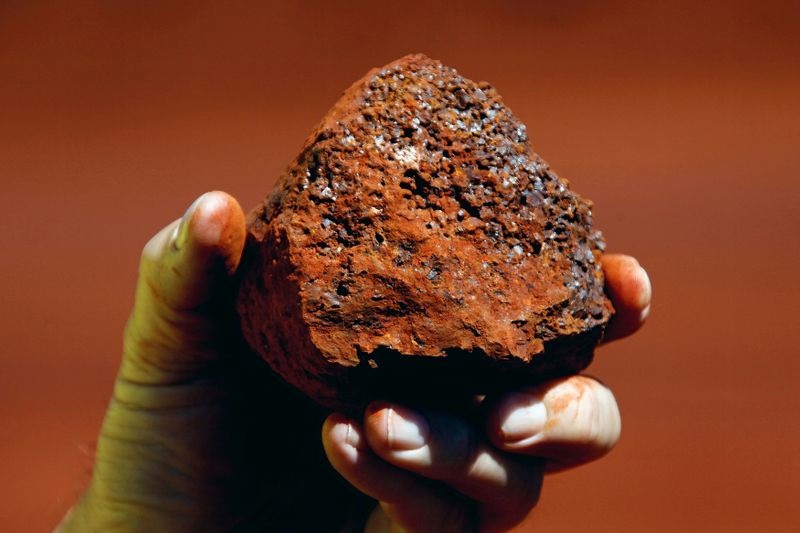

The iron ore market saw a slight uptick in futures on the Dalian Commodity Exchange (DCE) today, with the benchmark contract I2401 closing at 968 yuan per metric ton, marking a 0.47% increase. This modest gain comes amidst a backdrop of cautious trading activity, driven by steel mills’ tempered demand and the market’s anticipation of impending regulatory changes.

In the Chinese domestic market, prices for iron ore also experienced a lift. In Shandong, the price for PBF (Pilbara Blend Fines) ended the day at 992 yuan per metric ton, which is an increase of 7 yuan. Meanwhile, in Tangshan, transactions were completed within the range of 998 to 1000 yuan per metric ton, showing an increment of 8 to 10 yuan.

On a global scale, iron ore shipments for the month witnessed a 7% rise, totaling nearly 31 million tons. This surge was largely fueled by Australia’s strong export performance, which included a significant increase in shipments to China reaching 18.28 million tons—an increase of 5.4%. However, Brazil saw a decline in its deliveries to China by 17.9%, amounting to only 266 tons.

Chinese ports reported a slight decline in arrivals, down by 4.85% to 22 million tons for the period. This reduction was attributed to less efficient unloading operations due to poor weather conditions. Despite this hiccup, overall low inventory levels at these ports have provided some degree of market stability. Nonetheless, traders and analysts are preparing for potential price fluctuations in the short term as the market remains sensitive to both supply dynamics and policy shifts.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

Read the full article here