Last updated:

| 1 min read

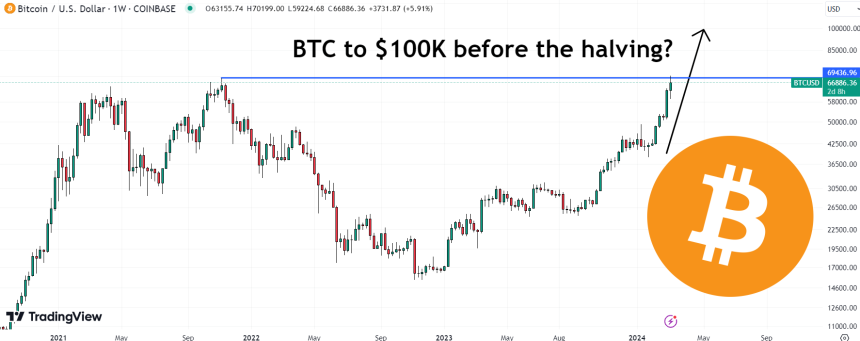

The Bitcoin (BTC) price just pumped to new all-time highs above $70,000 in volatile trade.

Following a brief seemingly stop-run-induced pump as high as $70,200, the Bitcoin price reversed abruptly lower back under $67,000.

But Bitcoin price risks remaining strongly tilted towards a more sustained push above $70,000.

That’s because spot Bitcoin ETF inflows this week have remained very strong.

While GBTC outflows have picked up this week, averaging more than $300 million per day, this has been more than offset by strong continued inflows into the other spot Bitcoin ETFs.

BlackRock’s IBIT, Fidelity’s FBTC, Ark/21 Shares’s ARKB and the other newly launched ETFs saw inflows of nearly $1 billion per day on Tuesday and Wednesday, as per data presented by The Block.

And macro tailwinds have also been supporting the price in recent days.

Whilst Friday’s US jobs report was robust, with analysts arguing the report gives the Fed another reason not to rush on rate cuts, the DXY and US bond yields have been falling in recent days after Fed Chair Jerome Powell basically said that the Fed is close to cutting interest rates earlier this week.

Where is the Bitcoin Price Headed Next?

Bitcoin’s abrupt sell off shortly after hitting new all-time highs for a second time this week suggests appetite to take profit remains high.

But this sell has, so far, been much shallower than the drop back from all-time highs on Tuesday.

Traders will recall that Bitcoin at the time fell from above $69,000 to under $60,000 in a few hours.

This pullback was at the time put down to profit-taking.

Many traders and investors had no doubt marked up the prior 2021 all-time highs as a long-term profit target.

The shallower pullback from the new all-time highs printed on Friday suggests that profit-taking could be subsiding.

As profit-taking continues to ease, the stage is set for another explosive move higher into the $70,000s.

Narratives surrounding Bitcoin, be it ETF inflows, the halving, or the macro backdrop, remain resounding bullish.

There even remains an outside chance that the Bitcoin price hits $100,000 before the April halving.

Read the full article here