Co-produced by David Ksir.

When it comes to investing in real estate investment trusts, or REITs (VNQ), understanding leverage is incredibly important.

We all know the saying that debt is a good servant, but a terrible master. Well, this is especially true in real estate. Debt enables REITs to grow faster and boosts shareholder returns. But if used poorly, it can easily cause dividend cuts and even lead to bankruptcy.

With the Federal Reserve raising rates at an unprecedented pace over the past year and a half in an effort to fight inflation, it is now as important as ever to beware of high leverage.

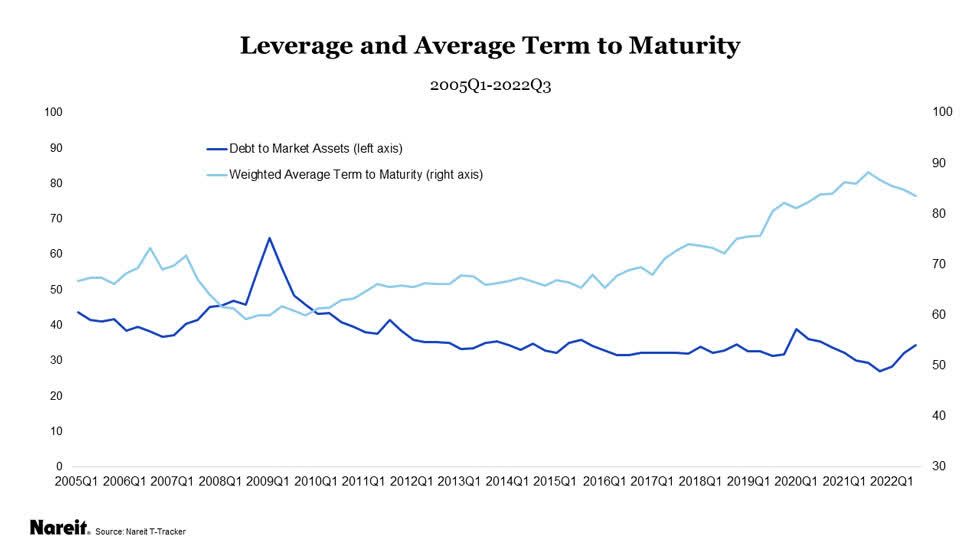

The good thing is that, on average, REITs today are much better positioned to withstand high interest rates than they were during the 2008 crisis. Leverage is lower, the average term to maturity is longer, and the share of fixed-rate debt is up from 70% in 2005 to over 85% today.

NAREIT

The industry has definitely learned from the last major crisis, but that doesn’t mean that every REIT is safe to invest in. While the rise in interest rates has led to many quality REITs trading in bargain territory, it has also significantly increased the risks for those who have not been on top of their game. As investors, our job is to separate the weak from the strong to mitigate risks.

Today, we highlight 5 REITs that are overleveraged:

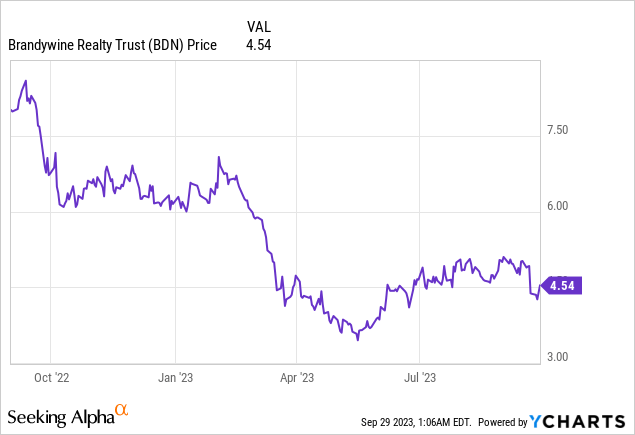

Brandywine Realty Trust (BDN)

Brandywine is an office REIT with a heavy focus on the Philadelphia market where 80% of the company’s NOI is generated. The remaining 20% of NOI comes from the fast-growing Austin market, where management chose to expand in an effort to diversify its portfolio.

The company’s stock has been hit especially hard over the past 18 months, because of two primary reasons:

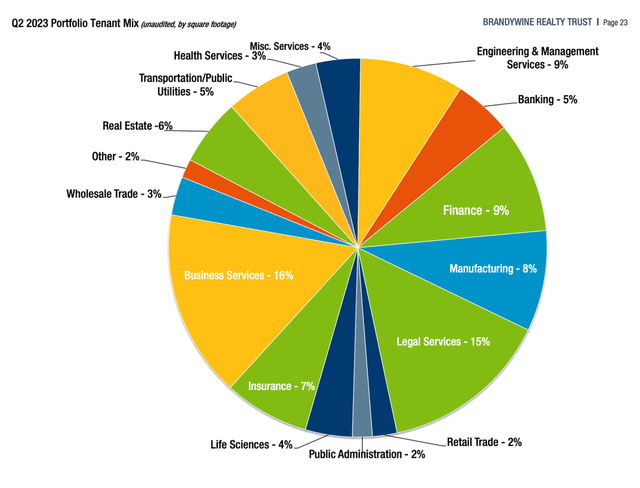

#1 – A tenant mix that’s not resilient to work-from-home

The problem is that BDN owns predominantly traditional office space leased to tenants in legal and business services, insurance, finance, and banking. All of these are industries where employees can do a large part of their work remotely, which increases the likelihood that tenants will want to downsize when their leases expire.

Brandywine Realty Trust

Management has been trying to combat this by increasing the proportion of Life Science tenants, which really aren’t facing the same risk. But despite their best effort, the proportion remains low at just 4% today, and although they currently have enough Life Science space under construction to double their exposure to 8%, I don’t think it will be enough to change the nature of their portfolio.

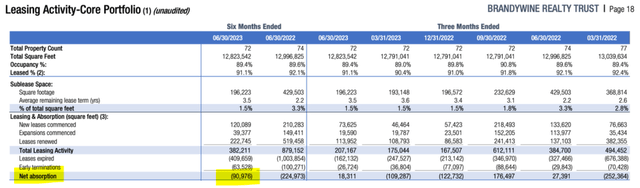

Recent leasing activity confirms this, as the company hasn’t been able to retain enough tenants, resulting in negative net absorption over the first half of the year and slowly declining occupancy.

Brandywine Realty Trust

The thing is that in order to turn things around and attract tenants, BDN will likely have to reduce rents, offer higher incentives (longer rent-free periods or higher fit-out contributions), and/or invest significant CAPEX to bring some of their older buildings up to date. All of these will have a major negative impact on the company’s cash flow.

#2 – Highly leveraged balance sheet

The market hasn’t been favorable to office REITs for a while, and things got a lot worse following the collapse of Silicon Valley Bank in March 2023. When SVB collapsed, it became evident that credit will tighten significantly and some office REITs may have trouble refinancing their debt as it comes due, for the simple fact that regional banks may not want to keep exposure to offices.

Understandably smaller office REITs focused on traditional space were left most vulnerable, especially if highly leveraged.

And frankly, Brandywine’s leverage is high at net debt / EBITDA of 7.6x.

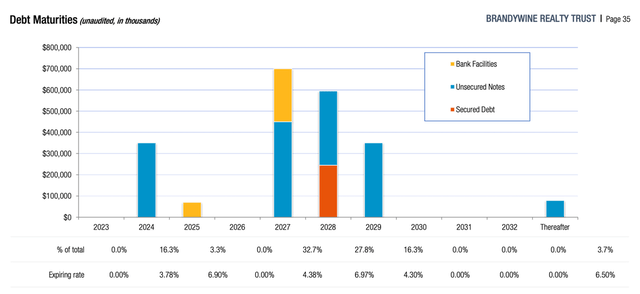

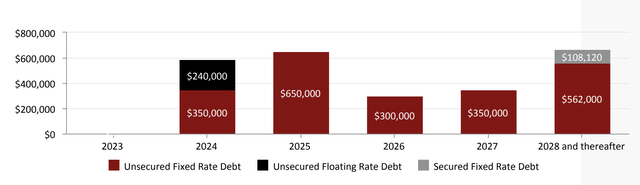

The company will also have to deal with a significant debt maturity of $350 million next year, which will at the very least lead to an increase in interest expense.

For comparison, we can look at Highwoods Properties (HIW), which is a well-run office REIT with properties all across the Sunbelt. HIW has a more modest net debt / EBITDA of 6.0x:

Highwoods Properties

So far, things are relatively stable and the company continues to pay its dividend which yields over 15%. However, their high leverage and high payout ratio are likely to hinder their ability to invest significantly in their portfolio to rebuild their tenant base, likely leading to further losses in the future.

Office Properties Income Trust (OPI)

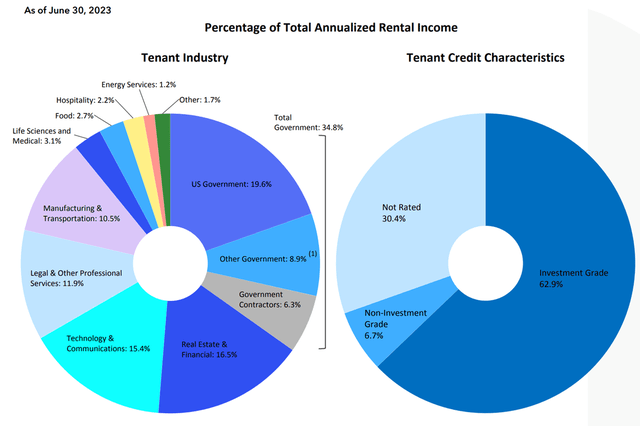

OPI is another small office REIT with 155 properties located all across the country, and it faces a lot of the same problems as Brandywine.

In terms of tenants, about a third of space is leased to the Government, followed by Real Estate and Financials (16%), Technology & Communications (15%), and other Professional Services (12%).

Office Properties Income Trust

Leasing to the government comes with a number of advantages, but there are also drawbacks. Firstly, with the ever-increasing budget deficit, it is possible that when leases expire, the government may choose to consolidate its operations into fewer buildings to cut costs. Moreover, the government generally has lower productivity standards for their employees compared to private corporations which means they may be less likely to insist on people coming back to the office.

All things considered, I think the REIT’s occupancy will come under pressure over the next 24 months as about a third of its leases expire, and a large part of tenants potentially choose to downsize, unless offered very favorable terms from OPI.

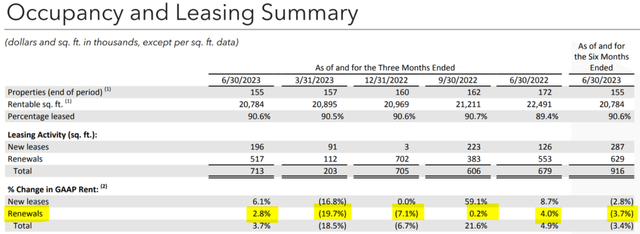

Recent leasing activity reveals that the REIT is indeed already offering discounted rents in order to retain tenants and renew their leases.

In particular, over the first half of the year, rent spreads on renewals have averaged -3.7% on a GAAP basis, which means that on a cash basis, the drop was even bigger. And in Q1, the discount was as big as 20%!

Office Properties Income Trust

But despite lower rents, the REIT has only leased 916,000 sqft of space during the first half of the year, which is low compared to upcoming expirations over the second half of 2023 of 1.5 Million sqft and almost 3 Million sqft in 2024.

I see only two possible ways going forward. Either occupancy drops or the company offers even more aggressive rent discounts. Either way, their cash flow will suffer.

Not only will 2024 be a tough year for OPI from a leasing perspective, but they will also have to handle a large $590 million debt maturity. I say large because it’s almost three times their annualized FFO, which means there’s no way to repay the debt from retained cash flow and refinancing won’t be easy nor cheap given their already high leverage of 7.9x EBITDA.

Office Properties Income Trust

OPI is not well positioned for the current high interest rate environment and has little hope of reducing its high leverage given that their cash flow is very likely to contract over the next two years.

You might be surprised to see Vonovia on the list. After all, we hold a significant position in the German apartment landlord and have been advocating buying it for quite some time.

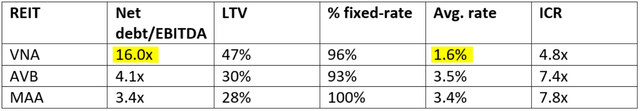

But despite our positive outlook, the fact is that the company is significantly more leveraged than its U.S. peers, especially on a net debt / EBITDA basis. Moreover, if interest rates remain elevated for a prolonged period of time, Vonovia will have to take active steps to reduce its leverage.

Author

The differences are huge, but to make a meaningful comparison, we have to understand some structural differences between the U.S. and German multifamily markets.

Firstly, as evident from the table above, Vonovia enjoys an extremely low cost of capital of 1.6%. Such low interest on their debt has historically really incentivized the company to grow aggressively through debt issuance, which is exactly what management has done over the years. As a result, debt LTV has averaged 45-50%, which is above the 30% mark commonly seen in quality U.S. residential REITs.

Secondly, as a result of high property values in Germany and regulated rents, Vonovia earns very low yields of around 3-3% on their properties. This makes their EBITDA quite low in comparison to their book value, which in turn results in a very high net debt / EBITDA of 16x.

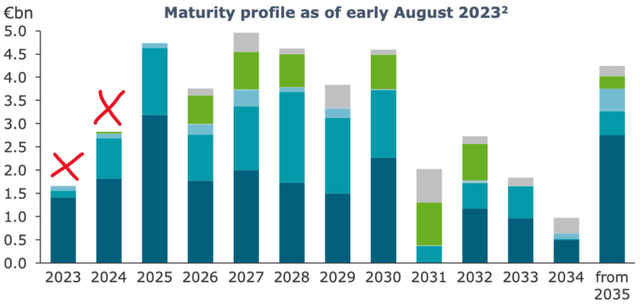

But it’s not all bad. Management has taken active steps to resolve the situation and they have already made good progress. All bank loans maturing until the end of next year have been refinanced, and two recent disposals have generated enough liquidity to repay all bonds maturing this year and next year.

Vonovia

Vonovia isn’t completely out of the woods yet, and if interest rates remain elevated for several years, they will most likely have to dispose of more assets to gradually repay the maturing unsecured debt and reduce leverage.

All things considered, we see the chance of bankruptcy as extremely low as banks are clearly open to working with Vonovia to renegotiate their debt and recent disposals near book value are very encouraging.

In the meantime, the stock trades at a meaningful discount to its net asset value, providing significant upside potential.

Cibus Nordic Real Estate (CIBUS / CBUS)

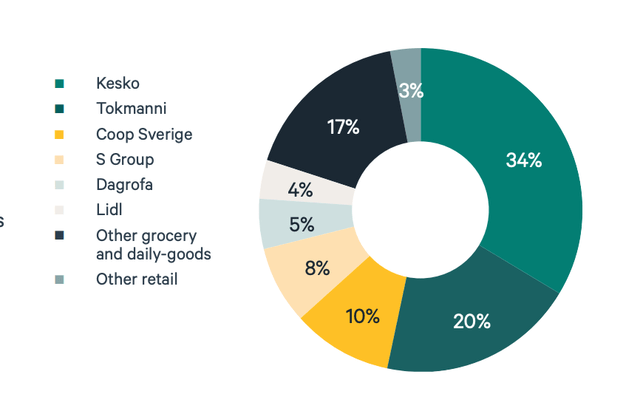

Cibus, Inc. is a European company that owns almost 500 grocery stores across Finland, Sweden, Denmark, and Norway. Their tenants include major local grocery store chains such as Kesko or S-Group as well as discount chains such as Tokmanni or Lidl.

Cibus Nordics

Their focus on grocery stores makes them highly resilient to recession as well as e-commerce. Moreover, grocery stores are very well positioned to withstand high inflation, because they can easily increase prices and pass the inflation onto the final consumer, making them the ideal tenant for a high inflation environment.

Overall, we like Cibus because of the defensive nature of its business and hold a small position in our international portfolio.

But one thing to be mindful of here is leverage which the company has accumulated as a result of an aggressive growth strategy in a low interest rate environment.

Cibus has just over EUR 1 billion of debt at an average rate of 4.6% (100% hedged), corresponding to an LTV of 55%. On an adjusted EBITDA basis (excluding unrealized portfolio revaluation P&L), net debt / EBITDA stands at 10.0x. That’s high by any measure, especially when we consider that Cibus has a weighted average debt maturity of only 2.5 years.

Consequently, if EUR interest rates remain elevated long enough, the company’s interest expense will increase. Luckily, because interest rates are only high because of high inflation, which directly benefits their tenants, we think it’s likely that Cibus will be able to raise rents to (at least somewhat) offset the higher cost of capital.

We like the risk-reward here because its valuation is heavily discounted but advise caution for more defensive investors because of the company’s higher-than-usual leverage.

Granite Point Mortgage Trust Inc. (GPMT)

Next on the list is GPMT, which is a mortgage REIT (“mREIT”). Mortgage REITs run a different business model than Equity REITs and generally use a lot more leverage.

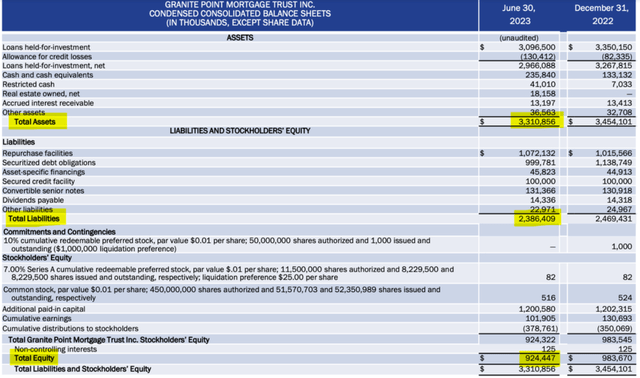

Granite Point, in particular, owes about $2.4 billion on its $3.3 billion loan portfolio. That’s debt-to-assets of 73% and leverage of 3.7x.

Granite Point Mortgage Trust

During the good times, leverage is great as it magnifies returns, but during the bad times, it creates additional risks. In the case of GPMT, the risk lies in a large number of office loans in their portfolio (42%). With office valuations dropping sharply over the past 18 months, if a large enough portion of borrowers default on their loan payments, the mREIT may have to default on its own debt.

The thing is that there are already some cracks forming as the REIT has already taken a $15.5 million write-off as a result of a default on a $114 million office loan in Q4 2022 and since then, management has been aggressively increasing its credit loss reserve in anticipation of further defaults on their 5-rated office loans which account for about 8% of the loan book.

Frankly speaking, at this time it seems unlikely that GPMT would default on its debt, as it would require about 30% of its loans to default. Nonetheless, the REIT is highly leveraged, which means shareholder losses will be magnified, and given the grim outlook for offices, we don’t like the risk-reward here.

Bottom line

Leverage is a double-edged sword and in this tough economic environment, we don’t like the risk-reward of investing in most overleveraged REITs.

While there are many great bargains in the market today, it’s as important as ever to be selective.

In the words of Warren Buffett: “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

That’s why we try to stay away from distressed beaten-down REITs that are overleveraged.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here