Synopsis

AAR Corp. (NYSE:AIR) specializes in providing products, services, and solutions to commercial and government aerospace customers. For FY2024, AIR continues to report strong year-over-year growth as consolidated sales increased to approximately $2.318 billion. In addition, its FY2024 adjusted margins also expanded year-over-year. For its most recent 4Q24, AIR continued to report strong top-line growth as consolidated sales grew 19% year-over-year to $657 million.

Looking ahead, AIR’s contract wins with Sumitomo Precision Products and Triumph are expected to bolster its Parts Supply segment. Additionally, the increasing demand for maintenance, repair, and overhaul is expected to support its Repair & Engineering segment growth. Given AIR’s positive outlook and strong performance, I am reiterating my buy rating for AIR.

Recap of My Previous Coverage

In my previous coverage on AIR, my recommendation was a buy rating. The rating decision was driven by a number of factors. AIR’s past financial results have demonstrated consistent top-line growth as well as margin expansion. In addition, it is anticipated that the acquisition of Triumph Group’s product support division will strengthen AIR’s present repair capabilities and expand its market penetration in the Asia Pacific region. Furthermore, supply chain disruptions are creating headwinds for aircraft deliveries. This headwind is expected to bolster AIR as it is creating more demand for aftermarket parts.

Update on AIR’s Historical Financial Analysis

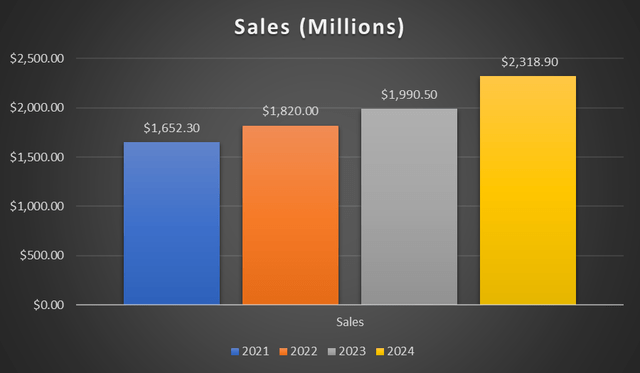

Author’s Chart

For FY2024, AIR’s consolidated sales increased to approximately $2.318 billion. Year-over-year, consolidated sales grew 16.5%. It also represents another fiscal year of sales growth. This strong double-digit growth was attributed primarily to an increase in sales to commercial customers. Additionally, an increase in consolidated sales to government customers also contributed to AIR’s consolidated sales growth.

For 2024, consolidated sales to commercial customers grew 23.3% year-over-year, meaning that sales were up approximately $309 million. This double-digit percentage growth was driven by the acquisition of Triumph Group’s Product Support business. In addition, robust volume growth and strong demand for new parts and used serviceable material in AIR’s Parts Supply segment also contributed to that growth.

On to AIR’s consolidated sales to government customers, it increased 2.9% year-over-year to $681 million. This growth was driven mainly by higher activity on the INL/A WASS contract with the US Department of State.

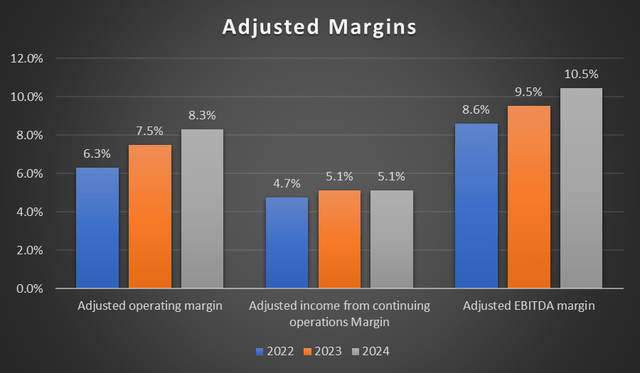

Author’s Chart

Moving onto AIR’s adjusted margins, all three were robust over the last three years. Adjusted margin provides a better overall picture regarding AIR’s core business activity performance because in 2024, AIR’s selling, general and administrative expenses [SG&A] were negatively impacted by the acquisition of Trax and Triumph Group’s Product Support business. In addition, an unfavourable Russian bankruptcy court judgement also negatively impacted it.

In 2024, AIR’s adjusted operating margin increased from 7.5% to 8.3%, showing three years of consecutive margin expansion. AIR’s adjusted EBITDA margin expanded from 9.5% to 10.5%. Its adjusted income from continuing operation margin remains robust at 5.1%. As a result of strong consolidated sales growth and a robust margin, AIR’s adjusted diluted EPS grew from 2023’s $2.86 to $3.33, representing year-over-year growth of 16.43%.

Fourth Quarter 2024 Earnings Analysis

AIR released its 4Q24 earnings results on July 18, 2024. For 4Q24, AIR continued to report strong top-line growth, as consolidated sales grew 19% year-over-year to $657 million. 4Q24’s sales to commercial customers were up 20% year-over-year. This strong growth was attributed to the acquisition of Triumph Group’s Product Support business. In addition, robust demand for new parts distribution activities also supported this growth.

On the other hand, sales to government customers were up 15% year-over-year. This growth was driven by an increase in order volume for new parts distribution activities as well as better results from all of its government programme activities.

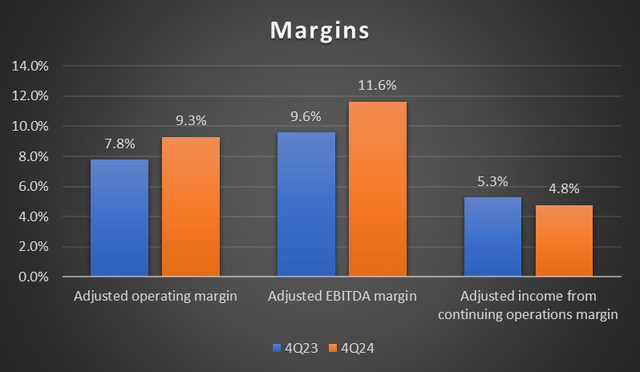

Author’s Chart

Moving onto margins, all three margins performed well year-over-year. AIR’s 4Q24 adjusted operating margin expanded to 9.3% year-over-year. AIR attributed this margin expansion to a favourable contribution from the acquisition of Triumph Group’s Product Support business. Additionally, its adjusted EBITDA margin expanded from 4Q23’s 9.6% to 4Q24’s 11.6%.

On the other hand, I do notice a slight contraction in AIR’s adjusted income margin from continuing operations. It contracted from 5.3% to 4.8% and was caused by an increase in interest expense. AIR’s interest expense increased from $4.7 million to $18.7 million due to bridge financing facility expenses related to its acquisition of Triumph Group. In addition, a higher interest rate also caused its interest expense to increase.

Parts Supply

For FY2024, AIR’s Parts Supply segment grew 18.2% year-over-year. For context, this segment accounts for 41% of AIR’s 2024 total sales. Therefore, it is an important and integral part of AIR’s business. This growth was driven by an increase in sales of new parts, which increased by $78.1 million. The increase in sales was due to more demand for these parts and growth from new and expanded distribution agreements. In addition, an increase in sales from aftermarket parts also contributed to the growth. The increase in sales from aftermarket parts was driven by increased demand for used serviceable aircraft engine and airframe material [USM].

In the aviation aftermarket, USM is a crucial and important segment. In this category, components that are extracted from engines or airframes can be restored and used as replacement parts. Compared to sourcing new parts, USM parts often provide operators with a more affordable and quicker solution.

Contract Wins with Sumitomo Precision Products and Triumph

Investor Relations Investor Relations

On April 11, 2024, AIR announced two new contract awards that are expected to bolster its Part Supply segment. First, AIR announced an extension and expansion of a multi-year contract with Sumitomo Precision Products to distribute its V2500 starter and valve components.

The next contract award is with Triumph, which was announced in April 2024. AIR has announced that a new multi-year distribution agreement with Triumph will begin in FY2026, providing its actuation product line to commercial airlines and maintenance, repair, and overhaul [MROs].

Increasing Demand for MRO

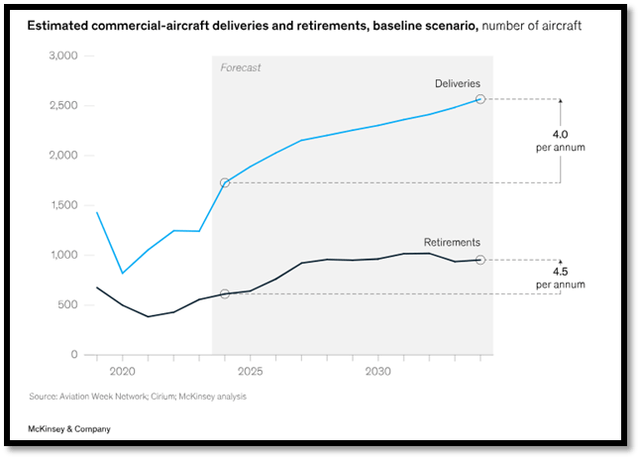

McKinsey

According to McKinsey, commercial airlines are facing challenges with a shortage of aircraft to support the increasing travel demand. Even though aircraft manufacturers are increasing production to meet travel demand, challenges in the supply chain and quality issues are creating massive headwinds for these manufacturers.

Currently, the backlog for new aircraft orders has already exceeded 16,000 units, and McKinsey stated that it will take a number of years to clear this backlog. As a result, many airlines are delaying their aircraft retirements as a temporary solution. This has led to an increase in demand for MRO services.

Looking ahead, McKinsey anticipates that airline companies globally are likely to continue keeping their current aircraft in service longer due to fewer new deliveries and ongoing issues with those new next-generation engines. As a result, McKinsey forecasts that retirement rates from 2024 to 2026 will be approximately 24% lower than pre-pandemic years. However, retirement levels are anticipated to normalise in 2028 onwards once supply chain disruption clears and new aircraft delivery increases.

Therefore, this outlook is expected to bolster AIR’s Repair & Engineering segment. For context, this segment accounts for approximately 28% of AIR’s 2024 total sales. For FY2024, AIR’s Repair & Engineering segment sales grew 20% year-over-year to $640.1 million. This strong double-digit growth was driven primarily by its acquisition of Triumph Group’s Product Support business. In addition to that, growth in airframe maintenance facilities also contributed to the growth.

Relative Valuation Model

Author’s Relative Valuation Model

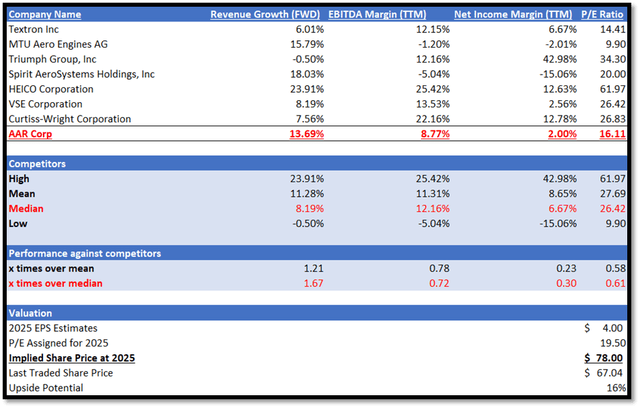

A quick recap, AIR supplies products and services to the aviation, government, and defence markets. In my relative valuation model, I will be comparing AIR against its peers in terms of growth outlook and profitability margins. For growth outlook, I will be comparing their forward revenue growth rate, as this metric is considered to be forward-looking. It gives us insight into their growth outlook for the next two years. For profitability margins, I will be comparing their EBITDA margin TTM and net income margin TTM.

Regarding growth outlook, AIR significantly outperformed its peers’ median, as AIR has a forward revenue growth rate of 13.69%, much higher than its peers’ median of 8.19%. This implies that AIR’s forward revenue growth rate is 1.67x over its peers’ median.

Moving onto profitability margins TTM, AIR underperformed its peers’ median in both EBITDA margin TTM and net income margin TTM. Starting with EBITDA margin TTM, AIR reported 8.77%, while its peers’ median is 12.16%. For net income margin TTM, AIR reported 2%, while its peers’ median is 6.67%.Currently, AIR’s forward non-GAAP P/E ratio is 16.11x, significantly lower than peers’ median of 26.42x. Given AIR’s weaker profitability margin performance against its peers, I argue that it is fair for AIR to be trading at a discount against them. However, AIR has a much better growth outlook compared to its peers’ median, and credit has to be given to that. Therefore, as AIR’s 5-year average P/E is 19.50x, I will be adjusting my 2025 target P/E upwards to that. Since AIR’s 5-year average P/E is still below its peers’ median, it ensures that my valuation remains conservative.

For 2025, the market revenue estimate for AIR is $2.70 billion, while 2025 EPS is $4 per share. Looking at management’s guidance, AIR forecasts that its 1Q25 revenue will grow somewhere between 15% and 19%, and its adjusted operating margin is anticipated to be approximately 9%.

For the longer term, AIR forecasts that its average annual organic sales growth for the next three to five years will be between 5% and 10%. AIR’s adjusted operating margin is expected to be in the range of 10.5% to 11.5%, while adjusted EBITDA margins will be between 12.5% and 13.5%. For adjusted EPS, AIR forecasts average annual growth to be between 10% and 15%.

Therefore, when taken together, AIR’s guidance and my forward-looking analysis as discussed support the market’s estimates as they share the same sentiment. By applying my 2025 target P/E to AIR’s 2025 EPS estimate, my 2025 target price is $78.

Conclusion

For FY2024, AIR reported another year of strong revenue growth. AIR’s consolidated sales increased to approximately $2.318 billion. This represents year-over-year growth of 16.5%. In addition, AIR’s 2024 adjusted margins remain robust year-over-year. For its most recent fourth quarter earnings results, it continued to report strong top-line growth, driven by its acquisition of Triumph Group’s Product Support business and robust demand for new parts distribution activities.

AIR also managed to win and secure contracts with Sumitomo Precision Products and Triumph. These new contract awards are expected to bolster its Part Supply segment, which accounts for 41% of AIR’s 2024 total sales. Due to aircraft delivery headwinds, many airlines are delaying their aircraft retirements as a temporary solution. This has led to an increase in demand for MRO services. This is expected to bolster AIR’s Repair & Engineering segment. For context, this segment accounts for approximately 28% of AIR’s 2024 total sales. Given AIR’s strong performance and positive outlook, I am reiterating my buy rating for AIR.

Read the full article here