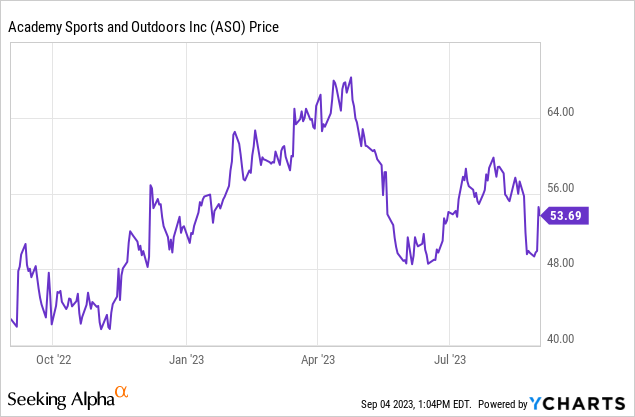

Academy Sports and Outdoors, Inc. (NASDAQ:ASO) is a stock we have traded over the years. While we have recently discussed this in our service, our last public call was a year ago with the stock in the mid-$30s where we said a no brainer rally was in store and to buy the stock. We think the stock is setting up for another trading opportunity. We believe that in the longer-term, investors could enjoy also sizable gains with this name from the present level. The company is growing at a very moderate pace, and is only located in 17 states with 270 stores. The company is planning on opening 11-12 new stores this Fall. Here is the deal. This is a rare time where we are coming back into a trade when a retailer is posting year-over-year comp sales declines. The shrink issue (theft/inventory loss) is a problem, as it is for all retailers. However, the valuation metrics, the ramp management saw in sales, and the beat in the quarter along with guidance has us growing bullish. During our last public trade, ASO stock rallied while the market got crushed from March into fall. Let us discuss.

There looks to be some support around $48 and we are buyers.

The play

Target entry 1: $53.55-$53.70 (25% of position)

Target entry 2: $51.50-$51.65 (35% of position)

Target entry 3: $48.00-$48.20 (45% of position)

Note: It may take a few weeks or more to complete a position. It is possible the full position never is made, but if the stock goes up, it is a high quality problem, because you still made money.

Short term target: $58

Medium term target: $67

Options: Specific guidance is reserved for bad beat investing members but generally speaking option players should consider selling puts for premium or to define entry here as the Vix likely spikes in September.

Performance shows slowing sales but better than expected performance

The just-reported quarter, while surpassing estimates, showed sales down from last year. The company is still dealing with rising costs and comparable sales pressures due to what seems like will be reduced discretionary spending thanks to high inflation and the fact that the jobs picture is slowly eroding. But here is the thing. The earnings picture remains pretty strong. Now the stock is trading at 7.5X FWD earnings. We believe shares are a long-term buy on the next down draft because the company still has a real runway for growth. While competition is stiff in this space, there is a lot of room for expansion as they are only in 18 states. The balance sheet is clean and the management is shareholder friendly. Let us discuss.

The company owns 270 stores spread across 17 states. There is lots of room for expansion here. Management indicated it will open another 11-12 stores this fall, so that is a 5% expansion of the business. Solid in our opinion. Recall many of its stores are located in seven of the top ten fastest growing metropolitan statistical areas. It is worth mentioning that its greatest exposure is to the state of Texas, where it has more than a 1/3 of its stores in operation. It also has large exposure to Louisiana and Georgia. There is a lot of room to grow across the nation.

Here is a reason we like owning this stock on pull backs. In the press release, management stated:

While sales in the second quarter were down versus last year, they steadily improved each month during the quarter, while also delivering a solid earnings performance… Academy is well positioned to continue to capture market share as a leader in the sports and outdoors space… We are planting the seeds for future growth by opening 11-12 new stores this Fall, building out our omnichannel capabilities and expanding our portfolio of new and exciting brands.

Academy has a growing online business and reaches customers with multiple distribution centers that it operates. With the growth overall, we think under $50 is a bargain price, and the chart suggests the high $40’s offer strong support.

Sales fall

So sales fell on the top line but was in line, while the bottom line surpassed estimates. Net sales in the quarter were $1.58 billion, which actually fell 6.2% from last year, compared to $1.69 billion. This was due to comparable sales falling 7.5%. Further, e-commerce sales continue to grow and margins are back to expanding.

Margins powers expand

Margins have been under pressure of late, but enjoyed expansion in Q2 year-over-year. Gross margins in Q2 were $563.4 million, or 35.6% of the total net sales. This was up from 35.3% of net sales in the prior year quarter. Before taxes, income was $203.3 million, which dipped from $247.0 million. This was largely due to the decline in sales.

Income dipped with sales, but outlook improves

On a GAAP basis we see that net income fell to $157.08 million, or down 16.8% compared to $188.8 million last year. Again, much of this due to the really tough conditions on the sector as a whole, and we view it as a short-term pressure. On a per-share basis, we saw $2.01 compared to $2.22 per share. Making adjustments, EPS was $2.09 compared to $2.28 per share last year.

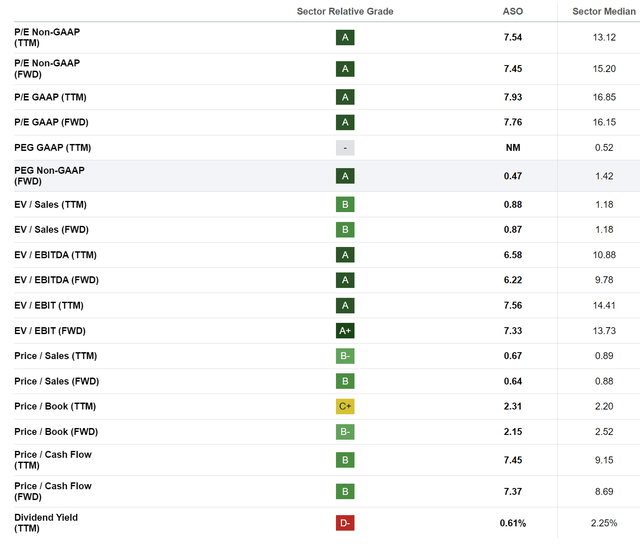

I hear the bears. Our firm is talking about finding value and growth, but declining earnings is not growth. However, we see it as a dip short-term and growth will resume as the company expands. If you review closely, the plan is to open another 100 stores in the next 5 years, growing the company by at least 37% or more. The company has its plan to open more stores. While the macro outlook is cloudy and tough, we like the long-term prospects here. And the company raised guidance. Net sales are unchanged at $6.175 billion to $6.365 billion, on comps that fall 7.5% to 4.5%. However, due to better margins and stock repurchases the company is now seeing $6.95 to $7.65 in earnings for the year, up from $6.80 to $7.50. That is a nice move of the goal posts, improving valuation. The valuation is quite attractive:

Seeking Alpha

There is a lot to like on the valuation. The stock is cheap on every metric. While the dividend payout leaves something to be desired, if you take into account the value here and the long-term growth expected as well as the healthy balance sheet, and we have another winning situation.

Academy Sport’s balance sheet is strong

The balance sheet is healthy. Academy has $311 million with $585 million in long-term debt. The company is using that debt to expand is store foot print and grow. Further cash flow is very strong. Adjusted free cash flow was $125 million during Q2 and for the year is guided to be $400-$450 million. It is all about the cash flow. One small risk is the inventory here and as such Academy may have to get promotional, so we need to watch margins going forward. Merchandise inventories were $1.3 billion, flat from a year ago, but still high. We will watch this metric closely going forward.

Shareholder friendly

We also like that the company is shareholder friendly, as it is buying back stock and is paying a dividend, which is up 7.8% from last year, but the yield is less than 1% of course. We would like to see a bigger dividend, but overall, cash is going back to shareholders. The company repurchased 2 million shares for $107 million in Q2 and will be paying a cash dividend of $0.09 per share in October.

New partnership for further growth

Last Wednesday, Academy announced partnership expansion with digital sports platform Fanatics. This new partnership allows Fanatics’ licensed sports merchandise assortment, featuring teams and players from various leagues and sports properties, available to Academy customers shopping online or in-store. This has the Street and our firm further bullish on the future prospects for the company and stock.

Final thoughts

Management is taking care of shareholders and the company is set to expand its footprint by nearly 40% in the next few years. Expect sales to ramp up, and earnings to follow. Let the market take the stock down, then do some buying. The balance sheet is healthy, and management is shareholder friendly.

Read the full article here