Times aren’t the easiest for discount-minded value investors. With the stock market surging, almost all of the traditional value plays are trading at higher multiples than they usually are, and floating around 52-week highs. That’s not to say there aren’t still deals to be had, but we have to look harder to find them.

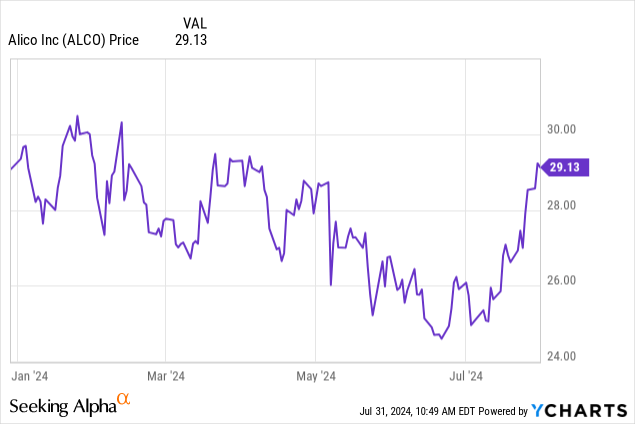

Today, we’re going to be looking at a stock that has been popping up in a lot of my screens lately, Alico. Inc (NASDAQ:ALCO). The company is a citrus grower and land management company in Florida, and while the company is still trading on the north end of its 52-week range, there is enough difference about this company to warrant a closer look.

Understanding Alico

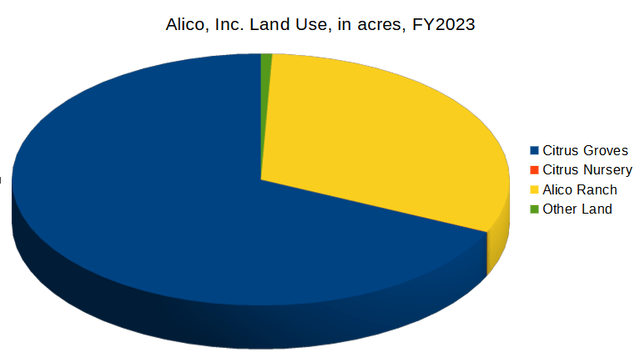

Alico is a grower of oranges and specialty citrus products who owns around 72,000 acres of land in south and central Florida. The company divides its business into basically two segments, Alico Citrus and land management.

10-K from SEC

As you can see, the land is divvied up mostly between active groves and ranch land. Though more land is committed to growing oranges than is listed as ranch land, and the company’s employees are overwhelmingly involved in the growing activities, it is, I believe, the ranch land that holds a lot of the potential value.

The company does business predominantly with Tropicana, with 81.3% of the company’s revenue in fiscal year 2023 came from Tropicana, which is higher than it’s been in previous years. Just last month, the company entered into a new supply contract with Tropicana, effective through the end of July in 2027.

Consolidated Balance Sheets – A Core Value Proposition

|

Cash and Equivalents |

$6 million |

|

Total Current Assets |

$51 million |

|

Total Assets |

$417 million |

|

Total Current Liabilities |

$20 million |

|

Long-Term Debt |

$83 million |

|

Total Liabilities |

$140 million |

|

Total Shareholders’ Equity |

$271.7 million |

(source: most recent 10-Q from SEC)

Alico is well-capitalized and has paid down a fair bit of its long-term debt in recent quarters, with the sale of land to the state of Florida (more on that later). The nice thing is that the shareholder equity is strongly high, with a price/book value of 0.81.

That’s a good discount, especially with the company trading near its 52-week highs. There is value in their property and equipment, and that is worth considering by itself for a value play.

The Risks

Being a company based in south and central Florida, the property is right in the potential path of hurricanes and tropical storms. These storms can shorten growing seasons and damage crops, and while the company is, obviously, well-insured, a bad storm could do a lot of harm to the company’s assets, which is something to be very concerned about.

The citrus groves are also subject to diseases like citrus greening and citrus canker. Greening is in particular a serious disease which can reduce productivity and even worse, potentially kill trees.

Citrus in general is a highly competitive industry, and they have to compete not just with other Valencia orange producers, but with orange producers in general, and citrus producers if other types of citrus come into favor.

That’s also an issue. Alico’s product is sensitive, like everything else in the world, to supply and demand changes, and there is no telling that the product perception of oranges will remain as strong as it is, potentially negatively affecting price and demand.

Statement of Operations

|

2021 |

2022 |

2023 |

2024 (1st Half) |

|

|

Operating Revenue |

$108 million |

$92 million |

$40 million |

$32 million |

|

Gross Profit |

$24 million |

($15 million) |

$6 million |

($32 million) |

|

Operating Profit |

$14 million |

($25 million) |

($4 million) |

($38 million) |

|

Net Income |

$35 million |

$12 million |

$2 million |

$27 million |

|

Diluted EPS |

$4.64 |

$1.65 |

24¢ |

$3.56 |

(source: most recent 10-K and 10-Q from SEC)

As you can see, the operating profits have been kind of hit and miss the last few years. Revenue is down. Despite this, the total net income has been generally positive and the diluted earnings per share has also remained positive.

The first half of the 2024 has been very positive, on the back of the sale of 17,229 acres of the Alico Ranch to the state of Florida for $79.09 million. The money was used to pay the outstanding line of credit as well as to pay down their variable-rate term loans. This is a great time to do that with interest rates being what they are.

While the company is sensibly using its profits to pay down the already very manageable debt, the company also pays a small 5¢ per quarter dividend. I like the dividend at these levels, and the brief raise of the dividend to $2.00 per year in June of 2021 is just too much.

Analyst estimates are that the total year of 2024 will come in with an operating revenue of $50.3 million, and the earnings per share will be $2.89. That puts the P/E ratio of this at around 10, which again is a nice value proposition. Though the estimates are very much fluid, as seen with the major earnings from the land sale this year, the estimates for fiscal year 2025 are not so promising, with revenue of $87.5 million but a loss of 38¢.

Earnings preview

Next week, Alico is expected to release third quarter earnings to come in at $17.8 million, revenue with a loss of 26¢. That’s not terrible, and we’re heading out of the growing season for oranges, so it’s understandable that the earnings per share won’t be positive.

Conclusion

While the Alico Citrus business is somewhat uncertain, the recent deal with Tropicana likely speaks to more stability going forward. That’s good news, but I’m still concerned that the company is vulnerable to hurricanes going forward.

What I really like about Alico is the discount to book value, and after the recent sale of some of its ranch land, I really think the land value is understated on the balance sheet. The company should do well as it continues to unlock the value in its property.

I would’ve rather had the stock a month or two ago at a cheaper price, but even the current levels seem more than reasonable. I’m not saying I would put a ton of money into it, but this could be well-suited as a value proposition in a market where good value is increasingly hard to find. This is definitely a buy.

Read the full article here