Ares Capital (NASDAQ:ARCC) is one of the market’s leading business development companies or BDC. It last traded at a market cap of $11.4B. With a forward core earnings multiple of 8.5x, it’s also ahead of its peers’ median of 7.8x, suggesting a relative premium. I urged investors to avoid the recession fears in my previous update, as ARCC bottomed out in late October.

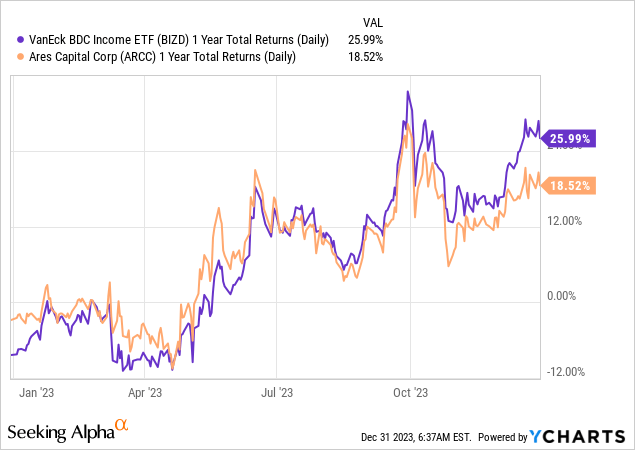

Despite its market-leading scale, ARCC’s total return performance has disappointed over the past year, underperforming its peers represented in the VanEck BDC Income ETF (BIZD). Despite this, it’s still a respectable performance, as ARCC delivered a total return of nearly 19%.

With the Fed expected to have reached the peak of its rate hike regime, concerns are mounting about the company’s portfolio performance moving ahead. Investors should note that Ares Capital’s portfolio is primarily based on floating rates. Based on the company’s third-quarter or FQ3 earnings update in late October, 97% of its new investments are attributed to floating rates. As a result, it’s possible that Ares Capital’s core earnings growth could come under pressure in 2024 as it laps the tough comps against FY23’s remarkable earnings growth.

Analysts’ estimates suggest that Ares Capital could deliver core earnings growth of 15.6% in 2023. However, Wall Street doesn’t expect the momentum to be carried forward in 2024. As a result, Ares Capital’s earnings growth could have peaked in 2023, as analysts penciled in a 0.1% decline in 2024.

Despite the growth normalization, the drop-off isn’t expected to be dramatic, suggesting a resilient 2024, even as the Fed could execute three rate cuts this year. Therefore, a higher-for-longer Fed is still expected, which makes sense as the economy has remained resilient. Furthermore, management argued that it had adjusted its hedges to react to potentially lower interest rates moving ahead.

Accordingly, Ares Capital was noted to have swapped its maturing fixed-rate debt into a “floating-rate debt instrument” at its Q3 earnings conference. The company stressed that the move was intended to align more closely to its “predominantly floating rate asset portfolio, indicating a strategic matching of assets and liabilities.” In addition, management underscored its expectation that “interest rates might remain higher but eventually trend downwards.” In other words, Ares Capital remains poised for a higher-for-longer posture but is ready to swing toward a lower-rate environment.

I believe credit must be attributed to management’s foresight and execution in this aspect. It’s evident now that the market has positioned for a lower rate environment, supported by the Fed’s communication of three rate cuts. However, based on Ares Capital’s earnings conference in late October 2023, the 10Y (US10Y) surged above the 5% mark. As a result, it wasn’t that clear then. Therefore, management’s ability to anticipate correctly should provide more credibility to its execution as it attempts to maintain its core earnings resiliency in expectation of a higher-for-longer environment.

Based on ARCC’s performance since it bottomed out in October 2022, I believe the market has already significantly discounted hard landing risks. Given the exposure to middle market companies that could be affected worse by a recessionary impact, the market seems convinced that such risks aren’t expected to be the base case.

Furthermore, Ares Capital is not expected to face imminent risks in its robust forward dividend yield of 9.7% at the current levels. In other words, unless investors expect the Fed to cut rates significantly, hurting its core earnings projections, income investors are expected to continue buying significant dips on the BDC leader.

Based on the current projections, Ares Capital is expected to see a more substantial decline in its core EPS in 2025 by more than 6%. With ARCC still valued at a premium against its BDC peers, I view the risk/reward at the current levels as reasonably balanced, given the expected peak in its earnings growth rates in 2023.

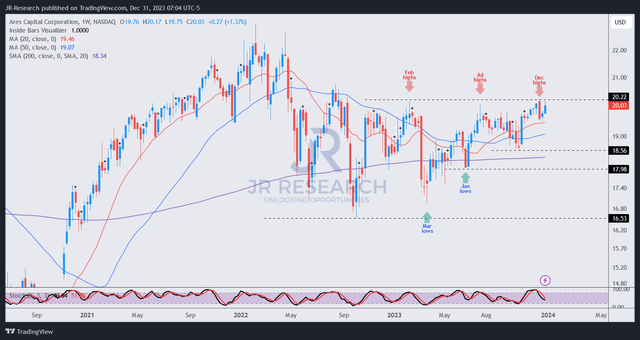

ARCC price chart (weekly) (TradingView)

In addition, from a total return perspective, ARCC might continue to underperform. I assessed it’s facing resistance at the current levels. It’s important to consider that ARCC has regained its medium-term uptrend. With ARCC still trading at a discernible discount against its 10Y average of 10x, I don’t see substantial downside risks at the current levels.

Moreover, the higher lows and higher high price structures suggest it could help ARCC continue grinding higher as it looks to break decisively out of the $20 level. However, I would prefer to watch the reaction to ARCC’s resistance level before assessing another more attractive buying opportunity.

Given ARCC’s relative premium and less constructive price action, I believe the opportunity for ARCC to outperform at the current levels could face more significant challenges. However, a steeper pullback could provide a more attractive entry point for income investors looking to buy into its attractive dividend yields.

Rating: Downgraded to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here