It was the second quarter in a row for Ares Commercial Real Estate Corporation (NYSE:ACRE) in which the commercial real estate investment trust reported negative distributable earnings amid a number of loan sales below book value.

The resulting losses chipped away at the trust’s distributable earnings and book value in 2Q24, but Ares Commercial Real Estate nonetheless declared a $0.25 per share dividend for 3Q24.

A potential dividend cut is priced into Ares Commercial Real Estate’s stock, in my view, which is still selling at an exaggerated 35% discount to book value.

If the trust can avoid new loan sales at a loss, it might also avoid lowering its dividend.

My Rating History

Ares Commercial Real Estate was a contrarian Buy for me after the commercial real estate investment trust slashed its dividend pay-out in 1Q24.

I continue to think that the trust’s loan issues are already fully reflected in Ares Commercial Real Estate’s valuation, and the dividend guidance for 3Q24 implies that the trust doesn’t anticipate ongoing loan and coverage issues.

With that said, though, Ares Commercial Real Estate is not out of the woods yet and there are lingering dividend concerns that might suppress the trust’s stock price for a while longer.

Portfolio Review

The second quarter was another challenging one for Ares Commercial Real Estate. The commercial loan real estate investment trust sold more loans at a loss, leading to a substantial decline in the company’s portfolio, income and book value. As of June 30, 2024, Ares Commercial Real Estate’s total loans held for investment totaled $1.84 billion, down $131.5 million compared to the end of 2023.

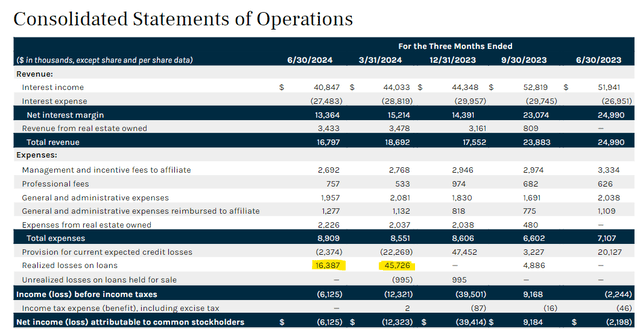

Ares Commercial Real Estate sold loans in the second quarter, leading to a realized loss of $16.4 million, and the trust placed one more multifamily loan with a principal of $98 million on non-accrual. In the prior quarter, the real estate investment trust realized incremental loan losses of $45.7 million.

Realized loan losses chipped away at the company’s profits for the second quarter, leading the trust to once again under-cover its going dividend with distributable earnings.

Realized Losses On Loans (Ares Commercial Real Estate Corporation)

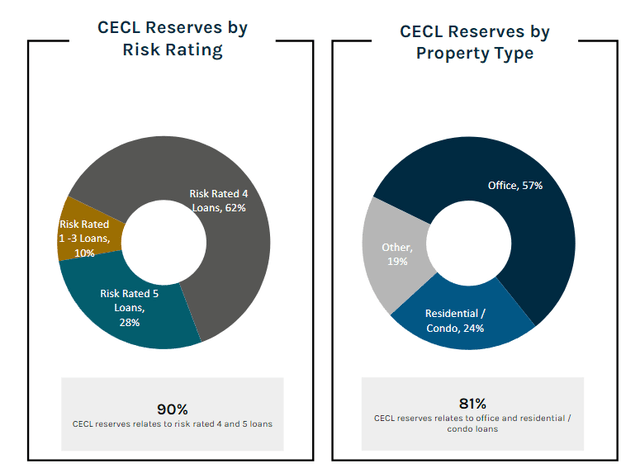

Ares Commercial Real Estate’s loan problems exist primarily in the office loan segment which is responsible for the largest reserve amount: In the second quarter, the trust had a total of $139 million in current credit loss reserves which equates to a 7% reserve ratio with regard to all the trust’s loan held for investment.

Current Credit Loss Reserves (Ares Commercial Real Estate Corporation)

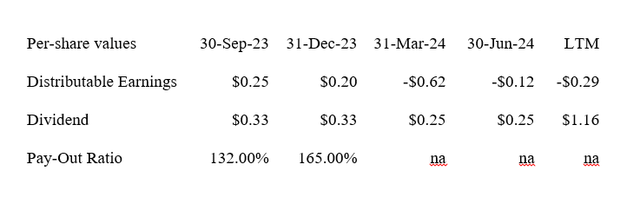

Dividend Pay-Out Metrics

Ares Commercial Real Estate reported yet another quarter of negative distributable earnings as loan losses (related to asset sales) ate into the company’s profitability. The real estate investment trust’s distributable earnings amounted to a loss of $0.12 per share in the second quarter and a loss of $0.29 per share in the last twelve months.

Asset sales in 2Q24 affected the trust’s distributable earnings negatively to the tune of $0.30 per share. Without realized loan losses, Ares Commercial Real Estate would have reported distributable earnings of $0.18 per share.

The trust, however, created confidence with its dividend declaration of $0.25 per share, which means management does not yet deem it necessary to adjust its dividend pay-out.

This could be related, in my view, to expectations of improving loan quality and a rebound in distributable earnings in the near-future. Obviously, this would be the best outcome for passive income investors. But even if management were to slash its dividend amid insufficient distributable earnings, the discount to book value is so big that a dividend cut might already be fully reflected in Ares Commercial Real Estate’s stock price.

Dividend (Author Created Table Using Trust Information)

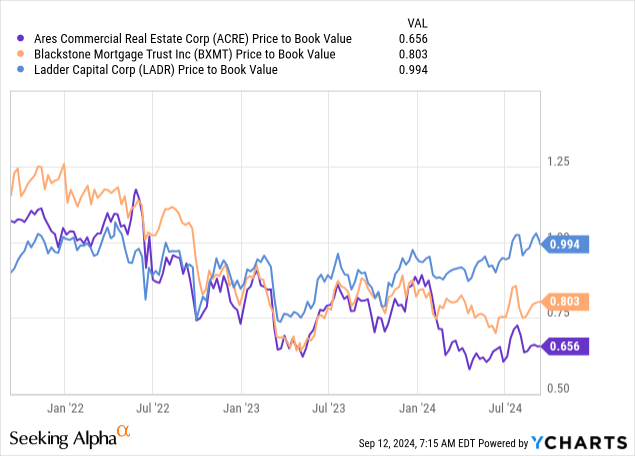

Big 34% Discount To BV

Ares Commercial Real Estate is selling for a big discount to book value, which, in my view, fully reflects the trust’s loan problems. The commercial loan real estate investment trust is presently selling for a 34% discount to book value which compares against a book value discount of 20% for Blackstone Mortgage Trust Inc. (BXMT) which in the last quarter itself slashed its dividend amid similar loan problems with regard to its investments in U.S. offices.

The portfolio and dividend pay-out ratio of Ladder Capital Corp (LADR) looks a lot healthier, and the real estate investment trust has better loan performance, leading to a relatively minor discount to book value of just 1%.

Why The Investment Thesis Might Be Faulty

Ares Commercial Real Estate’s big discount to book value highlights that passive income investors are concerned about the dividend. The trust had two consecutive quarters of negative distributable earnings, which obviously is a problem.

A continuation of this trend, particularly as it relates to realized loan losses, is a concern as far as the dividend and the stability of the trust’s book value are concerned.

In case Ares Commercial Real Estate can’t turn around its trend in distributable earnings, the trust may be forced to slash its dividend yet again.

My Conclusion

Ares Commercial Real Estate declared a third quarter 2024 dividend of $0.25 per common share, which suggests to me that management has confidence that its loan issues are not poised to get worse and that its distributable earnings trend might be in for a rebound.

With that said, though, Ares Commercial Real Estate did realize $0.30 per share in losses in the second quarter amid ongoing loan troubles, which has led to the second quarter in a row in which the real estate investment trust under-covered its dividend with distributable earnings.

I think, however, that the big 34% discount to book value already reflects concerns about the dividend, so even in the case of a dividend cut, the trust’s stock price might have limited downside.

Read the full article here