A Quick Take On Armlogi Holding Corp.

Armlogi Holding Corp. (BTOC) has filed to raise $11 million in an IPO of its common stock, according to an SEC S-1 registration statement.

The firm provides warehousing and logistics services to Chinese e-commerce companies seeking to sell their products in the United States.

While the low-float and low nominal price of the stock at IPO may attract day traders and the company has produced strong growth in recent periods, Armlogi Holding Corp. is exposed to significant trade tensions with essentially its entire customer base located in China.

I’m therefore Neutral on the IPO.

Armlogi Overview

Walnut, California-based Armlogi Holding Corp. was founded to develop a suite of supply chain solutions for the warehouse management and order fulfillment aspects of e-commerce company operations in the U.S.

Management is headed by co-founder, Chairman, CEO and president Aidy Chou, who has been with the firm since its inception and was previously CEO and CFO of Advance Tuner.

The company’s primary offerings include the following:

- Warehouses

- Customers brokers

- Merchandise transportation

- Warehouse management

- Order fulfillment

- Product, storage, packing, kitting

- Order assembly, load consolidation

- Inventory management and sales forecasting

- Third-party distribution coordination

- Other services.

As of March 31, 2023, Armlogi has booked fair market value investment of $8.9 million in equity from investors, including Aidy Chou and Tong Wu.

Armlogi Customer Acquisition

The firm pursues customers internationally who wish to sell and warehouse their products in the United States.

For the nine months ended March 31, 2023, 96% of the company’s revenue came from clients located in China.

It also serves U.S.-based clients who seek the company’s complete service options for warehousing and order fulfillment services.

General and Administrative expenses as a percentage of total revenue have trended lower as revenues have increased, as the figures below indicate:

|

General & Administrative |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Nine Mos. Ended March 31, 2023 |

8.0% |

|

FYE June 30, 2022 |

7.3% |

|

FYE June 30, 2021 |

12.4% |

(Source – SEC.)

The General and Administrative efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of General and Administrative expense, fell to 8.1x in the most recent reporting period, as shown in the table below:

|

General & Administrative |

Efficiency Rate |

|

Period |

Multiple |

|

Nine Mos. Ended March 31, 2023 |

8.1 |

|

FYE June 30, 2022 |

11.5 |

(Source – SEC.)

Armlogi’s Market

According to a 2023 market research report by Mordor Intelligence, the global storage and warehousing services market is an estimated $692 billion in 2023 and is forecasted to reach $964 billion by 2028.

This represents a forecast CAGR of 6.86 from 2018 to 2028.

The main drivers for this expected growth are the expansion of the e-commerce industry along with reconfiguration of global supply chains in the wake of the pandemic.

Also, the refrigerated warehousing market is expected to grow at a high rate of growth due, in part, to new opportunities created by major trade agreements allowing vendors to increase the trading of perishable food products.

The firm faces competition from all manner of logistics market participants.

Armlogi Holding Corp. Financial Performance

The company’s recent financial results can be summarized as follows:

- Sharply higher topline revenue

- Increasing gross profit and variable gross margin

- Higher operating profit and net profit

- Growing cash flow from operations.

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Nine Mos. Ended March 31, 2023 |

$ 86,931,574 |

184.7% |

|

FYE June 30, 2022 |

$ 56,030,258 |

521.4% |

|

FYE June 30, 2021 |

$ 9,017,286 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Nine Mos. Ended March 31, 2023 |

$ 19,002,187 |

547.3% |

|

FYE June 30, 2022 |

$ 6,329,250 |

288.4% |

|

FYE June 30, 2021 |

$ 1,629,397 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

% Variance vs. Prior |

|

Nine Mos. Ended March 31, 2023 |

21.86% |

12.2% |

|

FYE June 30, 2022 |

11.30% |

-37.5% |

|

FYE June 30, 2021 |

18.07% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Nine Mos. Ended March 31, 2023 |

$ 12,028,041 |

13.8% |

|

FYE June 30, 2022 |

$ 2,251,485 |

4.0% |

|

FYE June 30, 2021 |

$ 509,676 |

5.7% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Nine Mos. Ended March 31, 2023 |

$ 8,960,693 |

10.3% |

|

FYE June 30, 2022 |

$ 1,981,094 |

3.5% |

|

FYE June 30, 2021 |

$ 403,252 |

4.5% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Nine Mos. Ended March 31, 2023 |

$ 10,479,055 |

|

|

FYE June 30, 2022 |

$ 542,858 |

|

|

FYE June 30, 2021 |

$ (1,456,333) |

|

|

(Glossary Of Terms.) |

(Source – SEC.)

As of March 31, 2023, Armlogi had $5.4 million in cash and $54.5 million in total liabilities.

Free cash flow during the twelve months ending March 31, 2023, was $9.4 million.

Armlogi Holding Corp. IPO Details

Armlogi intends to raise $11 million in gross proceeds from an IPO of its common stock, offering two million shares at a proposed midpoint price of $5.50 per share.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

The firm will be considered a ‘controlled company’ by Nasdaq’s rules immediately after the IPO.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $217 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 4.76%. This low float percentage suggests the stock may be volatile in open market trading.

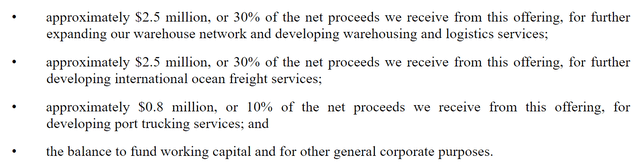

Management says it will use the net proceeds from the IPO as follows:

IPO Proposed Use Of Proceeds (SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is not currently a party to any legal proceeding that would have a material adverse effect on its operations or financial condition.

The sole listed bookrunner of the IPO is Prime Number Capital.

Valuation Metrics For Armlogi

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$231,000,000 |

|

Enterprise Value |

$217,122,289 |

|

Price / Sales |

2.05 |

|

EV / Revenue |

1.93 |

|

EV / EBITDA |

15.19 |

|

Earnings Per Share |

$0.26 |

|

Operating Margin |

12.71% |

|

Net Margin |

9.77% |

|

Float To Outstanding Shares Ratio |

4.76% |

|

Proposed IPO Midpoint Price per Share |

$5.50 |

|

Net Free Cash Flow |

$9,432,321 |

|

Free Cash Flow Yield Per Share |

4.08% |

|

Debt / EBITDA Multiple |

0.00 |

|

CapEx Ratio |

4.44 |

|

Revenue Growth Rate |

184.71% |

|

(Glossary Of Terms.) |

(Source – SEC.)

Commentary About Armlogi’s IPO

BTOC is seeking U.S. public capital market investment to fund the expansion of its service network capacity and capabilities.

The firm’s financials have produced much higher top line revenue, growing gross profit and variable gross margin, increased operating profit and net profit and higher cash flow from operations.

Free cash flow for the twelve months ending March 31, 2023, was $9.4 million.

General and Administrative expenses as a percentage of total revenue have trended lower as revenue has increased; its General and Administrative efficiency multiple fell to 8.1x in the most recent reporting period.

The firm currently plans to pay no dividends and, as a Nevada corporation, is subject to certain restrictions on the payment of dividends.

BTOC’s recent capital spending history indicates it has spent moderately on capital expenditures as a percentage of its operating cash flow.

The market opportunity for providing a range of warehousing and order fulfillment services to e-commerce companies is large, highly competitive and is expected to grow substantially in the coming years.

Prime Number Capital is the bookrunner of the IPO, and its five IPOs in the past twelve months have produced an average return of negative (9.5%).

Business risks to the company’s outlook as a public company include its heavy reliance on customers with operations in China.

The Chinese government has proven itself to be fast-moving and comprehensive in its ability and willingness to change industry conditions, so the firm’s customer base remains at risk of regulatory changes with little notice.

Management is seeking an Enterprise Value/Revenue multiple of approximately 1.93x.

While the low-float and low nominal price of Armlogi Holding Corp. stock at IPO may attract day traders and the company has produced strong growth in recent periods, it is exposed to significant trade tensions with essentially its entire customer base located in China.

I’m therefore Neutral [Hold] on the IPO.

Expected IPO Pricing Date: To be announced.

Read the full article here