Dear readers/followers,

Assa Abloy (OTCPK:ASAZF) is a company that I’ve been following for a long time, and my investment in the company is old. I’ve remained positive for most of the time based on the company’s timeless fundamentals and growth prospects. This is, therefore, an update on the business since the last piece which I published at the end of July of 2023. The RoR since that time is negative 11%, which has underperformed the various indices.

Does this bother me?

It bothers me a bit that I didn’t get some shares cheaper – but then again, I haven’t exactly added massive amounts to my portfolio in this company for some time, even if I’ve been positive.

As the company drops, I become more positive about the stock and the appeal that it has. Assa Abloy is in many ways, a world-leading and market-leading business with some of the best growth rates and historicals that you can find.

The issue, as with many companies in this sector, is that the company’s valuation has been inflated for some time. It has been over 10 years since the company could be called cheap on anything except a comparative basis.

However, we’re now moving toward price trends where this double-digit growing company is getting more and more interesting.

Let me show you.

Assa Abloy – The upside is getting stronger

Fundamentally speaking, very little is wrong or worrying about Assa Abloy. We’re talking about an A-rated business with a 2% yield and less than 37% debt/cap as well as a market cap approaching 270B SEK.

Margins are above-average in everything from gross to net, and the company despite a COGS-heavy and cost-heavy business model, manages a double-digit 10%+ net margin for its business. From the perspective of the business model, this company is not only attractive, it’s proven over time. Time-tested business models are what I like investing in, and my focus on the “Noise” of things is very close to zero.

We’re currently in a market characterized by a lot of volatility. I have not been in a hurry to deploy massive amounts of capital. My strategy has been, for some years now, to invest as the drop “stops”. So as opposed to many, I would characterize my buying patterns as being reversal-heavy – I typically buy on up days, not down days. For now, I haven’t been adding much to my Assa Abloy position, but I expect that will change within 2-to 3 weeks of this article.

Are the recent double-digit drops justified by company results?

No, they are not.

2Q23 was a good quarter for Assa Abloy. The company saw organic sales growth, with good growth in the Americas and global tech, as well as stability in the Entrance Systems segments. The company’s APAC and EMEIA geographical segments saw sales decline on a top-line basis, but this was weighed up by a record EBIT (Source: 2Q23 Assa Abloy).

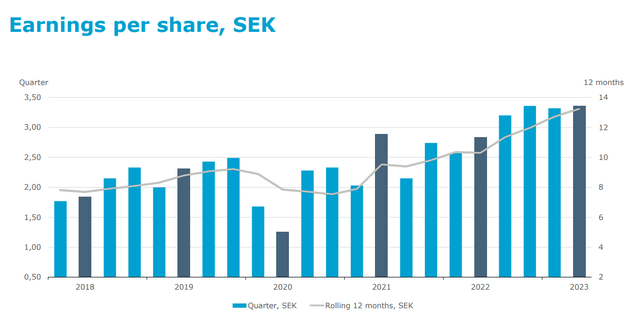

Worth pointing to in this update is therefore not only a double-digit organic sales growth based on organic growth and positive FX, but it’s also a growing EBITDA and EBIT Margin, as well as an 18% EPS increase.

Highlights here include 5,000 pedestrian doors and trailer restraints for a large US-based customer, cruise line company mobile keys, physical access control to a major financial firm with 6,000 HID readers and new product launches in Yale, IoT-enabled dock levelers, and IP video solutions.

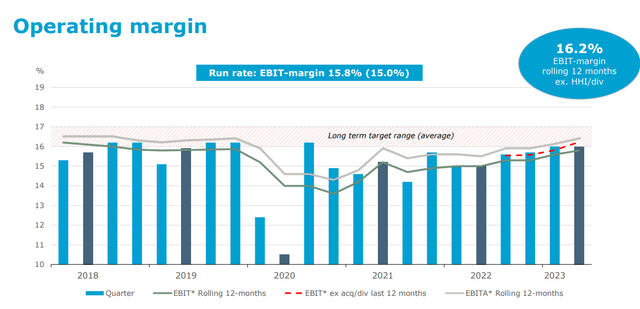

While 2020 might have been a bottom year in terms of the company’s operating margin, the years after saw significant increases and reversal to the company’s long-term target range – which for this sort of company is very lofty indeed, but something the company has actually managed for much of the time.

Assa Abloy IR (Assa Abloy IR)

It is these factors that make this company above-average and, to my mind, very much worth investing in. The company has essentially been growing its operating profit since the depths of COVID-19, and are now at over 20B SEK of operating profit on an annual basis. Assa is also very M&A-heavy and the latest set of acquired businesses and brands for the company have brought significant new revenue and profit to the business.

Assa Abloy IR (Assa Abloy IR)

HHI is the latest M&A that’s relevant for Assa here. Looking at the various sectors, the American operations of the company saw very impressive trends with an operating margin of 20%+. Even in relatively negative segments, such as APAC, the company saw substantial improvement – in this case in operating margins. APAC has been low for some time since it troughed in 4Q22, but is now back to almost 8% EBIT margin, despite an overall sales decline.

So what’s the cause of all these positive trends and increasing margins in an otherwise somewhat “negative” world, with increased inflation, raw material costs, and other factors, such as labor?

Well, Assa has the size and leverage to bring down material costs and efficiencies through better price realization – and that operating leverage on the purchase side of things. Efficiency measures are also “bringing things home” here, and there is a strong positive currency effect due to material strength in the USD compared to other currencies.

Negatives include acquisition and overall consolidation costs, as well as some divestments, such as Emtek and a Smart Residential US business.

With the addition of HHI, we have significant operating synergies of over 1B SEK, or around $100M for the company – giving HHI the ability to leverage its brands through Assas global presence and vastly improved manufacturing footprint, procuring and logistics efficiencies, and the like.

Cost actions is another way the company is saving money, almost 400M SEK from headcount reduction, reduced travelling, marketing, external service and other spending. Overtime hours are being limited, and redundancies are being eliminated. Whenever a company or any organization moves into measures like this, it’s crucial not to “overdo” things. Being a management consultant myself, I’ve seen many organizations where this has gone too far and where we’re down to a bare-bones-stripped organization that no longer has the ability to meet its goals in terms of quality or security.

This is not the case with Assa though – but it’s something to keep an eye on, given the importance of quality in the company’s products.

On a high level, the company is in a very good position. Cash flow is very strong, and the company’s debt level, while skyrocketing on a contextual level due to the company’s acquisitions, is still at a manageable level. I also hasten to add that the company’s credit rating is not affected by this recent change in leverage – it’s still stellar, at least for the time being.

Perhaps most important of all, company earnings continue to show very positive trends.

Assa Abloy EPS (Assa Abloy IR)

With regards to the HHI acquisition, this is a company I’ve been doing some research on as well, and what I’ve found is impressive. HHI has seen growing sales for at least 10 years running and while the company has seen an EBITDA margin decline to around 14.5% from a high of over 19%, it’s my stance that using Assa’s superior organization in terms of size and efficiency, the synergies this will bring to the table for both will be definite value-adds here.

Let’s look at valuation and how this company fulfills my demands.

Assa Abloy – Lower Valuation makes this interesting

I’ve been through before that I view Assa’s valuation premium as somewhat justified. The company is in a position to manage very good pricing power as well as operating leverage. In a rising interest environment, companies at high valuations should most definitely see discounting, but the degree of discounting should be carefully looked at to make sure you can lock in those potential double-digit and triple-digit returns from a quality business like Assa Abloy.

The company is expected to average growth rates of 8-9.5% for the next 3 years in terms of adjusted EPS. Much of that profit will go to reducing debt, but the expectation is also for a significant 2023E dividend increase – more than 15%, in fact (Source: FactSet).

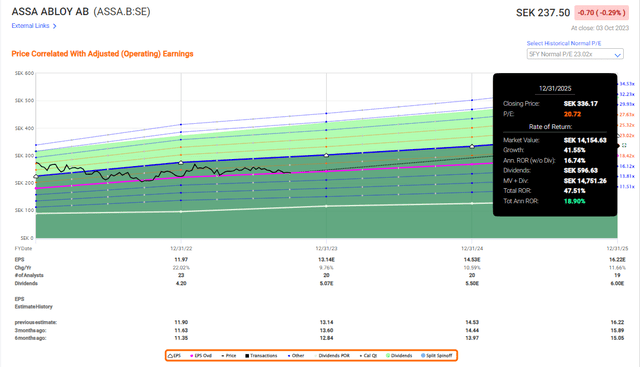

I called for a potential 2%+ yield for the company last I wrote about it, with the increased dividend. Thanks to the decline, we already have this increase in yield today, and are at 2.02%. The company trades very close to a P/E of 18.5x, which compared to the 8-10 year normalized average of 23-24x P/E can definitely be considered something of a discount here. Is it enough of a discount?

That depends on where you value the business.

At a 15x forward P/E, there is really no upside to be had here, at least none worth speaking of. Even at double-digit growth rates of almost 11% in EPS per year, we’re seeing only 3.6% per year, which is well below any risk-free rates at this time.

So in order to see good RoR here, you really need to consider the company at a higher multiple – 18-20x P/E is a good start. At around 20.5x P/E, the company has an upside of close to 18.5-19% per year. This is market-beating and within my own requirements for an upside for an investment.

Assa Abloy IR (Assa Abloy IR)

This is also more than 5% more per year compared to what I saw when I last reviewed the company, and highlights once again the importance of buying a business like this at a good valuation. In my last article, I had a PT of 265 SEK/share. I’m sticking to this PT because I believe in the long term, the company has plenty of upside. As you see above, a longer-term 20-21x P/E implies a PT of over 336/share. Even at a P/E on a forward basis of around 18.5x, the company’s implied share price is around 300 SEK/share, implying a 13.3% annualized rate of return. You’d have to go below 16.5x P/E to see a single-digit upside for the stock here.

S&P Global targets for Assa Abloy confirm what I see in the upside here. 19 analysts follow the company, and despite starting at a low-range PT of 230 SEK per share, and up to 335 SEK with an average of 282 SEK, only 4 out of those 19 analysts are at “BUY” here, showcasing a bit of a conviction problem. Most of the analysts, over 10, are at “HOLD”. Plenty of targets are looking like this at this time. The feeling is one of wanting to wait and see what happens.

I say that Assa Abloy is significantly undervalued here, and worth your attention if you’re a valuation-oriented investor. Investing in Assa Abloy means, as I see it, locking in a potentially double-digit upside at 13-18% per year.

This is my thesis on the company.

Thesis

- Assa Abloy is a global, market-leading provider of solutions in access, ID, locks, and passage systems. The company is an M&A-heavy, proven capital allocator with excellent fundamental safeties and a potential upside at a good valuation. At a cheap price, it’s possible to deliver significant market outperformance by investing in the company.

- At a 235 SEK per share price for the native ticker, the company is becoming more and more interesting. I bump my price target to 265 SEK/share for the longer term, and I now believe the company to be fully buyable for the 1-6 year timeframe, as I believe that you will significantly outperform the market in the meantime.

- This is a “BUY”, and no longer a weak one. I won’t call the company cheap yet – but it’s getting there.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

Assa Abloy is not “cheap” here, but it still does have significant upside potential – so I’ll say “BUY”.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here