During the latest market downturn that began in August and continued into the first week of October, I have been reading and studying up on several high-yield investments that I own in my Income Compounder portfolio. I recently retired from my full-time career and received a pension payout as well as a rollover of my retirement savings into my self-directed IRA that I have with Fidelity, so I have some new cash to invest. If you have read any of my previous articles, I like to invest for income that compounds over time as I reinvest the monthly or quarterly distributions into more shares of lower-priced funds or stocks that I already own, or I may initiate new positions in those closed-end funds (“CEFs”), exchange-traded funds (“ETFs”), business development companies (“BDCs”), or real estate investment trust (“REITs”) that offer a compelling opportunity.

I recently wrote about some new additions to my portfolio that you can read about here, “Going Against The Grain – Recent Additions To My Income Compounder Portfolio.”

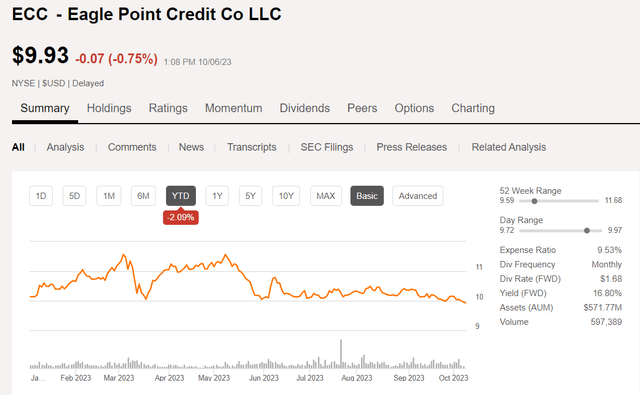

One of the funds that I already own in my IC portfolio is Eagle Point Credit Company LLC (ECC), a CEF which currently pays a high yield distribution of about 17% and was recently recommended by a fellow analyst on SA here – “Wake Up And Smell The Cash Flow: Eagle Point Credit Yield 17%.” In the comments section of that article was an analogy of the benefits of the income method from a reader who commented on holding securities such as ECC for generating a passive income stream:

I own 92 Momma cows and 3 bulls. The gestation period for a cow is about 9 months. Therefore, we have 92 calves to sell per year and the Momma cows keep producing a calf every year. Of course, there is some death loss, from time to time, of a cow and/or calf. It’s not unusual for a cow to produce 12 calves in her lifetime and then she goes to slaughter and ends up in your hamburgers. I fully expect her to be worth less on the kill date than when she is 2 years old. Every day I know what the price of calves are (Feeder cattle on the Chicago Mercantile Exchange) but I have no idea of the price, nor do I care what the Momma cows are worth today.

In this case, the “momma cow” is ECC and the calves that are born every year would be the distributions that are paid out each month that result in the 17% annual income (based on the current price of the momma cow, ECC). The only time the price of the momma cow (ECC) really matters is when you are buying the initial shares or reinvesting the dividends to buy more shares to produce more calves (income). Looking at a price chart of ECC, it would appear that now is a pretty good time to buy some shares while the price is lower than it has been all year, and the distribution is well covered and not in any danger of being cut.

Seeking Alpha

For many growth-oriented investors, or those who seek total return and care about the overall value of their portfolio, this can be a difficult concept to grasp. The primary difference between an income compounder method and a dividend growth or total return approach is that the seed corn, which is the shares owned in a fund like ECC, does not have to be sold off, ever, to capture the gains in order to receive the income. Those shares keep growing through reinvestment and keep increasing the crop yield (e.g., income produced) as long as the distributions keep getting harvested.

This is one reason why I welcome a market downturn that spreads fear through the market and sends the prices of my holdings lower even though nothing about the business has changed. This is especially true for me right now as I have new cash to invest. The best time to start a new position in a high-yield fund or stock is when prices are low.

Another of my high-yield holdings is Oxford Lane Capital Corporation (OXLC). While OXLC is also trading near its lowest price YTD, the CEF offers income investors a well covered 19% yield at the current price of just under $5.

Seeking Alpha

While the price of OXLC has been heading lower, the NAV of the fund has been increasing over the past several months. At the end of July, the company reported a jump in core net investment income in its fiscal Q1 (quarter ending June 30) compared to the previous quarter. Core NII of $0.43 for the quarter is considerably higher than the $0.24 per quarter that is paid out in monthly distributions of $0.08 per share, and it is therefore likely that a supplemental distribution or increase in the monthly distributions going forward will be required before the end of the year. The explanation of what Core NII includes may clarify why it increased so much over the previous quarter:

Core NII represents NII adjusted for additional applicable cash distributions received, or entitled to be received (if any, in either case), on our collateralized loan obligation (“CLO”) equity investments.

CCIF – Not a New Fund but Now a CLO Fund

Another recent addition to my IC portfolio is a CEF from Carlyle, the Carlyle Credit Income Fund (CCIF). From the fund website, CCIF is described:

CCIF’s investment objective is to generate current income and capital appreciation primarily through investing in equity and junior debt tranches of collateralized loan obligations, or “CLOs,” that are collateralized by a diversified portfolio of senior secured loans.

As a prominent player in the CLO market (both as a CLO manager and CLO investor), Carlyle’s market presence facilitates access to a wide range of market opportunities. Carlyle intends to source investment opportunities from the broad network of dealer, investor, and manager relationships that it has developed during its 24-year history in the CLO market.

In August of this year, Carlyle went through an interesting tender offer to essentially cannibalize the previous incarnation of CCIF that had been investing in residential debt securities and converted the fund to a CLO fund. Another analyst on SA covered that transition in more detail here, “CCIF Fund: From Tactical To Strategic Opportunity In This New CLO Equity CEF.”

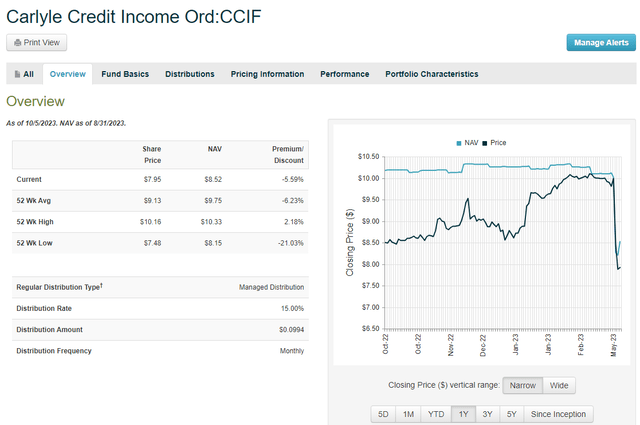

Then, on September 13the, the dividend declaration for the upcoming 3-month period announced monthly dividends of $0.0994 to be paid in September, October, and November. That results in a forward annual yield of 15% at the current share price of $7.95. The NAV of the fund as of 8/31/23 was estimated at $8.52, so the current shares are trading at a discount to NAV of about -5.5%.

While many of my readers attempt to understand the future potential of an investment by looking at the historical track record, this will not be very helpful in the case of CCIF. The recent history over the past 2 months is somewhat telling, but is not very helpful in understanding what is likely to happen in the future. Nevertheless, I am offering below a chart of the price vs. NAV from CEFConnect just to illustrate that the current price offers a unique opportunity to buy the fund at a discount, which I do not expect to last. My expectation is that the price will rise as distributions are paid and the fund NAV continues to rise. The fund NAV is reported monthly and the latest estimate for September should be posted any day now.

CEFConnect

Also, as I have attempted to explain in other articles where I discuss the merits of owning CLO funds, the NAV of the fund is not necessarily the best way to determine the fund’s value due to the complexity involved in evaluating the current market value of CLOs. In my recent article discussing XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT), “XFLT: DRIP At A Discount To Stream Your Income Into A River Of Cash,” I covered some of the risks of investing in CLOs as well as some of the advantages. I will reiterate some of what I wrote in that article for readers of this one.

CLO funds in general offer investors attractive yields in both bull and bear markets. And if the economy should dip into a recession later this year or in 2024, CLO equity can offer outperformance compared to stocks or bonds due to the unique characteristics of the asset class. According to this from Western Asset Management, CLO equities issued just before the 2 most recent recessions outperformed other asset classes.

For readers who really want to understand CLO investments in much greater detail, this discussion from PineBridge offers in-depth information regarding both the benefits and the risks. Some of the most important benefits that I see in the current market environment include:

- Strong credit quality.

- Hedge against inflation.

- Diversification (low correlation to other fixed income assets).

- Lower default rates.

- Low interest rate sensitivity.

- Strong returns with attractive risk profile.

- Wider yield spreads than other credit instruments.

Summary

The fears of higher interest rates and ongoing inflation are factors that have been primarily responsible for spooking the market over the past couple of months and do not pose as much risk to CLOs as it does to traditional equities or bonds. Yet the pricing of these CLO funds has been impacted by those fears, which is why I see opportunities to invest at lower prices to collect that high yield income over the coming years. I believe that is also why we are seeing more new CLO funds such as CCIF popping up recently.

That is not to say that there is no risk in holding CLO funds. But well managed funds that include experienced CLO managers such as Carlyle and Eagle Point offer substantial risk-adjusted rewards for those investors seeking long-term passive income streams. I do not recommend literally betting the farm and going all-in on CLO funds, but I do suggest an appropriate allocation to fertilize your income-oriented portfolio by holding funds such as the ones discussed above to add strong income-based cash flows and grow your future income stream.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here