When Carnival Corporation & plc (NYSE:CCL) Q3 2023 earnings hit late last week, the results broke a fourteen-month string of consecutive quarterly losses. To characterize the effects of COVID on Carnival as a headwind is a gross understatement. In fact, it was the financial equivalent of a Hurricane.

In FY 2020, the company posted $10.2 billion in losses followed by another $9.5 billion fall in 2021.

However, late last year, Truist Securities upgraded CCL to a hold from a sell, noting that “Forward-looking trends for 2024 and 2025 look exceptionally strong.”

As 2023 dawned, things were finally looking up for investors in CCL. After suffering a multi-year fall from above $70 to below $7, CCL nearly tripled in 2023. Then, as the shares neared a 52-week high, more analysts began coming on board.

First Jefferies upgraded CCL to a Buy rating from Hold. Analyst David Katz pointed to increasing cash flow, moves to lower debt, and the likelihood that the cruise line operator would regain investment-grade credit ratings. That was followed by Argus upgrading the cruise line to a Buy from a Hold, citing undervaluation as a key factor in the decision.

But after hitting a 52-week high of $19.55 in July, Carnival is now trading for $13 and change.

There are two sides to consider when dissecting CCL as a potential investment. On the one hand, to survive COVID, the company took on a great deal of debt and issued new stock at low price points.

But on the positive side, new bookings are soaring to record highs, Carnival is expanding capacity and lowering fuel costs per passenger, and an aging population means retirees could drive cruise line demand for the foreseeable future.

What Recent Results Reveal

Late last month, Carnival posted its first quarterly post-pandemic profit. Adjusted income of $1.1 billion beat analysts’ estimates of $1.01 billion. That represents an enormous improvement over the comparable quarter of 2022 when the company posted a loss of $688 million.

EPS of $0.86 was well above the $0.73 consensus and the $0.58 loss recorded last year.

Revenues of $6.85 billion set a record and were up 58.9% year-over-year, beating analysts’ forecasts by $160 million.

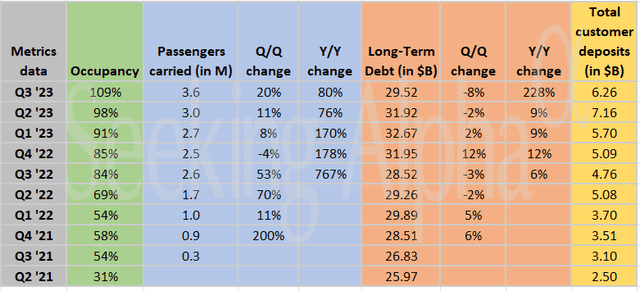

The number of passengers carried increased by 40% year-over-year to 3.6M, and passenger cruise days were 46% higher, rising to 25.8 million.

Customer deposits and booking volumes, both important forward indicators, hit record levels for the third quarter, and spending per passenger per day has not varied.

Carnival’s European operations reported better than anticipated results for Costa and AIDA, with both brands hitting 119% occupancy in August. The company’s P&O Cruises recorded the highest occupancy levels in over a decade, despite a 40% capacity increase since 2019.

Even though the cruise liner’s capacity is set to expand, robust demand positions Carnival to drive 2024 pricing higher. The company expects a capacity increase of 5% in 2024. In that year, three ships are scheduled for delivery, and another new ship is to go into service in 2025. There are no ships on order for 2026.

When COVID hit, the industry sent a wave of older ships to the scrapyard. The retirement of older ships coupled with the wave of new builds served to accelerate Carnival’s initiatives to rescue fuel usage. Today, the company’s fuel usage per passenger is nearly 16% lower than in 2019, and management claims Carnival runs the most fuel-efficient fleet “by a wide margin.”

Even so, a sour note in the Q3 earnings call centered on fuel prices. The company projects a 20% increase in fuel costs in the fourth quarter, and also noted that there has only been one other period in the last 15 years when fuel prices reached current levels. Consequently, Carnival is considering adding a fuel charge for future cruises.

Management estimates fuel prices combined with foreign exchange rates represented a $130 million drag on profits compared to June.

A transitory headwind lies in the company’s expected 18% increase in 580 more dry dock days than in 2023. The increased dry dock days are expected to add three-quarters of a point to 1 point to Carnival’s overall costs.

The following quote from the call by Josh Weinstein, President and CEO, works well to highlight the progress the company has made in recovering from the COVID shutdowns.

Our booked position is as far out as we’ve ever seen it. With our European brands booking curve now essentially back to 2019 levels and our North American brands exceeding historical highs. And importantly, we’ve been able to achieve this 10-point occupancy advantage at higher ticket prices for the same time last year. By all accounts, it’s a great start to 2024.

Seeking Alpha

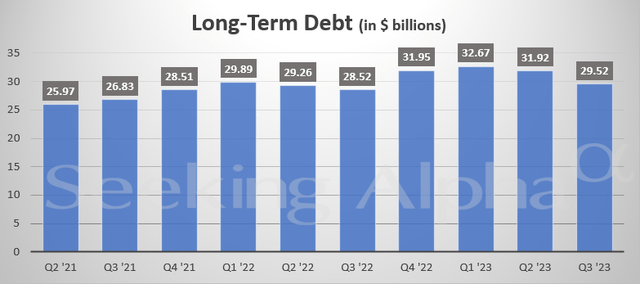

Carnival expects to end the fiscal year with debt just under $31 billion, a reduction of $4 billion off the peak. Management’s goal is to pay down $10 billion in debt and improve the balance sheet to the point that Carnival earns investment-grade credit ratings by 2026.

Carnival has $2 billion of debt maturities due in 2024 and $2.2 billion in 2025. The debt portfolio is 80% fixed with an average interest rate of approximately 5.5%.

Seeking Alpha

Management guides for adjusted EBITDA of $4.1 billion to $4.2 billion for FY 2023.

A couple of weeks before earnings hit, Redburn Atlantic analyst Alex Brignall upgraded Carnival to Buy from Neutral, noting the cruise line’s progress in repaying debt and enhancing profitability.

The 18 analysts covering Carnival forecast revenues of $23.9 billion in 2024, a 19% increase over the last 12 months.

Who Is Sailing Into The Sunset?

According to a study by the Cruise Lines International Association, global cruise capacity is forecast to grow 19% from 2022 through 2028.

Cruise lines stand out as one of the fastest-growing tourism sectors. The number of passengers that set sail is expected to grow from 29.7 million in 2019 to 39.5 million by 2027. Furthermore, 85% of those that have taken a cruise intend to set sail again.

Now consider that 2.5 million guests set sail on their maiden voyage aboard a Carnival cruise ship this year.

Additionally, the following trends are working in favor of cruise lines. Among Millennials, 88% that have cruised at least once plan to sail again, and the same is true of 86% of Gen-Xers. Among those two age cohorts, 73% of those who have never cruised would consider taking a cruise.

The graying of Americans and those in other leading economies should also create strong demand for cruise lines.

A recent study by Bank of America reveals that Baby Boomers, as well as those aged 78 to 95, are increasing their leisure spending, particularly on travel and hotels. Not only are they spending more than in the past, they are also outspending younger generations. In 2021, Baby Boomers planned to spend about a quarter more than Gen-Xers and roughly 50% more than Millennials on travel.

Now I will hearken back to Redburn Atlantic’s recent upgrade of Carnival:

The cruise industry, with an average guest age of almost 50, will enjoy a turbocharged version of this demand strength as the U.S. over-65 population is set to grow at more than 2% per year until 2030, four times the overall population growth of the U.S.

Alex Brignall, Analyst.

Count me as one of those gray-haired guys that hopes to enjoy numerous cruises in years to come.

Is Carnival A Buy, Sell, Or Hold?

Carnival Corporation & plc’s recent fiscal Q3 results are a positive development, as is the company’s progress towards paying down debt, demographic and consumer trends, and the surge in passenger demand.

However, there are several potential headwinds on the horizon, including the resumption of student loan payments and the possibility that a recession could unfold.

Furthermore, even if developments favor Carnival, the road the firm must take to make the cruise liner a solid long-term investment is rough and rocky.

Consequently, I rate Carnival as a HOLD. However, I do so with the following proviso.

I tend to focus on very high-quality companies, and the overwhelming majority of my investments are in dividend-bearing stocks. I am also loath to purchase stocks that do not sport investment-grade credit ratings. In other words, I have a low-risk tolerance, and CCL does not fit most of my investment criteria.

Furthermore, I am a largely buy and hold investor. I seldom engage in trades.

However, I will put forth that for those with a different risk/reward profile, there is a reasonable argument that CCL may fit their bill. In fact, I would not be surprised if those investing in CCL today have market-beating returns somewhere down the line.

I do not own shares in CCL, and I have no intention of investing in the stock in the foreseeable future. Nonetheless, I find Carnival’s prospects intriguing, and I will continue to follow the company.

Read the full article here