By Elisa Mazen, Michael Testorf, CFA, & Pawel Wroblewski

Positioning for Normalizing Liquidity and Leadership

Market Overview

International equities suffered losses in the third quarter, with rising bond yields leading to a wide divergence among growth and value investment styles. The benchmark MSCI EAFE Index declined 4.11% for the quarter, while the MSCI Emerging Markets Index fell 2.93% and the MSCI EAFE Small Cap Index dropped by 3.51%.

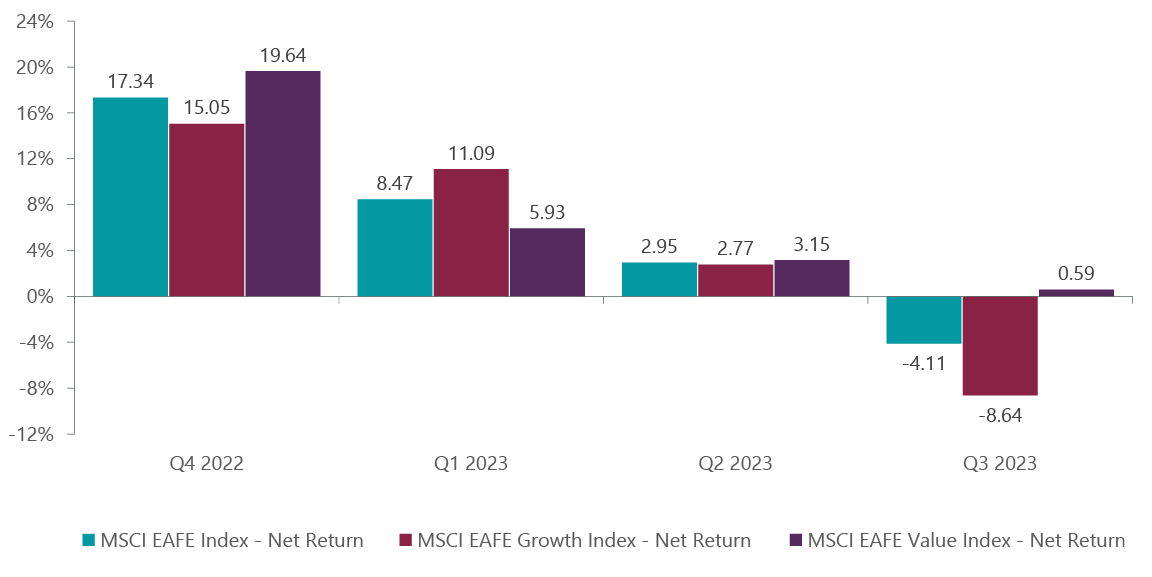

Over a three-month period reminiscent of 2022, which marked the brunt of global monetary tightening, value stocks outperformed growth by over 900 basis points (bps) with the MSCI EAFE Value Index up 0.59% compared to an 8.64% loss for the MSCI EAFE Growth Index, predominantly concentrated in the last month of the quarter (Exhibit 1). Value’s quarterly outperformance was dominant enough to turn a 490 bps year-to-date performance deficit at the end of June into a 560 bps lead through September.

Exhibit 1: MSCI Growth vs. Value Performance

As of Sept. 30, 2023. Source: FactSet.

The quarterly variance between value and growth was especially acute in the Strategy’s largest regions of investment: Europe Ex U.K. (value ahead by 840 bps), the United Kingdom (+760 bps) and Japan (+1,400 bps) (Exhibit 2). We detailed the drivers of Japan’s value resurgence in last quarter’s commentary, catalysts that continued over the last three months. Value’s outperformance in Western Europe, however, has been led by traditional value sectors: financials (predominantly banks), materials and energy stocks, which account for nearly 50% of the European value benchmark. This was driven by better-than-expected U.S. economic data, leading investors to expect a more forgiving economic environment.

Exhibit 2: Value Dominant Across Regions

| Data as of Sept. 30, 2023. Source: FactSet. Value and growth performance as measured by the growth and value components of the MSCI Japan, MSCI United Kingdom and MSCI Europe indexes. |

The ClearBridge International Growth ADR Strategy underperformed the benchmark for the quarter, held back by our commitment to growth during a broad-based value rally. The drivers of value outperformance this year – rising interest rates, narrow market breadth and a resurgence in Japan – continued to weigh on relative results. While disappointed by recent performance and aware that a handful of stocks have not worked as we expected, we remain confident in the composition of the portfolio and believe it is well-positioned to deliver alpha as the headwinds of restricted global liquidity and lower-quality leadership begin to dissipate.

We were surprised by the resilience of the U.S. economy – something we do not attempt to predict. It has had an outsized impact on our style which, combined with our broader allocation among sectors and growth groupings, historically has been beneficial to performance. The breadth of the market has narrowed quite meaningfully along with value dominance, which has also hindered relative performance. Importantly, we do not think these will last.

The performance of Dutch semiconductor equipment maker ASML provides a microcosm of the negative sentiment overshadowing international growth stocks. As the leading provider of extreme ultraviolet lithography equipment to makers of graphic processing units (GPU) and similar semiconductors powering demand for artificial intelligence applications, the company is in a prime position to benefit from the secular AI buildout. However, unlike U.S. GPU maker Nvidia (NVDA) which has seen its shares triple this year, ASML has failed to benefit from AI enthusiasm, with the shares down double digits in the third quarter and basically flat for the year.

Portfolio Positioning

Rather than reverse course to keep up with what we view as fleeting leadership for deep value stocks, we remain committed to a disciplined, valuation approach to portfolio construction that delivers diversification by investing across three types or buckets of growth companies (secular, structural and emerging). We remained active in the third quarter, with our positioning moves underscoring this commitment to sourcing attractive growth franchises across international markets.

Our biggest move was swapping out Swiss pharmaceutical and diagnostics maker Roche (OTCQX:RHHBY) for U.K. pharmaceutical developer AstraZeneca (AZN). Our original thesis for Roche was that its four large cancer franchises would not fade as quickly as market forecasts while the company built its new pipeline. The pipeline does not appear to be building, however, and we expect the stock to struggle until something significant materializes. We believe AstraZeneca has a deep, diverse pipeline of products and a patent portfolio with no material expirations until the 2030s, characteristics that should allow the company to deliver solid organic revenue growth above its pharmaceutical peers through the end of the decade.

Also within health care, we added a new position in Argenx (ARGX) as the Dutch biotechnology company demonstrated a successful launch for its myasthenia gravis drug, which it is rolling out globally. Argenx is targeting the same molecule to treat other rare diseases, with key readouts by year end or early next year.

Seeking to take advantage of the improved corporate environment in Japan and further reduce our underweight to the region, we added a position in SMC, a global leader in pneumatics automation solutions. We believe SMC will benefit from the strong capital spending cycle driven by electric vehicles and rechargeable batteries giving us confidence to start a position amidst this quarter’s market downdraft. With excess cash on its balance sheet, the changing environment in Japan means that better shareholder returns are possible from companies such as SMC.

To make way for these new names, we closed out our small remaining position in Teleperformance (OTCPK:TLPFF), a French customer service provider whose thesis was broken due to a shift in its acquisition strategy. We also exited French bank BNP Paribas (OTCQX:BNPQF) as a precautionary move before expected earnings downgrades start later this year or in early 2024. European banks, in general, had a good run in 2023 with net interest income peaking in the second and third quarters. BNP in particular has fee income dependent on economic activity in Europe, which is slowing.

While we remain underweight financials, we took advantage of short-term weakness to increase our position in German exchange operator and trade services provider Deutsche Börse (OTCPK:DBOEY). Lower cash and derivative trading activity as well as the high multiple acquisition of Simcorp (OTCPK:SICRF), a Danish maker of investment management software, have weighed on the stock. The market wants to see the synergies coming through, which we believe will occur in 2024.

Outlook

So far in 2023, our structural holdings have not moved meaningfully, which has hurt our ability to keep up when value leads. Some of our structural names, such as Olympus (OTCPK:OLYMY) and Daiichi Sankyo (OTCPK:DSKYF), are time-based, meaning the catalysts we bought them for have yet to materialize. Kering Group (OTCPK:PPRUF), a luxury goods company with a new designer who showed quite well at Milan’s Fashion Week, failed to move as the entire luxury space was in sell down mode. We also believe our strategic preference to gain consumer discretionary exposure through luxury goods rather than the top performing auto industry will lead to better long-term returns as the luxury retailers we own have better margins and cash and lower operating leverage than other stocks in the consumer discretionary space as well as a number of levers to pull in economic downturns.

The selloff in growth stocks is giving us a chance to evaluate quite a few new investment opportunities. Multiples in growth have come down meaningfully in areas like renewables, consumer staples, durables such as luxury goods and even materials. Many of the future opportunities are in our portfolio today and we have been increasing positions in areas that we think have been overdone to the downside.

The overall economic environment both in the U.S. and overseas is challenging but many of the excess costs of last year are coming down, save, at least for the moment, energy. Our focus remains on companies with dominant market positions that have strong cash generation, good balance sheets and attractive valuations, and we remain focused on these characteristics to eventually come to the forefront of investors mindsets. We have been invested in many names that have done quite well such as Inditex (OTCPK:IDEXY), Novo Nordisk (NVO), Linde (LIN), (SAP) and Safran (OTCPK:SAFRF). Rate decreases, a sign of economic weakness, will greatly benefit our consumer staples holdings which have not performed this quarter. We have seen these periods before and feel confident they will be good stocks even though they are testing investors’ patience.

Portfolio Highlights

During the third quarter, the ClearBridge International Growth ADR Strategy underperformed its MSCI EAFE Index benchmark. On an absolute basis, the Strategy saw losses across nine of the 10 sectors in which it was invested (out of 11 total) with the energy sector the lone contributor while the consumer discretionary, financials and IT sectors were the primary detractors.

On a relative basis, overall stock selection and sector allocation detracted from performance. In particular, stock selection in the financials and consumer discretionary sectors, underweights to energy and financials and an overweight to IT weighed on results. On the positive side, stock selection in the energy sector contributed to performance.

On a regional basis, stock selection in Europe Ex U.K., Japan and the U.K., and an underweight allocation to Japan, hurt performance while stock selection in North America proved beneficial.

On an individual stock basis, the largest contributors to absolute returns in the quarter included Novo Nordisk in the health care sector, Suncor Energy (SU) in the energy sector, Computershare (OTCPK:CMSQF) and RELX in the industrials sector and Barrick Gold (GOLD) in the materials sector. The greatest detractors from absolute returns included positions in OTCPK:LVMHF and Amadeus (OTCPK:AMADF) in the consumer discretionary sector, Adyen (OTCPK:ADYEY) and AIA Group (OTCPK:AAGIY) in the financials sector, and ASML in the IT sector.

In addition to the transactions mentioned above, we initiated a position in Sandvik (OTCPK:SDVKF) in the industrials sector and exited a position in Barrick Gold in the materials sector.

Elisa Mazen, Managing Director, Head of Global Growth, Portfolio Manager

Michael Testorf, CFA, Managing Director, Portfolio Manager

Pawel Wroblewski, CFA, Managing Director, Portfolio Manager

|

Past performance is no guarantee of future results. Copyright © 2023 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Morgan Stanley Capital International. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance is preliminary and subject to change. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent. Further distribution is prohibited. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here