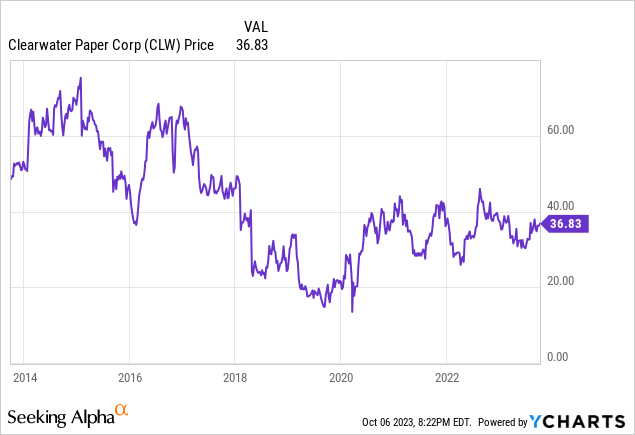

Clearwater Paper Corporation (NYSE:CLW) has been an average to below average business over the past decade and its stock has reflected this. This is not surprising given the fact that paper product companies are generally capital intensive, and operate in a very cyclical, fragmented and competitive industry. Only the very well-run companies in the industry can sustainably generate above average returns on invested capital and compound earnings over time.

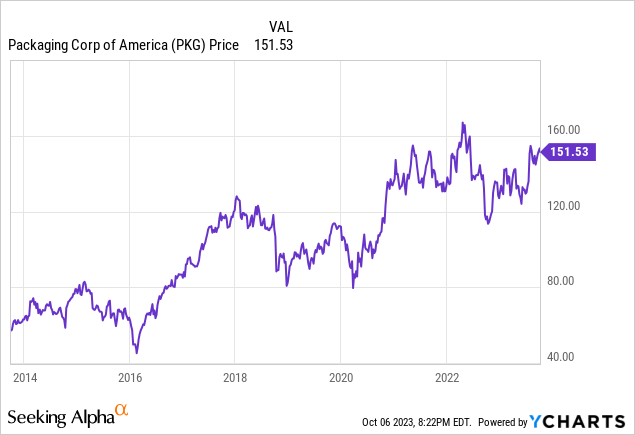

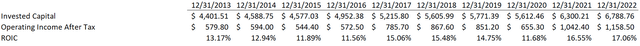

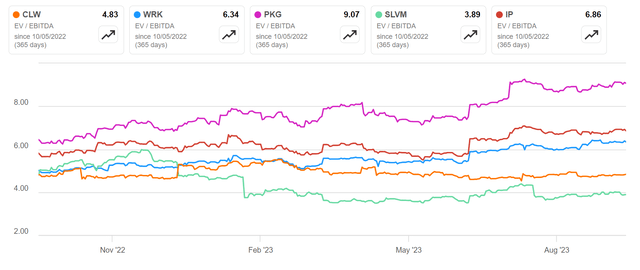

This has been the case with Packaging Corporation of American (PKG). Packaging Corp has generated 14% returns on invested capital over the past decade and its stock is up nicely over that time due to its higher cash flows and because the market recognizes its higher quality and assigns it a higher multiple.

Packaging Corp does operate an uncoated freesheet paper segment which Clearwater does not, but both companies operate a paperboard segment. Despite this similarity, the difference in ROIC has to do with the fact that Packaging Corp operates more efficiently and invests capital more intelligently. These products are also commoditized so there is minimal product differentiation when compared to Clearwater, so it is a lower cost operator simply because of better business execution.

Packaging Corporation of America ROIC (Created by Author)

Clearwater’s low returns on invested capital do not mean it is always a bad investment, it just means that investment timing is much more important. Investors must consider supply/demand dynamics of the industry to a much greater degree, as this will largely determine earnings. Additionally, a long-term holding period won’t bail out investors that incorrectly time their purchase of the stock.

Currently the industry’s supply/demand dynamics are creating a favorable situation for Clearwater. In its consumer products segment which includes production of private label tissue products, demand is high as consumers trade down from name brands that have pushed price increases just about as far as they could have. At the same time, in the paper and paperboard segment, demand is rising again as consumer product good companies have reduced packaging inventory and are ordering them again. Both of these dynamics will lead to higher sales and higher margins in 2024. Due to the improved results, I can see the stock trading much higher in 2024 as earnings rise and the multiple at which it trades rises.

I am initiating coverage with a buy rating and a $50 price target based on both my estimate of Clearwater’s intrinsic value and based on an 6x multiple of my estimate of 2024 EBITDA. The main risks of this thesis stem from the cyclicality of the industry, the low quality nature of the business, and the packaging industry’s high sensitivity to changes in GDP.

Business Overview

Clearwater operates two segments: pulp and paperboard, and consumer products.

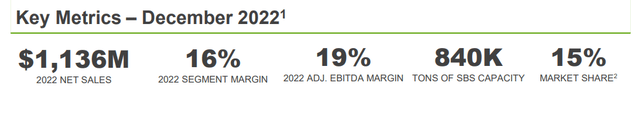

The pulp and paperboard segment primarily involves the manufacture of bleached paperboard for high-end packaging and Clearwater is one of the 5 largest producers of bleached paperboard in North America. Bleached paperboard is used for folding carton packaging that packages pharmaceutical, cosmetic, food and beverage products, for hot and cold cups, plates and food containers, for liquid packaging (e.g. juice, soup, milk and wine), and for heavy weight paper grade (e.g. blister board, signage, promotional literature).

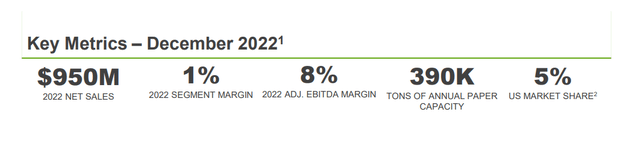

Clearwater Packaging Segment Summary (September 2023 Investor Presentation)

This segment has experienced deteriorating fundamentals over the past 12 months as demand for consumer product goods has declined relative to demand for services which has led to lower demand for packaging for these products. Companies that produce goods stocked up on packaging inventory assuming that demand for their products would be the same in 2023 as it was in 2022 and were left overstocked when this did not occur. However all signs are indicating that packaging inventories for these companies are almost normalized and that demand is starting to come back. This should lead to a rebound in earnings for this segment over the next 12-18 months.

The consumer products segment produces and sells both premium and value at-home tissue products such as bath tissue, facial products and napkin products. Clearwater accounted for 5% of the at-home tissue product market in U.S.

Clearwater Consumer Product Segment Summary (Clearwater September 2023 Investor Presentation)

In the most recent quarter, Clearwater mentioned on its earnings call that private label tissue market share reached an all-time high of 36.3%. This rise makes sense with the context of name brand companies raising price to extreme levels to offset declines in volume and a more cost conscious consumer as recession fears are high. This is great for Clearwater as EBITDA growth in this segment has offset declines in the pulp and paperboard segment.

Past Financial Results

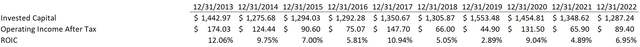

As I mentioned above, Clearwater has historically been an average to below average business with low and volatile returns on invested capital.

Clearwater’s Past ROIC (Created by Author)

ROIC is low due to the high capital intensity of the business and the intense industry competition. Clearwater’s stock commands such a low multiple because of these consistently low returns on invested capital and because of the company’s low growth. In fact many industry peers trade at similar multiples for the same reasons. With so little product differentiation, returns on invested capital come down to efficiency of operations.

Packaging/Paper Company Multiples (Seeking Alpha Charting)

Notably, manufacturing of tissue products and paperboard involves plenty of factory space, heavy machinery, moving parts and maintenance capital expenditures.

Screenshot from Tissue Product Factory Video (Tissue Products Mill)

Clearwater’s revenue was flat in the decade prior to the pandemic and margins rose and fell with the industry’s supply dynamics. Unlike most companies in this industry, Clearwater has not made many acquisitions over the past decade. The only one was its acquisition of Manchester Industries of Richmond in 2016 for $68 million. Even with this acquisition, sales did not grow in 2016 or 2017.

Prior to the pandemic, capital expenditures as a percentage of revenue were lumpy, high, and much larger than depreciation. Higher revenue, more cautious capex planning and more factory downtime caused capex to come in lower than depreciation during the pandemic years. These factors, along with the low and lumpy margins have caused Clearwater to generate low returns on invested capital and low returns on acquisitions.

Price Target and Risks

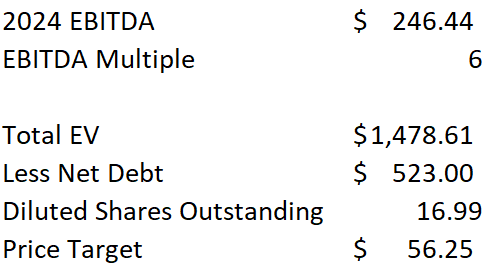

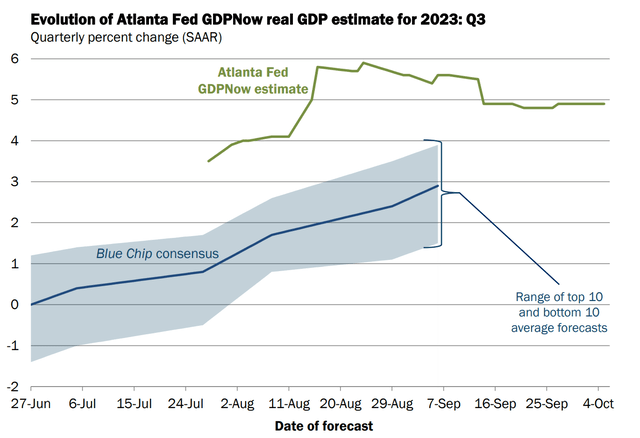

My buy rating is mainly due to the acceleration of the positive trends in the tissue products and packaging products industries that are occurring at the same time. With help from these trends, I estimate that 2024 EBITDA will be $246 million. With a 6x multiple, $523 million of net debt, and 16.99 million fully diluted shares outstanding, I estimate that Clearwater’s could trade for $56.

Clearwater Price Target (Created by Author)

To get $246 million of EBITDA in 2024, I am assuming 1% revenue growth in 2023 followed by 2% growth in 2024, a 7% EBIT margin in 2024, and D&A equal to 4.5% of revenue in 2024.

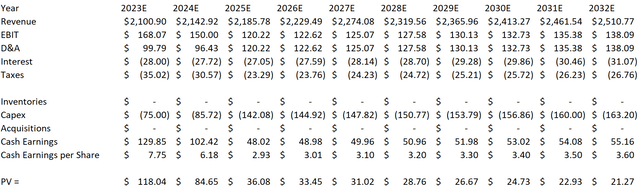

The primary risks I see are from the cyclicality and low quality nature of the business. However when I model out Clearwater’s future cash flows, I bake in changes in margins to account for the packaging industry’s business cycles. With these fluctuations, I estimate that the intrinsic value of the business is equal to about $44. Taking the midpoint of these estimates, I am assigning Clearwater with a $50 price target.

Clearwater DCF (Created by Author) DCF Continued (Created by Author)

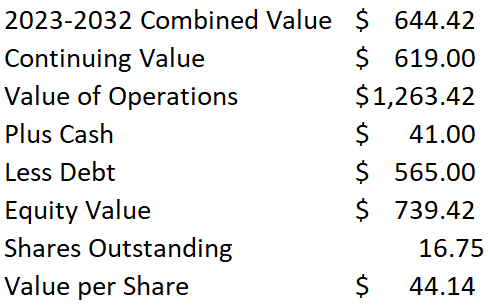

Economic weakness is of course a large risk given how sensitive packaging products are to GDP. With rising rates, the recession narrative is front in center in most investors’ minds but recent data has indicated that the economy is still quite strong. In September, non-farm payrolls rose by 336 thousand, handily surpassing the 160 thousand additions that were expected.

The Atlanta Fed’s most recent GDPNow Q3 real GDP growth estimate also remained high at 4.9%. This is only an estimate, but it takes into account much of the recent economic data that has been released. With this economic strength, demand for consumer products should be strong which, along with the favorable industry supply dynamics will lead to higher margins and higher earnings for Clearwater.

Atlanta Fed GDPNow Real GDP Growth Estimate (Atlanta Fed)

Additionally, the paper and packaging industry is very fragmented so the larger companies roll-up smaller paper companies to help with growth. This could provide a bit of a floor on Clearwater’s stock as most acquisition EBITDA multiples range in the 6-9x range. If the stock falls due to deteriorating economic conditions, a larger and better capitalized company may use it as an opportunity to attempt to acquire Clearwater. If EBITDA drops to $160 million, as it has at the low point of past industry cycles, a 6x multiple would put the stock at $32.

I wouldn’t bet on an acquisition like this happening but it is another way to think of the value of the business.

Final Thoughts

Clearwater is not a great business, but it is entering a period where the supply/demand environment for both tissue products and packaging products are optimal. In the tissue products segment, consumers are trading down to private label products which Clearwater manufactures and this is creating higher demand for its products. In the packaging segment, consumer goods companies have reduced inventory of packaging that they built up to meet what they thought would be another high demand environment in 2023. Both of these factors are positives for Clearwater.

As earnings inflect upwards over the next 12-18 months, I think that investors will bid the stock up to a higher multiple. I estimate that Clearwater will generate $246 million in EBITDA in 2024 and with a 6x multiple, I estimate the stock will trade for $56.

Additionally, I estimate Clearwater is worth $44 per share based on its future cash flows. Taking the middle point of these price targets I am assigning the stock a buy rating with a price target of $50. Given the fact that the packaging and tissue business has historically been a poor business, I would not plan on holding Clearwater’s stock for a long time. If it approaches my $50 target I would examine the supply side thesis to see if it is holding up and consider trimming or selling the position.

Read the full article here