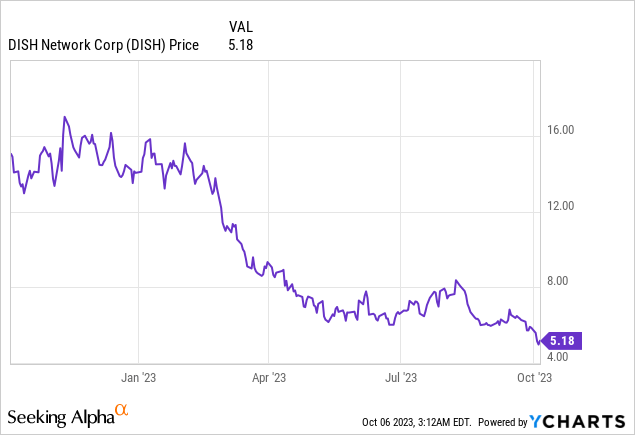

DISH Network’s (NASDAQ:DISH) stock remains on a downtrend as per the chart below despite meeting certain compliance requirements with respect to its nationwide 5G implementation commitments at the beginning of October. The stock now trades slightly above the $5 level making it an appropriate entry point for those willing to position themselves.

Now, one of the reasons for the lack of enthusiasm is investors focusing on the balance sheet, especially given the need to fund the deployment of the highly capital-intensive wireless business while revenues from DISH TV continue to fall. Amid this rather pessimistic backdrop, the aim of this thesis is to show that the merger with EchoStar (SATS) which was announced in the first week of August and should be finalized in the current quarter constitutes a big positive. In this case, existing DISH shareholders will own approximately 69% of the combined entity.

Merger Positioning DISH as an End-to-End Provider

Interestingly, 15 years back DISH spun off EchoStar which means that it is doing the opposite today. Well, one of the factors that prompted this decision is the disruption in the satellite industry whereby commonly available mobile phones, in contrast to bulky specialized phones can now communicate directly to satellites. One example is the iPhone 14 which uses Globalstar’s (GSAT) constellation of satellites to send SOS messages in case one is stranded in a forest. Apple’s (AAPL) move was followed by T-Mobile (TMUS) partnering with Elon Musk’s Starlink (STRLK) to use satellite connectivity to extend the mobile network operator’s (MNO) coverage to places where it has no radio equipment.

Therefore, by merging with EchoStar which has a constellation of communications satellites orbiting around the earth and is also an internet services provider, DISH looks to be positioning itself as an end-to-end player with its own 5G mobile wireless network, which implies bundling products to leverage better their combined customer base approximating around 18 million as per a SEC filing detailing the merger. This also differentiates the MNO in the highly competitive 5G marketplace.

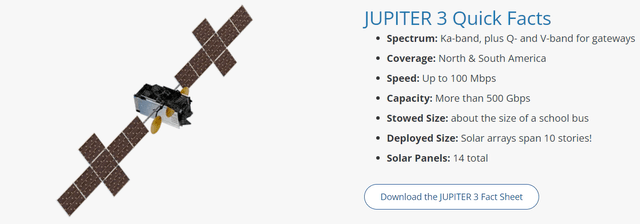

JUPITER3 (www.hughes.com)

Now, many of these customers are located in rural and hard-to-reach areas, which are deprived of cable or fiber connectivity, and given the unfavorable economics of expanding mobile cellular to these areas which are also relatively less populated (compared to cities), people and businesses there have to manage with 3G or 4G connectivity. Talking figures, there were about 8.3 million such premises without access to broadband (high-speed internet) as of May 2023, which means that there is scope for the combined entity to position itself in the $8.2 billion (2022 figures) global satellite internet market which is expected to grow at a CAGR of 13.6% from 2023 to 2030. For this purpose, HughesNet, EchoStar’s subsidiary already offers a low latency satellite internet offering which is already available in certain hard-to-reach areas of the U.S, with fast download speeds of 100 Mbps to follow through the Jupiter 3 satellite put into orbit in July this year in North and South America.

Moreover, satellite-based internet could help DISH achieve better coverage while spending less capital.

Using Relatively Less Capex Than Expected

Being cash-constrained in an area where relatively high levels of expenses are required, the MNO has issued several debt offerings with $1 billion due in March 2024. Now, even after its network rollout has met its commitment to the FCC to meet 70% coverage of the US with 5G wireless last month, it still has to meet the next deadline which has been set for 2025. This will require only an additional 5% coverage but is likely to cost much more in terms of the radio tower and associated backhaul infrastructure as it will entail covering rural parts of the country. As per estimates by analysts at Citigroup, this could cost $8.5 billion to $9 billion by 2025, which is an enormous figure considering that the company only had $1.78 billion of cash as of the end of June, weighed down by $20.1 billion of debt.

However, a corporate update puts capex requirement at around $2 billion for 2024 and 2025, which also includes EchoStar.

To explain this big difference between Citi’s estimate and what is actually being forecasted, Charlie Ergen, the Executive Chairman of both companies explained that the 600 MHz frequency spectrum already owned by DISH can be used in most (75%) of the smaller markets still to be covered, meaning that no related purchases have to be made. Another reason is Jupiter 3’s being less capital-intensive than previous generation satellites.

He also added that there is flexibility in achieving the 5% figure by temporarily sharing the physical networks with AT&T and T-Mobile as part of the existing MVNO agreements, especially in remote areas where there are not enough customers to justify the economics of deploying additional radio equipment.

Now, only time will tell whether this way of proceeding is acceptable to the FCC, but, the merger provides DISH with yet another option: extending coverage to less populated through a combination of satellite and terrestrial wireless communications.

Valuing the Disruptor

Now, integration of satellite-based and terrestrial communications is not easy as service providers tend to have proprietary networks. However, one factor that should make things easier is DISH having chosen to use open technologies including Open RAN (O-RAN) for its greenfield 5G deployment and Amazon’s AWS cloud for hosting the associated IT workloads, instead of being hooked up to proprietary equipment providers like Ericsson (ERIC) or Nokia (NOK) for the whole solution, as I had detailed in a previous thesis in September 2020.

At that time, I also elaborated on how this way of proceeding allows a capex reduction of up to 40% based on lessons learned from Japan’s Rakuten (OTCPK:RKUNY). This could mean that the initial amount of $10 billion initially forecasted by DISH could be on the high side as O-RAN is proving to be less expensive to build and operate as confirmed by Ergen. I had further highlighted this capital-light strategy when covering the stock again on May 30 this year this time for the commercialization of 5G, which was outsourced to Amazon’s online shopping portal which again spares the MNO the need to set up a sales and marketing department.

Therefore, faced with three giants constituted by AT&T (T), Verizon (VZ), and T-Mobile with relatively healthier balance sheets, DISH seemed to have all the odds stacked against it since day one. In these circumstances, had it proceeded by the book (or in the conventional telco way), there is little chance it would have achieved the 70% mark, especially given that revenues are regressing since its Pay-TV subscribers are migrating away to streaming services provided by both cable and fiber operators.

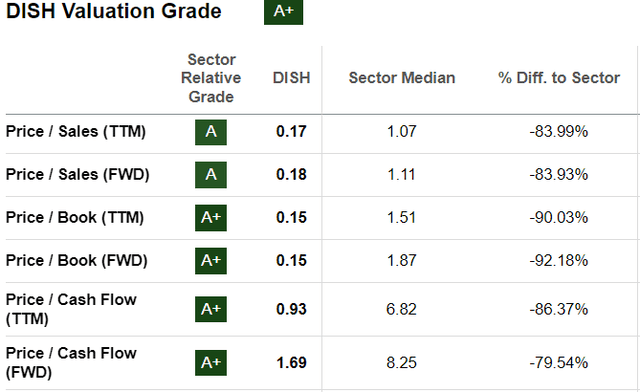

DISH’s way of proceeding has been nothing short of disruptive, but it has not convinced investors used to the more rigorously planned deployments in the telecom sector, done “years in advance”, in partnership with an “end-to-end supplier” with the budget for each phase available beforehand. This is one of the reasons that the stock has been dumped and it is now trading at a price-to-cash flow of 1.62x which is 80% below the median for the communications services sector. With such low valuations, it may be time to be positioned on the stock given Ergen’s ability to turn things around.

Valuation Grades (www.seekingalpha.com)

Thus, adjusting for a 20% upside, I have a target of $6.12 (5.18 x 1.2) based on the current share price of $5.18. This Buy position represents an upgrade on my earlier Hold in May. At that time, I advised investors to wait for FCC 70% compliance which has now been achieved.

Furthermore, investors will note that I have been moderate in my forecast because of the volatility risks associated with the 800 MHz spectrum DISH has to acquire for around $3.59 billion from T-Mobile for which an extension has been granted until April 1 by the DOJ. Now, such a purchase at prevalent interest rates weighs considerably on the balance sheet and would also cost approximately $180 million annually more than in 2020 when the initial deal was finalized by the FCC as part of T-Mobile’s acquisition of Sprint. At that time, DISH was designated as the nation’s fourth major wireless operator.

DISH is a Buy amid the Volatility

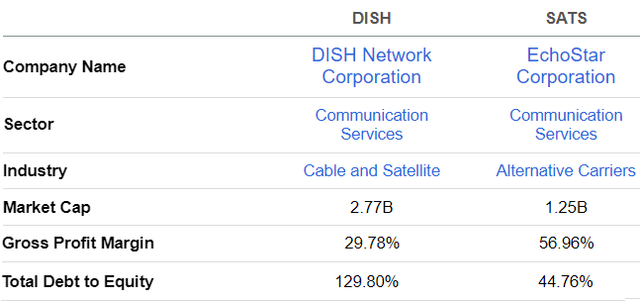

Thinking aloud, this extension also gives Charlie Ergen more time to come up with a solution, possibly through another merger to raise capital for acquiring the 800 MHz spectrum as it is valuable and in high demand. In this respect, the deal with EchoStar, in addition to being beneficial to DISH’s balance sheet with its better cash and debt metrics can also be viewed as an indirect equity sale. The reason is that firstly, DISH does not spend cash, and second, the satellite company’s shareholders will receive 2.85 shares of its stock for each share of EchoStar stock. As a result, the satellite operator’s shareholders will own approximately 31% of the combined company, which is roughly equivalent to the weight of its market cap (1.25/(2.77+1.25)) as pictured below.

Comparison of key metrics of DISH andSATS (seekingalpha.com)

In conclusion, the merger with EchoStar is positive, as in addition to everything I have talked about above, $275 million and $80 million of revenue and EBITDA synergies respectively are targeted by 2027. In all, approximately $150 million of EBITDA synergies are expected which should ultimately improve free cash flow.

Still, for a highly indebted company as per the above debt/equity ratio, do expect continued volatility in the share price as the latest non-form payrolls show a big acceleration in job growth for the month of August which implies that the chances of a rate hike have not only increased but the “higher for longer” rhetoric is also likely to perdure. However, the potential improvement in the combined debt position after the EchoStar merger should facilitate access to capital markets plus enable more favorable borrowing terms.

Read the full article here