A higher cost of living and growing savings shortfall has many Americans worried about their retirement security.

Those financial strains also make it harder for many workers to fund a retirement account.

To that point, 41% don’t contribute any money at all to a 401(k) or employer-sponsored plan, according to a CNBC Your Money Survey conducted in August.

Even the majority of those that do contribute say they are not on track with their yearly 401(k) savings to retire comfortably.

Despite the many advantages of a workplace plan, most savers are missing out, experts say. Here are three common mistakes workers often make when it comes to their 401(k) plans.

1. Missing out on the employer match

“It’s a fairly small subset of workers that are fully maximizing their employer-sponsored plans that allows them to build a bigger next egg,” said Joe Buhrmann, senior financial planning consultant at eMoney Advisor.

At the very least, workers should contribute enough to their workplace retirement plan to reap the benefits of the company match, if available.

Most 401(k) plans, 98%, make contributions to workers’ retirement savings, according to the Plan Sponsor Council of America.

Yet, roughly 22% of plan participants are not getting the full match, according to data from Fidelity, the nation’s largest 401(k) plan provider.

More from Personal Finance:

More employers offer a Roth 401(k)

More part-time workers to get employer retirement plans

These behavioral traits lead to greater retirement savings

“There are a lot of workers out there that aren’t even aware of what their company’s match is,” said Mike Shamrell, Fidelity’s vice president of thought leadership.

In fact, the average company match in a 401(k) plan was 4.7% of a worker’s salary in the third quarter of 2023, according to Fidelity, but can typically range between 3% and 6%.

To that end, couples with two employer savings plans could benefit from prioritizing the more generous employer’s 401(k) matching funds.

However, everyone should aim to contribute enough to get the full match, Shamrell added. Depending on your salary and the matching formula used, that could translate into thousands of extra dollars going toward your nest egg every year. “That’s the closest any of us are going to get to free money,” he said.

To get there, Shamrell advises savers to auto escalate contributions, which will steadily increase the amount you save each year.

The IRS recently raised the contribution limits to retirement accounts for 2024, increasing the thresholds to $23,000 for 401(k) plans and $7,000 for IRAs.

2. Tapping funds when times are tough

Taking money out of a retirement account will forfeit the power of compound interest. Still, more retirement savers are withdrawing money from their 401(k) plans to stay afloat amid a prolonged period of high inflation, recent reports show.

In times of financial stress, most financial experts advise against raiding a 401(k).

However, if participants do need to access their 401(k) savings through a loan or withdrawal, workers often don’t know which move makes the most financial sense, Shamrell said.

“A lot of times those two get lumped together,” he said.

With a 401(k) loan, workers can borrow up to 50% of their account balance, or $50,000, whichever is less, without penalty as long as the money is repaid within five years. There may be other conditions as well, and if you’re laid off or find a new job, most employers will require your outstanding balance be repaid in a shorter time frame.

Otherwise, workers can take a withdrawal, but those under age 59½ generally would owe a 10% tax penalty.

In more extreme circumstances, savers may take a hardship distribution without incurring the 10% early withdrawal fee if there is evidence the money is being used to cover a qualified hardship, such as medical expenses, loss due to natural disasters or to buy a primary residence or prevent eviction or foreclosure.

In some cases, a 401(k) loan may be preferable to other alternatives, said Fidelity’s Shamrell.

“There are times where the loans may be a more valid direction, as opposed to putting that on your credit card,” he said.

In other situations, especially for cash-strapped consumers living paycheck to paycheck, it may even make more sense to cover the cost of an emergency all at once with a hardship withdrawal, he added, rather than tap a loan for which repayment then gets deducted from your take-home pay.

Going forward, there is another option set to take effect in 2024 that will let savers make one withdrawal of up to $1,000 a year for personal or family emergency expenses. This measure is intended to provide a lifeline for those in immediate need.

3. Taking a short-term view

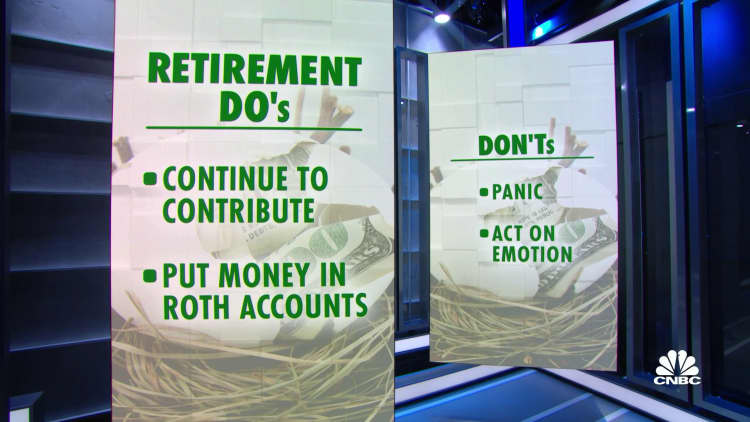

Ultimately, the key to investing for the long haul is “making sure you have an appropriate asset allocation and contribute in good markets and bad markets,” Buhrmann said.

After some extreme market volatility, 401(k) account balances lost nearly one-quarter of their value in 2022. However, the average balance is now $107,700, up 11% from a year ago, according to Fidelity, underscoring the importance of staying the course.

Workers who have been in their plan for 15 years straight have a much higher average balance of $448,800, up from just $56,300 in 2008, Fidelity found.

Although each household has their own unique set of circumstances, some age-based guidelines can help savers stay on track during periods of uncertainty, Shamrell said.

“You should not be making changes to your 401(k) based on short-term market moves,” he cautioned. “You want to make sure you are not losing out on possible growth opportunities or, alternatively, exposing yourself to unnecessary risk.”

Subscribe to CNBC on YouTube.

Don’t miss these stories from CNBC PRO:

Read the full article here