Big Can Be Better

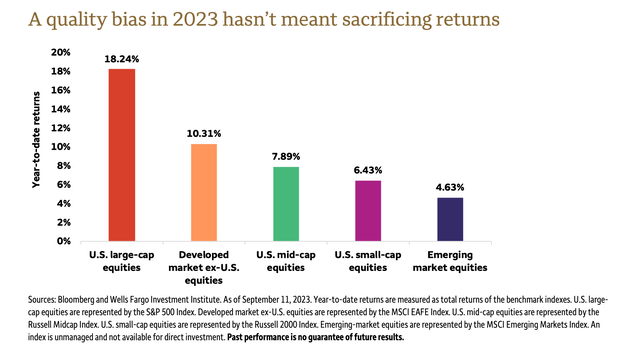

A portfolio reflects how an investor copes with temptation. Financial outlets and money managers are tempting investors by touting the stocks of small-cap ($2B and under) companies. We suggest in these dicey and uncertain economic and political times that retail value investors will potentially do better acting conservatively by investing in larger-cap stocks for the remainder of the year.

Look to large cap (+$10B) companies because big is doing better this year. Dover Corporation (NYSE:DOV) is another of our favorite primary industries, the industrial sector. Dover Corporation sports a $19.27B market cap. Dover is a compelling stock worthy of a moderate Buy rating, in our opinion, with the potential to move up ~15% in the next 12 months.

Upsides by Market Caps (Bloomberg & Wells Fargo)

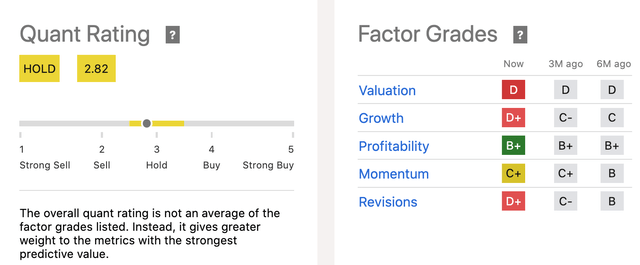

SA’s Quant Rating has been a Hold for most of 2023 but leans to the Buy-Side. We surmise Dover’s Quant Rating is attributable to the low dividend yield of 1.48% and the stock’s poor Factor Grades for valuation and growth potential. The company is consistently profitable, has an enticing low PE of 15.49, short interest at a low 1.43%, and fetes an A+ for dividend safety, consistency, and growth.

Quant Rating & Factor Grades (Seeking Alpha)

Profile

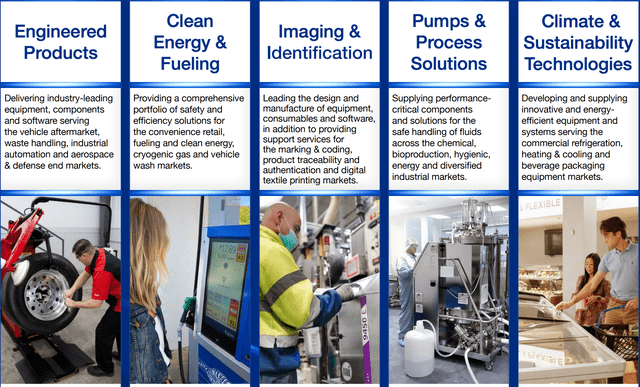

Dover is a global manufacturer of equipment and components, consumable supplies, aftermarket parts, software and digital solutions, and support services. It generates $8B in annual revenue. Key to operations and business strategy is the company’s dedication to digital tech. It has a digital hub in Boston undergirding and enhancing all segments. The company’s commitment to digitization makes it a leader in commercializing efficiencies using machine learning tools, AI, and digital commerce capabilities.

It operates through 5 segments:

5 Dover Corp Segments (Dover Corp Website)

M&A Spirits Growth

Dover has grown by employing search and acquire as an important factor in its business plan since its founding in 1955 in Illinois. Dover Corp closed dozens of acquisitions across all 5 segments of its operations at a cost of nearly $1.5B for the last 41, not including the one announced in October ’23. Dover is in the process of acquiring another business earning $120M annually for allegedly +$500M. A press release on October 4 ’23 claims:

This acquisition is projected to add new offerings… introduce digital and recurring revenue streams, help (Dover) to become a leader in compression technologies for clean energy, and enable (Dover) to benefit from the rising popularity of next-gen remote monitoring, predictive maintenance, and real-time performance optimization solutions.

For an analysis of the impact of past M&As, read the January 4, ’23 S A article by Badsha Chowdhury, “Dover Corporation: Acquisitions, Relatively Undervalued Multiples Keep You Hooked.”

Risks

20 Wall Street analysts are split on the stock. 10 tag it worth a Hold and 10 rate it Buy to Strong Buy. A factor for the split decision and S A Hold Quant Rating may be the pessimism pervading the U.S. economy and the Machinery Industry.

High volatility over the long term is a risk to retail investors. Dover’s Beta rating stands at 1.31 to 1.34. The share price was as low as $81 in 2020 and touched $180 in ’22. Dover shares dipped from a high of $160 in February ’23 to $133 in June; the price clawed up to nearly $138 in early October. The next earnings announcement is October 19, ’23 when analysts forecast a Q3 EPS of $2.33 compared to $2.26 for Q3 ’22.

On a positive note, Dover’s earnings beat the forecasts of analysts in 8 of the last 9 EPS quarterly announcements. The PE ratio for the U.S. Machinery Industry was on average 34.3x in June 2021. It is almost half that ratio today (+19x). Dover’s PE is 15.49, in our opinion, weighted down by the pessimism pervading the macroeconomy and machine industry.

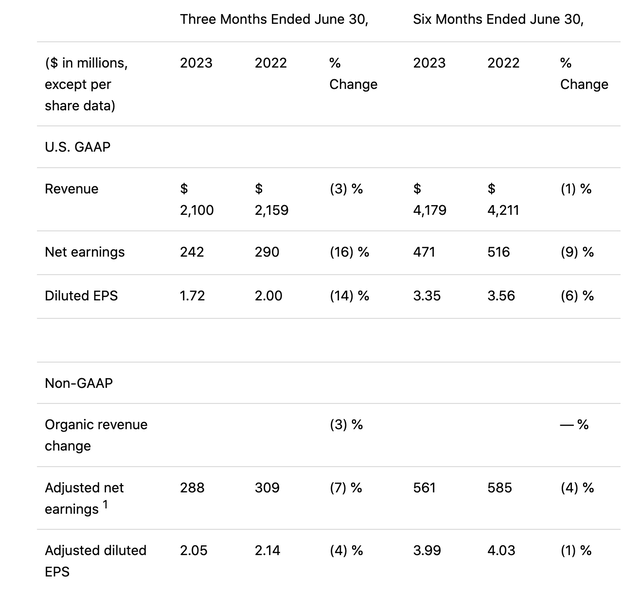

Dover Reports Second Quarter 2023 Results to a lukewarm reception. Numbers missed estimates. Management blames the showing on “post-pandemic destocking across the industrial economy…” and other common complaints including supply chain issues and systems upgrade disruptions.

3 & 6 Months Earnings (NASDAQ.com)

We anticipate Q3 ’23 EPS will be reported +9% better than Q2 ’22. FY ’23, ’24, and ’25 earnings. NASDAQ.com has a forecast better than the FY ’22 EPS, perhaps $8.89 to $8.96 EPS. Revenue at the end of 2022 was $8.5B and TTM was $8.4B. Cash flow from operations tumbled in 2022 to $805M from 2021’s $1.11B but will well top them in 2023; cash flow from operations TTM is $1.03B.

Revenue & Earnings Past & Future (Seeking Alpha)

Debt & Ownership Risks

There is some risk to investors from Dover’s $3.42B debt incurred before the recent M&A announcement. It last reported only $285.78M in cash on hand, though assets exceed its liabilities. Further interest rate increases or an economic slowdown can kill any opportunity for a higher dividend payout ratio that is now an anemic 24%. The debt-to-equity ratio currently tops a high 73%, but that is down from 114%. The net ratio drops to 67% but it is still high. Operating cash flow covers the debt and EBIT covers the interest payments.

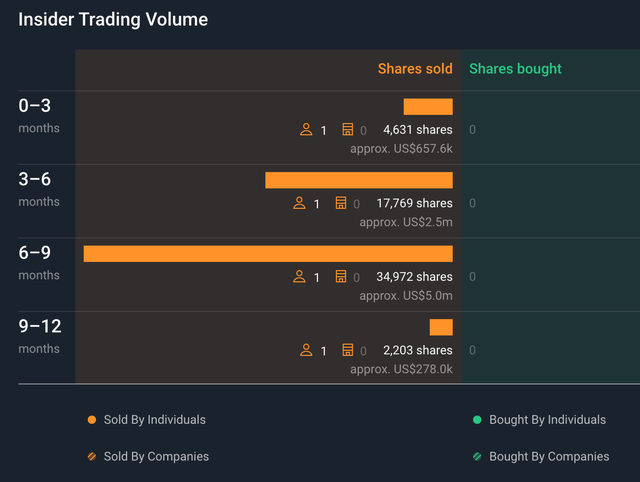

Corporate insiders sold more shares this past year than they purchased. It is not a pretty picture, nor does it bode well for stimulating a Buy assessment for retail value investors. Insiders sold nearly $658K worth of shares in the last 3 months. After 2020, hedge funds also sold off their shares. 41 owned the stock in Q3 ’20 while an average of 31 owned stock in Dover Corp over the last 11 quarters. On a positive note, 36 funds owned shares at the end of Q2 ’23.

Insider Trading (SimplyWallStreet.com)

Valuation and Growth

Valuation and growth deserve brief special attention because of their influence on the S A Quant Rating. Regarding valuation, the PE Non-GAAP Fwd and PE GAAP Fwd get Factors Grades approaching a B grade. All other metrics get Cs and Ds including Enterprise Value to Sales, Price to Sales, and Price to Book. Likewise with growth metrics.

Revenue growth is forecast at 3.15% but we suspect it will be +4% Y/Y. S A grades Free Cash Flow Growth and Operating Cash Flow Growth at C+ and C, respectively. We predict better earnings and revenue growth over the next 12 months driving the share price to an average target of $160 per share or higher.

Takeaway

Our overall take on Dover Corporation is positive. We believe the share price dip is a potential opportunity for retail value investors. The share price stagnated YTD at +2%, whereas it is up ~11% over the last 12 months and 56.44% higher over 5 years ago. Debt is high but manageable. On October 4, 2023, Dover Corporation announced another notch to its M&A business plan agreeing to purchase FW Murphy Production Controls for $530M in cash. Considering the limited cash on hand, this move will add to the corporate debt.

Growth will be modest in the near term but we and other analysts forecast excellent long-term growth and earnings. One expects the shares to hit $200 each which we consider a bit farfetched. Among the various sectors driving the U.S. industrial industry, “investors are most optimistic about the Industrial Machinery industry.”

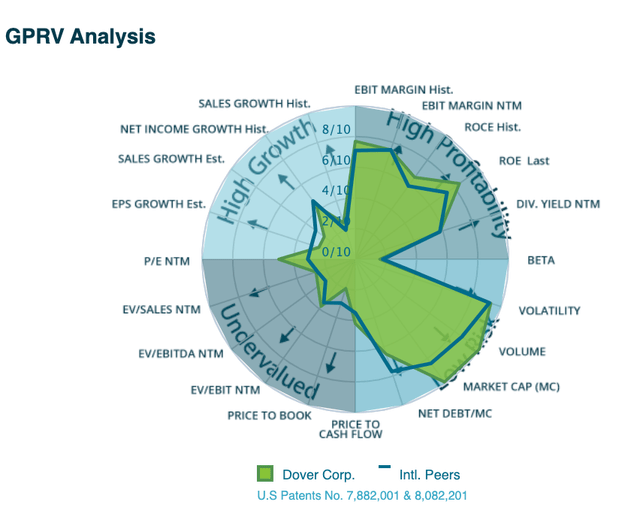

Dover Corp Analysis (Infrontanalytics.com)

In our opinion, the financial picture of Dover is to expect better profits at low risk though growth will be moderate. Retail value investors accumulating shares ought to do so in moderation nibbling a little at a time until markets, political strife, and the economy settle.

Read the full article here