Top view of laptop with text Elasticsearch, which is Elastic’s flagship data product.

Elastic N.V. (NYSE:ESTC), often underestimated within the AI sector, boasts a stellar product. Nevertheless, following a 50% surge in price since the last earnings report, coupled with less optimistic signals from other software peers and heightened competition, the stock is facing considerable pressure before the upcoming earnings. While its valuation may seem appealing to investors who solely consider multiples in comparison to peers, the company’s significantly lower growth rates and intensified competitive landscape suggest it is prudent to hold off for now.

Quick recap: ESTC has surged since my last review

At the end of November 2023, I recommended ESTC as a Buy for the following reasons:

- ESTC had been demonstrating solid double-digit revenue growth and promising EBITDA expansion.

- The company’s unique data management tools are pivotal for AI applications.

- The stock’s relatively steep valuation was justified by solid execution and encouraging growth prospects.

Seeking Alpha

That article happened to be published just before the release of the FQ2 2024 earnings report, in which the company significantly exceeded analysts’ expectations. It demonstrated another quarter of substantial revenue growth and a solid EPS beat, resulting in the stock surging more than 50% since then.

The report provided further evidence supporting the buy thesis. The company generated $311 million in revenue, marking a 17.6% increase year-over-year, with Non-GAAP EPS reaching $0.37, surpassing estimates by a hefty $0.13, or 52%. Management also confirmed an expected 17% revenue growth for the full fiscal 2024 (ending April 30, 2024), indicating sustained short-term demand for Elastic’s offerings.

In summary, revenue and profitability expansions remained on track in the quarter, with reiterated guidance reflecting continued solid demand.

Expectations and competition intensify

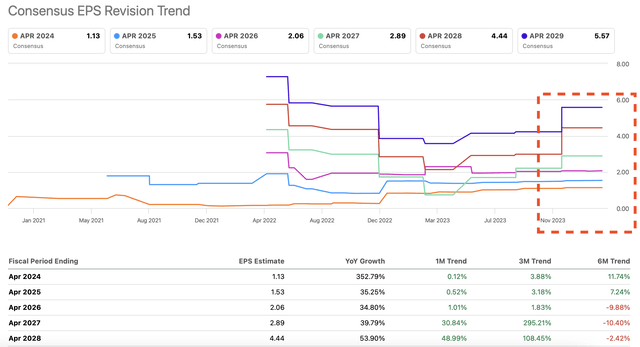

Now, with a 50% surge in the stock price in just 2.5 months, there is a lot at stake for ESTC. We expected solid demand and continuing revenue growth with a stock price of $79. However, now, with it at $125+, expectations are clearly higher. This can be seen from the significant upward revisions in consensus EPS after the latest report. The market now has a 30% higher expectation about EPS for FY2027 and almost 50% higher EPS for FY2028, compared to where the consensus was before FQ2.

Seeking Alpha

To meet these expectations, ESTC needs to increase its earnings by about 35% in each of the next two years, followed by further growth of 40% and 54% in FY2027 and FY2028, respectively. Simply put, these are very large shoes to fill.

In order to accomplish this goal, the company must focus on enhancing profitability. This can be attained through adjustments to pricing or the business model, or by implementing cost-cutting initiatives. However, the first two options carry risks, potentially resulting in reduced demand or slower mid-term growth, as illustrated by Palo Alto Networks (PANW) this week. Their stock experienced a decline of over 25% following a strategy shift to a “freemium”-like model, which, while beneficial for long-term adoption, adversely affected revenue projections.

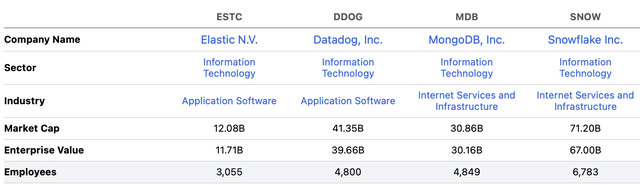

So, cost-cutting measures, such as layoffs, are potentially likely in the mid-term, especially considering the size of Elastic’s workforce. With a market cap of 25% of Datadog (DDOG) and 39% of MongoDB (MDB), ESTC employs approximately 64% of their workforce. However, layoffs remain tricky and expensive, especially considering the workforce is largely based in Europe, and they might impede the company’s ability to expand its products.

Seeking Alpha

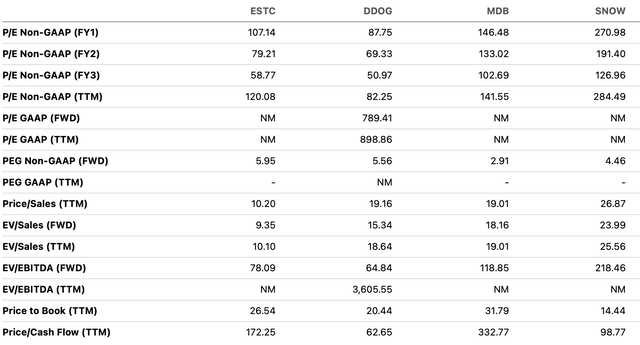

Moreover, looking at the current valuation multiples, the stock starts to appear rather expensive, especially when considering one- to two-year forward valuations. Currently, ESTC trades at a 1-year forward P/E (based on FY2025 ending April 2025) of around 80, which is in line with peers like Datadog and below some data warehousing/database software companies like MongoDB or Snowflake (SNOW).

While this might not seem high at first glance, we need to consider the pace of growth. DDOG, MDB, and SNOW have 3-year revenue CAGR of 52%, 43%, and 75%, respectively. They have also expanded their adjusted net income at a faster pace, resulting in ESTC now having the highest P/E ratio relative to growth (‘PEG’).

Seeking Alpha

Additionally, in my opinion, the other three companies generally have a broader target market with their solutions, which should make it easier for them to grow at a fast pace. This is not to mention that R&D budgets of DDOG, MDB, and SNOW are 3, 1.5, and 3.7 times higher than that of ESTC, based on TTM data.

Furthermore, competition for Elastic’s flagship offering, Elasticsearch, has intensified as MongoDB recently launched its own Atlas Vector Search product. While this is not likely to have an immediate effect on Elastic’s performance, as companies need to be on MongoDB’s platform to use Atlas Vector Search, it may still exert pressure on ESTC in the long term.

Overall, while there is no immediate danger to ESTC and I still believe in the company’s long-term potential, the recent surge in its stock price and changes in the market make it more challenging to recommend as a Buy, especially after the over 50% run ESTC has experienced since my previous article.

ESTC earnings preview: What to watch for

Elastic reports its results on February 29. The key things to watch:

- Top line performance, specifically revenue growth expected for the next quarter. While the AI hype is certainly real, evident by Nvidia’s (NVDA) impressive performance, not every company will benefit to the same extent. Therefore, 17% revenue growth might not be enough for ESTC to justify its valuation in the mid-term.

- EPS growth rates in FQ3 and projections for FQ4. Based on the discussion above, there is a lot hanging on ESTC’s ability to generate higher EPS. Currently, the market estimates an 87% EPS growth YoY in FQ3 and a 10% reduction in FQ4, or $0.2. If the management guides for higher EPS the next quarter, the stock might continue its bull run.

- General commentary about market conditions and competition. Datadog’s 21% revenue growth forecast for this year recently disappointed investors, sending the stock lower. Investors currently tend to have elevated expectations based on the AI hype fueled by Nvidia’s run. If Datadog’s commentary is indicative of the general data software market, Elastic might be affected as well.

- Consensus EPS revisions. Datadog has experienced a significant number of downward revisions for its EPS after the report (with 29 down revisions in the last 90 days), which could potentially occur for ESTC as well.

Key takeaways

Elastic has witnessed substantial growth driven by its strong FQ2 results and the prevailing AI hype, positioning it well for long-term success. However, the recent 50% surge in its stock price, coupled with subdued signals from industry peers like Datadog and intensified competition in the vector search space from the likes of MongoDB, increase pressure on the stock.

As ESTC prepares to report its FQ3 results, key areas to monitor include its revenue growth trajectory amidst its elevated valuation, EPS expansion rates, and management’s commentary on market conditions and competition. Understanding these factors will be important for evaluating ESTC’s future in a changing industry with heightened investor expectations.

Read the full article here