Energy storage, as those who follow my analyses know, is one of the sectors on which I am focusing most of my attention. Having already analyzed several companies involved in this field, today I want to extend my coverage to EOS Energy Enterprises (NASDAQ:EOSE). I believe that the company has a very useful and interesting technology, and at the same time, there are a number of particularly favorable conditions for a possible short-term rally of the stock.

I would like to clarify that the operation I am about to analyze is highly speculative, while my analyses usually have a multi-year investment horizon. The last time I suggested a pre-earnings operation was on KeyCorp in July, which indeed proved to be successful. Now, I think there is potential to replicate an asymmetric bet on EOS Energy, and consequently, I will start my coverage with a BUY rating. During the analysis, I will explain in detail the reasons for this bullish sentiment and why there are prerequisites for a stock rally after the publication of the next quarterly data, scheduled for November 7th.

The Business Model

EOS Energy deals with long-term energy storage, but does so in a different way compared to other companies in the sector. Instead of using classic lithium-ion batteries, EOS has developed – through 95 patents and 15 years of R&D – its own zinc-ion batteries. These promise several advantages to customers compared to lithium batteries:

- They can be used to supply energy to the grid for up to 12 hours, while most lithium-ion technology products can efficiently provide energy only for 4 hours.

- They are non-flammable, making them safer and usable on a large scale even in high-density urban environments.

- The materials to manufacture the batteries are cheaper. Not only is zinc used instead of lithium in the electrolyte, but the anode is made of plastic and the cathode of graphite felt.

- The batteries have a lifespan of 20 years and are expected to maintain 88% of their efficiency at the end of their life cycle.

- Dendrites do not form inside the battery, which can cause sudden failures and short circuits.

- The battery can be discharged 100% without compromising its performance or components.

- Recycling zinc is significantly less complex and costly compared to recycling lithium, making this technology more eco-friendly.

EOS Energy provides its energy storage systems in various formats: small plants that can be installed in urban environments, containers, or complete hangars for large-scale applications. Since August 2023, the company has started manufacturing its devices in-house at the EOS Ingenuity Park in Turtle Creek, Pennsylvania.

EOS Energy’s goal is clear: to prove that their technology is superior to traditional energy storage with lithium-ion batteries. If not universally, at least for those applications that require a discharge time longer than 4 hours.

A Look at the Financials

Below is a table with all the main financial data of EOS. As can be seen, these are typical numbers for a company that is still in its very early expansion phase.

| 2019 | 2020 | 2021 | 2022 | TTM | |

| Revenue | 0.5 | 0.2 | 4.6 | 17.9 | 17.8 |

| Gross profit | -6.9 | -5.3 | -41.9 | -135.3 | -101.2 |

| Operating income | -24.1 | -37.4 | -104.3 | -214.4 | -174 |

| EBITDA | -22 | -35.9 | -101.7 | -207.6 | -164.3 |

| Cash on hand | 0.9 | 121.9 | 104.8 | 17.1 | 23.2 |

| Cash from operations | -23.8 | -26.6 | -116.1 | -196.9 | -185.4 |

| Total debt | 76.6 | 1.4 | 113.5 | 181.2 | 237.7 |

The reason why the TTM revenue has not grown compared to the 2022 figures is very simple. During Q2 2023, the company converted all its production to its new EOS Z3 battery model. Compared to the previous flagship product, the EOS 2.3, the improvements are significant: the cycle time to build a battery has gone from 90 minutes to 4 minutes, with the goal of reaching 2 minutes by the end of the year; production leaves less than 1% of scrap materials, the product takes up less space, and is much simpler and cheaper to produce.

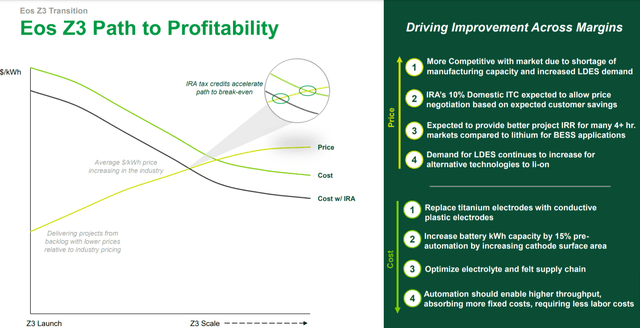

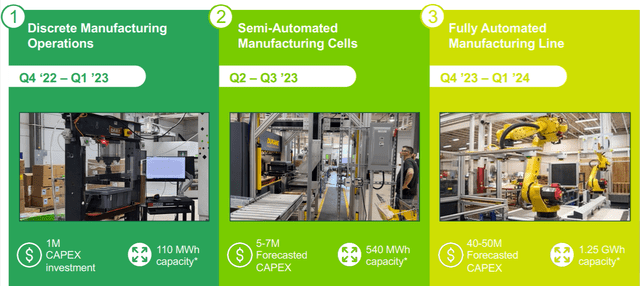

Now that the company has achieved its goal of moving to the third generation of zinc-ion batteries, it has started large-scale production and expects revenues of $80-85 million for FY 2023. Meanwhile, margins are improving significantly, thanks to the shift from a mainly manual manufacturing system to a semi-automated one. A partnership with ACRO Automation has also been introduced recently, for the creation of a high-output and highly automated production plant. In this way, the gross margin is expected to increase significantly. Lastly, EOS is moving to a supply chain that uses 100% US-sourced materials to take advantage of the tax credits provided by section 45X of the IRA. The management expects this to have a significant impact on the path to profitability.

EOS | Q2 2023 Earnings Presentation

It’s noteworthy that the company currently has a backlog exceeding $500 million and is undergoing its final significant phase of capital expenditure to automate its production facilities. By the end of 2023, EOS should have a fully automated manufacturing line capable of producing 1.25 GWh of capacity annually. For comparison, until the end of Q1 ’23, the annual production capacity was a mere 110 MWh.

EOS | Q1 2023 Earnings Presentation

Obviously, the fact that the company is burning through a substantial amount of liquidity and that the latest $300 million S-3 shelf registration is running out is a significant concern. Investors must necessarily expect further dilutions of ownership shares, especially considering the company’s high level of debt. That said, even if ownership shares were diluted by 50-100%, we are still talking about a company that potentially has technology capable of capturing a massive market share in the world of energy storage. The U.S. energy storage market was worth $60.3 billion at the end of 2022, and it is expected to reach $249.3 billion by 2032, growing at a CAGR of 15.4%. In my opinion, therefore, if the new Z3 truly establishes itself as the product to beat, we are discussing a company with an upside potential that far outweighs the short-term impact of share dilutions.

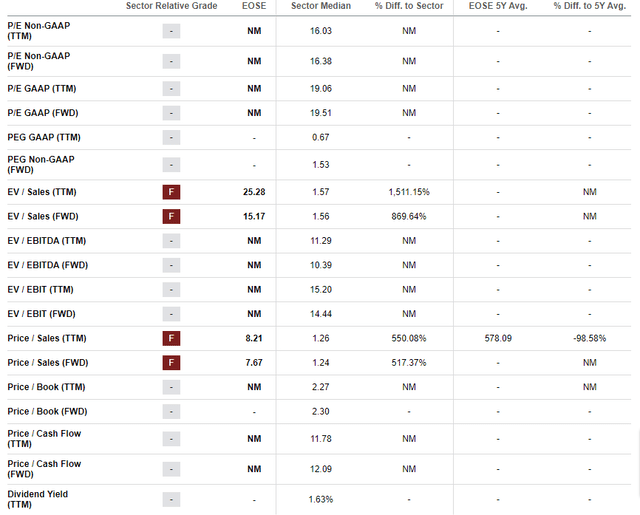

Valuation: What to Base It On?

Currently, it would be insignificant to consider valuation multiples for insights into EOS’s valuation, and even less useful to use a DCF or sum of the parts model. The only real point to focus on is the fact that the company has a large backlog: $533.6 million at the end of Q2 ’23, totaling 2.2 GWh.

Considering that the fully automated production line should be able to produce 1.25 GWh annually, it means that the company already has over a year of production capacity fully occupied by customer orders. This implies that there is market demand, and as we mentioned, the energy storage market is growing at an extremely high rate.

Seeking Alpha

As with many other companies still in the pre-commercialization phase of their products, the valuation is exclusively the result of the extremely high potential of EOS’s zinc-ion batteries and the significant risks arising from a lack of information: will the company successfully complete its ramp-up to commercial production? Will solid-state batteries capture the market? Will the zinc-ion batteries produced in the new automated plant immediately maintain the performance levels that EOS expects? Will green hydrogen become the dominant technology in energy storage? How much cash burn will be necessary before the company can self-finance its operations? At this moment, speculating on the answers to these questions would be akin to guessing.

Rather, the current valuation should be understood as the meeting point between all these uncertainties and the significant technological value of EOS’s products. Clearly, the valuation is very low compared to the estimated TAM of $249 billion by 2032 (in the U.S. alone) and the potential leadership role in all applications requiring a discharge time of more than 4 hours.

It is a classic asymmetric bet: a potential upside of over 100% against a maximum risk of 100%. I believe that, in the long term, there are no grounds yet to say whether the current valuation is correct or not; instead, I focus on short-term prospects, especially on announcements that could come between the next earnings call and the end of the year.

Why I’m Bullish on EOS Energy in the short term

My investment thesis is based on two elements:

- There is a significant potential catalyst on the horizon, which seems to have a high likelihood of materializing.

- The short interest is very high. In case the Q3 ’23 data is better than expected or if the catalyst does indeed materialize, there is a concrete possibility of a squeeze.

Below, I will analyze both points in detail.

1. The DoE Provides a Catalyst

On August 31, EOS announced its new Project AMAZE (American Made Zinc Energy), a $500 million expansion project for which the Department of Energy has issued a conditional commitment for a loan up to 80% of the total amount. This means that 80% of the capital required for the planned expansion until 2026 could come from financing under favorable conditions, bringing the total production capacity to 8 GWh per year. Considering that EOS values its backlog at $536 million for 2.2 GWh, this means that if the loan is approved, the company could reach 2026 with the capacity to generate revenues of $2 billion per year.

EOS Energy proposes 700 potential hires by 2026, all in Pennsylvania. Given that funding towards energy transition has been a central part of Bidenomics and that Pennsylvania always plays a critical role in American elections, in my opinion, it is very likely that the funding will be granted.

2. The Short-Seller Provides a Squeeze Potential

Currently, EOS Energy’s stock has a short interest of 35% (source: Seeking Alpha). This is mainly due to a short seller report published by Iceberg Research, which accuses the company of having inflated its backlog by including orders from customers in distressed financial conditions. In particular, attention is given to the Bridgelink group and International Electric Power, which together account for over 45% of the backlog reported in the latest quarterly data.

After analyzing the situation, I believe that there are undoubtedly strong doubts regarding the possibility of converting this part of the backlog into revenues. However, even so, EOS’s current backlog remains extremely high: over 1 GWh, i.e., what the company can currently produce in 9 months. Meanwhile, the energy storage world continues to grow, and there is significant interest in the new EOS Z3 batteries, as evidenced by the recent order from Dominion Energy. Dominion intends to test these batteries against other technologies, and if it is satisfied with the data collected, it could place very important orders.

I expect that in the next earnings call, the management will present a solidly growing backlog, in line with the fact that the entire energy storage sector is growing, and that there will be positive news regarding the increase in production capacity. At this moment, looking at all of EOS’s numbers, producing more remains the main problem and improving margins on sales is the second problem; the backlog is not the bottleneck slowing down the company’s expansion. If the path of automation and scaling of production is proceeding as planned, then in my opinion, it will not be difficult to collect new orders.

Conclusions and Final Thoughts

EOS Energy is a very interesting company, with innovative technology and that will soon finally start producing its zinc-ion batteries on a large scale. Technologically, they have already proven to be very competitive; economically, the new production line and the IRA incentives should significantly improve the profitability of operations. While I expect that there may be further dilutions to ownership stakes in the short term, I also expect that the company will be able to announce positive news in the next earnings call and I believe there is a high probability of seeing the DoE loan approved. If so, given the relatively low daily trading volumes (8,020,668 shares – source), Iceberg and other short-sellers may find themselves having to cover their positions hastily.

I see all the potential for an asymmetric short-term bet, with a horizon of 2-12 weeks: I expect that within this time frame, bullish opportunities can materialize both in terms of announcements in the next earnings call and in terms of progress on the AMAZE project.

Risks Associated with the Analysis

Clearly, this analysis carries risks, especially concerning a micro-cap company with disruptive technology but not yet produced on a large scale:

- The next earnings call may reveal delays or problems with the progress of work at the Pennsylvania facility;

- EOS may be forced to announce significant cuts to the backlog due to customers in complicated situations, as already explained;

- The DoE might decide not to approve the credit line;

- The first batches of production with semi-automated and fully automated processes may not meet the company’s desired technical specifications;

- The rate of cash burn could intensify if there were problems related to commercial-scale production.

Despite taking all these risks into account, I believe that a small side bet is worth considering. In the case of a short-squeeze, the stock could surge within a matter of hours following the next earnings call or the approval of DoE funding. I also believe that, given the quality of EOS’s industrial partners, the likelihood of production issues is quite low. For this reason, I reaffirm my BUY rating and will definitely update this analysis in the future.

Read the full article here