AMC Entertainment (AMC) and its near-term fate is the most material headwind for triple-net lease experiential REIT EPR Properties (NYSE:EPR). The REIT’s common shares previously formed the largest position within my portfolio. I last covered EPR in the summer with a sell rating on the back of the failure of AMC to close its preferred share conversion plan. The shares have dipped around 9% since then to match a stock market that has translated the Fed’s September rate pause higher for longer comments to the most significant pullback of REITs since the March 2023 banking crisis. The largest cinema chain in the US was able to clutch its preferred shares conversion plan from the jaws of defeat and has since been able to raise $325 million through share sales in the first tranche of what’s going to be a multi-year effort to aggressively tap its newly expanded share count to address its large debt balance. This equity raise stands to boost its cash position at the end of its second quarter by 75%.

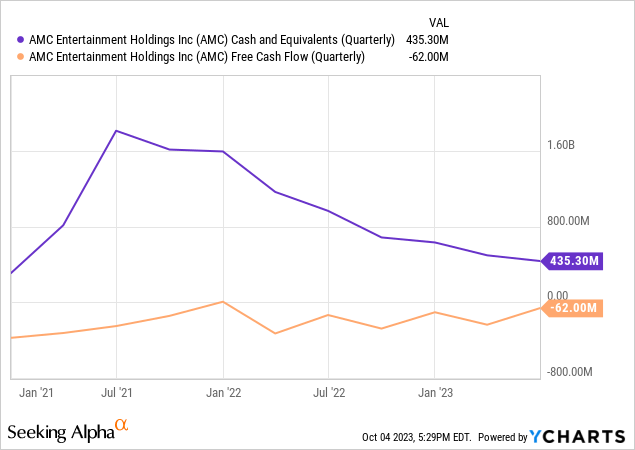

A lot has gone well for AMC since. Negative free cash flow for its fiscal 2023 second quarter at $62 million was a material drop from $237 million in the prior first quarter. Further, AMC is widely expected to report positive free cash flows for its third quarter on the back of the Barbenheimer, the dual summer releases of Barbie and Oppenheimer. Both movies set the summer box office alight as pre-sales for Taylor Swift’s upcoming Eras Tour breaking records. Eras is projected to gross a huge $2.2 billion in North America and should help a late 2023 box office adversely impacted by the dual writers and actors strike. The writers strike has been resolved and it’s likely the strike by actors will reach a conclusion sometime this month.

Is The Dividend Set For A Hike?

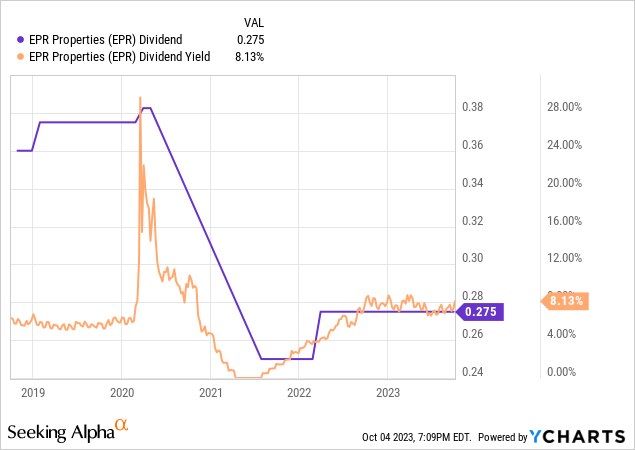

EPR last declared a monthly cash dividend of $0.275 per share, in line with its prior payout for an 8.1% annualized forward dividend yield. The second quarter was somewhat pivotal for EPR. The REIT entered into a comprehensive restructuring agreement with Regal, anchored by a new master lease for 41 properties set to drive a $65 million annual fixed rent that will be hiked by 10% every five years. This is down from 57 theatres leased by Regal pre-bankruptcy which generated $86.3 million in annual fixed rent. The master lease will also see EPR receive an annual percentage rent on all revenues exceeding $220 million within a lease year. Of the remaining 16 properties, five will be taken over by existing cinema tenants with EPR looking to offload the remaining 11 theatres. It will be good to see if these disposals have been closed at the third quarter earnings call and at what price. Around 3% of North American theatres are owned by EPR but these same properties constitute 8% of the North American box office. They are well-located properties.

EPR recorded second-quarter revenue of $172.91 million, up 7.8% over its year-ago quarter and a beat by $20.46 million on consensus estimates. Funds from operations as adjusted (“FFOAA”) came in at $98 million, around $1.28 per share. This was up 11 cents from $1.17 per share in the year-ago quarter with EPR guiding for its full year FFOAA per share to come in at $5.05 to $5.15, around a 9% year-over-year increase at the midpoint. To highlight how material this figure is even at the low end, the dividend annualized comes to $3.30 per share, a payout of around 65%. EPR was paying out around $0.3825 per share monthly before the pandemic hit, this figure annualized would amount to 91% of the lower end of FFOAA per share guidance. Hence, it will be hard for management to continue keeping the dividend muted especially if FFOAA per share is able to notch growth again next year.

Less Than $140 Million Coming Due In 2024

Bears would be right to flag that AMC’s survival is not certain even against its expanded fundraising ability. But there now exists a material level of uncertainty around any timelines for bankruptcy that may actually never come with third-quarter earnings for the theatre operator likely blowing past consensus estimates. This aggregated with the end of the actors strike could form catalysts to push the common equity of both companies up. EPR held cash and equivalents of $99.7 million at the end of the second quarter, down from $168.3 million in its year-ago period but with still no borrowings on its $1 billion unsecured revolving credit facility.

There is about $2.8 billion in consolidated debt with a blended coupon of 4.3% and a weighted average consolidated debt maturity of just under five years. Critically, there are no more debt maturities coming up in 2023 with only $136.6 million coming due in 2024. This can easily be addressed by a combination of cash on hand and the revolver. However, it’s likely the REIT will keep the dividend muted to build up the cash buffer to address this without having to dip into its revolver. This has always been a great REIT but the AMC issue represents a perpetual cloud over its prospects. I’m rating EPR as a hold against the new AMC share issues and upcoming catalysts from the end of the Hollywood strikes.

Read the full article here