EQT Corporation (NYSE:EQT) management has a lot of accomplishments to their credit. This management is a huge improvement over what came before they arrived. However, one of the challenges this management faces is getting better prices for natural gas production. The reason is that midstream transportation contracts are long-term and therefore take time to significantly modify. For EQT shareholders, this means that there are years of selling price improvement ahead.

Potential Price Increases

If management can continue to slowly switch the natural gas destination, then price variances between leading competitors and this company could slowly disappear.

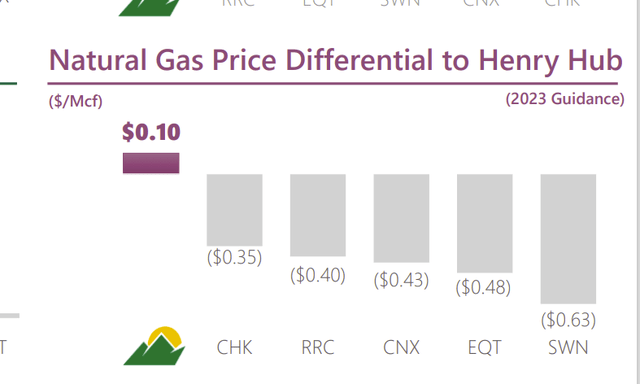

Antero Resources Natural Gas Price Comparison (Antero Resources May 2023, Corporate Presentation)

No matter which Antero Resources (AR) presentation one picks, there is always this comparison about how Antero Resources does better with natural gas selling prices than nearly anyone in the basin. Now that “does better” will vary by quarter. The reason is that Antero Resources management has the ability to get the production to stronger markets. This ability was a far-sighted move by management that one seldom sees.

The difference between the selling price for EQT and Antero shown above heads straight to the bottom line of Antero Resources with probably only some additional transportation charges and some taxes (or royalties) taken out on the way down. The comparison shown is for the important first quarter heating season prices. That and the fourth quarter is when natural gas companies make their money. Hence, a first quarter comparison is very important to profit evaluations.

But a consideration has to be that net income is nearly always a small percentage of revenues. Therefore, any improvement in the comparison shown above is going to be a major contributor to profit growth in the future.

Given that the average net income is about 5% of the revenue on average for all companies reported, that difference shown above could make a huge change in the profitability of EQT should management be able to close that pricing gap. This is yet another challenge for EQT management that the past management left for them.

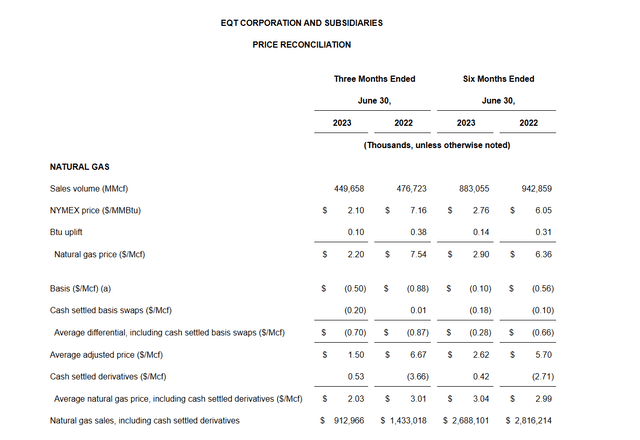

EQT Natural Gas Price Sales Compared To Natural Gas Price Received (EQT Second Quarter 2023, Earnings Press Release)

This inability to select the sales market shows in the decline in sales volumes. A dry gas producer will lower operational drilling and completion activities when the natural gas price is low. For this company, the price is definitely low.

The reason is this is primarily a dry gas producer. Combine that with a lack of ability to get the production to more robust markets. That means that recently acquired rich gas production only has a minimal effect overall on the average price received by the company.

The permanent improvement in prices received would likely be shown in the basis part of the calculation above as well as the potentially better selling price. Guessing better on the hedging program is also a possibility, but not a reliable one. There are very few consistently profitable hedging programs among the companies that I follow. Ironically, Antero Resources has one of those programs.

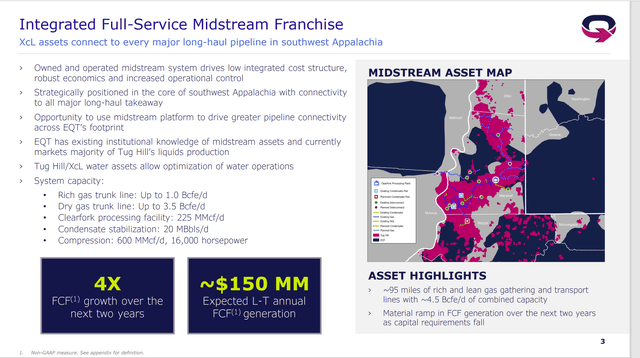

EQT Presentation Of Tug Hill And XcL Midstream Acquisition Advantages (EQT Presentation Of The Now Completed Acquisition)

The acquisition (which is now completed) has the additional benefit of adding transportation abilities to markets other than the Marcellus basin (even potentially some exporting). That adds a value to the acquisition for EQT that some competitors do not need.

It also accelerates the transition of getting some production out of the basin, which appears to be clearly oversupplied. There are plenty of stronger markets to sell natural gas if you can get the production to that market.

As a side note, management also mentioned around this time that they were able to acquire some capacity to the LNG plants that export natural gas as LNG.

Therefore, it is not like management is not trying to get better prices. It is just they are “boxed in” with a bunch of long-term contracts that are really forgettable.

Similarly, this management also has hope for the Mountain Valley Pipeline completion after years of delays. If that project gets on track long enough to be completed, then (finally) there were to be a major new outlet for natural gas production that would likely have a major impact on earnings the minute that pipeline could be used.

Costs

Management was relatively unencumbered by any cost restrictions. So, this is where much of the profit improvement has been made (aside from accretive acquisitions). In the latest presentation, management goes down the list of cost improvements through several slides. Those achievements are substantial and definitely material.

This management does what it can with the hand it was dealt. Too many times, shareholders get a list of things management can do nothing about (and this management will state that). But they spend a fair amount of time discussing what they can do and have done. That appears to be very beneficial to company results.

Key Takeaways

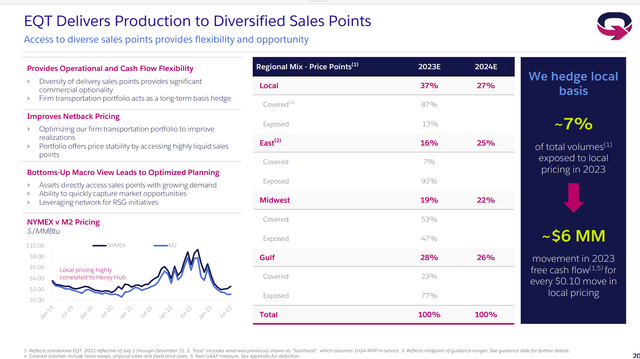

Management points out the diversification progress made along with the potential to improve the situation more (and what that effect would be).

EQT Pricing Strategy For Natural Gas (EQT Second Quarter 2023, Earnings Conference Call Slide Presentation)

The ability to switch natural gas transportation to stronger markets has been proven to be a very material profit driver. This management shows above just how material that will be.

Management has made progress getting the natural gas to stronger pricing markets. Clearly there is more progress to be made (and this management would be the first to admit that).

Since this strategy will take a while to fully execute, shareholders can expect better earnings in the years ahead even if production does not grow. That alone should assuage any fears about a large mature company that will not grow earnings.

More importantly, more cash flow at different parts of the industry business cycle will mean a larger sustained dividend that can be defended during times of extreme downturns.

This management is doing a lot of other things common to the industry like repurchasing shares. This will also lead to per share growth and eventually dividend increases as well.

Investment Idea

EQT Corporation remains a strong buy consideration for those that can withstand the low visibility of the upstream industry and the volatility that goes with that low visibility.

This is one of the few companies I follow that has achieved an investment grade rating. Therefore, excessive debt is not a consideration. Though management has addressed any debt issues by making considerable progress on repaying debt.

There are some convertible bonds that can now be converted. Some of those may well have been repurchased (which avoids some shareholder dilution). But the conversion alone will reduce debt as well.

This management is one of the best in the industry. That alone reduces many investment risks. Good management is often one of the biggest assets for shareholders that is not on the balance sheet. This management is one very large asset.

Read the full article here