Introduction

Many may be wondering how well BDCs will fare in 2024, with rates still expected to decline. I am a big believer in the sector and think they are more than just high interest rate environment investments. With the banking crisis roughly a year ago causing tighter lending standards, I think this will benefit the sector for the long term.

And even though many BDCs have rewarded shareholders these past two years with extra income because of their predominantly floating-rate portfolios, some have still faced headwinds in the process. One that has recently is the fourth-largest BDC, FS KKR Capital (NYSE:FSK). In this article, we’ll discuss why the BDC has sold off recently but why they are still a great investment for income-focused investors.

Previous Article

I last covered FS KKR Capital back in December: Is The Discount To NAV Justified Or Is This BDC A Bargain? I rated the stock a buy but since then the stock’s share price has declined nearly 6% at the time of writing. In it, I discussed how the company had been impressively growing its portfolio by making acquisitions.

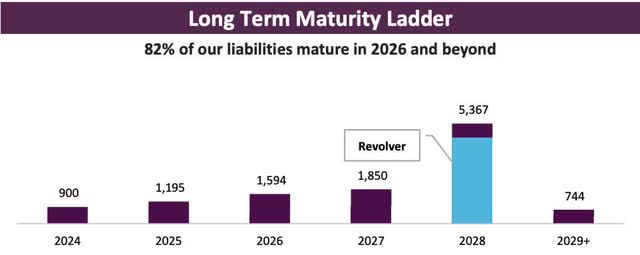

Additionally, I discussed the BDC’s strong balance sheet which had upcoming debt maturities, but these were well-laddered and covered by their strong liquidity profile. They had also outperformed popular peers, Ares Capital (ARCC) and Main Street Capital (MAIN) in total returns through 3 quarters, which I thought was highly impressive considering the two are more popular amongst investors. So, why has the BDC sold off while both ARCC & MAIN are both in the green?

Brief Overview

Before we get into why the BDC sold off recently, let’s talk about the company. FSK is an externally-managed BDC, similar to peers ARCC and Blackstone Secured Lending (BXSL) and is managed by FS/KKR Advisor.

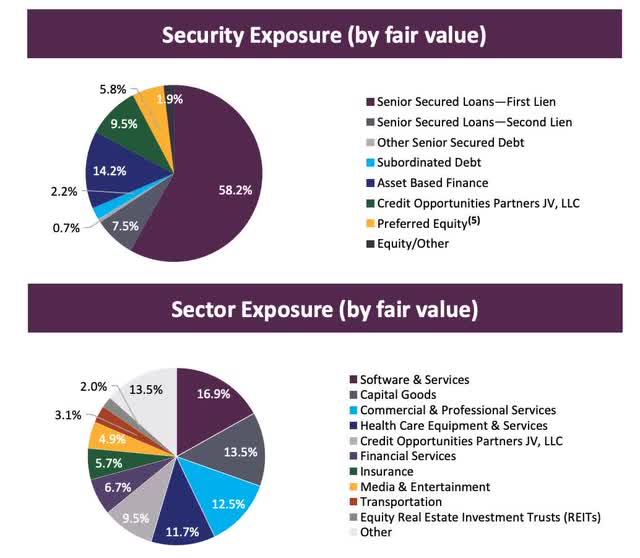

They are the 4th largest BDC with 204 portfolio companies that have a total fair value of $14.6 billion. They invest primarily in senior-secured investments with these accounting for 66.4% and 58% in first-lien loans across 24 industries. Like many of its peers, they also have a sizable portion of their portfolio invested in the Software & Services sector at 16.9%.

FS KKR IP

So Why The Sell-Off?

Since my last article, FSK reported their Q4 earnings at the end of February and the BDC disappointed some investors with the rise in non-accruals during the quarter. Although BDCs have enjoyed the extra income from portfolio companies, they have also faced downward pressure from higher interest rates.

Through the first 3 quarters, the company actually managed to decrease non-accruals with these declining quarter-over-quarter through the first 9 months. But in Q4 these accounted for 5.1% at cost and 2.6% at fair value, up from 2.4% in the third quarter.

Non-accruals have plagued many BDCs, but the higher-quality ones like ARCC & BXSL have managed these prudently in the past year. BXSL actually managed to decrease their non-accruals from 0.14% in Q1 to just 0.1% of total investments. ARCC also saw a decline in non-accruals from 1.7% at cost to 1.3% to close out the year.

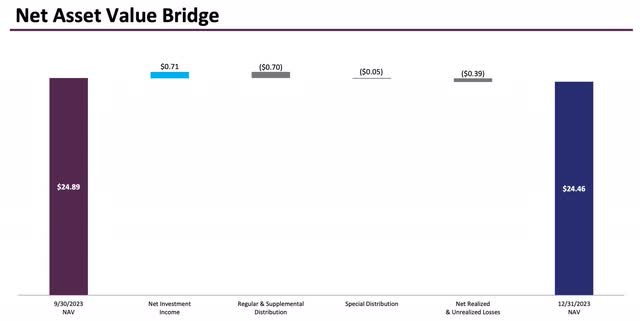

This, along with a drop in NII also caused FSK’s NAV share price to decline quarter-over-quarter as well. They also had a few challenges with credits placing two additional companies, Miami Beach Medical Group & Reliant Rehab, on non-accrual. In Q4 there were a total of 5 companies placed on non-accrual status.

Another portfolio company also showed material deterioration in their forward EPS projections. NII declined from $0.84 in Q3 to $0.75 while total investment income fell 3.9% to $447 million over the same period. So, not a great quarter for the BDC to say the least.

FS KKR IP

With rates remaining higher for longer, non-accruals will continue to be a headwind for BDCs. And even though the FED still expects rate cuts in the near future, these will likely have a lagging effect and still place downward pressure on BDC borrowers. This also causes higher net expenses, which impacts their NII. So, this is something investors in the sector should be aware of when looking to invest. I will be keeping a close eye to see how FSK’s management handles portfolio companies in the near future.

Despite challenges, FSK did manage to invest $680 million in new investments during the quarter, resulting in portfolio growth of approximately $162 million. 58% of these were add-on investments in existing companies. But seeing by the number of companies placed on non-accrual and additional (companies) with deteriorating projections, FSK investors should be really careful going forward.

Dividend Safety

As a BDC investor, most care about the safety of the dividend. For the fourth quarter, the dividend payout of $0.75 was covered by NII. The good thing is that BDCs who pay supplementals and/or specials can easily cut these at any time. The regular dividend of $0.64 gives FSK dividend coverage of 117% which is safe. And for the first quarter, the BDC declared an additional $0.75 total payout payable in April.

This is in comparison to an absolute favorite of mine and current holding BSXL, who had dividend coverage of 125% during Q4. For the full-year FS KKR Capital paid out $2.95 in distributions and brought in a total of $3.18 in net investment income. So, for those worried about their dividend safety, this is more than covered currently. Looking forward, if borrower credit quality continues to drop, the BDC will likely cut the supplemental but still pay a nice regular dividend.

Liquidity Profile

While they do have $900 million in debt maturing this year, FSK’s balance sheet remains in good shape with total liquidity of $3.9 billion and net-debt-to equity of 1.13x, compared to 1.10x to end the third quarter. This is in comparison to the largest BDC by market cap, Ares Capital’s 1.02x.

However, they will likely have to refinance their upcoming debt at higher rates as these have weighted-average interest rates of 4.625% and 1.650% respectively. But as previously mentioned, their liquidity profile remains strong. They are also investment-grade rated by Fitch and Moody’s.

FS IP

Undervalued For A Reason

As seen by their borrower credit quality issues, FSK currently trades at a P/NAV ratio of roughly 0.78x. This is in comparison to many of its peers who currently trade at premiums above NAV because of their attractive yields and distributions thanks to higher interest rates.

Furthermore, the current discount of nearly 28% sits higher than the 3-year average of 20.94%. So, those looking for strictly income, now may be a very good time to pounce on FSK as the valuation is attractive at the moment. However, due to their mentioned credit issues resulting in a drop in NAV and rise in non-accruals, I don’t see the share price appreciating much from here until these issues are resolved. And it offers little upside to their price target from the current price of roughly $19. But again, great income play for investors in search of higher yields.

Seeking Alpha

Bottom Line

Although FS KKR Capital has seen their borrower credit quality diminish quarter-over-quarter, the double-digit dividend yield remains attractive with dividend coverage over 100%. Additionally, their balance sheet remains in good health with manageable debt maturities in the coming months and ample liquidity.

At a P/NAV below its 3-year average and less than 1.0x currently, the BDC may be too hard to pass for those in search of higher yields. Especially with interest rates expected to decline in the near future. And although I am downgrading the BDC to a hold due to current borrower credit issues, I still think they remain a great income play.

Read the full article here