Investment Thesis

The First Trust Growth Strength ETF (NASDAQ:FTGS) provides investors with large-cap equal-weighted exposure to 50 stocks that have increased earnings per share by over 21% annually over the last three years. Trading at 19.17x forward earnings, it’s a GARP investor’s dream, but there’s a catch. Unlike most growth ETFs, analysts expect FTGS’s growth rate to slow over the next year, and this relatively poor earnings momentum could become a short-term headwind. Therefore, my advice today is to avoid it, but I still look forward to evaluating its strategy and comparing it with four alternatives in more detail below.

FTGS Overview

Strategy Discussion

FTGS tracks the Growth Strength Index, selecting 50 securities based on cash on hand, debt ratios, and revenue and cash flow growth. The methodology document is linked here, but I’ve summarized the key screens below:

- Minimum $5 million three-month average daily traded value.

- Rank in the top 500 by free-float market capitalization.

- Minimum $1 billion in cash or short-term investments.

- Maximum 30% long-term debt to market cap ratio.

- Minimum 15% return on equity.

Securities passing these screens receive two ranks based on three-year cash flow percentage growth and three-year revenue percentage growth, and the two ranks are combined to obtain a single combined rank. The top 15 securities with the best combined rank from each ICB industry are selected for the final step, and then the 50 securities with the best combined ranks are chosen. This process is repeated quarterly, with reconstitution in effect following the third Friday in January, April, July, and October. Each security receives an equal weight (2%) on these dates.

In my view, there’s also the potential for a few low-growth stocks to sneak into the Index, as the cash flow and revenue growth screens must only be positive relative to three years ago. In bull markets, it’s an easy target to hit, and since all screens are backward-looking, there’s nothing preventing the Index from selecting stocks whose growth rates have topped out. On the plus side, the Index should be well diversified due to the 30% max allocation per sector (15 stocks per sector / 2% per stock). That could give it an advantage over large-cap growth ETFs that overweight the Technology sector and many Magnificent Seven stocks, but as we’ve witnessed in the last year, betting against them doesn’t always work, especially over the long run.

Performance Snapshot

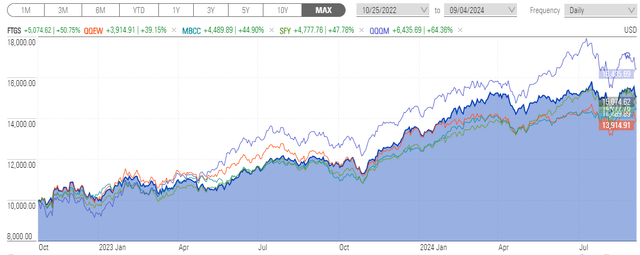

FTGS only launched on October 25, 2022, and since this is close to the time when mega-caps started to outperform significantly, its track record is underwhelming compared to the Invesco Nasdaq 100 ETF (QQQM). Through September 4, 2024, FTGS has lagged by 14% (50.75% vs. 64.36%).

Morningstar

Still, FTGS beat the First Trust NASDAQ-100 Equal Weighted ETF (QQEW) by 11.60%, which is perhaps its closest competitor. FTGS also outperformed the Monarch Blue Chips Core ETF (MBCC), which is also equal-weighted and slightly edged the Sofi Select 500 ETF (SFY), which I’ve labeled as “growth light” in previous reviews.

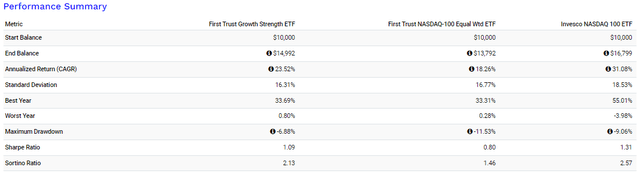

Portfolio Visualizer provides some additional information on risk and returns. Since November 2022, FTGS has been less volatile, as measured by standard deviation, and had the lowest max drawdown. Also, it managed to gain 0.80% in the last two months of 2022, while QQQM declined by 3.98%. Had the ETF launched earlier, there’s a good chance its returns would be much more competitive with QQQM, which fell 32.52% in 2022.

Portfolio Visualizer

Finding other large-cap growth ETFs with better track records is relatively easy. However, much can be explained by the outstanding performance of a select few stocks. For example, the Roundhill Magnificent Seven ETF (MAGS) is up 43.49% over the last year, and other top performers, like the Schwab U.S. Large-Cap Growth ETF (SCHG), allocate over 50% to these stocks. Naturally, SCHG and similar ETFs could become bottom-performing ETFs if these stocks were to decline, which is why I welcome better-diversified options like FTGS.

FTGS Analysis

Sector Allocations

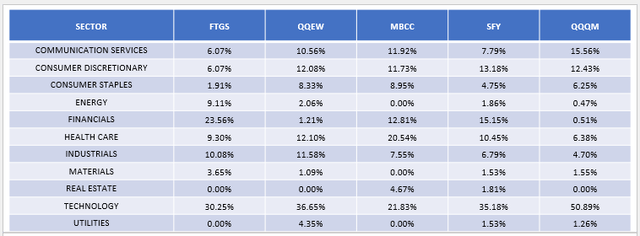

The following table highlights the sector allocation differences between FTGS, QQEW, MBCC, SFY, and QQQM. At 30%, FTGS’s Technology sector exposure is maxed out, with the difference distributed primarily to Financials. Meanwhile, QQEW and SFY have 35-37% allocated to Technology, while QQQM is the outlier at 50.89%.

The Sunday Investor

Fundamental Analysis: Top 25 Holdings

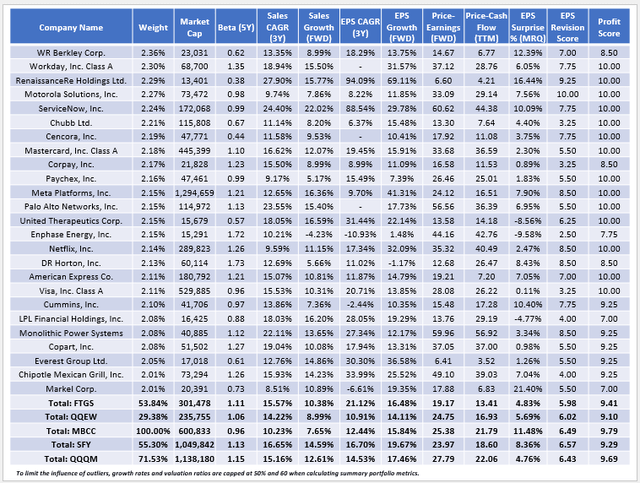

The next table highlights selected fundamental metrics for FTGS’s top 25 holdings, which total 53.84% of the portfolio. My first observation is that FTGS includes several mid-cap funds like RenaissanceRe Holdings (RNR) and Enphase Energy (ENPH). With market caps of around $15 billion or less, I’m surprised these stocks were eligible, but it does open the door to it functioning more like an all-cap fund.

The Sunday Investor

FTGS is a high-quality fund, evidenced by a 9.41/10 profit score, which I derived from Seeking Alpha Factor Grades. I attribute this to the initial set of screens for debt and return on equity. FTGS’s selections have also grown sales by 15.57% per year over the last three years, an impressive but unsurprising find, given how that’s one of the factors its Index uses to rank securities. I don’t have cash flow growth figures, but its selections have also grown earnings per share by an annualized 21.12% over the last three years, by far the largest in this sample. Many Financial stocks, including Visa (V) and LPL Financial Holdings (LPLA), contribute to these strong results.

However, the catch is that FTGS’s one-year estimated earnings per share growth rate is almost 5% lower at 16.48%. Please note, this is not normal for large-cap growth ETFs, and the gap between the two figures is the third most among the 69 funds I track in this category. The only two ETFs with wider gaps are the Pacer US Cash Cows Growth ETF (BUL) and the Invesco S&P 500 GARP ETF (SPGP), which is expected because these ETFs actually use value screens. In contrast, FTGS uses no value screens, and while its 19.17x forward P/E is quite attractive from a growth-at-a-reasonable-price perspective, I’m concerned this won’t be the case after future reconstitution. Based on the Index methodology document, there’s nothing stopping the Index from selecting high P/E stocks with high historical earnings growth rates but weak estimated growth rates.

Part of FTGS’s expected growth slowdown is attributed to relatively weak earnings surprise and earnings revision figures. Its selections delivered a 4.83% earnings surprise last quarter and have a 5.98/10 EPS Revision Score. Meanwhile, the average figures for the category are 7.23% and 6.46/10, respectively, so FTGS is quite a bit behind. Put differently, FTGS’s cheaper valuation is likely the result of its selections delivering underwhelming results, which provided Wall Street analysts with little reason to upgrade earnings expectations. I place these statistics in the broader “sentiment” category, and sadly, FTGS ranks #65/69 on this factor among large-cap growth ETFs.

Investment Recommendation

FTGS has delivered solid results compared to equal-weight growth alternatives like QQEW and MBCC. In addition, it trades at just 19.17x forward earnings and features 21.12% three-year historical earnings per share growth, which is incredible from a GARP perspective. However, I’m concerned that FTGS’s attractive valuation is because its growth rate is slowing, and I’m even more concerned that this is an unintended consequence of a flawed strategy. With frequent quarterly reconstitutions, I won’t have to wait too long to test this hypothesis, but out of an abundance of caution, I’m limiting my rating on FTGS to a neutral “hold” for now. Thank you for reading, and I look forward to answering any questions in the comments below.

Read the full article here