When trying to engage a readership with news writing, images are more important than ever in showing a professional presentation. There are several companies that have a business in offering images to media organizations.

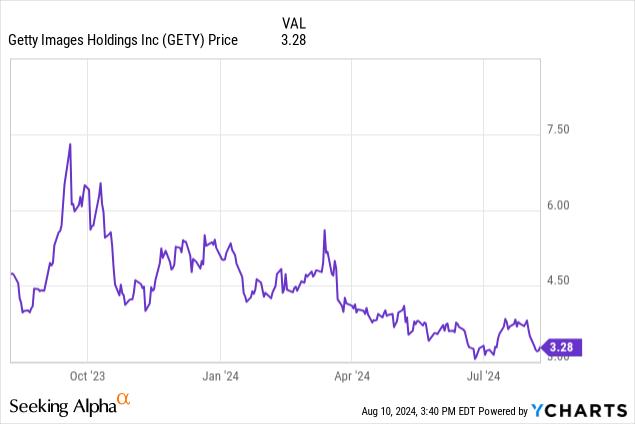

Today we’ll be looking at one of the big ones, Getty Images (NYSE:GETY). The stock is trading at a fairly low part of its 52-week range, and we’ll be looking at it from a potential value and return on investment perspective.

Understanding Getty Images

Getty Images provides libraries of premium content to end users in the form of not just images, though that is clearly its largest business, but also music and video. In addition to Getty Images, the company also provides image content through the iStock and Unsplash services.

The company has also tried to get into the artificial intelligence craze, offering a generative AI service that they first launched in fall of 2023. Their stated determination is to try to become the industry leader in the visual content space.

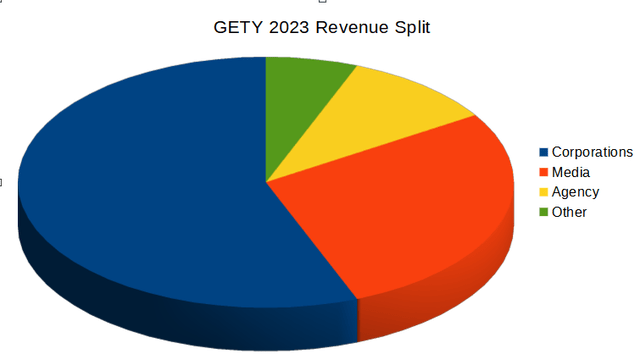

10-K from SEC

Getty Images’ revenue comes mostly from corporations, with a fair amount also coming from media and agencies. The interesting part is that more than half of its revenue comes from long-term, established customers, so while they are putting a lot of effort into bringing in new customers, the money mostly comes from people who’ve been doing business with them for a while.

Consolidated Balance Sheet

|

Cash and Equivalents |

$122 million |

|

Total Current Assets |

$330 million |

|

Total Assets |

$2.56 billion |

|

Total Current Liabilities |

$426 million |

|

Long-Term Debt |

$1.35 billion |

|

Total Liabilities |

$1.86 billion |

|

Total Shareholder Equity |

$702 million |

(source: most recent 10-Q from SEC)

Getty Images has a fairly stable balance sheet, with $1.35 billion in debt, which is considerable but is not unmanageable given the amount of profit they are bringing in. The company has enough cash on hand to manage the business as they are liable to need.

The company is currently trading at a price/book ratio of 1.92. Not bad at all, though not the screaming discount that might make the smallish company seem like it is a value stock. The company is also not growing in any particularly fast way.

The Risks

With existing customers such a big part of their revenue base, Getty Images’ biggest risk is their not being able to retain those customers, as there just aren’t enough new customers to replace them at this point. The long-term business model may require the growth of new customer bases, but retaining the old is essential in the near-term.

While images and other content are hugely important to customers, Getty Images is by no means the only source of such content to choose from. There are literally dozens of commercial stock image sites available for end users, and Getty Images has to prove they are the best, or at least the most cost-effective.

The company envisions generative AI technology as a key part of the future, and many other companies seem to be investing similarly in AI. It’s a potential godsend, but the risk is that AI-heavy production could damage the company’s business model. Perhaps more seriously, the intellectual properties law surrounding AI-generated artwork hasn’t been settled yet, and it may turn out that Getty Images’ IP on the content, part of their bread and butter, may not be enforceable.

Whether AI generated or traditionally sourced, Getty Images will need to continue to deliver relevant content to its customers base if it wants to maintain revenue.

Statement of Operations

|

2021 |

2022 |

2023 |

2024 (1H) |

|

|

Revenue |

$919 million |

$926 million |

$917 million |

$451 million |

|

Operating Income |

$202 million |

$202 million |

$128 million |

$87 million |

|

Net Income |

$117 million |

($78 million) |

$20 million |

$17 million |

|

Diluted EPS |

23¢ |

(53¢) |

5¢ |

4¢ |

(source: most recent 10-K and 10-Q from SEC)

As you can see, the revenue for Getty Images is quite consistent, reflective of a fairly stable business model, even with things like AI threatening to disrupt the visual content world. The company has shown that, apart from outliers as in 2022, the company is able to repeatedly manage to turn a profit, even if it is comparatively a small amount per share.

Estimates are suggesting much of the same going forward. In 2024, Getty Images is expected to report $938 million and earnings of 19¢. 2025 estimates show a slight amount of growth, with a revenue expected to come in at $969 million and earnings of 22¢.

Unfortunately, the company pays no dividends and doesn’t have an amount of cash which would offer a serious share repurchase program, even if the company got cheap enough to really justify it. The cash generated by the company will probably be best used to try to pay down the debt and to acquire potentially valuable competitors.

Reported earnings – Q2

Getty Images has just reported their earnings in the past week, coming in slightly below estimates. The estimate was that they would come in at $240 million and 6¢, but only came in at $229.1 million and 1¢ earnings. That’s a miss, but not a giant one, and there is as yet no reason to suspect the annual earnings will be too impacted.

Conclusion

Getty Images has traded near the lower end of its 52-week range, and doesn’t have any obvious catalysts to move substantial in either direction any time soon. I really like the company’s business model as an online visual content provider, and it would be nice to recommend them as a way to diversify one’s portfolio, but sadly, I cannot.

Getty Images is simply at too high of a multiple to the company’s underlying value to justify recommending them, even at their comparatively low price. There is a foreseeable price around $2 per share where I would reconsider and label them a buy. At current prices, though, I view Getty Images as a hold.

There is not enough growth here to justify taking a flier on the company, and the prospects of artificial intelligence are not a clear way that the business is going to grow markedly to justify these prices.

Read the full article here