By Ewa Manthey, Commodities Strategist

US economic data in focus

Ten-year Treasury yields have continued to decline after recently hitting levels last seen in 2007, after US data releases this week signalled that the US economy is cooling, easing pressure on the Federal Reserve to continue raising rates.

US inflation in July was in line with expectations, second-quarter economic growth was revised lower, and private payrolls increased less than expected in August. This followed data released earlier this week that showed job openings have fallen to their lowest level since early 2021. Focus will now turn to the headline US labour market report which is due later today.

The latest data releases have lowered expectations that the Fed will raise interest rates this year. The central bank hiked rates by 25 basis points at its July meeting as economic data was strong.

Both higher rates and yields are typically negative for non-interest bearing gold.

Gold holds above $1,900/oz

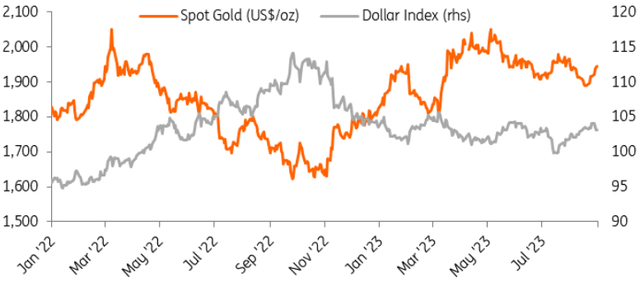

Gold has been unable to break the $2,000 level since mid-May

Refinitiv Eikon, ING Research

Federal Reserve Chair Jerome Powell said at the Jackson Hole conference last week that the Fed plans to keep policy restrictive until it is confident that inflation is steadily moving down toward its target. We will need to keep a close eye on US data releases in the coming weeks, which could shed more light on what the Fed may do.

We believe gold will remain volatile in the near term given the implications of the uncertainty of persistent inflation on the US economy, and its trajectory will be influenced by US economic data in the coming weeks. We believe the threat of further action from the Fed will continue to keep the lid on gold prices for now.

ETFs continue to see outflows

The rebound in gold prices has failed to draw buying interest from investors in exchange-traded funds or the Comex futures market. Gold ETF positioning, typically a strong driver of price direction, has been falling with holdings tumbling for a third month in August.

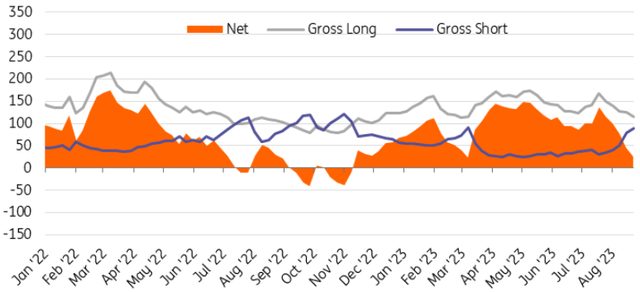

Hedge funds turn more bearish on gold

CFTC, WGC, ING Research

Hedge funds and other large speculators have also reduced their net long positions in gold, according to the latest CFTC data for the week ending 22 August. Net long positions in gold fell by 44.75% to 79.9 tonnes, equivalent to 25,695 contracts. Open interest decreased to 581,386 contracts from 598,932 contracts.

Outright long positions declined by 7.33% or 28.5 tonnes, to 360.1 tonnes or 115,766 contracts. Short positions rose by 14.89% to 280.2 tonnes or 90,071 contracts.

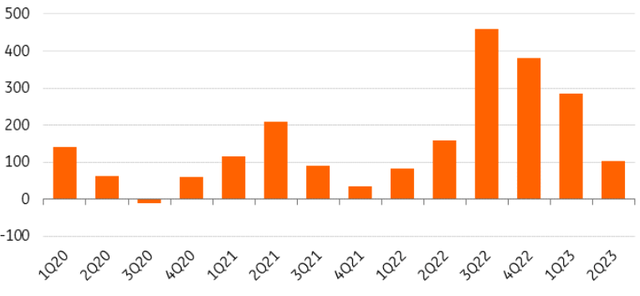

Central bank buying at a high level

This contrasts with strong demand from central banks, which bought a net 55 tonnes of gold in June following three consecutive months of selling, according to data from the World Gold Council. June was the first month of sizeable global net buying since February.

Activity from the Central Bank of Turkey was pivotal to the global total. Having been a significant net seller between March and May in order to meet local demand, it swung back to net buying in June, adding 11 tonnes to its official reserves.

Six central banks added gold during the month, the largest of which was the People’s Bank of China. It added 21 tonnes to its gold reserves during June, the eighth consecutive month of purchases. Since it began reporting increases in November 2022, gold reserves have grown by 165 tonnes (+8%), of which 103 tonnes have been bought in 2023, making it the largest buyer year-to-date.

The National Bank of Poland (NBP) was another large purchaser in June, increasing its gold reserves by 14 tonnes. This is the third consecutive month of buying from the bank, which last year indicated that it planned to add 100 tonnes to its gold reserves. The NBP has added 48 tonnes year-to-date, pushing its total gold holdings to 277 tonnes.

Last year, global central banks purchased a record 1,078 tonnes of gold, mostly driven by a flight towards safer assets amid soaring inflation. We expect central banks to remain buyers, not only due to geopolitical tensions but also due to the economic climate.

Central banks boost reserves in June

WGC, ING Research

China gold imports fall

Meanwhile, China’s gold imports fell in June but ended the first half of the year with a year-on-year rise. In June, gold imports totalled 98 tonnes, 50 tonnes lower than in May, according to data from the World Gold Council. However, the month-on-month drop may have been driven by a low local gold price premium, disincentivising importers. The second quarter is also usually an off-season for gold demand in China.

This brings China’s first half of the year gold imports to 792 tonnes, a pickup of 400 tonnes compared with the first half of 2022, according to the World Gold Council data. However, measures released by Beijing over the last couple of weeks to stimulate the flagging economy could benefit gold consumption in the country.

US Fed policy remains key theme for gold

The future direction of Fed policy will remain a central theme for gold prices for the months ahead. We believe the downside remains limited for prices as the Fed is close to the end of its monetary tightening cycle.

Rising interest rates have been a significant headwind for gold for more than two years now.

September appears set for a pause given recent encouraging signals on inflation and labour costs, but robust activity data mean the door remains ajar for a further potential hike. Markets see a 50-50 chance of a final hike while our US economist believes that rates have most probably peaked.

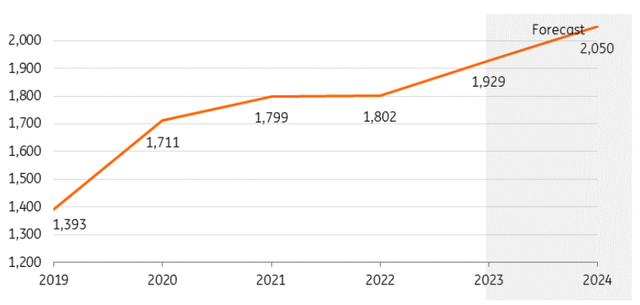

We see gold prices moving higher towards the end of the year, given the Fed should start to cut rates in the first quarter of 2024, while geopolitical tensions and macroeconomic uncertainties will also provide headwinds for gold prices going forward.

We forecast prices to average $1,900/oz in the third quarter and $1,950/oz in the fourth. We expect prices to move higher again in the first quarter of 2024 to average $2,000/oz on the assumption that the Fed will start cutting rates in the first quarter of next year.

ING forecast

ING Research

Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Read the full article here