All financial numbers in this article are in Canadian dollars unless noted otherwise.

Introduction

It’s time to talk about two related things: geopolitics and the Cameco Corporation (NYSE:CCJ).

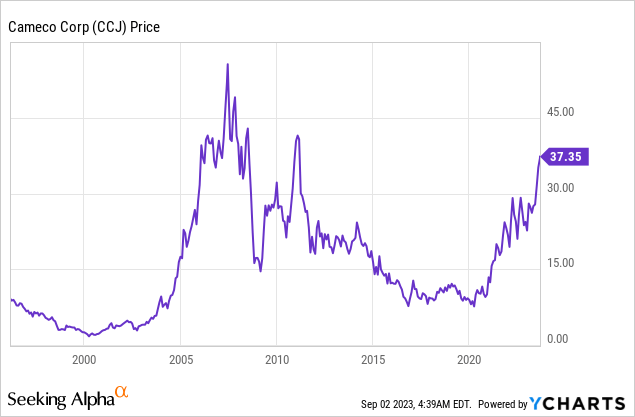

On June 18, I wrote an article titled The Nuclear Boom – What To Make Of Cameco’s New Stock Price High? In that article, I discussed the new upswing in global uranium demand and the company’s important position in the Western supply chain – especially in light of dependence on uranium imports from nations that can be considered to be less friendly to Western nations.

Since then, CCJ shares have added 17%, bringing the total return of this uranium giant to 65% on a year-to-date basis!

Now, we’re taking things to the next level, fueled by geopolitics.

In this article, I’ll update my bull case and explain why CCJ remains in a terrific space to fuel the energy demands of the West for many decades to come.

So, let’s get to it!

Geopolitics As A Fundamental Driver

I’m not a geopolitical expert. While I frequently discuss geopolitics on podcasts and various interviews, I tend to stick to a few key things/developments that I monitor when making investment decisions.

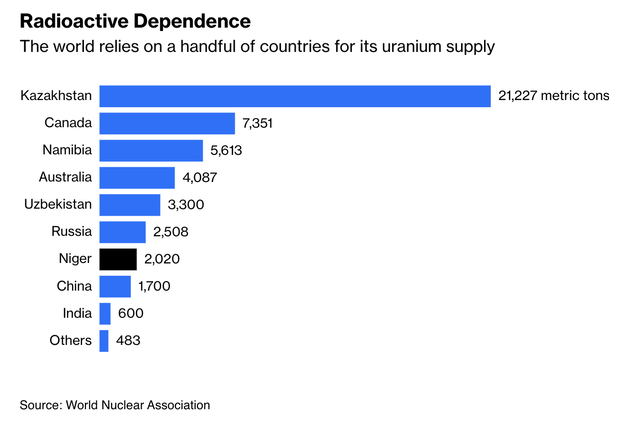

This includes the bigger picture. For uranium, the bigger picture is pretty clear. If Western nations want to increase nuclear energy output, they are dependent on a very unstable supply chain.

In May, the Wall Street Journal wrote an article highlighting some of these developments.

Wall Street Journal

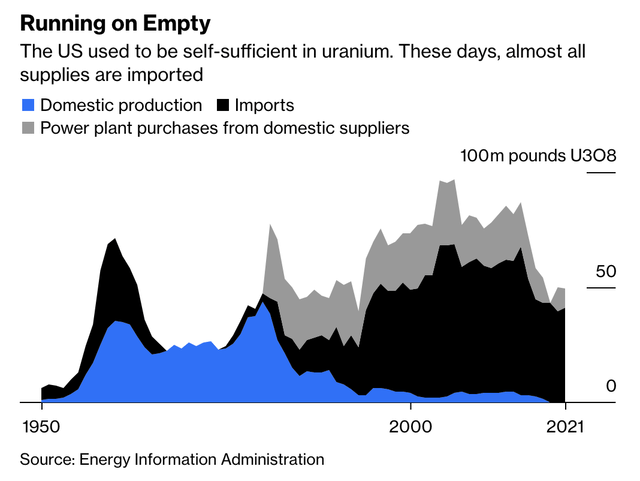

According to the paper, nuclear power is experiencing a resurgence in the Western world, with new reactors emerging in the United States and Europe, driven by the need for cleaner energy sources and a desire to reduce dependence on Russian oil and gas.

However, a significant challenge lies ahead—the Western nations lack the necessary nuclear fuel resources and production capacity.

Notably, a substantial portion of critical nuclear fuel ingredients is sourced from Russia’s state monopoly, Rosatom, which has raised concerns due to its involvement in the Ukraine conflict.

Bloomberg

The origin of the West’s dependence on Russian nuclear fuel dates back to a 1993 deal known as Megatons to Megawatts, which aimed to convert highly enriched uranium from Russian warheads into reactor fuel.

While this program successfully reduced nuclear weapon stockpiles, it led to a situation where Russia became the dominant supplier of enriched uranium in the world.

As the chart above shows, since the 1990s, the U.S. has become entirely dependent on imports.

Last month, Bloomberg columnist Javier Blas elaborated on these issues.

Bloomberg

Russia’s influence goes well beyond its own production. After all, just like the U.S., Russia has a lot of connections to other nations that will listen to its demands.

This includes various African nations, as Russia is trying to win influence in that continent.

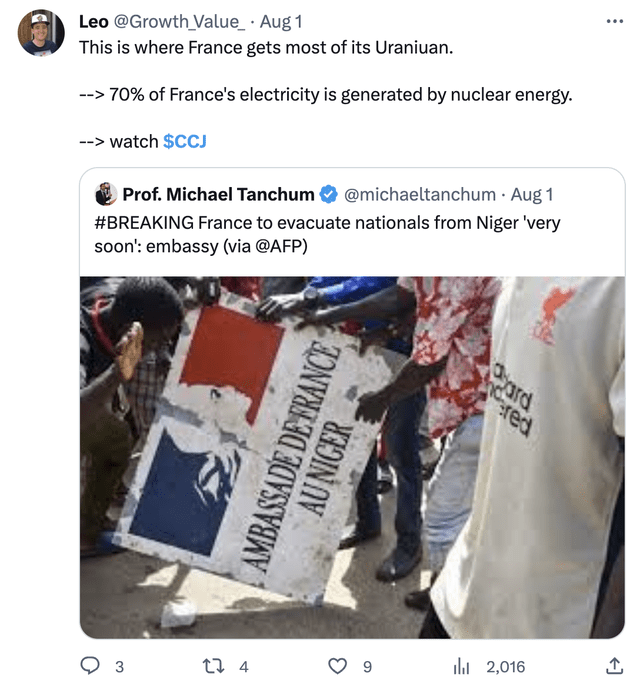

On August 1, I tweeted that the increasingly tricky situation in Niger is a reason to watch Cameco. After all, that’s where France gets most of its uranium.

Twitter/X (@Growth_Value_)

Bear in mind that France generates 70% of its electricity from nuclear energy!

Going back to Javier Blas’ comments, he wrote that the Kremlin’s propaganda machine has fueled anti-French and American sentiment across the Sahel region, leading to a series of political upheavals since 2020.

For example, pro-coup demonstrations in Niger’s capital, Niamey, have seen the display of the Russian flag, signaling Russia’s growing influence in the region.

If Niger were to fall under Russian influence, the world’s dependence on Moscow for atomic energy would increase significantly, given Russia’s substantial uranium conversion and enrichment capabilities.

When combined with other major uranium-producing countries like Kazakhstan and Uzbekistan, this would result in over 60% of the world’s uranium supply being controlled by Russia and its clients.

Bloomberg

Needless to say, that’s a big deal!

Russia holds a nearly 45% share of the global market for uranium conversion and enrichment, which poses a strategic vulnerability for countries like the United States and its partners – including France and everyone looking to escape rising fossil fuel prices by switching to nuclear energy.

All of this is good news for CCJ.

CCJ Remains In A Top Spot

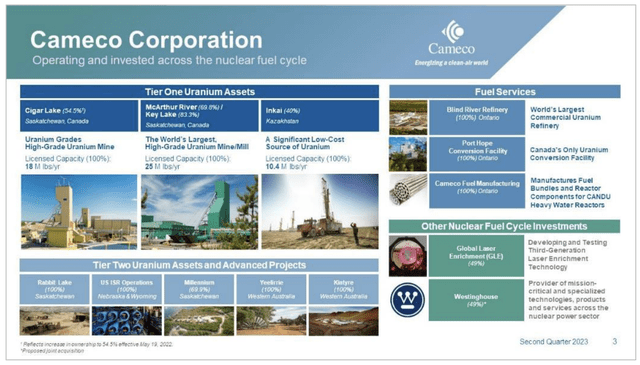

With a $16 billion market cap in New York, Cameco is the world’s largest publicly traded uranium producer. The company has major mining operations in North America, Australia, and Kazakhstan, including the world’s largest uranium mine, McArthur River-Key Lake, in northern Saskatchewan (Canada).

Cameco Corp.

It goes without saying that the company is well aware of the many tailwinds benefiting its company. This includes electrification, decarbonization, and headwinds like geopolitics, energy disruptions, and decades of underinvestment.

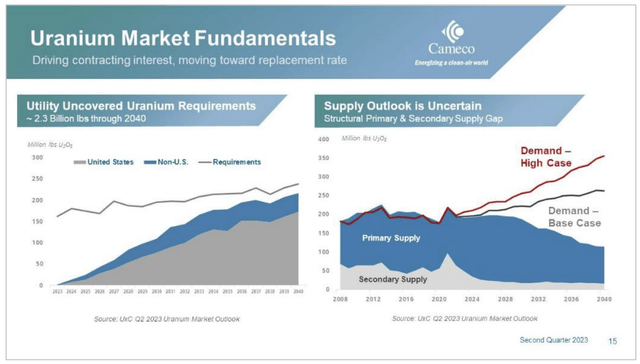

Cameco Corp.

This situation is tricky (to put it mildly), as we’re essentially trying to replace 85% of the current energy supply with clean alternatives while trying to lift 1/3rd of the global population out of poverty.

Between 2050 and 2021, electricity demand could rise by up to 80%.

So, even without additional disruptions, the world is looking at a widening supply gap for many years to come, benefiting future uranium prices.

Cameco Corp.

During its 2Q23 earnings call, the company elaborated on these developments, as it noted the increasing global support for nuclear power, driven by government policies and corporate decisions.

With demand growth looking more robust than ever and with the industry expectation that by 2030 both primary and secondary supplies will not be sufficient, the industry needs to invest in more capacity. But expanding or building new capacity across the fuel cycle will take time.

[…] In addition to production challenges, let’s not forget the geopolitical uncertainties are leading to concerns about origin of supply. Some utilities are seeking to exclude Russia in their future contracting decisions. And there’s always the ongoing risk of formal sanctions. Then tied to the origin risk, there was a recent reminder that moving nuclear material around the globe to various points in the fuel cycle is also more difficult than it once was.

[…] Utilities are starting to contract now to cover their requirements 2030 and beyond, which is what we mean when we say we’re in a long-term contracting cycle today.

– CCJ 2Q23 Earnings Call

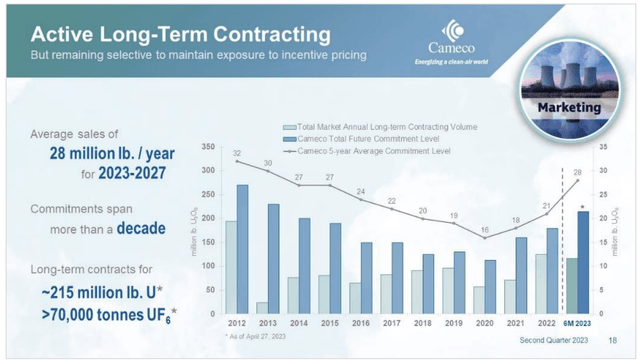

Thanks to these tailwinds, over the next five years, the average delivery volume is projected to increase from 26 million pounds per year to 28 million pounds per year.

Cameco Corp.

This growth is attributed to the translation of previously announced accepted volumes into executed contracts.

Additionally, the company holds delivery commitments that extend beyond a decade, with some contracts extending out to 2040.

Cameco also has a substantial and expanding pipeline of contracting discussions in progress.

Cameco Corp.

I know what you’re thinking right now. Isn’t long-term contracting a major issue for an efficient pricing strategy?

Cameco isn’t committing to future prices.

The company is pursuing market-related pricing mechanisms for these contracts.

This means that contract prices will be based on the future price of uranium, possibly including floor price protection and ceilings.

After all, the company’s goal is to maintain exposure to future incentive prices, which will incentivize investment in new supply to meet long-term demand.

This approach provides flexibility to benefit from potential price increases while also offering strong downside protection against macroeconomic or industry headwinds.

Given the long-term industry tailwinds, it’s a fantastic strategy.

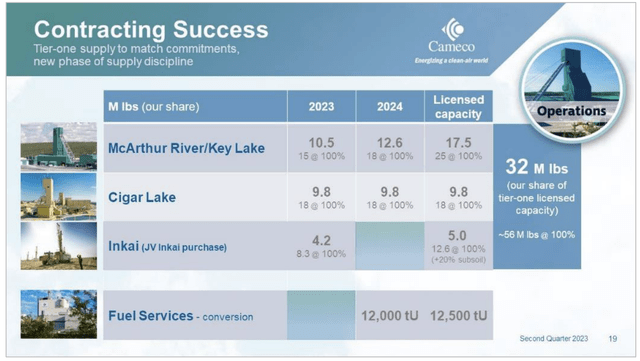

Cameco is also boosting its output to respond to higher global demand.

During its second-quarter earnings call, Cameco highlighted its flexibility in managing uncovered requirements and its existing Tier 1 assets.

The company retains the option to expand and extend production at these assets, potentially increasing its annual share of Tier 1 uranium supply to approximately 32 million pounds.

However, for Tier 2 assets, Cameco plans to keep them on care and maintenance unless it can secure long-term contracts that offer returns similar to those achievable with Tier 1 assets.

This strategic approach to contracting and production is expected to lead to improved earnings and cash flow, bringing the company back to Tier 1 run rates.

It also has a healthy balance sheet.

In the second quarter, the company reported $2.5 billion in cash, $1 billion in total debt, and a $1 billion undrawn credit facility.

In other words, the company is net cash positive.

Valuation

The valuation is tricky. After all, we’re dealing with a bull case that is expected to see increasing supply shortages for many years in the future. This warrants an elevated valuation – but how much is fair?

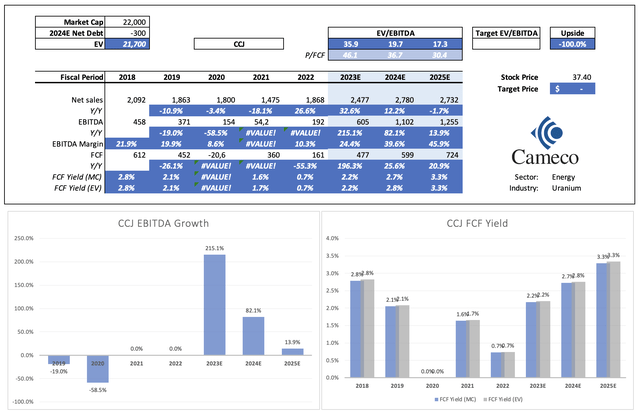

Using estimates until 2025, the company is trading at 17.3x 2025E EBITDA. It is also free cash flow positive, with strong EBITDA growth in both 2024 and 2025. Personally, I expect that EBITDA growth will turn out to be much higher in the years ahead, as I believe that we’re seeing geopolitical shifts that put an even bigger emphasis on supply from CCJ and its allies.

Leo Nelissen (Based on analyst estimates)

The current consensus price target for NY-listed shares is $38, which is just 2% above the current price.

While I do not suggest that investors chase the price at current levels, I believe that CCJ is poised for a long-term uptrend – especially if my oil and gas thesis turns out to be correct, which could put an even bigger emphasis on the return to nuclear.

Again, I would wait for a correction before jumping in and believe that we could see $50 – $60 within 12–24 months.

Takeaway

In a world shaped by geopolitical complexities and an urgent need for clean energy, the Cameco Corporation emerges as a stellar player in the uranium market.

As I’ve discussed in prior articles as well, Western nations find themselves subject to an unstable supply chain heavily reliant on Russia, which is raising concerns about energy security.

CCJ, with its position as the world’s largest publicly traded uranium producer, capitalizes on these dynamics. Its strategic approach to contracting and production, flexible pricing mechanisms, and robust balance sheet position it as an impressive player in meeting the surging demand for nuclear energy.

While valuing CCJ is a challenge, given the supply shortages looming on the horizon, it’s clear that this company holds enormous potential.

While I don’t advocate chasing current prices, CCJ appears primed for a long-term uptrend, especially if the shift away from fossil fuels continues.

A correction may present an entry point, but don’t be surprised if we see CCJ reach $50 to $60 within the next 12–24 months.

Read the full article here