Will MO continue being a good dividend stock?

If you’re an existing or potential Altria (NYSE:MO) investor, and you are asking this million-dollar question: Is it still a good dividend stock today? You’re asking the wrong question. There’s little point to this question in my mind because the answer is obviously yes. After all, the stock just raised its dividend for the 54th year! To wit, it recently declared a 4.3% increase in its quarterly dividends to $0.98 per share. Such a long track record only belongs to a very elite and exclusive group of dividend kings. According to this list, there are only fewer than 30 companies that have managed to consecutively increase their dividend payments for 50 years or more.

The million-dollar question is if it will continue to be a good dividend stock going forward. The goal of this article is to analyze and answer this question. And you will see that my answer is yes after scrutinizing its fundamentals. My conclusion is that, despite the challenges, the core pillars that worked in the past 54 years are still effective and will continue to be effective. And I will elaborate on these pillars immediately below.

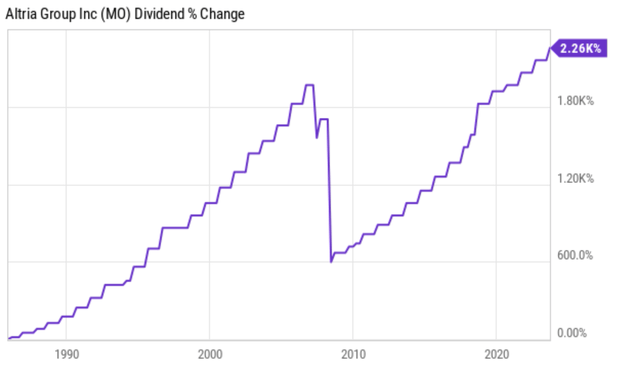

MO dividend increase

Decades ago, a very wise man (Warren Buffett) summarized the core pillars of the tobacco business better than anything else that I’ve read. He commented that:

“Why I like the business? It costs a penny to make. Sell it for a dollar. It’s addictive. And there’s fantastic brand loyalty.”

In case you were wondering why he has not owned any tobacco stocks in a long time (since the late 1980s), the reason is that he has been so successful with his investment (including with tobacco stocks) by that point that he did not want to risk the reputation cost anymore. In his own words, he commented “I’m wealthy enough that I don’t need to own a tobacco company and deal with the consequences of public ownership” when he had the opportunity of a large tobacco deal involving RJR Nabisco).

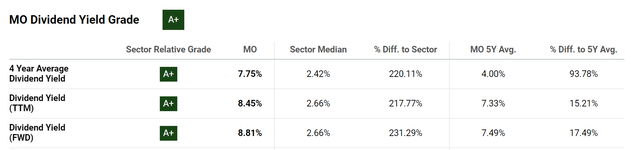

So, to me, the reason Buffett avoided tobacco stocks has more to do with reputation issues rather than basic economics. And basic economics have worked effectively for decades, as evidenced by MO’s 54th consecutive dividend raise. Its dividend payouts have increased by more than 22-fold since the 1980s, as you can see from the chart below. Also, note that the apparent decrease during 2009 is only because of the spinoff of Kraft and shouldn’t be considered as a dividend cut. Currently, thanks to its recent 54th raise, the stock is yielding almost 9% on an FWD basis, which is substantially above its own track record (four-year average yield is 7.75%) and also the sector average (sector median is about 2.66%).

As such, there’s little point in debating if it’s a good dividend stock today or not. And I will move on to explain what makes it continue to be a good dividend stock going forward.

Source: Seeking Alpha Source: Seeking Alpha

Business model remains effective

Looking ahead, I expect MO to keep enjoying low cost, high margin, and therefore superb profitability.

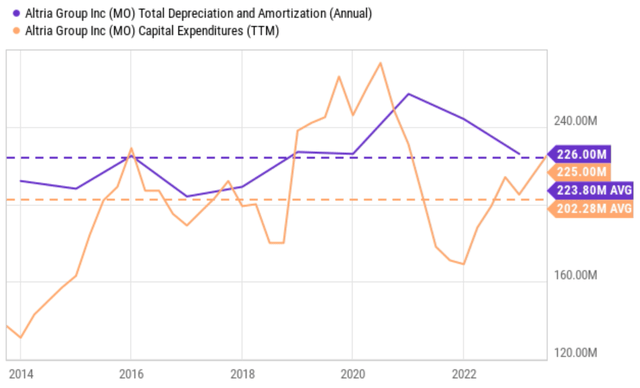

For cost, the following chart compares’ its capex expenditures and its total depreciation and amortization (“DA”). As a quick and dirty approximation, I’m using the DA data here to represent the maintenance capex of the business. As seen, MO spends around $200M to $225M quarterly on DA and capex only. And that is it – enough to support a business that has generated more than $5 BILLION quarterly sales on average in recent years.

Source: Seeking Alpha

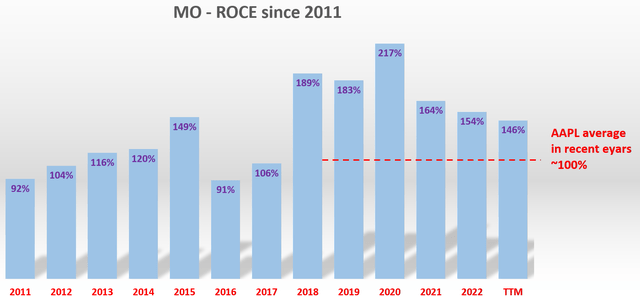

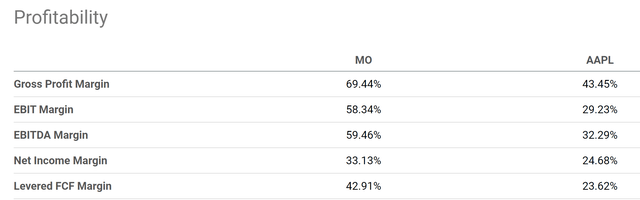

On the margin front, the following two charts show its ROCE (return on capital employed) in recent years and also its various margins when compared to Apple (AAPL). The point here is not to compare oranges to apples (pun intended), but to show its profitability rivals a tech giant is considered the best/largest money-minting machine in the world.

Source: Author Based on Seeking Alpha Data Source: Seeking Alpha

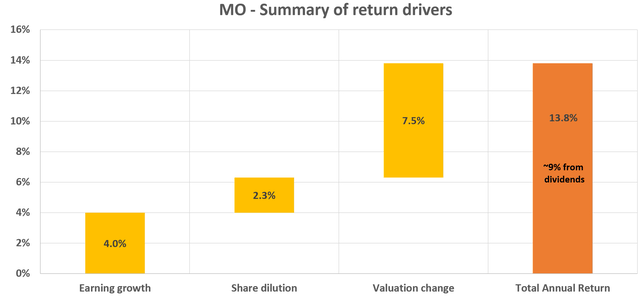

As detailed in our blog article, the long-term EPS growth rate of a business is governed by the product of its ROCE and its reinvestment rate (“RR”). For MO, its RR is 2~3% based on my analysis. With its current ROCE of 146%, the long-term EPS growth rate would be about 3% to 4% (3% RR x 146% ROCE ~ 4% growth). The stock is also undervalued in my view. Its current FWD P/E is only about 8.8x, compared to a historical median P/E of about 12x. As such, the stock offers not only a safe and generous dividend but also good price appreciation potential as summarized in the following chart.

All told, I anticipate the stock to provide annual return potential in the mid-teens range for the next 3~5 years. And under current conditions, the main return drivers are:

- The 3~4% EPS growth rate as analyzed above.

- A 2.3% share repurchases based on its recent historical trend. Given its compressed valuation under current conditions, these share repurchases would be highly accretive to shareholder returns.

- A valuation expansion to the mean.

Source: Author

Risks and final thoughts

Now, risks. The elephant in the room is the market’s fear of the demand decline for its traditional tobacco products (i.e., smokable products). And there’s no doubt that demand has been, and is still, in secular decline. Anyone trying to argue otherwise is simply ignoring reality. A 20-year study, sponsored and published by the U.S. CDC (Center for Disease Control and Prevention) clearly showed this megatrend. Unit sales (i.e., shipment volume) of cigarettes in the U.S. have declined by almost half since 2000, from over 400 billion sticks in 2000 to a little over 200 billion sticks in 2020.

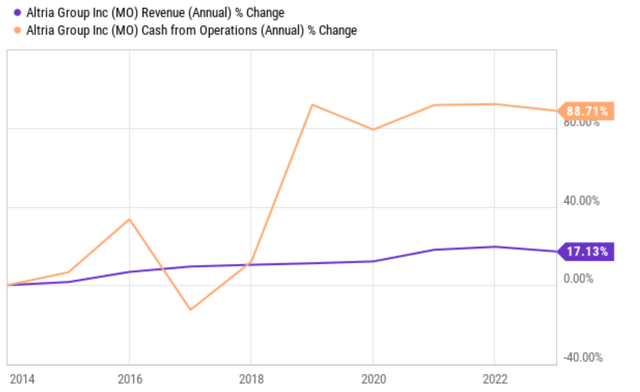

So just to be perfectly clear, my thesis is not to argue against or deny such a decline. My thesis is built on the argument that MO’s business model has been coping with such decline effectively thanks to its light capex requirements, high margin, and brand loyalty. Also, note that shipment volume decline does not necessarily translate into sales decline or profit decline because pricing power is another key variable in the equation. On this front, in addition to all the results shown above to support these arguments, the next two charts provide two final pieces of data. As seen, MO has been very successful in offsetting the decline of smokable products just mentioned over the long term. So successful that its total sales and cash flow have grown at a robust rate over the years despite the volume decline.

To conclude, my view is that MO has been, and of course is still, a good dividend stock. The real question is whether it will continue to be a good dividend stock or not, given the secular decline of traditional products and its setbacks in pushing into alternative products. And my answer is yes. The key reason that I see the fundamental economics that have worked in the past 54 years continue to remain effective. The setbacks suffered in its recent attempts into alternative products (such as the JUUL acquisition) are only temporary. It’s a long game and Altria has the resources to stay in it (e.g., its more recent acquisition of NJOY Holdings is another push into this space).

Source: Seeking Alpha

Read the full article here