Kaiser Aluminum Corporation (NASDAQ:KALU) recently reported better than expected quarterly earnings, and the outlook for 2024 includes net sales growth and EBITDA growth. With a diversified product offering, KALU also promised net debt/EBITDA reduction, lean manufacturing, and other operational efficiency efforts, which may bring net income growth and dividend growth in the coming years. There are clear risks coming from competitors, alternative manufacturing options, and materials. In addition, delivered net sales could be lower than expected. Despite all this, I believe that Kaiser Aluminum appears undervalued at this point in time.

Kaiser Aluminum Offers Technically Challenging Applications With Global Distribution

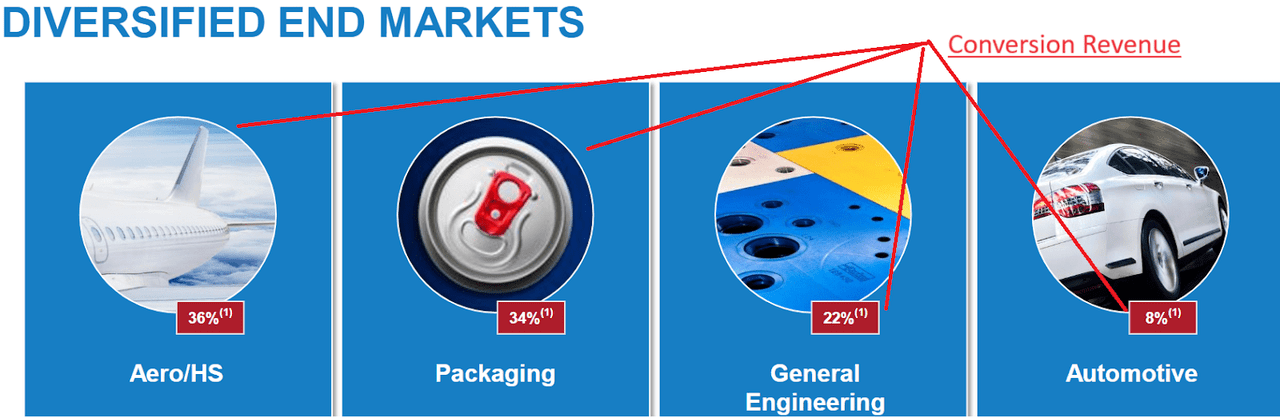

Kaiser Aluminum specializes in the manufacture and sale of semifinished aluminum products for various end applications, including Aero/HS Products, Packaging, GE Products, Automotive Extrusions, and other products.

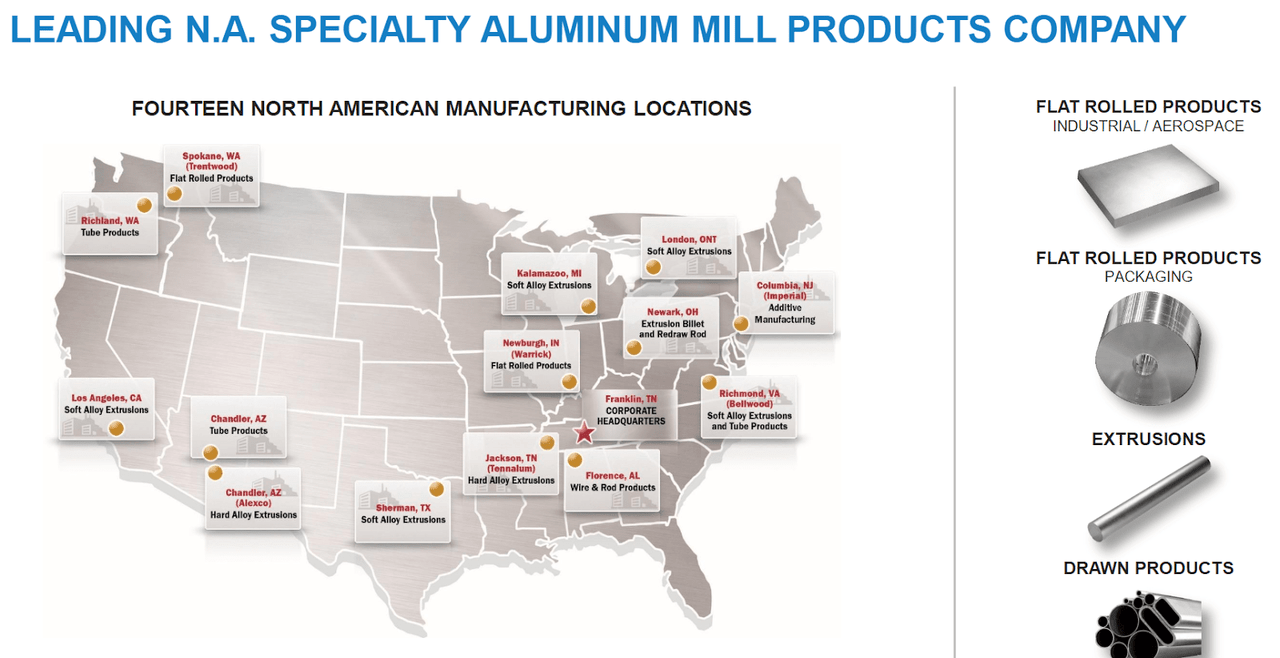

In my view, the company does not only seem to offer diversification of activities, but also a geographically diversified business profile. Manufacturing facilities are located all over the country.

Source: Kaiser Aluminum Business Update February 2024

Source: Kaiser Aluminum Business Update February 2024

The company’s focus is on technically challenging applications requiring specific metal properties, where it can deploy its technological and metallurgical capabilities to produce highly engineered and differentiated products.

Operating neutrally to the price of aluminum in the market, the company earns profits primarily from converting aluminum into semifinished products. Its product portfolio includes heat-treated plates and sheets as well as bare and coated aluminum coils, serving various global industries such as aerospace, food and beverage packaging, and general engineering.

The company markets its semifinished aluminum products for various end applications. Its sales are made directly to customers through sales personnel in the United States, Canada, and Western Europe. Sales are also made through independent sales agents in other regions of the world. Through long-term agreements and attention to market trends, the company seeks to maintain strong relationships with its approximately 520 clients.

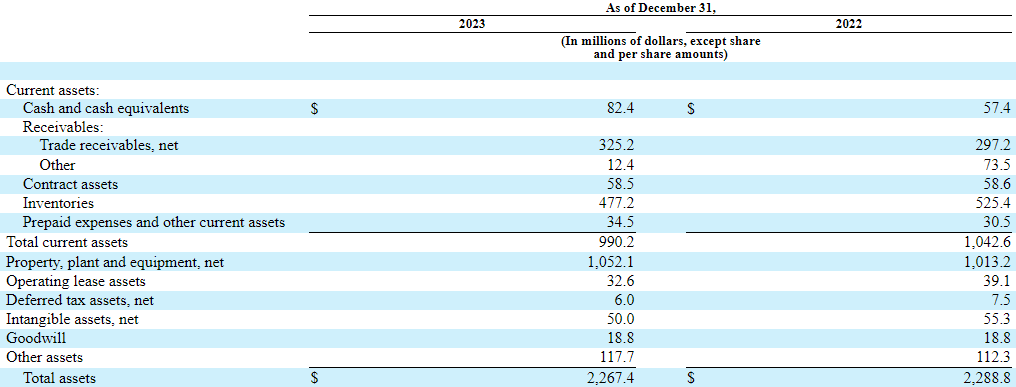

Balance Sheet

As of December 31, 2023, Kaiser reported cash of $82 million, accounts receivable of $325 million, and inventories of $477 million, which implied current assets of $990 million. The current ratio stands at more than 2x, so I believe that the company does not report a liquidity issue.

In addition, given the total amount of property and equipment of $1.052 billion, total assets of $2.26 billion, and asset/liability ratio of more than 2x, I believe that Kaiser reports a healthy balance sheet.

Source: 10-k

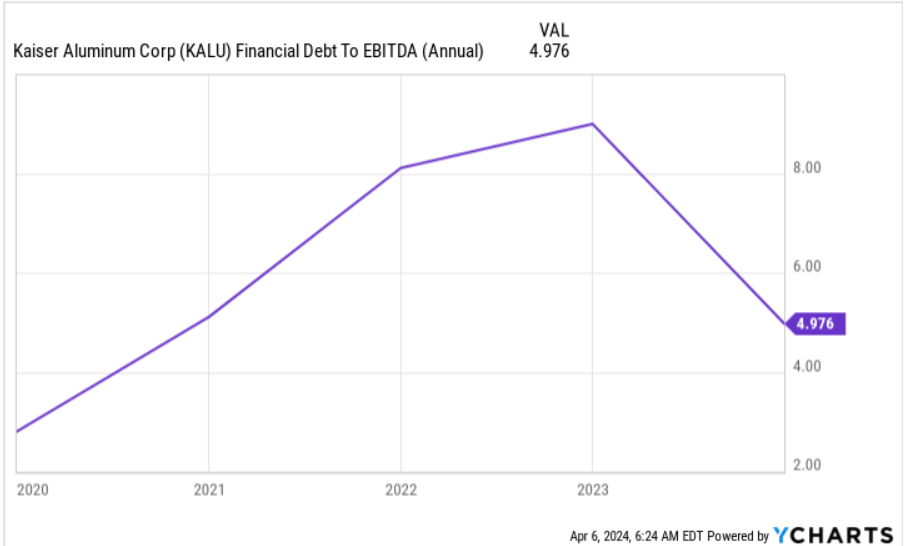

With long-term debt close to $1 billion, Kaiser Aluminum does not have a lot of debt. However, the financial debt/EBITDA seemed to decrease recently from close to 8.5x to less than 5x. In this regard, I believe that a further decrease in the total number of assets could lead to higher trading multiples.

Source: Ycharts

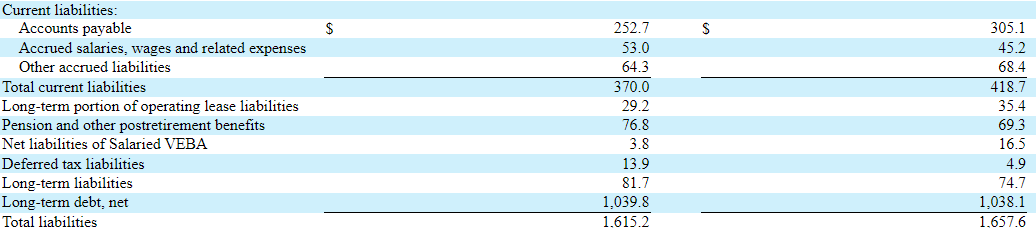

The total amount of liabilities stands at about $1.61 billion, and current liabilities are close to $370 million. In 2023, the company did report a decrease in the total amount of liabilities and current assets.

Source: 10-k

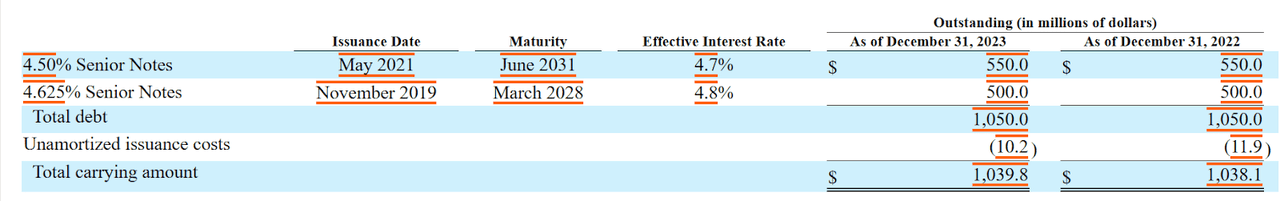

Cost Of Debt Stands At Close To 4.6%-4.5%

As of December 31, 2023, and 2022, Kaiser Aluminum had fixed rate senior unsecured notes outstanding, with different maturity dates and interest rates. Additionally, the company entered into a Revolving Credit Facility, increasing the commitment and extending the maturity date to April 2022. The interest rates included in the debt agreements are close to 4.5% and 4.625%, so I believe that the cost of debt may be close to these figures in the near future. The WACC may be higher than 4.5%-4.625%.

Source: 10-k

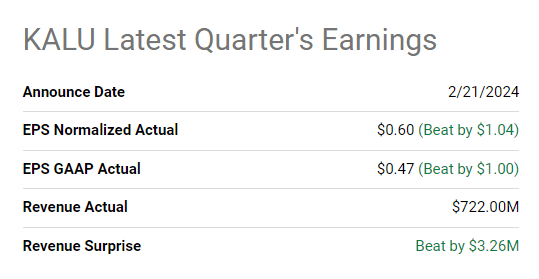

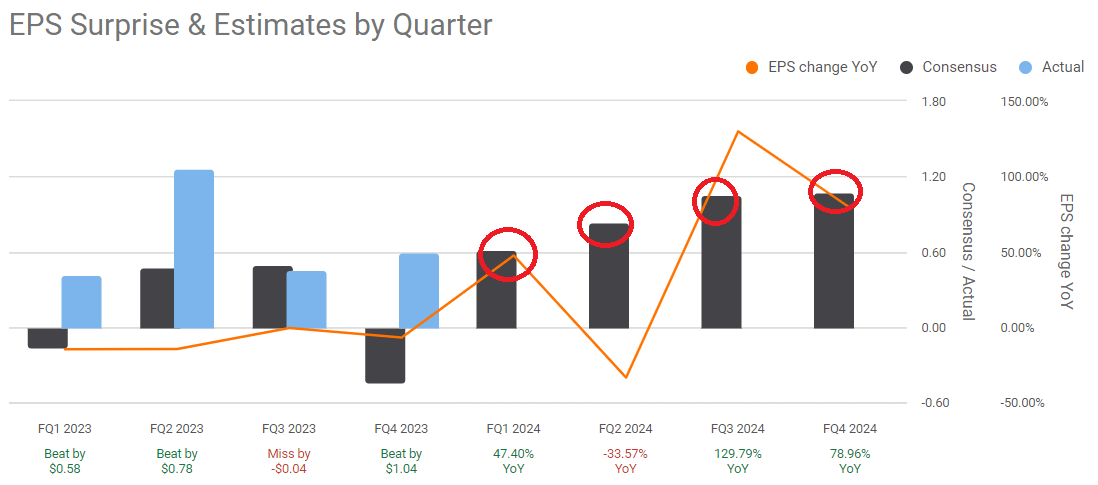

Assumption 1: Recent Earnings And Outlook Could Lead To Demand For The Stock

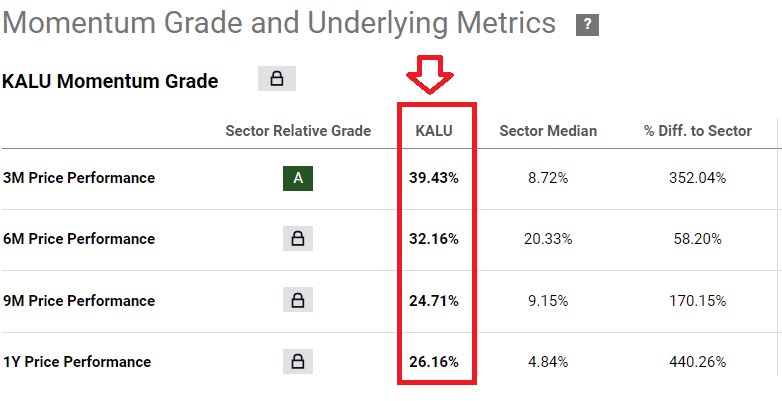

I believe that the recent quarterly earnings reported in February were beneficial because they were better than what the market expected. Both the EPS GAAP and quarterly revenue were better than prevised. The recent increase in earnings could also partially explain recent price momentum increases, which seemed to be larger than price momentum in the sector. In sum, it seems that both the earnings and the stock price are moving up.

Source: Seeking Alpha

Source: Seeking Alpha

On the top of it, analysts out there are expecting EPS increases in future quarterly earnings in 2024. In my view, if Kaiser offers once again better than expected earnings, we could see further price increases.

Source: Seeking Alpha

With all that being said about previous earnings and expectations, the outlook given by Kaiser in the last annual report was beneficial. The company expects demand to continue in 2024. The demand for defense, space, and business jets as well as the packaging applications are expected to bring net sales growth close to 2%-3% in 2024, with adjusted EBITDA margins improvements.

We believe Kaiser remains well positioned in the current demand environment as a key supplier in diverse end markets with multi-year contracts with strategic partners and expect demand will continue to improve across key markets throughout 2024.

As a result, conversion revenue for the full year 2024 is expected to improve 2% – 3% with adjusted EBITDA margins to improve 70 – 170 basis points over 2023. Source: 10-K

I believe that the expectations from other analysts could bring demand for the stock. As a result, Kaiser Aluminum may enjoy a lower cost of capital. Under my best-case scenario in my dividend discount model, I assumed a WACC close to 7%.

Assumption 2: Lean Manufacturing, Six Sigma, And Other Operational Efficiency Efforts Could Lead To Net Income Growth

Kaiser Aluminum Corporation’s future strategy focuses on maintaining its key position in markets such as Aero/HS Products and Packaging through long-term contracts. In addition, it will seek to improve operational efficiency, invest in strategic growth, and adapt to market trends. In this regard, it is also worth noting that Kaiser expects to accelerate operational efficiency thanks to the integration of management teams, improvement of supplier selection, and integration of several tools as a result of Lean Manufacturing, Six Sigma, and Total Productive Manufacturing. Under my best-case scenario, I assumed that these efforts could lead to net income growth.

We further strive to enhance the efficiency of product flow to our customers and our status as a supplier of choice by tightly integrating the management of our operations across multiple production facilities, product lines and target markets. Additionally, our strategy to be the supplier of choice and a low-cost producer is enabled by a culture of continuous improvement that is facilitated by the Kaiser Production System, an integrated application of tools such as Lean Manufacturing, Six Sigma, and Total Productive Manufacturing. Using KPS, we seek to continuously reduce our own manufacturing costs and eliminate waste throughout the value chain. Source: 10-K

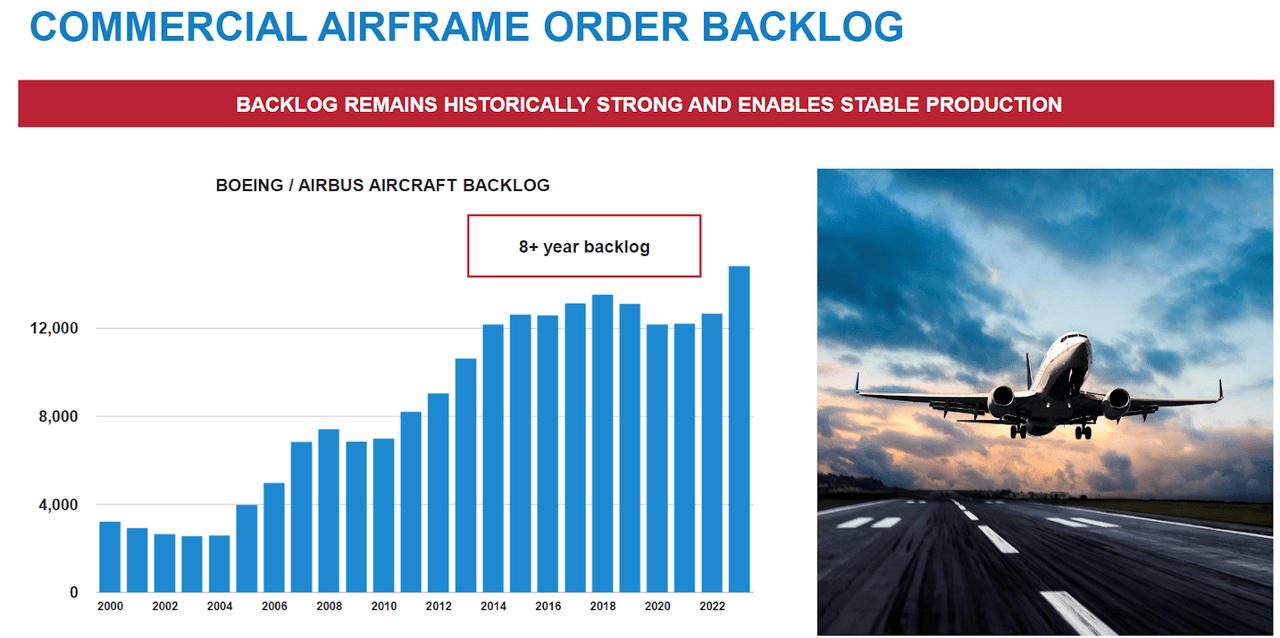

Assumption 3: Backlog Growth With Orders From The Boeing Company (BA) And Airbus SE (OTCPK:EADSF) Imply Future Stable Net Sales

Given the total number of orders accumulated from Boeing and Airbus, I believe that we can expect somewhat stable net sales in the coming years. In a recent presentation, the company mentioned an eight-year backlog accumulated with these massive corporations. It is worth noting that aerospace represents close to one-third of the total amount of revenue. In sum, future production will not stop any time soon.

Source: Kaiser Aluminum Business Update February 2024

Assumption 4: Market Growth Close To 2%-5% Would Imply Net Sales Growth Close To 2%-5%

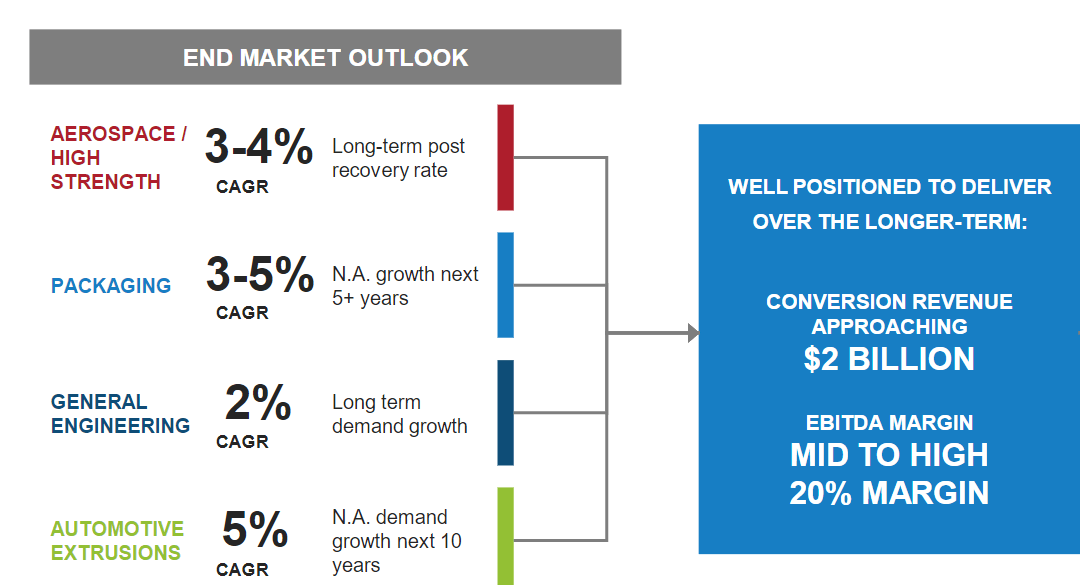

For the assessment of my financial models, I took a careful look at the market expectations of different end markets in which Kaiser sells products. Aerospace, packaging, general engineering, and automotive extrusion markets are expected to deliver growth close to 2%, 3%, and even 5%. With these numbers in mind, I believe that assuming median sales growth close to 4% in my best-case scenario makes sense.

Source: Kaiser Aluminum Business Update February 2024

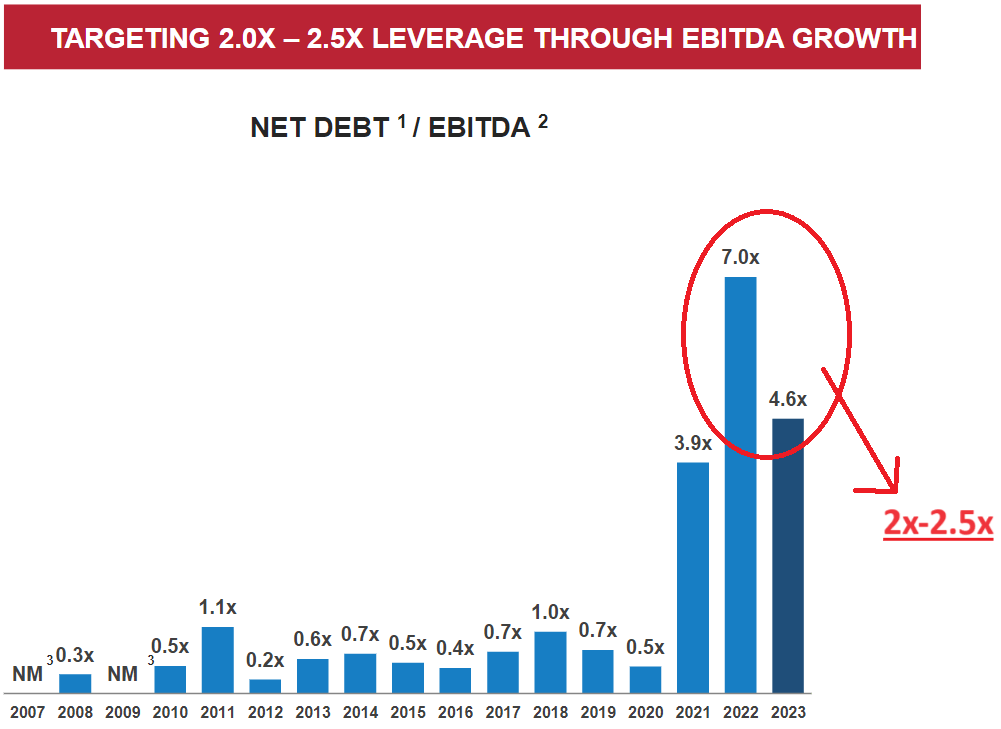

Assumption 5: Debt Reduction Could Accelerate Demand For The Stock, Lower The WACC, And Enhance The Valuation.

In 2022, Kaiser Aluminum reported net debt close to 7x. In 2023, the ratio was close to 4x, and management recently announced that it targets a leverage of 2x-2.5x.

In my view, further reduction in net leverage thanks to EBITDA growth or debt reduction will most likely bring more demand for the stock. As a result, the stock valuation may increase.

Source: Kaiser Aluminum Business Update February 2024

My Best-Case Scenario Implied A Valuation Of $163 Per Share

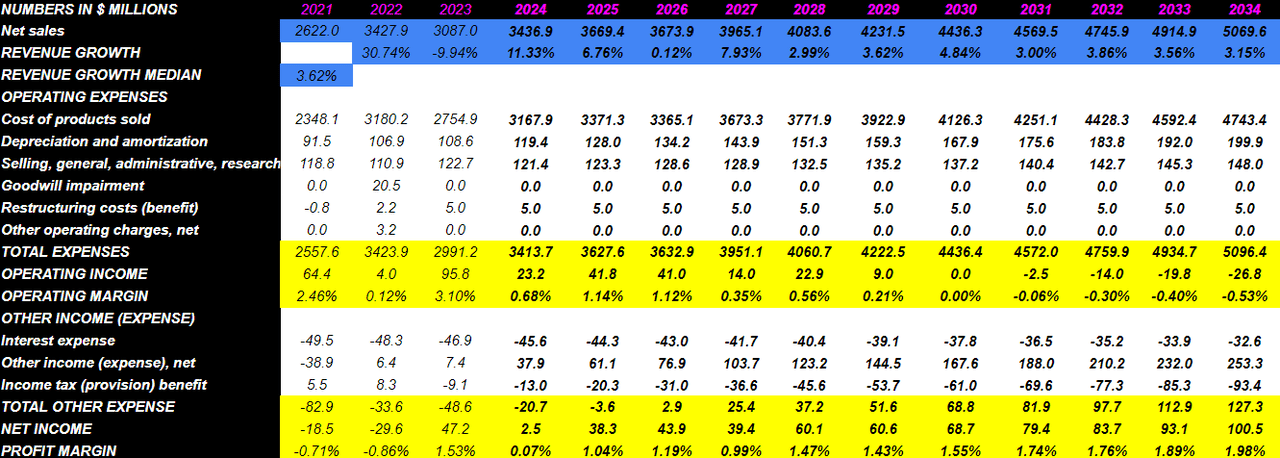

Under my best-case scenario, Kaiser Aluminum will enjoy net sales growth thanks to its growing end target markets. Backlog accumulated will most likely continue to grow, the net debt/EBITDA multiple may lower, and operating efficiency will also improve. In sum, my previous assumptions will be successful.

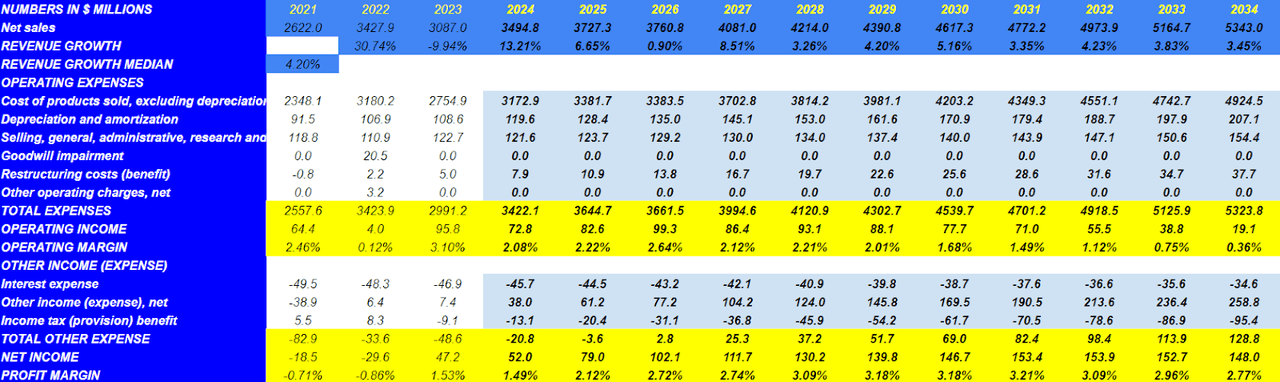

In the best-case scenario, 2034 net sales will be $5,343 million, with revenue growth of 3.45%, giving a median revenue growth of close to 4.20% from 2024 to 2034.

On the other hand, operating expenses would include the cost of products sold, excluding depreciation and amortization around $4,924.5 million, and having a depreciation and amortization of $207.1 million.

In addition, I took into account selling, general, administrative, research, and development costs, which are around $154.4 million. If we also consider restructuring costs of $37.7 million, total expenses could be around $5,323.8 million, which will result in an operating income close to $19.1 million and an operating margin of 0.36%.

Finally, with interest expense of -$34.6 million by 2034, if we add the other income net close to $258.8 million and the income tax benefit close to -$95.4 million, 2034 net income would be close to $148 million, with profit margin close to 2.77%.

Source: My Dividend Model

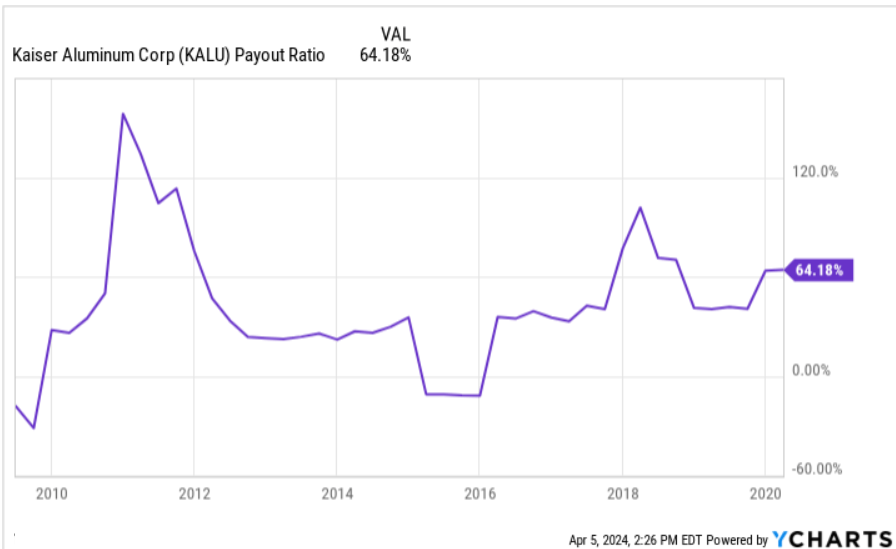

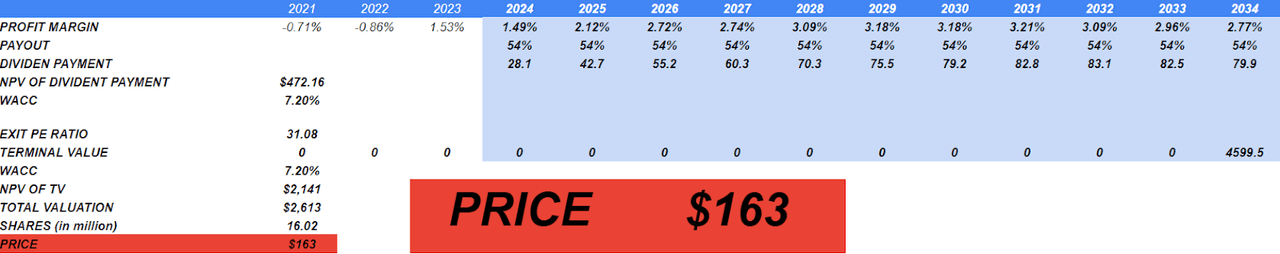

I estimate that the payout will be 54%, giving a dividend payment of $79.9 million. With a WACC of 7.2%, the NPV of future dividend payments would result in close to $472.16 million. Note that the payout ratio was larger than 54% in the past. I believe that my numbers are conservative.

Source: Ycharts

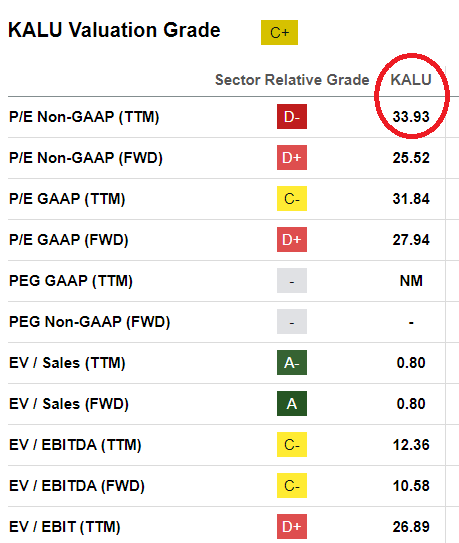

If we assume an Exit PE ratio of 31.08x, which is close to the current PE, the terminal value would be $4,599.5 million, and the NPV of TV would be $2,141 million.

Source: Seeking Alpha

Finally, the total valuation would stand at no less than $2,613 million, and taking into account the share count of 16.02 million, the fair price would stand at $163 per share.

Source: My Dividend Model

Risks And Competitors

Kaiser Aluminum Corporation’s products compete with other materials in various applications. In the aerospace industry, they face competition from titanium, composites, and carbon fiber to reduce weight and increase fuel efficiency. In the automotive industry, the use of aluminum competes with steel and other materials, while in packaging they face alternatives such as steel, plastic, and glass, influenced by costs and recyclability. Changes in customer preference could affect demand, resultantly affecting the financial position and results of Kaiser Aluminum Corporation.

The semifinished aluminum industry is highly competitive. Kaiser Aluminum Corporation differentiates itself with continued investments in quality and machinability, offering unique select attributes and customer support. KALU competes with Arconic, Constellium, Novelis, and Tri-Arrows in Aero/HS Products, and with Arconic and Norsk Hydro ASA (OTCQX:NHYDY) in GE Products and Automotive Extrusions.

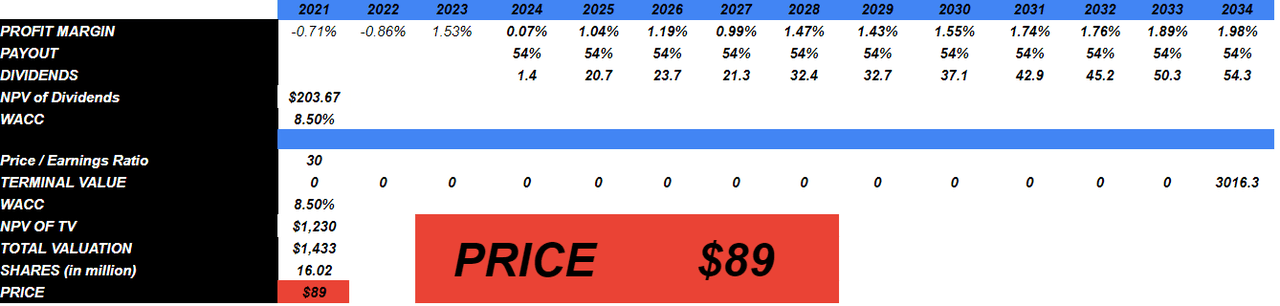

My Bearish Case Dividend Model Includes Failed Efficiency Efforts, Lower End Target Market Growth, And Failed Assumptions

In the worst-case scenario, net sales for 2034 are expected to be around $5,069.6 million, with revenue growth of 3.15%.

The following operating expenses may also be generated, with the main expense being the cost of products sold of around $4,743.4 million, accompanied by a depreciation and amortization of $199.9 million. To this, we can add a selling, general, administrative, research, and development expense of close to $148 million.

In this scenario, there is no expected goodwill impairment, and the restructuring costs would stand at $5 million, giving total expected expenses of $5,096.4 million.

On the other hand, we take into account interest expense of -$32.6 million, with other income of $253.3 million, which would imply net income close to $100.5 million.

Source: My Dividend Model

Under this case scenario, the payout is expected to be 54%, with dividends very close to $54.3 million, providing a NPV of dividends of $203.67 million. The WACC is estimated to be 8.5%. Regarding the price / earnings ratio, it is expected to be 30x, generating a terminal value of no less than $3,016.3 million. Finally, I obtained an NPV of a terminal value of $1,230 million, which would indicate a fair price of $89 per share.

Source: My Dividend Model

My Opinion

In my view, Kaiser Aluminum Corporation exhibits a strong business strategy, diversified product offerings and geographic diversification. Its focus on key markets and long-term contracts provides stability and growth potential and will bring net sales growth close to 4% over the coming years. In addition, with promises regarding net debt/EBITDA reduction, lean manufacturing, Six Sigma, and other operational efficiency efforts, I would expect significant net income growth. The company faces competitive risks in a dynamic and highly competitive market and may suffer from alternative manufacturing options and different materials. With that, I believe that Kaiser could trade at better marks.

Read the full article here