The Financials sector has been beaten down over recent months. While higher interest rates are no doubt pressuring smaller banks as the big money center firms attempt to manage high volatility in the Treasury market, asset managers have been standing by waiting for the capital markets to warm up. Higher yield volatility could throw a wrench in the private equity recovery given surging interest rates lately.

Still, I have a buy rating on KKR & Co. (NYSE:KKR). The valuation is attractive ahead of what should be better times ahead in the investment banking industry.

Interest Rate Volatility Ticks Higher Again, Posing Risks to the Banking Industry

TradingView

According to Bank of America Global Research, KKR is a leading global investment firm that manages capital across several alternative asset classes including private equity, credit, and real assets. KKR has a differentiated business model with a large balance sheet and a sizable capital markets business.

The New York-based $51.3 billion market cap Asset Management and Custody Banks industry company within the Financials sector trades at a high 51.4 trailing 12-month GAAP price-to-earnings ratio and pays a low 1.1% dividend yield. Ahead of earnings later this month, shares trade with a moderate 31.4% implied volatility percentage, and short interest is low at 1.6%.

Back in August, KKR reported a solid Q2 earnings beat. Operating EPS verified at $0.73, better than the $0.71 consensus estimate, while fee-related earnings of $602 million were higher by 31% compared to year-ago levels. The firm reported that its book value per share increased to $28.17.

The stock rose around the earnings release as the management team was optimistic about better fundraising trends in 2024 which should result in higher performance and transaction fees. Moreover, higher asset prices are seen as generating better investment income. Stronger earnings trends are seen over the coming periods as a result, and KKR expects a robust fundraising cycle over the next handful of quarters, which should yield healthy returns from 2024 to 2026.

Key risks include poor investment outcomes from the 2020-2021 era, volatility in the private equity market, exposure to cyclical swings in the capital markets, and heavy selling from key insiders. On the plus side, KKR has very modest exposure to US commercial real estate while the management team is focused on strong EPS growth and a higher ROE – its healthy balance sheet should make that goal quite attainable.

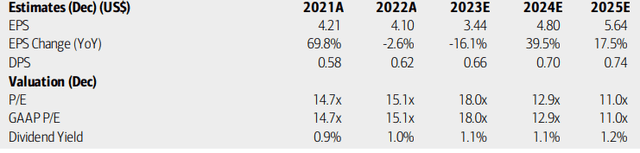

On valuation, analysts at BofA see earnings falling materially this year but then rising sharply in 2024. Per-share profit growth is then seen as growing at a still-strong pace in 2025. The current consensus estimates for out-year EPS are $4.65 and $5.64, which are near what BofA projects. Dividends, meanwhile, are expected to climb at a steady rate over the coming quarters. With mid-double-digit P/E ratios today using current-year EPS figures and low-double-digit earnings ratios in ’24 and ’25, the stock appears reasonably valued while the yield leaves something to be desired.

KKR: Earnings, Valuation, Dividend Yield Forecasts

BofA Global Research

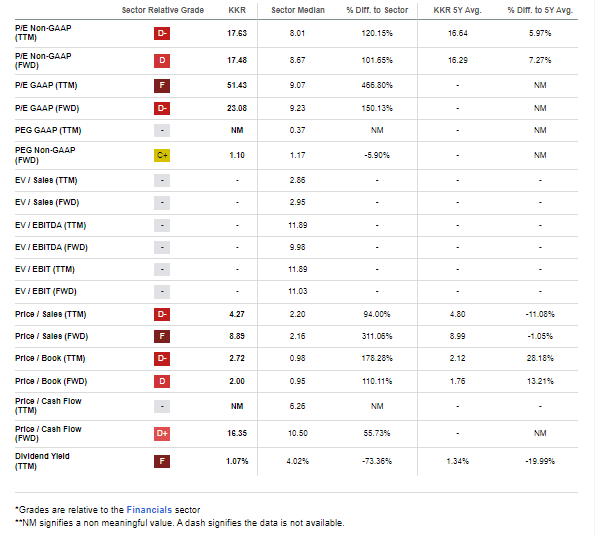

On valuation, if we assume a 15 operating P/E on normalized EPS of $5, then shares should be near $75. That multiple is above the sector median but also below KKR’s 5-year average P/E. Given its diversified portfolio compared to years ago, the firm should be somewhat more insulated from risks specifically related to private equity. Shares do, however, trade at a lofty price-to-book ratio, so the mid-$70s intrinsic value could have downside risks.

KKR: Mixed Valuation Metrics, But Ample Growth Ahead

Seeking Alpha

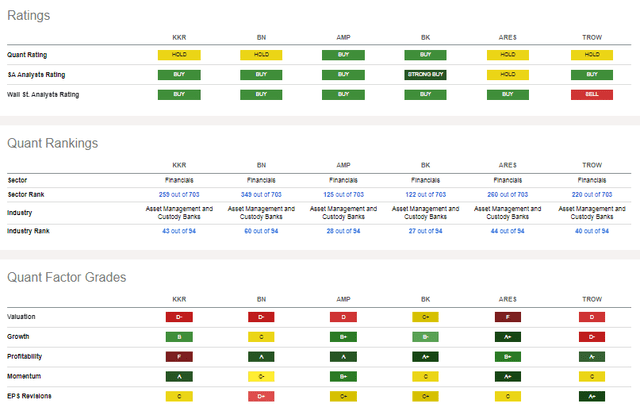

Compared to its peers, KKR features a comparable valuation as many of the PE-related firms trade at higher earnings multiples than the banks today. KKR’s growth outlook is relatively favorable while share price momentum has been robust throughout 2023. Still, profitability is weak given the down year in EPS change, and EPS revisions are merely middle of the road.

Competitor Analysis

Seeking Alpha

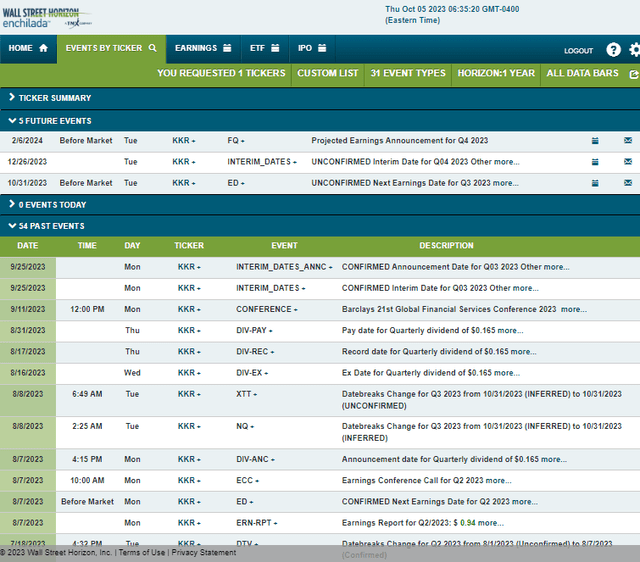

Looking ahead, corporate event data provided by Wall Street Horizon shows an unconfirmed Q3 2023 earnings date of Tuesday, October 31 BMO. No other volatility catalysts are seen on the calendar in the near term.

Corporate Event Risk Calendar

Wall Street Horizon

The Technical Take

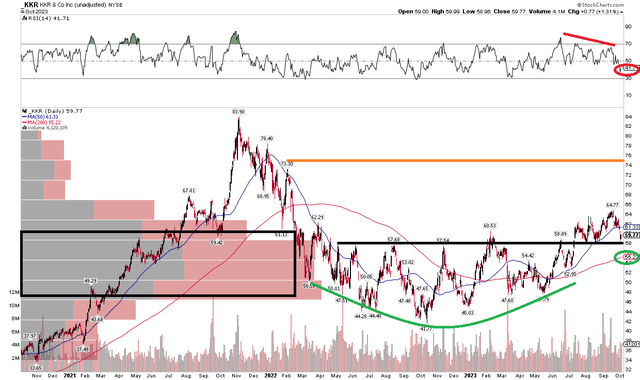

KKR peaked in late 2021 when interest rates were exceptionally low and market volatility was muted. Following a 50% drawdown from the Q4 2021 high to the low notched in October 2022, shares have trended higher. Notice in the chart below that KKR has put in a bullish rounded bottom reversal pattern. It will be key to watch the $57 to $60 range as that had been resistance on rally attempts from mid-2022 through June of this year. More recently, KKR has retested the $58 level on a few occasions.

More broadly, the long-term 200-day moving average is upward-sloping, indicating that the bulls have retaken control of the trend, but the RSI momentum indicator at the top of the chart shows that the stock has hit oversold levels during this latest pullback. With a high amount of volume by price down to the upper $40s, there should be a cushion on declines, so a long position can make sense. On the upside, the $17 range added on top of the previous resistance area implies a measured move upside price target of nearly $75 based on the height of the bottoming pattern.

A key risk I noticed in the short run is bearish RSI divergence, so the stock may be susceptible to a test of the 200 dma or perhaps the $53 low from a few months ago – something to watch in the coming weeks.

Overall, the chart is encouraging, and shares hang right near short-term support.

KKR: Bullish Rounded Bottom, Monitoring Bearish RSI Divergence

StockCharts.com

The Bottom Line

I have a buy rating on KKR. I see shares as undervalued ahead of what should be an earnings acceleration while the stock has been trending higher for the last 12 months.

Read the full article here