Dear readers/followers,

There are plenty of opportunities available on the broader market today that you could potentially invest in. Some sectors, such as telco, are much more undervalued than others given what yields and what earnings potential they offer (even if they don’t necessarily offer massive prospects of growth). Industrials are another favorite of mine to look at here at this time, and one of my favorites in the industrial sector is the company Knorr-Bremse (OTCPK:KNRRY). I’ve actually written about Knorr-Bremse before, so this is a bit of an update. My latest article was a 2-company piece with a focus on Knorr and KION (OTCPK:KIGRY) from back in June – so this is a bit of an update on that thesis.

Essentially, my thesis for the company has to do with my view of this being a very undervalued core industrial company. It works with some of the more relevant and conservative sectors in the industry – meaning braking systems, which is almost technology-agnostic (every vehicle needs to brake), leading to what I believe(d) in my thesis to be at least double-digit potential upside.

It’s a relevant update because we’ve seen some decline in the company share price – which begs the question, of course, if things for the business are getting worse.

In this article, I’ll address this and look at what we can expect from the company.

Knorr-Bremse AG – The upside is significant

The upside in a 100+-year-old German industrial in a fundamental segment should never be underestimated. Especially when the company in question manufactures something so basic as brakes and braking systems on commercial vehicles – because no matter the drivetrain or technology, land-based vehicles need to be able to brake.

And what gives Knorr an upside here is that it’s the world premiere/largest manufacturer of all things braking systems. With over 30,000 employees and over €5B in revenues on an annual basis, Knorr is a company you can “count” on. That’s before even mentioning that every single KPI in the fundamental perspective, such as gross margins and overall profitability, points to Knorr being an above-average company.

The native symbol for Knorr is KBX, and this is the one I would go with if you want to invest – the ADRs are relatively illiquid for this business.

Knorr has the sort of fundamentals you really want to invest in. It has zero debt, so any interest rate risk is almost non-existent here. Of course, this industrial has essentially the same pressures that any industrial company is currently experiencing – that means inflation and SCM issues, to one degree or another – but these are trends that we have for the long term, and as long as the business remains stellar can mostly be ignored (as I argue, at least).

So, what about results and where the company is going?

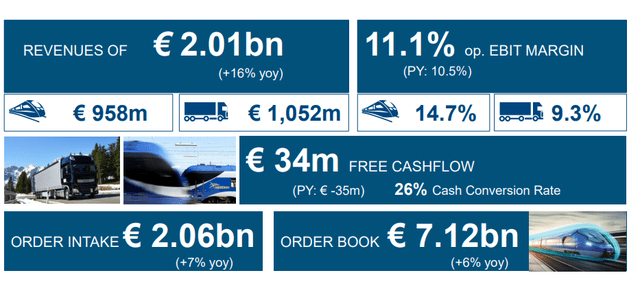

So, we have 2Q23 – naturally, about a month-old results at this point. These sets of results show a continued high demand in rail and truck markets, which is what Knorr does. Ongoing stimulation for higher railway traffic in basically every market except the USA is driving sales – including China, actually. We have larger order books, in fact to a degree that has led to record order books at Knorr-Bremse. (Source: Knorr-Bremse 2Q23)

Knorr is in the same conundrum as some other companies I’ve reviewed, where legacy contracts they’ve agreed to manufacture or service are at margins that inclusive of inflation are no longer either as profitable as the company wants, or profitable at all. Alstom (OTCPK:ALSMY) was another company in this situation. When your contracts don’t include inflation indexation clauses, then this can land you in hot water quickly. Knorr reports inflationary burdens similar to these companies – but new contracts are obviously on track with such clauses and modifications, and the inflow is strictly such contracts. Meanwhile, trucking remains positive overall. We have continued high demand here as well, and discussions on pricing are evolving very positively. All of the company’s segments here, EU, NA, and CN are actually up, though the demand is expected to slow somewhat in 2H. (Source: Knorr-Bremse 2Q23)

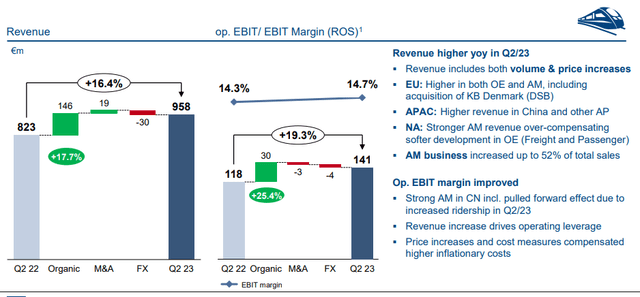

Knorr IR (Knorr IR)

Much as with KION, we’re seeing significant indications of margin recovery. We have significant, double-digit growth in revenue growth, and slowly recovering margins. 60 bps for this company is really nothing to “crow” about, and as you can see Trucking is substantially lower than railway, but things are slowly recovering. We’re also seeing a run rate of almost €8B worth of orders if 2Q23 is any indication and a very well-filled order book that will take the company more than a year to work through. (Source: Knorr-Bremse 2Q23)

On the high-level economic side, we have very solid working capital improvements and capital return improvements. CapEx is actually down – both in absolute numbers and in percentage of sales, now to 3.7%. The company is one of the very few businesses to manage this that I’ve recently reviewed. More though, working capital in terms of scope of days is down to 71.7 – it’s still somewhat high, but improved, with ROCE improvements of again, 60 bps YoY.

Company FCF turned positive and the cash conversion rates are moving in the right direction as well.

Both segments are seeing positive trends due to volume as well as price increases.

Knorr IR (Knorr IR)

Trucking order books and margin improvements are even better, with demand at a continued high level with no cancellations due to inflation or other trends worth mentioning. Brazil is a bit of an issue worth at least mentioning in terms of inflation and recent order flow trends – even if orders currently continue to climb. What I’ll look at here are continuing order trends based on development of the current economic landscape, following several years of economic turmoil (Source). Macroeconomic difficulties continue to be the major headwind here – if they happen, the company is likely to see some tapering in terms of order flow.

However, as of the latest quarter, the company formally confirmed its 2023 guidance, to where it expects upwards of €7.8B worth of revenues with an EBIT margin that could go up to 12%, but also go as low as 10.5%. (Source: Knorr-Bremse 2Q23) So the primary uncertainty at this half-time is the company’s margin estimates. FCF is expected to potentially more than double this year, and this estimate includes both no new COVID-19 lockdowns, the ability to comp inflation increases with pricing and no further SCM issues. I personally see SCM and other shortages as “over”, and the notion of a new COVID-19 lockdown is one I consider a very low likelihood at this point.

If this does happen, then we’ll be in the perfect position to start seeing significant upside from this particular investment.

KBX has technically been at a lower price than we’re seeing it even today. Back in October of 2022, when I started establishing my position in the company, I did so at below €50/share for the native share. However, at €58/share we’re still at a level that based on valuation trends, we would consider being extremely attractive, and potentially much more attractive even than just a few weeks back.

With the confirmation of guidance, it’s my stance that the major uncertainty in the near term for the company is more or less clarified and much of the trajectory of where I believe the company to go is actually materializing. For that reason, I would be extremely careful expecting anything majorly “negative” for the business here I don’t see indications of this either in the long or short-term trend for the company.

Let’s look at what specifically valuation and forecasts tells us for this business.

The upside in Knorr – It may take time, but I do view it as inevitable based on earnings.

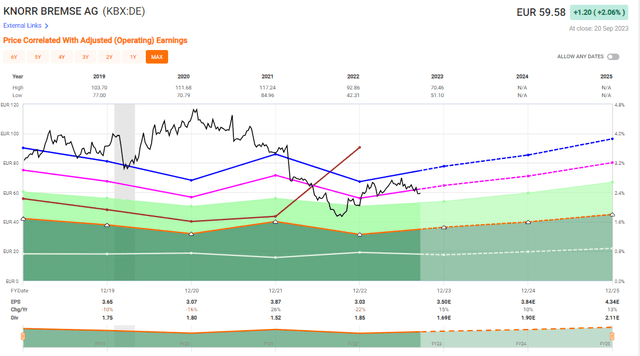

Knorr P/E History (F.A.S.T Graphs)

So, Knorr is A-rated. This is due to the non-existent debt that the company has, and a net cash position. The company has a market capitalization of close to €10B, with a well-filled order book. It hasn’t been listed under its iteration for a very long time, but during that time it has commanded your typical industrial premium for a solid company with a good growth rate of about 20-23x P/E. It’s currently, at €58, at a P/E of less than 17.5x. It has been lower – last fall we dropped below €50/share, but I don’t view this as a likely repeat because the company is not forecasted to see further earnings decline. This should prevent further significant deterioration, at least as I see it.

What we therefore can do is forecast the company based on 3-year forward earnings estimates. The company just now reaffirmed its 2023E guidance, putting us at an EPS of around €3.5/share, which would imply a 15.4% EPS growth rate, followed by close to double digits in 2024 and 2025E, coming to a 3-year average growth rate of 11.7%. (Source: Knorr-Bremse 2Q23)

I view such a turnout as likely given the company’s market position and recent trends, as well as what macro is looking like in both railway and trucking segments. Even forecasted just on a P/E of 15x, the company still annualizes at above 8% return per year until then. And that’s almost a “negative” expectation for a company like this.

I believe Knorr-Bremse commands a higher premium, more than we saw in early 2022 of 20-23x P/E. On that basis, this is the upside that we can see, and one I consider to actually be relatively conservative if these earnings materialize.

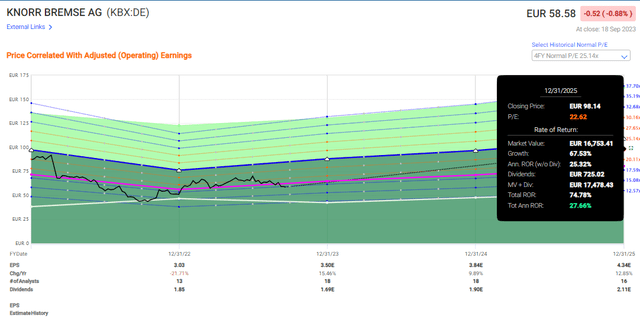

Knorr Bremse Upside (F.A.S.T Graphs)

S&P global analysts give the company an average of €45-€80/share with a midpoint/average of €68/share. In this case, I’m significantly more positive than the analysts, but it’s with mentioning that analyst targets were as high as €112/share only a year ago – so there’s a bit of conviction issues here with the followers of the business – as we’re used to. 16 analysts follow the company – only 7 are currently at a “BUY” or equivalent rating, with most at a “HOLD”. I understand the sentiment of holding on to see if it drops lower, but in this particular case, I do believe the company is low enough for the challenges it faces. (Source: S&P Global, TIKR.com)

For that reason, I go in with high conviction here. I have a very solid set of common shares in the company, making up over 1% of my commercial portfolio, and I’m adding more here.

Thesis

- Knorr-Bremse is the world’s leading manufacturer of braking systems for railways and with a strong presence in commercial trucking. It has absolutely stellar, A-rated fundamentals with a superb balance sheet and a very well-covered dividend. It’s well-managed, and as of recent earnings, has a very well-filled order book.

- At any cheap valuation below €50-€65/share, this company becomes what I consider to be a “BUY”, even a strong one. The upside for the company is easily in double digits without estimating too high or too crazy numbers.

- At the current valuation, I consider Knorr to be a very solid “BUY” and I give the company an overall PT of €100/share based on what I believe to be a normalized fair-value target from growth rates and rocks-solid fundamentals. I believe Knorr is worth at least a forward 22x P/E with an EPS growth rate of 11.75% annualized for 2025E – this comes to around €99.78, which I then round to €100/share. It’s high, but the company’s fundamental advantages are high as well.

- This is the same PT as I had in my mixed article on the company, and I’m not shifting this to the current article. This is a long-term PT, but one I believe the company can and will attain over the next few years.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

This means that the company fulfills every single one of my criteria, making it relatively clear why I view it as a “BUY” here.

Thank you for reading.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here