Investment Thesis

Leggett & Platt (NYSE:LEG) has declined from the recent peak performance due to macro pressure, but its overall strength hasn’t been impacted. The company’s cash flow is still sound and it has room to conserve cash to protect dividend payout. Looking back for twenty or thirty years, it has weathered past volatile periods with endurance and its improved capability in technological innovation and capacity will provide more support this time. The price fall has priced in large bearishness and we think the valuation has become attractive. We recommend a buy for investors to wait out with a 7.1% dividend yield.

Company Overview

Leggett & Platt, founded in 1883 with headquarters in Carthage, Missouri, is a major manufacturer of steel coil bedsprings and a supplier of adjustable beds, and a wide range of engineered components and products homes, automobiles, aerospace and construction industries, with domestic distribution in the US and a global sourcing network. The company has three segments: Bedding Products; Specialized Products; and Furniture, Flooring & Textile Products.

Strength & Weaknesses

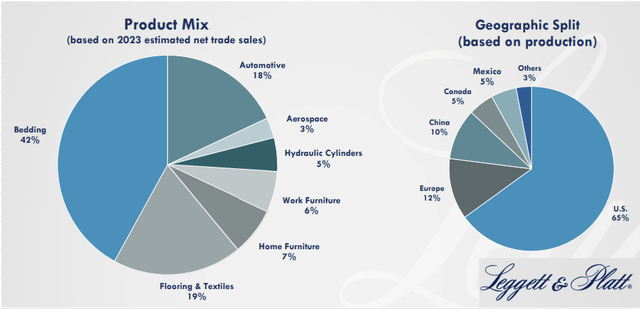

Leggett & Platt has a diverse portfolio with Bedding in the US, accounting for at least 30% of all sales, to be its largest contributor to net sales, while significant sales in Automotive and Flooring & Textiles, and geographically important presence in Europe and China.

LEG: Product Mix and Geographic Split (Company Q2 presentation)

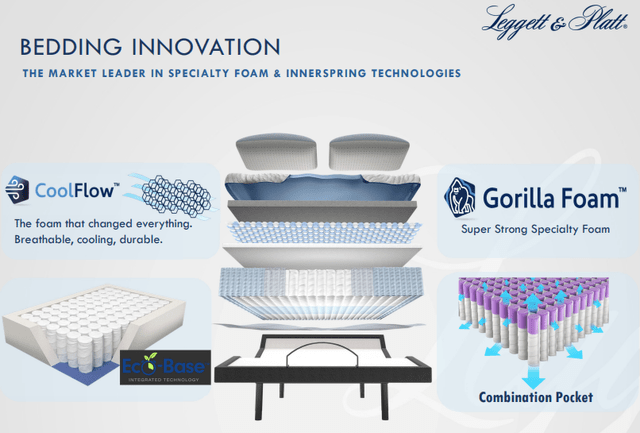

As one of the oldest manufacturers of bedding springs in the country, Leggett & Platt remains a leader in the field. Its breadth of product offering and vertical integration provides large selections and cost savings to its customers, while its leading R&D innovates in both innerspring product specialty and efficiency. With US Bedding and Automotive Cabin Comfort markets combined, it has large addressable markets of over $30 billion. Its deep industry knowledge accumulated over a hundred years and a global footprint add to the endurance of this company’s ability to weather different economic conditions.

LEG: Bedding Innovation (Company Q2 Presentation)

Indeed, the company’s performance is subject to economic cycles, which span through periods longer than just the past few quarters. Upfront in the Q2 presentation, it has a clear presentation to investors on where their macro exposures are, 55% to consumer durables, 20% to the automotive industry, and 25% to aerospace and construction equipment. It concluded that consumer confidence is the most important economic factor that impacts its sales, since the second or the third bedding/furniture purchases are usually a replacement of the existing one, which is a deferrable “large ticket” item expense. While other factors such as total housing turnover, employment levels, consumer discretionary spending, and interest rate levels also have strong impacts.

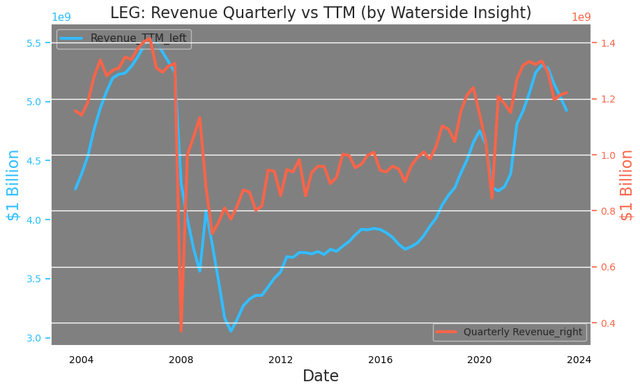

Not surprisingly, as a consumer durable company, their products are the first ones to be “deferred” when there is a slowdown in consumer spending. But within the historical context, its revenue, although has dropped by about 8.5% YoY, is still at the highest levels since 2008.

LEG: Revenue (Calculated and charted by Waterside Insight with data from company)

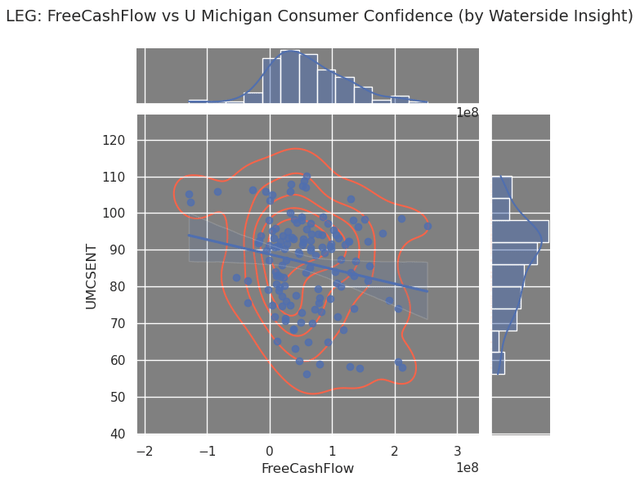

With that in mind, to see how Leggett & Platt will fare under the current and near-term macro environment, we check where its earnings stand with respect to consumer confidence since 1989, assuming such confidence to a high degree reflects employment level, desire to spend discretionarily, and interest rate level. The current level of the University of Michigan Consumer Confidence level at 63 reading is hovering at the lower end of the past twenty years. If the confidence stays at this level for the next few quarters, its free cash flow appears to have reached the bottom and doesn’t have more downside to fall from here.

LEG: Free Cash Flow vs Consumer Confidence (Calculated and charted by Waterside Insight with data from company and FRED)

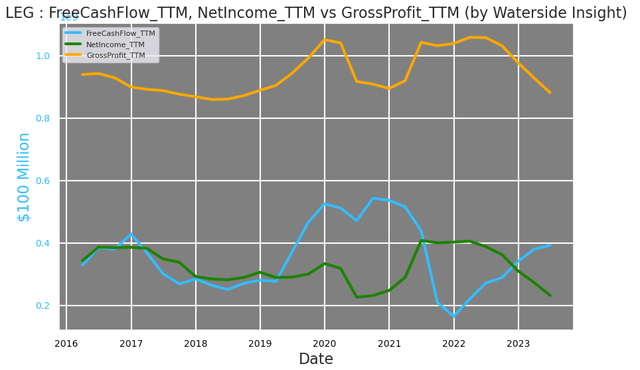

The falling top-line growth has induced lower growth in gross profits and net income, which also have seen about a 43% YoY decline, reaching the lower range of the past ten years. But its free cash flow has held up on an upward trend on a TTM basis, recovering from a fall in late 2021.

LEG: Free Cash Flow, Net Income vs Gross Profits (Calculated and charted by Waterside Insight with data from company)

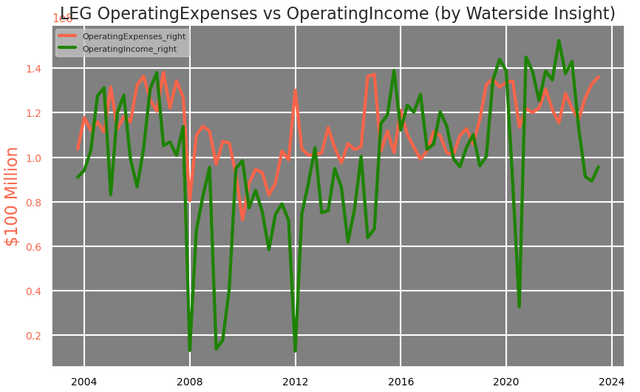

One of the difficulties that pressures its gross profits is its operating expenses. While its operating income has dropped by 38% YoY, its operating expenses are still rising. Such divergence has produced a large gap between them. But such a gap has occurred before in ’06, ’08, ’09, ’12, ’15, and once again in 2020. What it shows is it is not uncommon for LEG to have volatile operating income, and the current fall isn’t even one of the most severe ones. It does need to rein in its rising operating expenses, but its cost of goods, which accounted for about 80% of revenue, is very stable at this level in the past two decades. This level is currently around 86%.

LEG: Operating Expenses vs Operating Income (Calculated and charted by Waterside Insight with data from company)

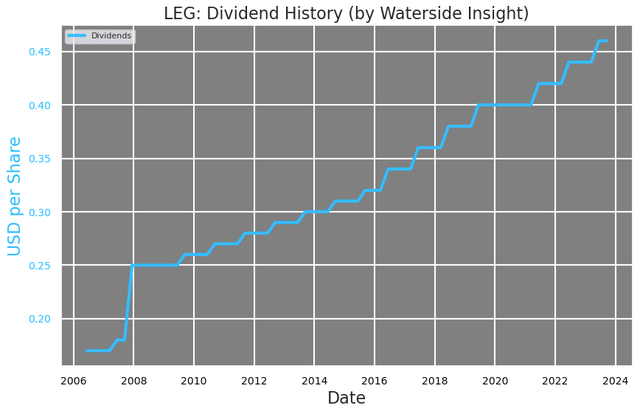

But you wouldn’t notice it if you were an income growth investor who only pays attention to its dividend. It simply hasn’t cut once in almost the past twenty years.

LEG: Dividend History (Calculated and charted by Waterside Insight with data from company)

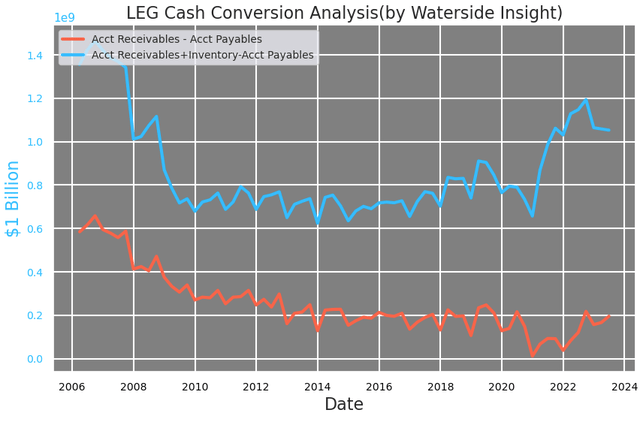

In fact, its NOWC is rising with a large contribution from the higher inventory, but even without inventory, the difference between its account receivables and payables is still at a historical average in the past ten years or so.

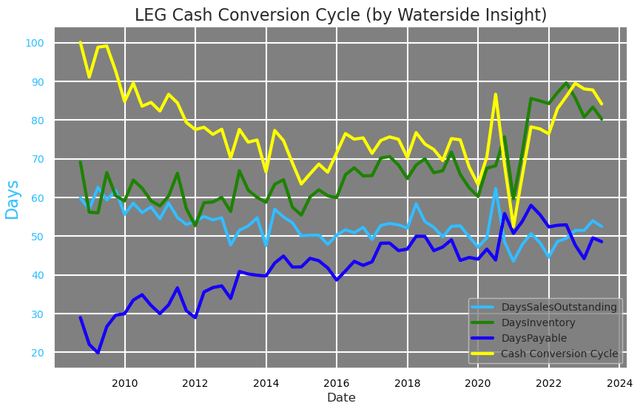

LEG: Cash Conversion (Calculated and charted by Waterside Insight with data from company)

Digging into Leggett & Platt’s cash conversion cycles, we find that such a cycle has prolonged by about 10 days from its past ten years’ average to 80 days, about where it was in 2010-2011. The company actually hasn’t had a significant rise in days sales outstanding, given the lower consumer confidence reading registered in October last year and April this year. And to help this cycle, its days of payable are almost 20 days longer than where they were in the pre-’08 period. The largest rise is driven by its days of inventory, which is about 10 days higher than its average before the pandemic. Overall, its cash conversion cycle ended up rising by about 9-10 days above the past eight years’ average but is still better than the stressful period in ’08.

LEG: Cash Conversion Cycle (Calculated and charted by Waterside Insight with data from company)

Incidentally, Leggett & Platt’s current price is where it was in 2010-2011. This is quite interesting. So can it really afford the dividend payout with the current cash flow condition? It has a lot to do with how it spends its cash. According to its 2022 10K, its

long-term priorities for uses of cash are: fund organic growth including capital expenditures, pay dividends, fund strategic acquisitions, and repurchase stock with available cash.

The company regards strategic acquisitions as part of the provision of organic growth. It has a strategy that emphasizes competitive advantage and enhances its current capabilities with synergies and low risks of disruption.

LEG: Acquisition Strategy (Company Q2 Presentation)

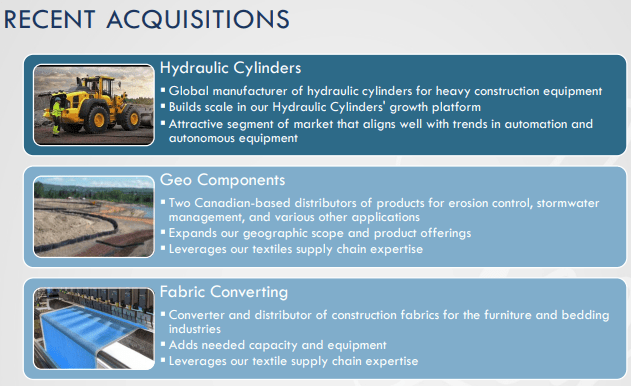

2022 marked a busy year of acquisitions for Leggett & Platt. The company acquired two Canadian distributors of geo components for over $20 million in total, and a leading global hydraulic cylinder manufacturer for $61 million, plus a small US textile business for $2 million. In total, it reported spending close to $112 million in acquisitions last year to boost capacity in its second largest segment Furniture, Flooring & Textile Products, which it sees as an attractive market going forward. In 2021, its acquisitions were mostly focused on finding targets that can complement its current products and capabilities, such as a UK manufacturer in metallic ducting systems with applications in space and military, a Polish manufacturer in bent metal tubing for furniture in offices, and a foam and finished mattress manufacturer in UK and Ireland. They benefit all of the other smaller segments, such as home and work furniture, automotive, and aerospace in revenue. The company expects these acquisitions could generate returns well above its WACC, which is currently at 7.64% in our estimate.

LEG: Recent Acquisitions (Company Q2 Presentation)

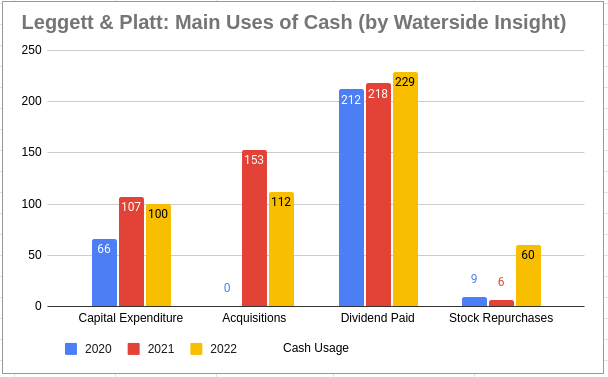

Its spending in CapEx and dividend paid are more comparable with previous years, while its largest increase in uses of cash from the past two years came from acquisitions, which was zero for 2020, and stock repurchase, which was at a minimal level in ’20 and ’21.

LEG: Main Uses of Cash (Calculated and charted by Waterside Insight with data from company)

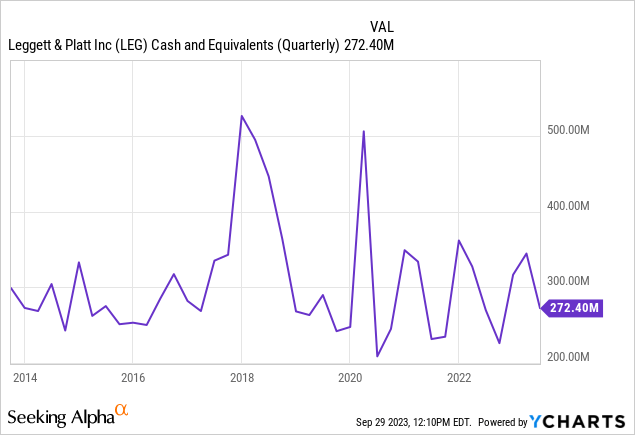

Its cash and cash equivalents at $272 million so far this year is at the average of the past three years. In its 10K, the company expects acquisition activities to be minimal this year, and its stock repurchase in 2023 to be lower than last year. So by regressing back to their levels two years ago, these two items could save over $100 – $170 million in cash for this year, which is more than one-third of its current cash and cash equivalent. Given the company’s emphasis on commitment to “extending the 52-year history of consecutive annual increases”, we think its dividend should be safe.

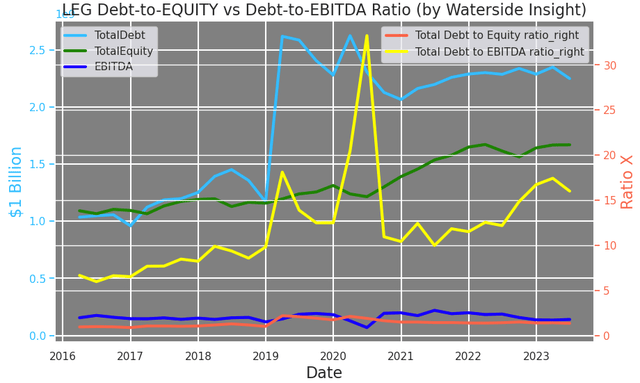

Fitch downgraded Leggett & Platt’s rating a month ago mainly due to its higher debt-to-EBITDA ratio. The company has made large repayments of $301.5 million to serve long-term debt in 2022. So the total debt has declined by about 8%. Although its debt-to-EBITDA ratio rising in contrast to the lower debt-to-equity ratio, this is not from higher debt but due to lower EBITDA in recent quarters. Should the past two years’ acquisitions kick into gears to produce above-WACC returns, its EBITDA should see improvement from here. Overall, the debt-to-EBITDA ratio is high but still manageable, which Fitch gives a stable outlook.

LEG: Debt Ratios (Calculated and charted by Waterside Insight with data from company)

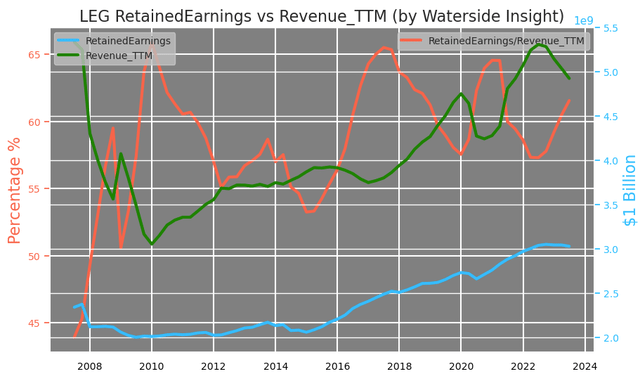

Leggett & Platt’s stock prices actually do not reflect its retained earnings growth. Although its revenue has come off its historic peak, the company currently has over 60% of its revenue as retained earnings, which in its absolute value is at its highest levels in the past fifteen years. This level has been stable since 2022. In contrast, its stock prices have fallen almost 60%.

LEG: Retained Earnings (Calculated and charted by Waterside Insight with data from company)

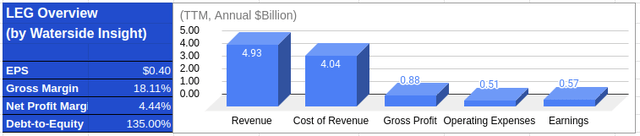

Financial Overview

LEG: Financial Overview (Calculated and charted by Waterside Insight with data from company)

Conclusion

To see the future, we sometimes need to go back to the past. For Leggett & Platt, the most prominent catalyst to its performance came from macro pressure, which has cycles of over a decade or longer. From our historical analysis, we believe the company has sufficient resources to not cut the dividend while still satisfying its regular operation and growth spending. While for the medium term, the past two years of acquisition could provide more integrated growth potential. With the strength in its cash flow and retained earnings, LEG to fall by over 60% does seem to have priced in excessive bearishness, which could be derived directly from the macro outlook. We think the valuation started to look attractive. Although the macro picture will continue to pressure this stock, long-term investors who have income generating in mind can start accumulating at or below current prices to collect the 7.1% dividend yield while waiting out the volatility.

Read the full article here