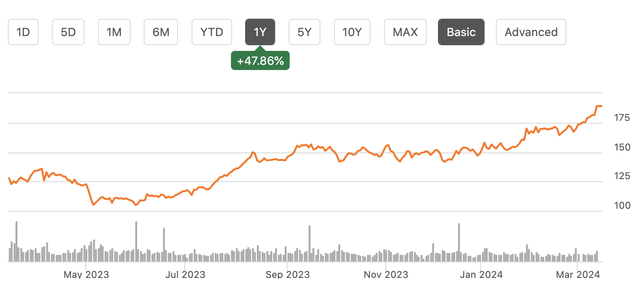

Marathon Petroleum Corporation (NYSE:MPC) has continued to be a strong performer with shares recently hitting a 52-week high, up nearly 50% from a year ago. Since reiterating MPC as a strong buy in November, shares have risen a further 27%, more than doubling the S&P 500’s gains. With this rise, shares have reached my ~$186 price target, making now an appropriate time to revisit shares, as valuation may not be as compelling as it once was. I come to the conclusion that MPC is still a buy.

Seeking Alpha

Importantly, Marathon has continued to perform well, even in less favorable conditions for refiners in late 2023. In the company’s fourth quarter released at the end of January, MPC earned $3.98, blowing past consensus of $2.22 while revenue declined by 8% to $36.8 billion. When looking at MPC or refiners in general, revenue is of less importance than for most companies. It is ultimately tied to the level of crude oil, which is style highly volatile. Refineries make their money on the spread between oil and gasoline, not based on the absolute price of oil, and so these revenue swings can be misleading as to the company’s underlying economics. Q4 EBITDA declined sequentially from $4.6 to $2.2 billion given lower refining margins as the spread between gasoline and crude oil narrowed.

For the full year, the company earned $23.63 while refining EBITDA was $13.6 billion from $19.3 billion. 2022 was a banner year for refining margins as travel demand soared back and the war in Ukraine caused supply disruptions. 2023 represented results that were not quite as strong but that was still very healthy. MPC generated $12.74 in EBITDA for every barrel of oil it refined, resulting in $14 billion of operating cash flow.

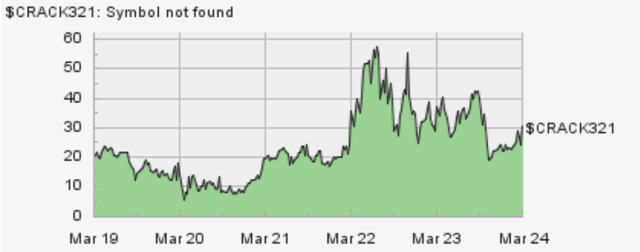

Now in Q4, refining margins declined from $28.82 last year to $17.79. Throughput was 2.9 million barrels/day given a 91% utilization while operating costs were $5.67/barrel. Utilization remains strong, and the company’s national footprint has allowed it to enjoy strong refining margins relative to the generic “321 crack spread, ” or what a refinery makes by turning crude oil into gasoline and diesel products.

Now, we may see some moderation in results in Q1 as MPC expects crude throughput to be about 2.45 million barrels per day at an 83% utilization. Due to lower utilization and some fixed costs, operating costs should be about $5.85/barrel, up about 3% sequentially. MPC is doing more turnaround activity to update and maintain operations at its refineries, reducing throughput in Q1. It times this activity for this quarter because gasoline demand is somewhat seasonal, with less driving in Q1 than the vacation/summer driving season in late Q2 and Q3. This creates some seasonality in earnings and throughput, which MPC uses to time the magnitude of turnaround activity, as best as possible. This is akin to how a beach hotel may do more remodeling work during the quiet winter season than the summer

Rather than focus on seasonally lower volumes, the more encouraging point to focus on is the widening of crack spreads, from Q4 levels. As I outlined in November, I expect crack spreads to stay structurally wider than pre-COVID because global refining output is constrained. Given the cost and regulatory burdens, we may never see another large-scale refinery built in the developed world. With oil demand still rising, the constraint on refining capacity should keep margins wider.

While wider on average, crack spreads can be volatile within their band based on oil supply/demand and end-product supply/demand. In the second half of last year, we saw margins compress-though to levels wider than pre-COVID. Recently, crack spreads have been widening, which will be a tailwind to cash flow. I continue to believe crack spreads are likely to operate in a $15-25 band from $10-$20 previously, though they may spend this year closer to the top-end of the band.

Energy Stock Channel

This will be a positive to MPC’s cash flow as it earns more on each barrel it refines. There are several reasons we are seeing crack spreads improve. The first is oil supply has remained relatively buoyant, thanks to record US production. Oil product demand is economically sensitive, and a recession seems less and less likely, which is keeping demand for gasoline relatively high. Indeed, we learned gasoline demand has remained quite strong with a 5.7M inventory reduction last week. Tighter gasoline inventories support wider spreads.

On top of these economic factors, MPC is benefitting from some “geopolitical risk premium.” Recently, Ukrainian drones have launched attacks on Russian refineries. With refining capacity already limited globally, these attacks could further tighten global product markets and widen spreads. This provides further upside risk to crack spreads and MPC’s free cash flow capacity.

In November, I argued MPC could generate $7.5 billion in standalone free cash flow, at a $20 crack spread. Since then, we have seen crack spreads widen a bit. Additionally, management has announced a$1.25 billion 2024 cap-ex plan, about $800 million of which is for growth projects. This spending is down from $1.4 billion last year as it reduces its low-carbon growth spend by $140 million to $350 million. This plan is consistent with my prior projection. While I still view $20 crack spreads as a long-term average, we may see spreads average slightly higher with each $1 worth about $700 million in free cash flow, creating the potential for $8.5-9 billion from MPC’s refining and marketing unit in 2024.

Alongside this unit, Marathon also owns ~65% of MPLX LP (MPLX). MPLX is consolidated into MPC’s financials, but since it is publicly traded, I believe it best to value MPC separately and then add the value of its MPLX shares. At current market prices, this stake is worth nearly $27 billion, and it provides about $1.5 billion in after tax dividends to MPC.

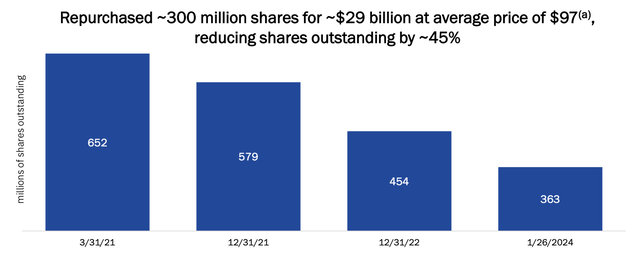

With its stellar cash flow profile, the core of my thesis for MPC has been about its capital returns. In Q4, it repurchased $2.5 billion in stock, bringing its 2023 total to $11.6 billion in stock, and since May 2021, MPC has bought back about 45% of its shares at an average price of $97. It has $5.9 billion on its buyback authorization. It also raised its dividend by 10% last year and offers a 1.75% yield with the dividend costing about $1 billion.

Marathon Petroleum

MPC has a stellar balance sheet with $9.2 billion of stand-alone cash, and it has just $6.8 billion of debt. On the last earnings call, management said it is comfortable with the “gross amount” of debt it is carrying. As such, I continue to believe MPC will return all free cash flow to investors in 2024. With $10 billion in free cash flow (including MPLX dividends), that means MPLX can repurchase about $9 billion in stock in 2024 or 13% of its share count in 2024, continuing its recent history of aggressive share count reduction.

Now, its stake in MPLX is worth $74 a share, meaning MPC’s stand-alone refining operation is being valued at $115, or $109 excluding its net cash position. At $7.5 billion in free cash flow, MPC’s long-term free cash flow is about $20/share. I continue to believe 6x free cash flow is an appropriate terminal valuation, or $120, creating $11 of upside or a fair value of about $200, today.

Now, this estimate could prove conservative as 2024 free cash flow is likely to be closer to $23-$25/share given wider crack spreads. That said, given the volatility of crack spreads, I do believe investors should value refiners off of long-term earnings capacity, not peak results, viewing the incremental spread as akin to a one-time benefit. However, I would note my $200 fair value is based on a 363 million share count. This share count will be substantially lower in 3, 6, and 12 months. Assuming an 8% share count reduction from 1/31 levels by year-end, which may prove conservative, the fair value would be ~$216 on 12/31/24.

At this price, shares have 14% upside and a ~16% return potential including its dividend. This is still holding the refining operation at 6x long-term free cash flow. This is still a solid return profile for the next ~9-10 months, and I continue to view MPC as quite attractive. However, given the strong rally, I am moving shares down from a “strong buy” to a “buy.” With strong fundamentals and an impressive share repurchase program, MPC has further upside even at new highs. I would stay long shares.

Read the full article here